Breaking: Apple Dives into NFTs

In This Issue

- David shares his thoughts on Apple + STEPN, low crypto trading volumes, crypto tax-loss harvesting & Coinbase’s television campaign.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on the history of debt… until Bitcoin.

- In case you missed it by Rebecca.

The Ultimate Taking Profits Guide

Hey there,

Quick question before starting: Have you ever invested in crypto only to think “what do I do next?

Crypto investing is easy! It’s taking profits that’s the hard part!

Once you start investing in crypto and see the volatility, you’ll quickly start wondering when you should actually cash out.

The problem is, if you’re not a seasoned investor, your emotions can lead you to over analyzing and it ends up consuming all your time.

We like to avoid that, and the best way is with a tested system which removes the guesswork and keeps things simple!

You can get the Ultimate – Taking Profit Guide for FREE by upgrading your subscription below:

Upgrade & Get The Guide for FREE

The News Now

Apple 🤝 STEPN

You can now purchase NFTs with Apple Pay.

Specifically, STEPN NFTs. That’s because STEPN just announced a partnership with Apple to allow users to purchase NFTs via Apple Pay directly within the STEPN iOS app. No longer will users need a third-party crypto wallet to make such a purchase. This makes STEPN the first ever blockchain gaming app to secure such a deal with Apple.

The setup is simple. Within the app, users purchase SPARK credits via Apple Pay. Users then use their SPARK credits to purchase their desired NFT(s). Users can also hold and sell their NFTs within the app too because the full STEPN NFT marketplace will soon be made available on the iOS app.

It seems there’s always some crypto-related rumor swirling with Apple. But this STEPN news serves as one of the few hard examples of the company dipping into crypto. Other major notables are last week’s announcement that Axie Infinity will be made available for download via the App Store (although there’s no in-app NFT purchases nor any NFT marketplaces within the Axie app) and MetaMask’s integration with Apple Pay in March of 2022.

With this news, one can’t help but wonder if Apple, as well as any competitors watching these moves, will delve even further into crypto in the near future. Just a friendly PSA that Apple is the largest company in the world with a total market cap at $2.7T. Currently, more than 1 billion people use their phones, and Apple Pay serves as the company’s flagship payments application.

STEPN is a Web3 move-to-earn fitness app that operates on Ethereum, Binance Smart Chain, and Solana. Users purchase sneaker NFTs and then complete real life physical challenges to earn additional rewards. STEPN says the app has been downloaded millions of times and users collectively logged over 70 million miles by the end of 2022. STEPN’s native currency, GMT, rallied 17% on the news.

