BRC-20 Tokens on Bitcoin: ‘Worthless’ Tokens Reach 1 Billion Market Cap

TL;DR A new token standard on Bitcoin, BRC-20, has created a minting frenzy, driving up fees. A staggering 11 thousand+ new coins have come into existence. It has sparked fierce debate between Bitcoiners who believe their chain should be used for peer-to-peer cash transactions only – versus Bitcoiners who believe the new token standard can ensure a healthy fee market. Let’s explore and show you how to mint and trade your own BRC-20 tokens.

On May 7, 2023, something unprecedented happened: the first Bitcoin block ever was mined in which transaction fees in BTC exceeded the block reward (6.75 BTC versus 6.25 BTC)! Just five months ago, this would have been almost unthinkable. The reason? The frenzy of the past weeks to mint AND trade fungible tokens on the Bitcoin blockchain, using the Ordinals protocol.

To create, mint or trade this new type of BRC-20 token, users must inscribe satoshi’s. And that amounts to doing on-chain transactions. This explains why currently, there are over 400,000 transactions in the Bitcoin mempool.

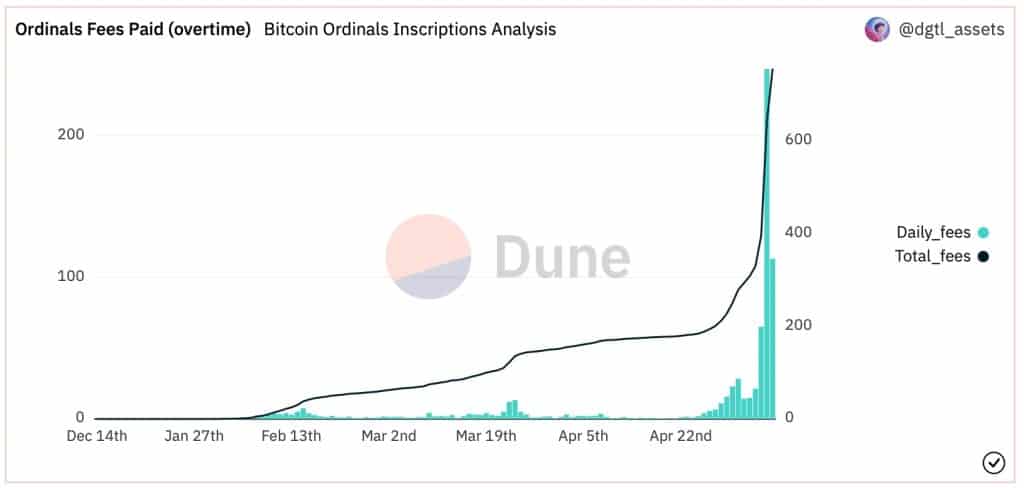

Over 1,000 BTC has been paid in recent months purely for Ordinals fees. 750 BTC of which has come since May 1, after the BRC-20 token craze kicked off in earnest.

As all crypto aficionados know, there is no frenzy like meme coin frenzy. And meme coins are what these new BRC-20 tokens are. Why meme coins? Because, unlike ERC-20 tokens on Ethereum, they have no smart contract functionality. In the words of their inventor Domo: “These will be worthless. Use at your own risk.”.

Famous last words when he introduced the BRC-20 experiment, as these BRC-20 tokens have done pretty well for worthless tokens: the total market value of all new tokens has reached a billion dollars in recent days (leading up to May 8, 2023).

BRC-20 Tokens Are Not NFTs but Fungible Tokens

BRC-20 tokens are not to be confused with Ordinal NFTs on Bitcoin (also read this article on Ordinal NFT collections).

The foundation of both is the Ordinals protocol, launched in January 2023. This makes it possible to track each satoshi and inscribe ‘meta data’ to it. The first application was NFTs. In April 2023, mentioned developer Domo invented a way to create fungible tokens using the Ordinals protocol.

The consequence? It has become pretty easy to create your own token: give it a name using four characters and a total supply, and then start minting. That’s pretty much all, lol! It’s just a token, it doesn’t do anything.

What IS pretty cool is that these tokens are minted and stored on the Bitcoin blockchain. Also, trades of tokens happen on-chain. Setting aside for a moment the early-stage, experimental nature of the project, this is a way of trading without the usual counterparty risk of a decentralized or centralized exchange.

What is the Difference Between ERC-20 Tokens and BRC-20 Tokens?

