Breaking: Binance!

In This Issue

- Rebecca shares her thoughts on a possible Binance bankruptcy, the UK’s crypto regulations, Chainlink collaborating with SWIFT, El Salvador’s Bitcoin mine & Optimism’s Bedrock upgrade.

- Altcoin alpha by David.

- This week’s airdrop by Jesse.

- Sam has an NFT report on big brand NFTs.

Premium Subscription highlights this week:

- Jesse’s Altcoin Report: This week Jesse’s altcoin report covers the future of crypto governance with BitDAO. There might even be an airdrop opportunity with this one!

- Airdrops and Testnets: Speaking of airdrops, don’t miss the Airdrop report every Wednesday with a list of incentivized testnets that everyone should be participating in.

The News Now

😱 Binance Outflows Boom As A Bankruptcy Looms

Binance’s week just went from bad to bonkers. Since the SEC’s lawsuit against the exchange…Binance.US is offering a bonus for selling your Bitcoin to them, bitcoins left the building, and CZ has less than 21 days to face the music. It’s not surprising a bombshell rumor dropped on Twitter of an imminent bankruptcy. Never a dull moment in crypto!

Where there’s smoke, there’s usually fire. Well, that’s what has proven to be true so far in this bear market. With Bitcoin selling on Binance.US for $2K more than its actual price, you know it’s probably nothing. Or maybe, Binance.US doesn’t have as much Bitcoin as they say they do. It’s not a good sign.

Crypto traders know the drill, it’s time to move out. Almost $100M in Bitcoin was withdrawn in one day alone this week. That equated to 94,466 unique Bitcoin addresses—an all-time high.

So, is it another one bites the dust? Maybe. Binance.US has halted USD deposits and will stop USD withdrawals from as early as June 13. The exchange has struggled to secure banking partners since the banking crisis in March. There’s more: Bitcoin Magazine CEO, David Bailey, also said in a tweet: “Major custodian about to declare bankruptcy without last minute bailout.” The platform in question is reportedly Prime Trust, a Binance.US partner. But it seems Prime Trust may just be in luck. Custody firm BitGo has reached a preliminary agreement to buy the company. It still requires regulatory approval, but it’s a positive step forward.

If you haven’t already, do this one thing now: move your coins off the exchange and into a hardware wallet. Just in case. If these regulatory woes continue, be prepared to go shopping in a sat-stacking race before the halving.

Amongst all the chaos, CZ has been summoned by the US District Court to face the music. Whilst he’s not required to appear in court, he has 21 days to respond to the summon…or else. The consequences could include fines, penalties, or other regulatory actions. Yet the SEC reeks of hypocrisy. Binance’s lawyers allege that Gary Gensler offered to be a Binance.US advisor back in 2019 before he became the SEC Chair. WILD!

🇬🇧 UK Not United On Crypto Regulations

The UK is divided on many issues. Brexit, immigration…football teams. And of course, crypto. Whatever the US does, the UK usually follows. And with the US unable to commit to a crypto classification, the UK is staying firmly on the fence too. Just last month, the UK Treasury Committee thought that crypto should be treated like gambling. Okay cool, so crypto gains won’t be taxed then. “Oh, but wait,” they say, “that’s not what we meant.” Now, it seems they do want to send the tax man after you.

The UK’s Crypto and Digital Assets All Party Parliamentary Group (APPG) published a new report this week on crypto regulation. APPG Chair, Dr Lisa Cameron puts forward the case for crypto being a financial asset “I like people to pay tax when they make gains in the UK and that can only be achieved under the financial services regulation rather than gambling.”

The UK government wants its cake and to eat it too. It wants tax revenue but doesn’t want to legitimize the asset class. But it can’t have both. The clock is ticking. The report puts urgency behind the need to create a clear regulatory framework for crypto in the next 12-18 months. Cos, after all, the UK says it wants to become a “crypto hub.”

Regardless of what the UK government wants, the regulator is making its own rules. Crypto advertising in the UK is about to get a shakeup. The Financial Conduct Authority (FCA) has just proposed a ban on crypto incentives.