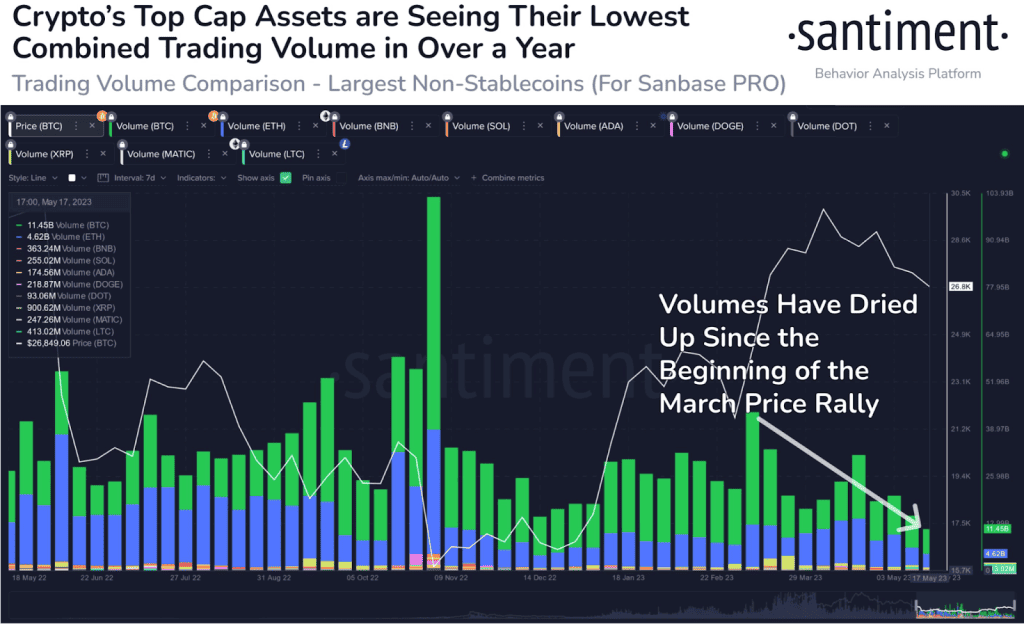

Crypto Trading Volumes Are Super Thin

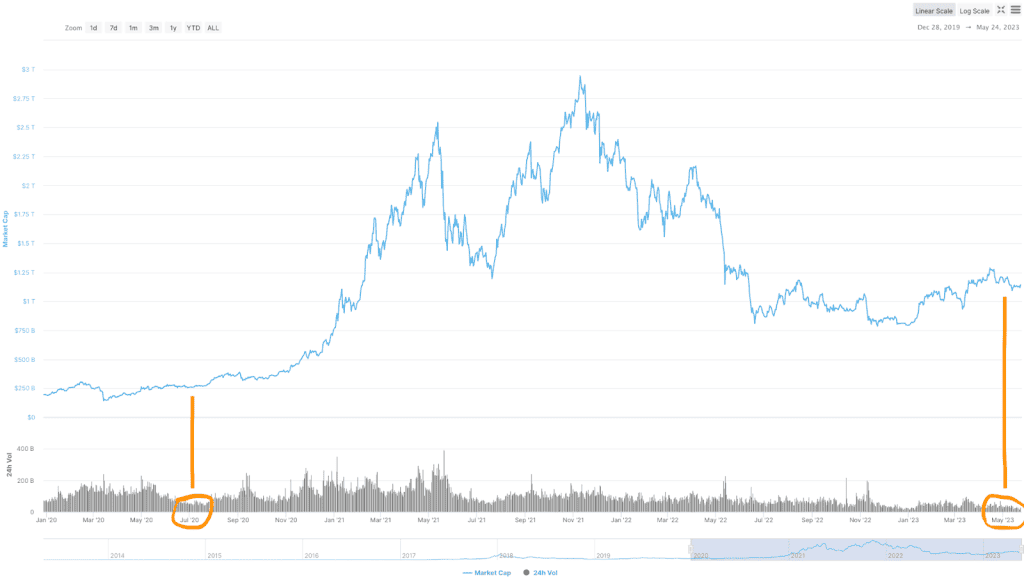

Total crypto trading volumes are at record lows.

That’s according to data from the on-chain analytics firm Santiment. Specifically, the 7 day trading volume of crypto’s top assets, which includes BTC, ETH, and BNB, is at the lowest point within the past full year.