ERC-20 tokens live on Ethereum, BRC-20’s obviously on Bitcoin. First, let’s start with a similarity. To trade ERC-20 tokens on a dex, you pay in ETH and you need to fund your wallet with a bit of ETH for that. The same for BRC-20 tokens, in which case you will need some BTC.

But most similarities end there. A difference between BRC-20 and ERC-20 is that the BRC-20 token can’t interact with smart contracts, which makes it less powerful. It gives it less functionality and it means BRC-20 tokens can’t be used in for example decentralized exchanges, and borrowing and lending protocols.

On the positive side, a BRC-20 token is protected by Bitcoin’s proof-of-work security mechanism rather than Ethereum’s proof-of-stake security. Pick your flavor of security and trade accordingly.

A final important difference is that BRC-20 is a very novel protocol. Recently, a hacker found a way to exploit the Unisat wallet and do double spends. This bug has been fixed, but you get the point. This is all experimental stuff.

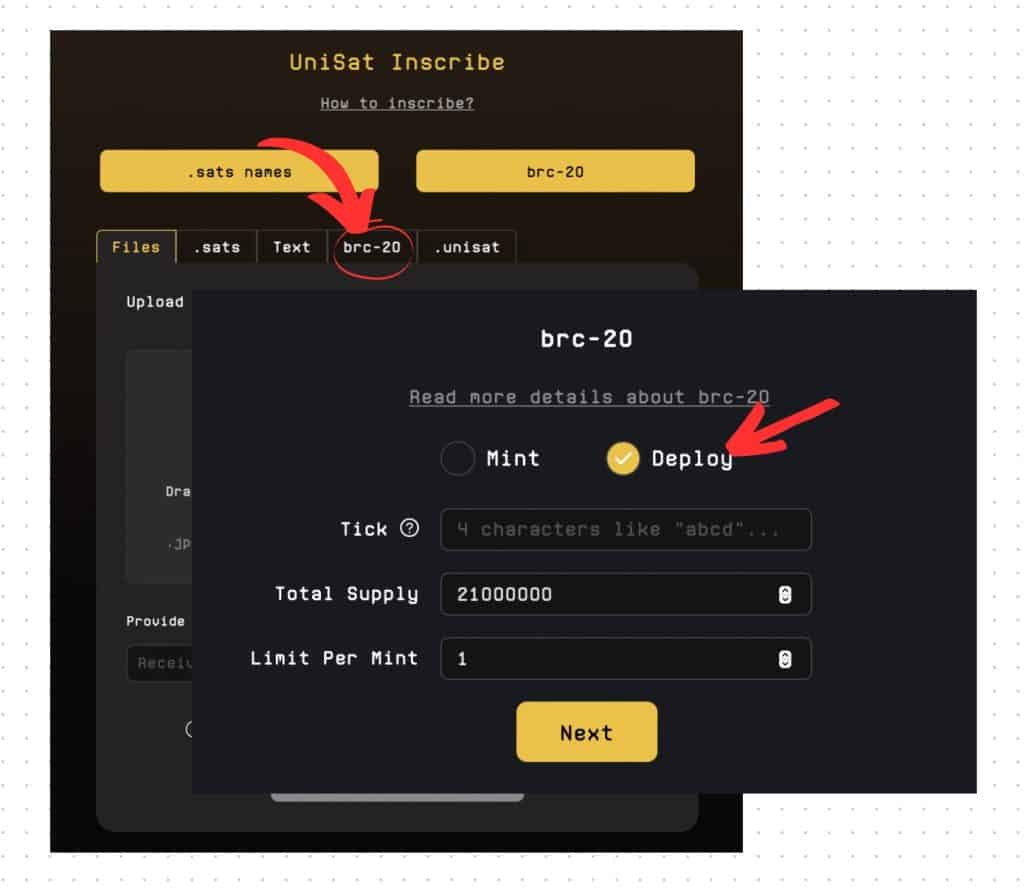

How to Create a BRC-20 Token

Creating a BRC-20 token is a piece of cake – for pastry chefs. In other words, you need knowledge about Bitcoin transactions in general and the programming language JSON in particular.

- First, you deploy a Token Contract. This BRC-20 token contract is a JSON file that defines the four-letter name of your new token, its maximum supply, and mint limit. You need a wallet that supports ordinals and inscriptions to inscribe this file onto a satoshi. This creates the first set of coins, assigned to your wallet.