From October 8:

- crypto will be classified as “restricted mass market investments”

- no more “refer a friend” bonuses

- first-time investors will have a 24-hour cooling-off period between sign-up and purchase

In other UK news:

- The digital pound CBDC public consultation deadline has been extended from June 7 to June 30—they forget a question, oops! LOL

- England has launched a Universal Basic Income (UBI) trial—30 Brits will get £1,600 in addition to their income for two-years

🏦 Chainlink Collaborates With SWIFT And Big Banks

SWIFT is the global financial messaging system that handles almost $5T in daily volume. And Chainlink just scored a partnership. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is where the magic will happen. It allows messages and token transfers to execute across multiple networks. Experiments between Chainlink, SWIFT, and TradFi will provide connectivity between public and private blockchains.

The pilot program will test 3 use cases:

- A token transfer between two wallets on the Ethereum Sepolia testnet.

- A token transfer from Ethereum to a permissioned blockchain.

- A token transfer from Ethereum to another public blockchain. The aim of the pilot is to explore the regulatory and operational obstacles banks experience when interacting with digital assets.

Over 12 banks are involved in the tests including:

- Citi (US)

- BNY Mellon (US)

- Lloyds Banking Group (UK)

- BNP Paribas (France)

- Australia and New Zealand Bank (Australia)

Whilst this has the potential to supercharge crypto adoption, it also has the potential to lay the foundations for CBDCs—something SWIFT has already publicly acknowledged.

🌋 El Salvador’s $1 Billion Bitcoin Mine

El Salvador’s mining dreams are becoming a reality. Volcano Energy has announced $1 billion in commitments to build a Bitcoin mine in El Salvador. Tether is an investor from the first funding round. The first $250 million has been released and will be used to develop the power generation park. Whilst previous mining efforts in El Salvador have been centered around geothermal, this new venture will use solar and wind energy. If the park can achieve its target hash rate of over 1.3 exahashes per second, it would rank among the top 20 pools in the world.

🔥 Optimism Optimizes With Bedrock Upgrade

Ethereum’s Layer-2 competition is heating up. Optimism has successfully completed its long-awaited Bedrock upgrade. The upgrade was deployed on Ethereum’s Goerli testnet back in January and later confirmed the code in April. It launched on the mainnet this week.

Bedrock is designed to optimize three things on the Optimism network:

- Lower gas fees

- Reduce deposit-confirmation times by 90%

- Allow ETH to function like a native token

The goal is to minimise any differences between itself and Ethereum. That way it’s easier for Ethereum-native protocols to deploy dApps on the network. Optimism is hoping to take market share away from Arbitrum with this new upgrade. In a week where Arbitrum suffered an outage, Optimism takes the crown.

Altcoin Alpha by David

Existing Projects / Tokens

- Arbitrum [ARB] is launching USDC natively on its network June 8th. Say goodbye to bridged USDC. Benefits of native USDC include: (1) fully reserved and 1:1 redeemable with USD, (2) opening of institutional on/off ramps, and (3) elimination of bridge withdrawal delays.

- Fractal [FCL] has launched a new Web3 gaming studio – FStudio – that will give game developers a way to incorporate crypto into games without needing to code. Fractal is lead by a co-founder of Twitch, Justin Kan.

- Injective [INJ] just launched their Open Liquidity Program, which allows anyone to provide liquidity to Injective’s order-book in exchange for INJ rewards. Up to 60K in INJ can be earned during each 28 day epoch.

- Pendle Finance [PENDLE] just launched RocketPool rETH and wstETH pools on their platform. Pendle is an Ethereum and Arbitrum protocol that allows for the tokenization and trading of future yield.

- TON is considering a proposal to burn 50% of all network fees, moving forward. A move similar to Ethereum’s EIP-1559. If implemented, when a user makes a transaction, 50% of the tokens normally reserved for payment to the validator would instead be burned. This could help the crypto become deflationary in the future.

- Turbos Finance [TURBOS], a DEX on the Sui blockchain, is introducing “smart routing” for USDC on Sui. This makes any bridged USDC asset compatible and tradable against any native Sui asset on the network.

New Projects / Tokens

- ARPA is teasing the release of “Randcast”, a distributed random number generator for the network. ARPA is a decentralized secure computation network built to improve other blockchains. ARPA is currently in testnet.

- Avail Network [AVL] is beginning phase 2 of their “Kate” testnet. Avail Network is a spin-off project from Polygon. Testnet users can currently acquire AVL tokens for staking, nomination, validating, and other functions.