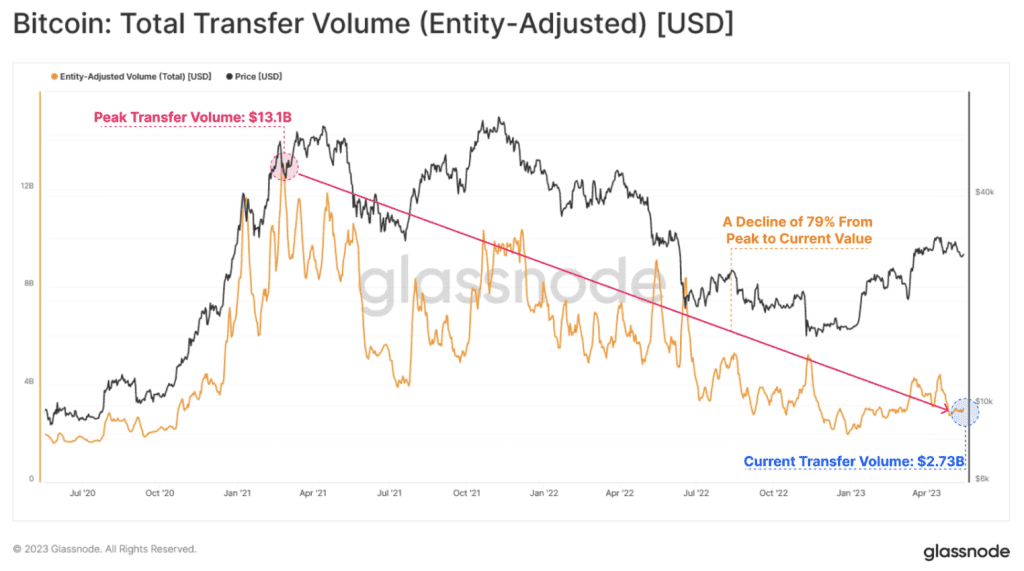

And from Glassnode, Bitcoin’s total transfer volume has dropped an astounding 79% since hitting all time highs (ATH) in early 2021.

Remember, total trading volume measures the amount that an asset is being traded within a particular time-frame. High trading volume means many buyers and sellers and low trading volumes means the opposite. Generally, low total trading volumes signify:

- Low Interest. The coins just aren’t trading hands. People seem indifferent.

- Low Trading Volume = Less Liquidity = Chance for Higher Price Volatility. Low volumes mean the asset, at the moment, isn’t super liquid. This means there’s an increased chance for a major price move if a big player enters the market.

- Not Much Information. Low volume means less certainty about the current value of the asset. Traders vote with their wallets as to how they value the asset. So fewer trades equals less “votes” about the current price.

Having said all that, here’s my take on the current situation:

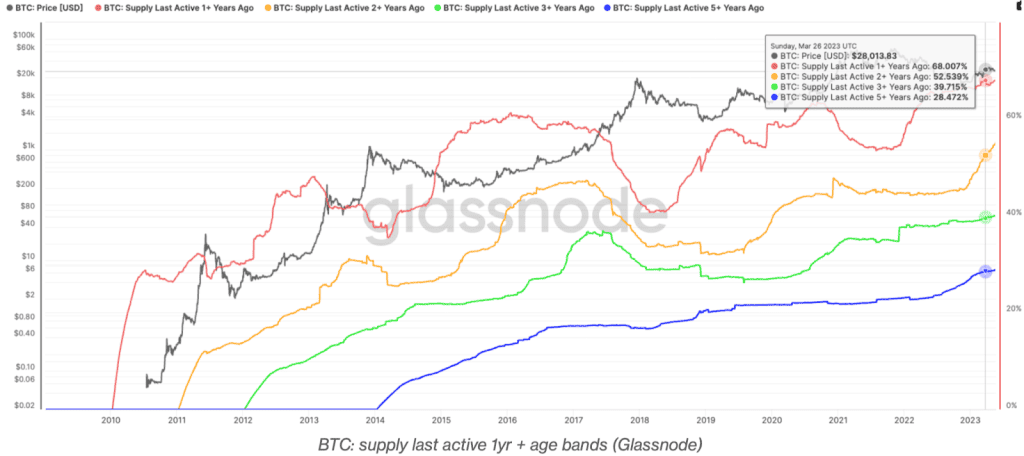

- The Bottom Is In. Sure, there’s not a lot of new buyers, but neither are there many sellers willing to unload at these prices. The tourists are long gone, as new data from Glassnode shows that BTC HODLed for a year or longer just hit new ATHs at 68%. I think this all points to an established price floor before the 2024 bullrun.

- A Widening Divergence in Volume and Price. We’ve had many periods of thin trading volume in the past, but I’ve never seen such thin volume while the prices are ranging sideways at such high levels. BTC ranging at $30K on volumes not seen since the 2019 bear market is just a further indicator that the bottom is in.

- Price is About to Move. Historically, low crypto volume almost always precedes some serious price volatility. So buckle up.

