ByBit vs Binance: The Ultimate 2023 Comparison

The year is 2023, and ByBit and Binance are two of the most popular centralized cryptocurrency exchanges in the Cryptoverse. If you’re needing a comprehensive overview and comparison of these two exchanges, then you’ve come to the right place. This article gives an updated, relevant, and information-packed summary of everything ByBit and Binance. So without any further adieu…

ByBit vs Binance: Executive Summary

Founded in 2018, ByBit is a Singapore-based crypto exchange that services a global user-base of more than 10 million clients. ByBit is currently a top 10 crypto exchange in terms of 24 hour trading volume. ByBit offers a very diverse menu of trading instruments, including spot, margin, options, futures, and perpetual derivatives. The exchange features multiple savings products, a token launchpad, and an NFT marketplace. In late 2022, ByBit launched the Apex Pro Exchange, a non-custodial, permission-less, decentralized crypto exchange.

ByBit likely appeals to intermediate and experienced crypto investors and traders due to its diverse, exotic product menu and low trading fees. Bybit offers extensive optionality with regards to trading order types and TA tools. There is no KYC is required on ByBit! And most users will want to fund and withdraw with only crypto, as there are fewer options for fiat on and off ramps. Apex Pro offers users a trading avenue that’s completely discrete and immune from possible misuse of funds by a centralized authority.

Interesting Read: The Ultimate Bybit Review

Next Level Reliability, Products & Opportunities

0% MAKER FEES & $30,030 BONUSEstablished in 2017, Binance is the largest centralized cryptocurrency exchange by 24-hour trading volume. The Binance platform is extremely diverse, allowing users to engage in spot, margin, and derivatives trading, trade NFTS, and participate in various types of interest-bearing and financial products. A central component to Binance is its native token, BNB, which is currently the 4th largest cryptocurrency by market cap.

Binance was originally a China-based exchange, founded by Changpeng Zhao (known on crypto-Twitter as “CZ”). The exchange moved its headcounters outside of China near the end of 2017 just before the implementation of Chinese government cryptocurrency regulations. Binance quickly grew in size and began serving a global user-base. The exchange services approximately 90 million users and offers trading on roughly 384 coins.

This comparison will analyze ByBit and Binance under the following seven factors:

- Security

- Ease of access, control, and use

- Fees

- Supported trading instruments, orders and tools

- Unique features

- Aesthetic experience

- Supported cryptocurrencies.

Note that this analysis focuses on ByBit and Binance product suites for retail investors. Binance does offer various institutional and OTC products, but these are included in this comparison.

Definitions

- Security: Degree of protection against third-party theft, exchange freezes or seizures, and privacy leaks

- Ease of Access, Control, and Use: Ease and ability to access, deposit, withdrawal, and trade assets

- Fees: Fees charged to deposit, withdrawal, and trade assets

- Supported Trading Instruments, Orders & Tools: Diversity of available trading instruments, order types, and TA indicator tools