Airdrop by Jesse

Cedro Finance is a cross-chain decentralized liquidity protocol where users can lend and borrow the listed assets across multiple chains with affordable transaction fees. Lenders are able to deposit their assets to contribute to the liquidity of the platform and borrowers are able to borrow the liquidity in an overcollateralized manner.

The Cedro Unified Liquidity Token or CULT tackles the problem of fractured liquidity found on protocols like Uniswap. Instead of spreading one token across multiple networks, CULT lets users deposit multi-chain assets (ex. USDT, UNI, etc.) from different chains and add them to a singular unified liquidity pool.

Cedro Finance has announced the release of its CED token and is expected to distribute rewards to all users who’ve participated in the Cedro Finance Testnet on BSC, Fantom, Arbitrum, Avalanche, and Ethereum.

To get started all you have to do is click on the “Get Test Token” tab located at the top of the page. Once you have your test tokens choose “Add More” from the collateral list at the bottom of the page and deposit your tokens into Cedro. You can jump between multiple networks and request testnet tokens for each one. If you have any questions or concerns about how to use the protocol, check out the Cedro Finance FAQ.

Big Brand NFTs Are Here by Sam

Prices may be down on PFPs, metaverse land, and many well known collections, but big brand NFTs are creating some major changes in the landscape, suggesting that there is still a lot more to come from NFTs.

Basically, when you take a look at recent NFT developments, what you’ll find is a lot of news relating to huge, global companies. That’s very different from how things were not so long ago, so let’s take a look at how the space has evolved and what’s coming up next.

How The NFT Landscape has Shifted

Pre-2017

The experimental era, when early NFT-like objects weren’t called NFTs. Before Ethereum, you had Colored Coins, Counterparty, and a platform called Ascribe, all on Bitcoin, and what’s regarded as the first NFT, a piece called Quantum, was created on Namecoin in 2014.

2017 to early 2021

In 2017, NFTs gathered a little recognition but were still unheard of outside crypto circles. Development was by this time happening on Ethereum, and both CryptoPunks and CryptoKitties launched in 2017, laying some important foundations. In November 2020, Art Blocks was founded, and as a crypto bull gathered momentum, the JPEG stage was set.

2021 to 2022

The NFT explosion, with hype and prices going through the roof. CryptoPunks became art objects, Bored Apes minted, Beeple and Fidenzas grabbed the spotlight, and huge numbers of new projects launched into the crypto-sphere. But even amid growing mainstream attention, NFT projects still felt indie, creators were anonymous, and corporate players were mainly hanging back.

2023 and ongoing

Despite the NFT market crashing, we appear to be entering the era of big brands executing Web3 strategies. Traditional companies call their NFTs digital collectibles, and there’s an emphasis on easy onboarding through custodial services and credit card payments, along with links between digital assets, and physical products and services.

The Recent Big Brand NFT News

Nike and EA Sports

Image credit: Nike and Electronic Arts

Nike and Electronic Arts are both giants in their respective fields, so it feels like big news that the two are collaborating in Web3, especially as blockchain gaming is a potential-filled area.

Nike Virtual Studios last year launched the .SWOOSH platform, which is focused on NFTs and metaverse-style development, and .SWOOSH will now link up with EA Sports, with the aim of letting users bring assets from .SWOOSH into EA games and experiences.

Details are not yet clear about how the integration will work in practice, but options to outfit in-game avatars in Nike virtual apparel look likely to be implemented.

ANA NFT Marketplace

Image credit: All Nippon Airways

All Nippon Airways is the biggest airline in Japan, and has now launched its own NFT marketplace, ANA GranWhale NFT Marketplace, through ANA NEO, a metaverse-focused arm of the company. This might seem like an unusual combination–airlines and NFTs aren’t usually mentioned together–but it kind of makes sense.

After all, transport attracts enthusiasts (and Japan is the home of otaku culture), who are often into collectibles, and NFTs are a new kind of collectible. In ANA’s case, there is an initial collection of photography NFTs from aviation photographer Luke Ozawa, along with other items including aviation-themed PFPs.

Either way, it’s an interesting move by a huge company, and it will be interesting to see how it plays out.