Crypto Tax-Loss Harvesting at Center of U.S. Debt Ceiling Negotiations

On Monday, Sam discussed the debt ceiling debacle currently embroiling the U.S. government. Well, we have a quick news update on that. It appears that crypto tax-loss harvesting is a central point of contention between President Biden and House Speaker McCarthy in relation to striking a debt ceiling agreement between the two parties.

Apparently, Biden wants the deal to include new rules that prohibit crypto traders and investors from engaging in tax-loss harvesting, claiming that such a prohibition would add significant tax revenue for the U.S. Government. McCarthy and the Republicans are opposed to the idea, arguing that the U.S. has a spending problem rather than a tax revenue problem.

Coinbase is Launching a New U.S. Television Campaign

Coinbase is engaged in straight total war to get what they want in the U.S.

Both last week and two weeks ago, we discussed Coinbase suing the SEC and the company’s explorations to possibly establish a new global headquarters outside of the U.S. Well now, Coinbase is launching a new U.S. television campaign. You can watch the first video here.

The first TV ad released indicates that Coinbase is taking their talking points past U.S. officials and instead going directly to the U.S. electorate. Their message is this: “Crypto is vitally important and even has national security implications. So elect government officials who respect the technology and will adopt clear and sensible regulatory guidelines.”

I love seeing Coinbase go to war for crypto in the U.S. And given they’ve got plenty of dry powder, they’re an important and staunch ally in the fight for common sense crypto regulation and adoption in the U.S.

Market Analysis by Rekt Capital

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed and discussed:

- Chainlink (LINK)

- Stacks (STX)

- Cosmos (ATOM)

- Solana (SOL)

- Oasis Protocol (ROSE)

- Power Ledger (POWR)

Let’s dive in.

Chainlink — LINK/USD

Chainlink has been moving sideways for several months now and price is now tagging the Range Low support once again.

Many times over the past several months, LINK has tagged the Range Low and rallied to the Range High and then price would drop back to the Range Low and then back to the Range High etc.

This is the intra-range bound behaviour that LINK has displayed in what is almost certainly its Accumulation Range in anticipation for the next, new macro uptrend for LINK.

Of course, LINK has a history of downside wicking below the Range Low (even fake-breaking down below it, in fact).

Those deviation periods have offered the best ROI opportunity for bargain buyers.

So technically, LINK is now at support and any downside volatility below the Range Low is price’s way of searching for price stability here.

Monthly Close above the Range Low would be a good sign for a reversal to the Range High over time.

Of course, one may ask: at which point will this intra-range behaviour stop?

Having played this range multiple times publicly for reliable gains over the past several months, for me it works until it doesn’t.

