Bull Trap vs Bear Trap

Whereas a bull trap is a temporary revival of the price in a downward trend, a bear trap is a correction in an upward trend. Both these corrections are false signals which can catch bullish and bearish investors respectively off-guard. They are called traps, as investors are fooled that a trend is reversing. Let's dive into the difference between a bull trap vs a bear trap.

Investors and traders who monitor a stock or coin, often rely on resistance and support levels. These are important price levels for some technical reason. For example, if a price level has acted as support on many occasions, a drop below that level can signal that the price won't recover above this level. But this can be the bear trap: a trader sells or shorts, only to watch empty handed how the price recovers and shoots up above the support level.

What Is a Bull Trap?

Bull trap vs bear trap are mirror images in terms of their patterns: in the case of a bull trap the price seems to break above a resistance level. The trader buys, only to be trapped with a loss as the price breaks down again.

Example of a Bull Trap

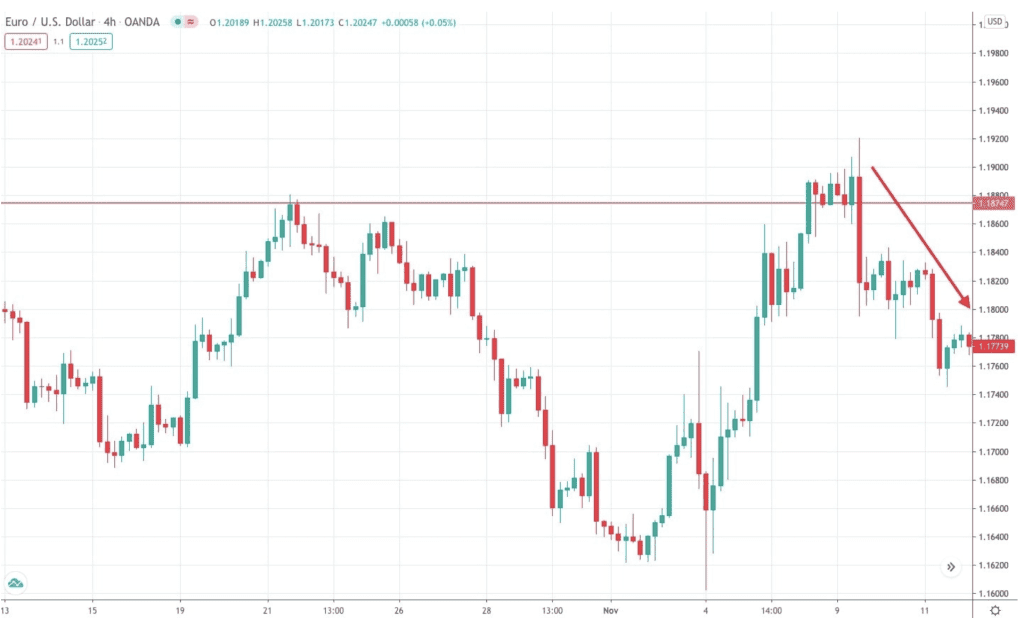

In the above example, the four-hour chart of EUR/USD shows that the price broke above the previous resistance within a strong bullish trend.