Aavegotchi & the Gotchiverse Playdrop

A huge name in the play-to-earn gaming space is Aavegotchi, which incorporates tokens, DeFi and NFTs, all wrapped up in a retro, ghostly aesthetic reminiscent of Pacman and the 8-bit console era.

At the end of March, the Gotchiverse Alpha period, incorporating a playdrop, went live. Gotchiverse is Aavegotchi’s Polygon-based, play-to-earn game world, and the playdrop runs until the end of April (more on what playdrop means below).

Something to be aware of before you look into Aavegotchi is that it initially comes across as extremely complicated, with a confusing array of gameplay and earning mechanics. Then, after you read through whitepapers, litepapers, and blogs, it becomes about a hundred times more confusing.

Getting hands-on by diving in and trying it out is the best way to learn how it works, so here’s a quick rundown on getting started.

How To Get Started Playing Aavegotchi

1. Acquire Some GHST Tokens

In order to play, you’re going to need currency, and in the Gotchiverse that means the GHST token, currently valued at around $2, having hit an all-time high of $3.25 last November.

On the Gotchiverse site, connect up your wallet (there are a variety of choices, but MetaMask works fine), click on GET GHST, and there’s an easy-to-use converter, which allows you to acquire GHST by swapping from DAI, USDC, USDT, Wrapped ETH, and Wrapped Matic.

2. Play The Game

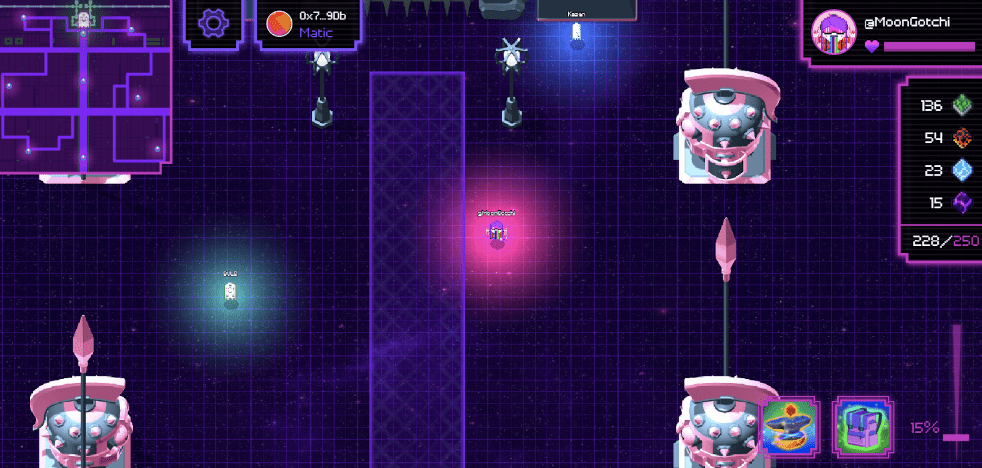

In the Gotchiverse, you take your Aavegotchi NFT (which is a kind of ghost), and navigate around attempting to acquire Gotchus Alchemica, which is the collective name for four kinds of ERC-20 tokens called FUD, FOMO, ALPHA and KEK.

Jesse Johnson, the COO of Pixelcraft Studios (the company behind Aavegotchi), has explained of the tokens that they’re, “the keys to ‘making it’ in the Gotchiverse and getting the most out of this one-of-a-kind gameplay experience.”

There is more to the game than just this, including a metaversal, social element. It’s notable also that several guilds have set themselves up in the game, including Yield Guild Games. (A guild is a kind of organized gaming cooperative that pools its resources and know-how in order to maximize profits).

What Is A Playdrop?

When projects launch a token, they often take the airdrop route, as famously happened with ApeCoin last month, which was dropped to Bored Ape holders. However, Aavegotchi has gone down a different route, utilizing the concept of the playdrop.

Basically, the Gotchiverse Alpha period is a chance to acquire Gotchus Alchemica, the tokens mentioned above, but you’ll have to actually play the game in order to pick them up. It’s a strong incentive to play, and looks like a win-win that benefits both players and creators.

Lend & Borrow Aavegotchi

If you don’t already own an Aavegotchi NFT and you’re not sure you want to commit funds to buying one, then you can still try the game and get in on the Aavegotchi playdrop by using the lending function to borrow one.

The main variables to consider when borrowing (or lending) an Aavegotchi, are the rental duration period, whether there’s an upfront charge, and the profit split. All of these factors can be back-and-forth negotiated before finalization.

And on the other hand, if you own one and want to make some passive income, then you can use this function to loan out your NFTs. This can also be a useful option when you don’t have time to play the game yourself, but hold an Aavegotchi.

Trade Aavegotchis & Other Assets in the Gotchiverse

Go to the Aavegotchi Baazaar, and you can buy and trade the NFTs, along with other in-game assets, including land, wearables and consumables.

This is an evolving in-game economy, and it’s necessary to get a feel for the game and its mechanics in order to make informed trades. The best route is to borrow one first, and get a sense of the game and whether or not you want to invest in the ecosystem.

Virtual land in particular is on a lot of investors’ minds recently, and there are many metaverse projects to choose from. What the Gotchiverse offers is a well-known, gameplay-oriented platform, which has active users and financial incentives to bring in new players.

For a summary of what factors to assess when valuing Gotchiverse land, the official blog has summed it up concisely.