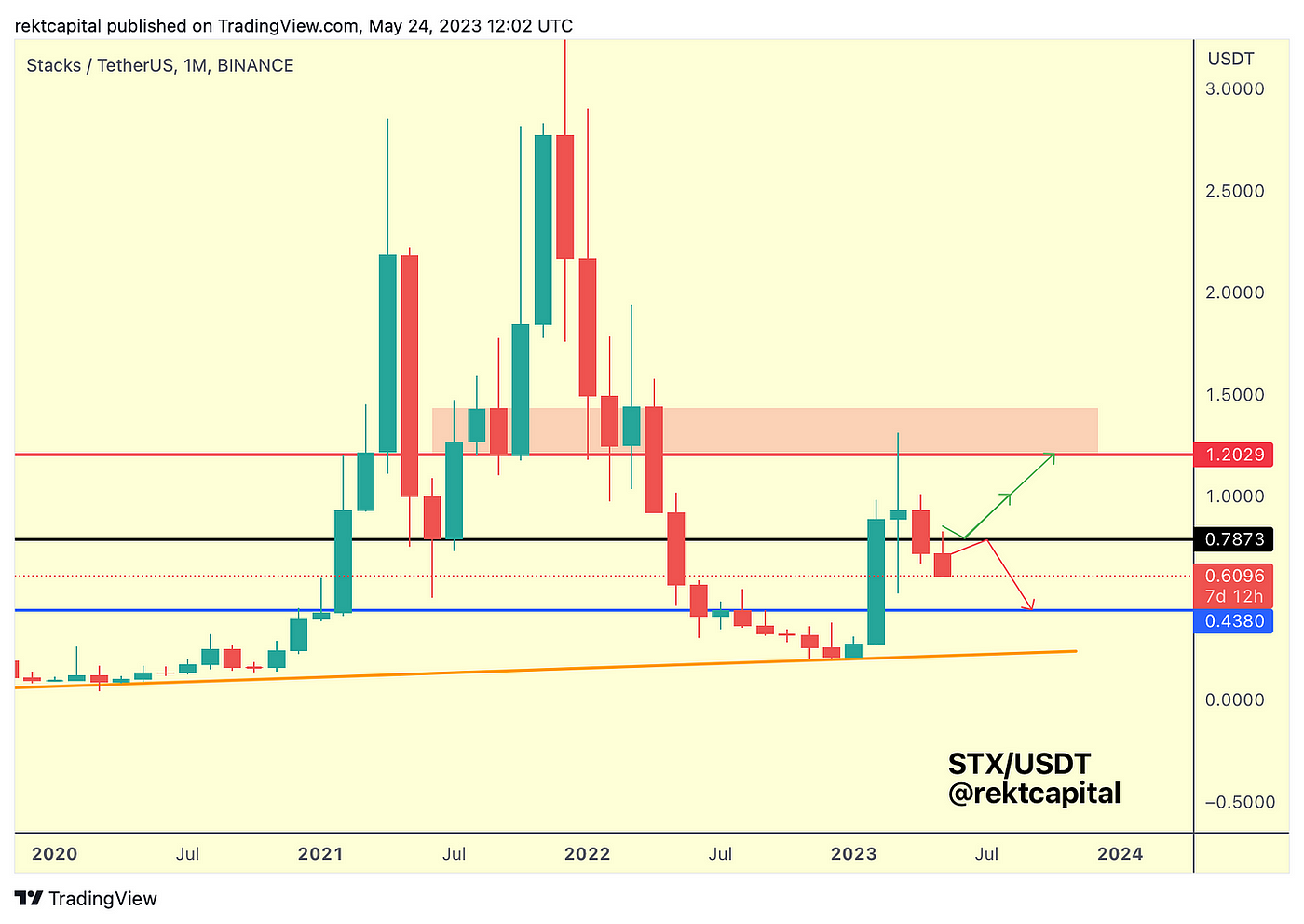

Stacks — STX/USDT

STX has officially broken down into the blue-black range.

Last month, STX Monthly Closed below the black then-support and this month STX has flipped this same level into new resistance, essentially confirming this level as new resistance and thus — a new Range High.

As a result, it’s possible STX will drop into the very bottom of this blue-black range.

After all — normal consolidation occurs from Range Low support to Range High resistance.

And seeing as the Range High resistance has rejected price, it’s expected that price will drop deeper into the range, and certainly a revisit of the Range Low remains a distinct possibility as part of intra-range bound behaviour.

Go Premium to Keep Reading

Subscribe to the Wealth Mastery Premium Investor Report to read the rest of this article AND gain full access to the premium archives.

The History of Debt (Until Bitcoin) by Erik

If you think Ethereum’s Proto-Danksharding aka EIP-4844 is a rabbit hole, wait until you start researching the history of money, the biggest rabbit hole of them all.

On our way down you will gather nuggets of knowledge from sociology, anthropology, engineering, and of course economics. Few people know enough about all fields to have a comprehensive view of what money is. Few… but we will.

As crypto enthusiasts, we are drawn to this what-is-money rabbit hole and a successful descent is necessary if we want to make sure our belief in crypto is valid. We’re in crypto for… the technology – right? But how does this magic new technology relate to previous ones? Understanding this will make our conviction stronger when number go down for a while…

Is Debt Our Number 1 Problem?

For many people their interest in Bitcoin springs from a sense that something is wrong with the traditional financial system. That intuition is often – justly – inspired by the image of a central bank money printer.