- Next, you can mint more coins by inscribing a similar but shorter JSON file onto another satoshi.

- Transferring coins is also a matter of inscribing a file onto – yet another – satoshi (fortunately, there are plenty). The file contains the from and to wallet addresses and the number of coins of the token.

On the Unisat Wallet, they built an interface for this that makes it quite user-friendly, see image below.

Unisat helps you by generating the deploy code, for example, if you want to create a token ERIK:

{“p”:”brc-20″,”op”:”deploy”,”tick”:”ERIK”,”max”:”21000000″,”lim”:”1000″}

It then lets you receive this inscription on your wallet address.

How to Buy and Trade BRC-20 Tokens

Not all wallets support BRC-20. Unisat Wallet is a wallet that does. It’s a browser extension for Chrome that support Ordinal NFTs. Ordinals Wallet is another. Of course, both also support Ordinals NFTs.

So here are the steps:

- Install a wallet that supports BRC20, like Unisat Wallet or Ordinals Wallet. Go through the usual steps of creating a password and generating a seed phrase.

- Move some BTC to your wallet.

- In the list of available BRC-20 coins, pick your choice. They are sold in blocks of for example 50 or 100.

Which Are the Largest Meme Coins on BRC-20?

At the time of writing the total market cap of all ten thousand plus coins built on the BRC-20 protocol is already around 1 billion dollars. Ordi was the first token created on BRC-20 and it’s still the most valuable.

There is a clear top 4:

- $ORDI: 500 M dollars

- $MEME: 100 M dollars

- $VPMX: 50 M dollars

- $PEPE: 45 M dollars

Of course, keep in mind that these market caps are not ‘real’, as with other illiquid crypto coins. If people would start selling these coins en masse, the price will drop rapidly. In other words, if everyone wants to get out of their ORDI position, the total amount of dollars obtained won’t be 500 million.

Vulnerabilities in the BRC-20 Ecosystem

Keep in mind that developers and hackers are still in a contest to make this ecosystem robust.

- In April, UniSat Wallet reported a huge number of double-spend attacks as a consequence of a vulnerability in its coding. That is, the coding of the wallet.

- In early May, developer Supertestnet found a way to inscribe a satoshi it didn’t own.

Keep in mind that BRC-20 is a proposal, not a standard. It is used by some wallets but not widely used. As mentioned before, it’s experimental stuff. We wouldn’t recommend spending too much funds.

The Debate About BRC-20 Tokens and the Fee Market

As mentioned, the flood of inscriptions has pushed up the number of Bitcoin transactions and fees. Let’s stage a dialogue between an anti-Ordinals advocate and a pro-Ordinals person.

- Anti: ‘NFTs and fungible tokens are not what Bitcoin is meant for. It’s supposed to be purely for online peer-to-peer cash transactions.’

- Pro: ‘Ordinals and BRC-20 create a healthy fee market, which will be much needed after a few more halvings in the future.’

- Anti: ‘A healthy fee market could also develop on a purely monetary Bitcoin.’

- Pro: ‘That hasn’t been the case. We are desperately in need of a new narrative on boring Bitcoin.’

- Anti: ‘Let the shitcoins deal with the NFTs and memes, not Bitcoin. Bitcoin is serious business.’

- Pro: ‘I’m sure the first goldsmith also met scorn, making frivolous jewelry out of this god-given metal. Similarly, anyone can do with Bitcoin what they want. It’s a free market for block space.’

- Anti: ‘I can’t even onboard friends to Bitcoin, because of the high fees’.

- Pro: ‘Let your friends use Lightning, which was built for low-fee transactions’.

Conclusion

In a sense, the BRC-20 experiment is nothing new. Bitcoin’s base layer has been used before as a platform for issuing fungible tokens. In 2012, the Colored Coins protocol was introduced but failed to gain traction because… wait for it… high transaction fees on Bitcoin and limits on programmability drove users to explore Ethereum. Sounds familiar, right?

It’s why Ethereum was invented because Bitcoin lacks the expressiveness to create tokens that have functionality. Still, compared to previous attempts, the Ordinals protocol has made it a much lower threshold to inscribe content on the Bitcoin blockchain. And ever since Ordinals, we keep getting surprised by new functionality, BRC-20 is the most recent example of which.

Sure, a lot of these NFTs and meme coins will die. But some will stay. And inscribing content on the safest, most immutable blockchain of them all will probably have a lasting allure.