Mercedes-Benz and Fingerprints DAO

Image credit: Mercedes-Benz

Like several other big companies, Mercedes-Benz now has a Web3/digital division, called Mercedes-Benz NXT, and it just collaborated with Fingerprints DAO and artist Harm van den Dorpel on an NFT drop called Maschine.

Fingerprints is one of the top NFT DAOs, with a substantial art collection and a history of collaborating with artists on new collections. Harm van den Dorpel is a celebrated creator with a history of digital and blockchain experimentation, and Mercedes-Benz is, well, Mercedes-Benz, showing again that major brands are interested in NFTs, in this case taking an artistic angle.

Louis Vuitton Treasure Trunks

Image credit: Louis Vuitton

If you don’t like the word phygital then look away now, because luxury fashion house Louis Vuitton is releasing a collection of NFTs that blend the physical and the digital. The items are called Treasure Trunks and at 39,000 EUR, they’re not cheap.

The collection is part of a Louis Vuitton Web3 project called Via, there will only be a few hundred items, and potential buyers need to sign up for a waiting list. Curiously, the NFTs will be Soul Bound Tokens, meaning they can’t be traded.

Buyers will receive a high-end physical trunk, while the NFT will provide access to future product releases and experiences, both physical and digital, as well as membership of an exclusive community.

Doodles, Red Bull and Camp

Image credit: Red Bull

Burnt Toast, the Doodles artist, recently collaborated with Red Bull for a drop called Red Bull Doodle Art. The collection actually features work from 61 artists who won a contest to be selected, and were then mentored by Burnt Toast.

On top of that, a partnership is lining up between Doodles and physical toy retailers Camp. Doodles will be releasing physical goods and creating in-person immersive experiences, and holders of original Doodles NFTs will receive some special perks.

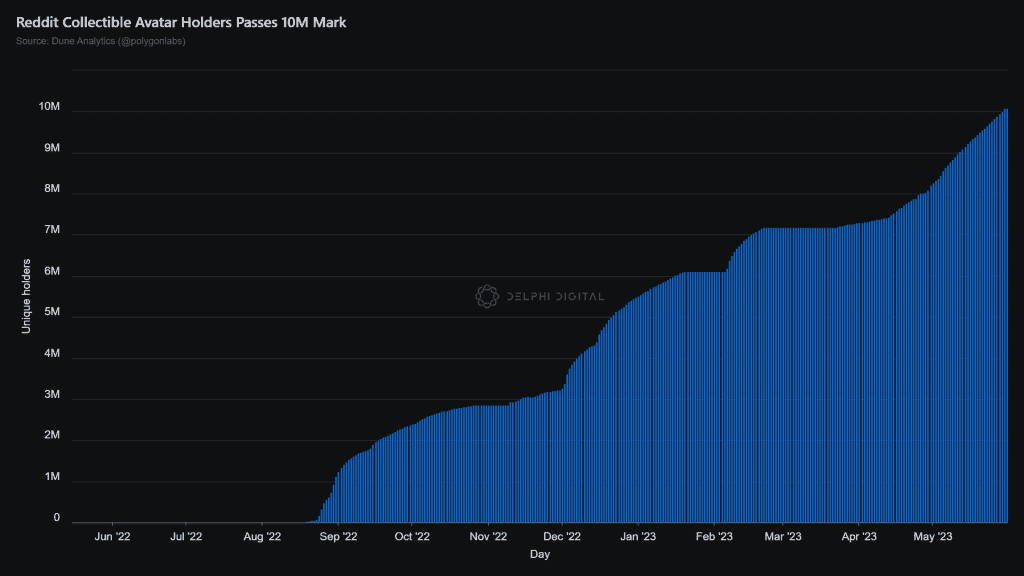

Reddit Collectible Avatars

Chart from Delphi Digital

Last year’s surge in NFT interest among Reddit users took people by surprise, and there are currently no signs of the enthusiasm abating. This year has seen the release of further Reddit NFTs (or Collectible Avatars, as they’re known), and recent data shows the number of holders climbing to over 10 million, with 82% held by wallets containing one Avatar, meaning there’s a healthy distribution of items.

If you wanted an example of a major Web2 platform that has embraced NFTs (and, arguably, parts of the Web3 ethos), then look no further than Reddit.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Final Notes

Bitcoin price prediction, BTC chart and crazy news in the video below. Click on the thumbnail to watch. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.