Then there’s the related issue of debt. People have become aware that the current level of debt in our financial system is unsustainable. The 31 trillion dollar debt of the US government is indeed unlikely to be paid off, barring a productivity miracle. A more likely solution will be to switch on the money printer and inflate the debt away, hurting every saver’s purchasing power.

Many Bitcoiners don’t like the concept of debt. Bitcoin is what one calls a ‘bearer instrument’ – like gold. Its value doesn’t depend on another party making good on its promise. A bearer instrument is great: it’s something you can hold in your vault or your hardware wallet and no authority can take it from you. So, debt is – rightly – perceived as a problem in our financial system. But does this mean that debt is always and in and of itself a problem?

Both gold and Bitcoin are in a sense ‘anti-debt’ because there is no other party involved. There is no counterparty risk. And I think because of this, many Bitcoiners shun debt altogether, viewing it as the cancer of our financial system, controlled by governments and banks.

There is probably truth to this but I challenge you to read the view of anthropologist David Graeber in his classic book Debt, the First 5000 Years, debt has existed since prehistoric times and has been the grease of the markets, however local and small. It’s perfectly natural for people to be indebted to each other. Only when a precise monetary value was attached to debt, and when governments started enforcing debt, hell broke loose. In times of famine, farmers had to take loans to feed their families. But the collateral for that loan included not just their home but also their wife and children. Because of this, the advent of debt expressed in monetary terms and enforced, introduced widespread slavery in the early big societies of Mesopotamia.

Let’s dive in and let’s have a look at what this means for the role of Bitcoin and crypto in general in our financial system.

Debt as ‘Layer 0’

Graeber starts by dismantling a false story about prehistoric trade we’ve all been told, namely that before there was money, people used barter: ‘in exchange for 12 chickens, I give you this fine-looking goat.’ Only later, so goes the orthodoxy under many economists, did people invent money, like shells and beads, and later, metals. And only then debt arrived on the scene. But Graeber argues:

“Our standard account of monetary history is precisely backwards. We did not begin with barter, discover money, and then eventually develop credit systems. It happened precisely the other way around. What we now call virtual money came first. Coins came much later, and their use spread only unevenly, never completely replacing credit systems. Barter, in turn, appears to be largely a kind of accidental byproduct of the use of coinage or paper money.”

So, taking the liberty to translate Graeber’s view to crypto bro’s parlance: we can view debt as the ‘Layer zero’ that preceded the invention of hard money. Or rather than debt, we should say: obligations people felt towards each other. It’s the universal: ‘I owe you one’ after someone has given you something or helped you out.

Money (beads, coins) only later made it possible to exchange goods and services with people who were not from your own circle. What about barter? That, according to Graeber, only happened between societies that had little contact with each other. In those cases, the ‘economy of service and reciprocity’ was not possible. Nor did money work because different people used different kinds of money. Only in that extreme case was there no alternative but to exchange sheep for goats.

But wait a second. How could people have a (small-scale) economy without using barter AND without having money? Well, people had a memory. They carried around ‘the ledger’ in their heads. In their heads they kept track of who did them a service or gave them goods. The fact that they couldn’t express the debt that resulted from this action in a concrete number, didn’t matter so much.

In other words, debt that preceded money didn’t need to be expressed in monetary terms. And that still holds true today in the small-scale economy of a neighborhood. If I give you a ride to the airport, I have built up some ‘credit’ with you. And you might help me with gardening some other time. Our ‘trade’ doesn’t depend on knowing if these services have the same monetary value. Credit does not have to be expressed in a currency to make a small society function. And this explains how people in prehistoric times could keep their society going while they had no money. It also implied that debt didn’t necessarily have to be repaid. Sure, it would help your social standing if you were generous to others, ‘repaying’ their favors, but unlike present-day Bailiffs, no one would stand at your doorstep to demand you rub their back asap because they massaged your feet 5 lunar cycles prior.

Hard Money as Layer 1

Scaling up this informal debt-based system from small communities to large societies in which people don’t know each other required physical money. That’s the ‘Layer 1’ on top of the ‘Layer 0’ which was debt/credit that people carried around in their heads.

According to Graeber, money – be it shells or, later, silver, copper and gold – made debt ‘scalable’. (Again, ‘debt’ does not carry the heavy connotation it has with us. View it as offering a service and the implicit expectation of getting something in return. There was no amount attached to the debt and no bailiff’s order.)

But scaling up this system from small communities to large societies where people don’t know each other required physical money, a ‘Layer 1‘ on top of the ‘Layer 0’ which was debt.

Graeber: ‘A system of pure credit money would have serious inconveniences […]. Credit money is based on trust, and in competitive markets, trust itself becomes a scarce commodity. This is particularly true of dealings between strangers.’

You can view this Layer 1 of hard money as a technology like many others in human history that scales up small-scale processes. The invention of physical, hard money allowed for trade across long distances between people who couldn’t have ‘outstanding debt’ with each other. The invention of hard money abstracted the debt away from intimate social relations.

You can also see hard money as an invention that outsources the mental load of storing different debts in our memory. Compare it to the technology of writing. Instead of remembering stories, we invented writing to confine to paper what was in our minds. This aspect of ‘outsourcing’ a mental load also applies to the invention of money. We condensed into silver and gold coins what was previously in our minds.

By the way, Graeber posits that governments have in many cases been instrumental in kickstarting an economy with physical money. He gives the example of the huge challenge of feeding your troops that would march through your country. Instead of having a second army of suppliers follow them, you could also give these soldiers silver coins with the King’s face stamped onto them. Next, you set up a tax system where your people must pay the government taxes in these coins. Since the soldiers carry these coins, a market will spring up sustaining the troops.

Seems like a nice way to get a market economy off the ground. But according to Graeber, in line with the previous example, a market economy is dependent on a government. This of course introduces centralization/monopoly/inflation risks. We don’t need to explain to Bitcoiners how government control of the money supply will almost always lead to monetary debasement, aka money printer go brrr. That’s where paper currency comes in, the ‘corrupted government sidechain’.

Currency as a Corrupted Sidechain

We can’t leave paper currency out of this discussion of layers. Paper currency, or fiat currency issued by governments has gradually replaced hard money (coins). Remember that paper money is a representation of money. Originally, paper notes were covered by gold or copper bullion and coins in bank vaults.

Just like a sidechain in crypto, paper currency was useful for solving scaling issues. A sidechain helps with solving transaction throughput issues and high fees. Similarly, paper notes are easier to carry around and administrate.

But while paper currency indeed makes transactions more practical, it is like an untethered, corrupted sidechain of hard money. Because of course, since the earliest time of banks that issued paper notes, it turned out to be irresistible to print more paper than there was gold, silver or copper in the vault. That is why, unlike scarce hard money such as gold, paper money will lose its value over time. It’s an inflationary process.

The Role of Bitcoin

So, after stacking these layers, we see that debt has always been the grease of human societies. It’s in our human nature that where goods and services are going in one direction, ‘credit’ goes in the other.

What is the relation between debt and Bitcoin? If it’s true that debt is the foundation layer of human society, why do we need anti-debt, aka Bitcoin?

Well, as explained, we need a layer of hard money on top of debt. While debt can function in small societies and doesn’t require hard money, we need hard money to scale debt to larger societies. But this layer of hard, physical money is not practical for most purposes in current society – imagine the transaction latency and fee of an international transaction involving shipping gold bars! The sidechain of paper currency has always been the solution to this problem but has time and again led to inflation of the supply – really theft by governments.

If only we had a form of hard money that also would be scalable: travel across countries at the speed of light, with low transaction fees…

Aha! And that’s it, right there. The promise of Bitcoin – and, arguably, crypto in general – is that it combines the advantages of incorruptible hard money with the nimbleness of paper money.

Bitcoin is arguably the best hard money, the best Layer 1 on top of debt. Why? Like gold before, it enables transactions between parties who do not know and may not trust each other. It is trustless and can work where a debt-based currency does not function (After 2022, Russia will not ever trust the paper promises from the US ever again).

Perhaps debt creation itself is not the problem, suggest books like Graeber’s. What is problematic, according to the author, is a government’s monopoly of violence over money and debt. It can force the use of a certain kind of money. The Central Bank alone has the ‘money printer’. So, while Bitcoin won’t rid us of debt – it doesn’t need to – it might just free us from the central bank… Well, at least we ca

In Case You Missed It by Rebecca

Crypto Market News

- Ledger is postponing the launch of its new Recover service after a week of criticism and says it will open-source the code. Source

- Coinbase is rolling out a US ad campaign called “Moving Forward America” to explain why crypto is important for the global financial system. Source

- Coinbase has launched a new subscription service called Coinbase One to users in the UK, Germany and Ireland offering users zero trading fees. Source

- Coinbase Cloud has integrated with Chainlink and will run a node to improve smart contract reliability. Source

- CryptoCom has added pay support for fiat-to-crypto purchases in MATIC, USDC, and DAI into its DeFi wallet. Source

- Hotbit has halted its operations and advised users to withdraw funds before June 21. Source

- Bitget has received a regulatory license to operate in Poland after securing a license for Lithuania in April. Source

- MetaMask parent company ConsenSys has denied rumors that it will collect taxes from crypto investors. Source

- Strike has announced it’s relocating its headquarters from the US to El Salvador and expanding services to 65 countries. Source

- Jack Dorsey’s TBD has announced a Web5 decentralized web platform to put the control of data and identity back into the hands of users. Source

Coins and Projects

- Bitcoin developer has unveiled Ark, a Layer-2 protocol enabling faster and more secure transactions. Source

- Tether’s USDT has been added to Bitcoin payments app, Strike. Source

- Tether has announced it will DCA into Bitcoin starting in May, using as much as 15% of its net monthly profits. Source

- USDC issuer Circle has added $8.7B in overnight repurchase (repo) agreements as it braces for the possibility of a US default. Source

- Visa has started blockchain experiments on Ethereum’s Goerli testnet to trial gasless transactions. Source

- Australia has made its first foreign exchange transaction using its CBDC during its pilot program on Ethereum Layer-2 platform Canvas. Source

- Cardano has added over 1,000 smart contracts since the beginning of 2023. Source

- Solana has announced its ChatGPT plugin is available for download on GitHub. Source

- BNB Chain has seen its highest transaction count since May last year. Source

- Uniswap has launched on Polkadot thanks to Moonbeam parachain. Source

- Uniswap governance members have proposed launching V3 on Coinbase’s Layer-2 network Base. Source

- Aave V2 on Polygon has suffered a bug that has been blocking users from withdrawing funds from specific pools. Source

- Gala Games has partnered with poker streaming platform PokerGO to launch a Web3 game. Source

- STEPN has integrated with Apple Pay for in-app purchases such as NFT sneakers. Source

- Litecoin Futures have jumped 22% so far this year as the upcoming halving event is getting closer—it’s less than 70 days away now. Source

- TON blockchain has launched a $25M fund for projects building on the network. Source

- Axie Infinity has been listed on the Apple app store and the AXS token gained 12% upon the news. Source

- Apecoin DAO has revealed plans for an Ape Accelerator program allowing the community to vote on proposed projects using APE. Source

- Filecoin Foundation has rejected the US SEC’s classification of its FIL token as a security. Source

- Elon Musk has explained to the Wall Street Journal why his favorite cryptocurrency is Dogecoin—”it has the best humor and dogs.” Source

Macro News

- The UK Treasury Committee has seemingly opposed the government’s view on crypto saying investing in it is like gambling and has no intrinsic value yet is promising technology. Source

- Robert Kennedy Jr. has announced he will be accepting Bitcoin donations making him the first presidential candidate in the US to do so. Source

- Australia’s oldest bank, Westpac, has announced plans to block crypto payments to Binance. Source

- Argentina has unveiled a new 2,000-peso banknote that will be issued in response to inflation rising over 100%. Source

Final Notes

China crypto news, Tether buys BTC, FED updates and MORE in the video below. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.