- Unique Features: Additional features, products, and investment opportunities

- Aesthetic Experience: Quality of UI and visuals

- Cryptocurrencies Supported: Number of cryptocurrencies supported

Security

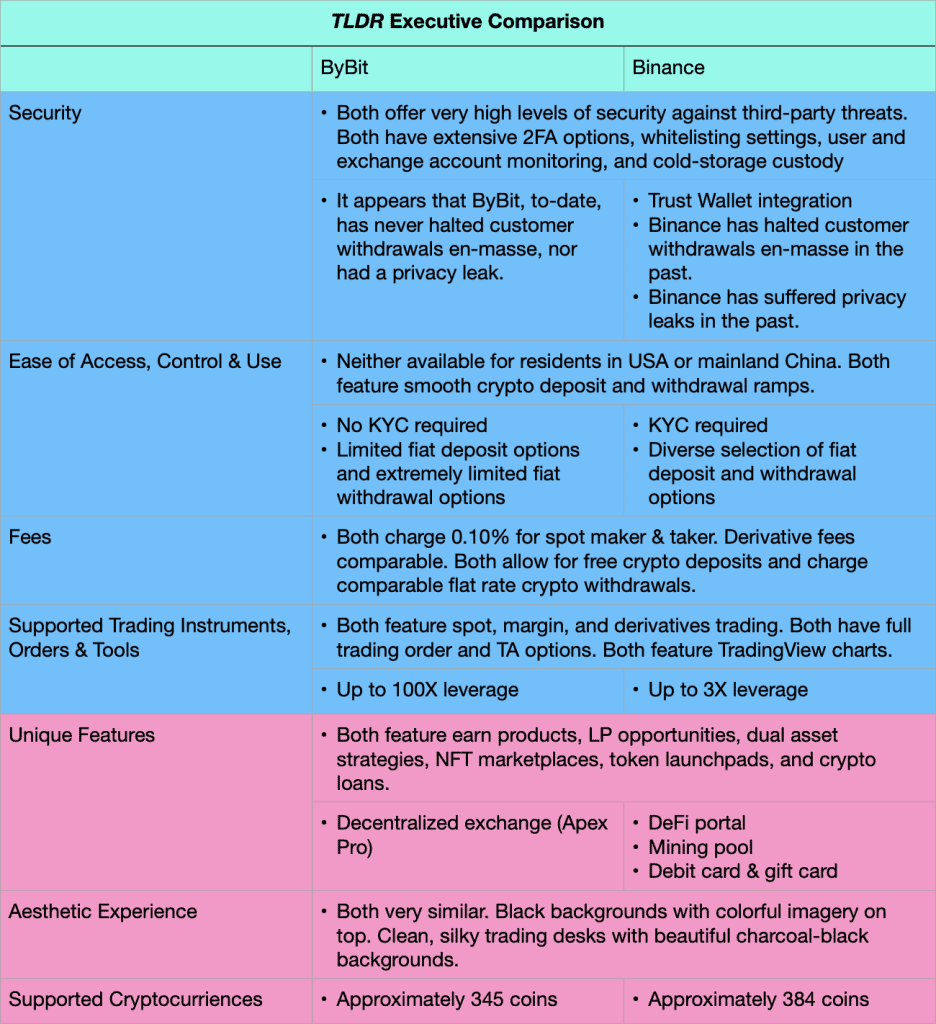

Overall, ByBit and Binance both offer their users with high levels of security against third-party theft. However, ByBit likely has an edge on Binance in terms of exchange seizures, freezes, and privacy leak risks.

Protection Against Third-Party Theft

ByBit and Binance are approximately equal in terms of offering high levels of security against third-party theft.

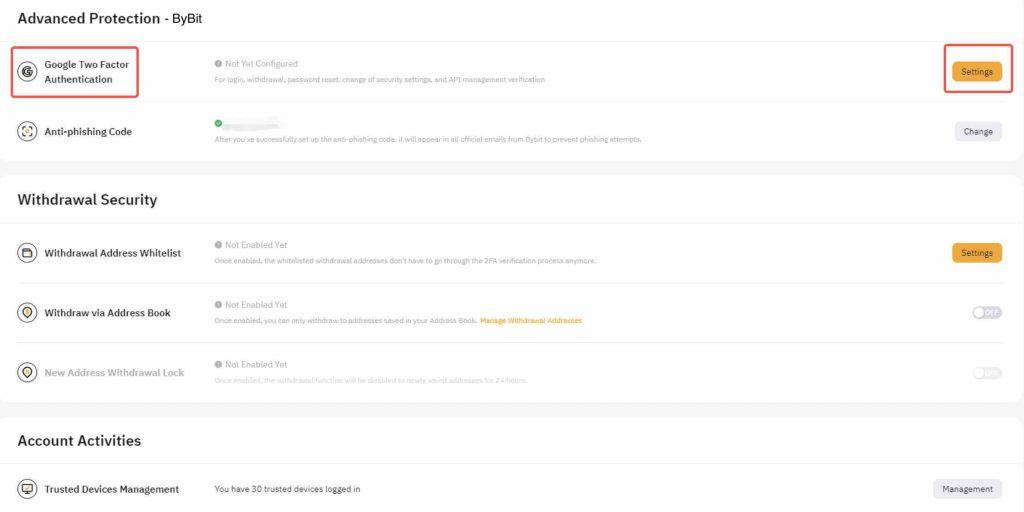

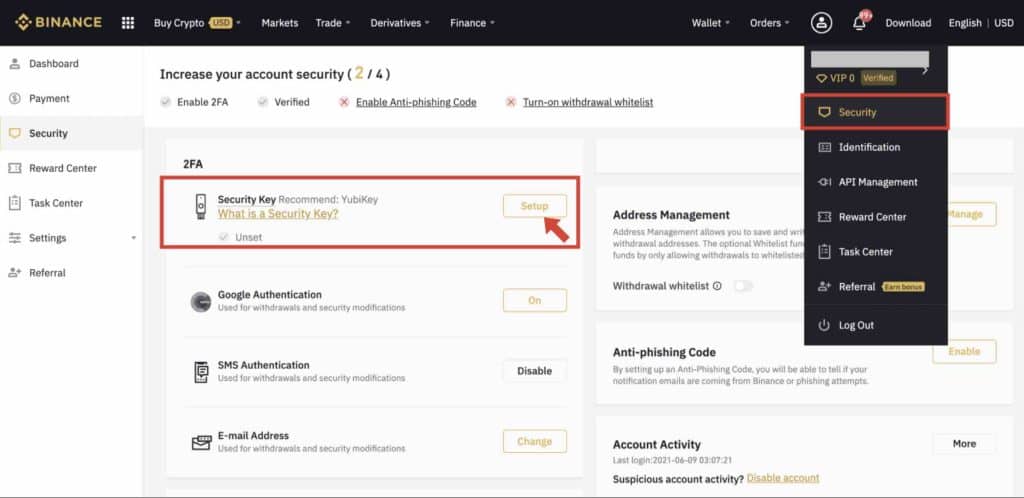

Both exchanges offer several 2FA options, including SMS, Google Authenticator, and email. Additionally, Binance offers 2FA hardware security via Yubikey. Both platforms allow for “whitelisting” specified withdrawal addresses. Both platforms allow users to review their own account activity, including device, browser, login, and trading attempts. Users on both platforms can block access to suspicious devices that might be attempting to access their accounts.

Binance features a wallet integration with Trust wallet, a very popular, third-party, non-custodial wallet. In contrast, ByBit offers the ByBit Wallet, an in-house, custodial, Web3 wallet.

Both exchanges custody user funds in cold storage solutions to protect from theft. Both platforms use risk management systems that continually analyze withdrawal attempts, security setting changes, and other account activity. Unusual account activity triggers email notices to the account holders as well as possible withdrawal period suspensions or additional verification requirements as established by the exchanges.

Risks of Exchange Seizures or Freezes

With regards to exchange seizures or freezes, there is arguably a greater risk of an exchange imposed seizure or freeze on Binance given (1) the exchange is exposed to larger contagion risk (it’s the largest crypto exchange in the world), and (2) the exchange temporarily halted BTC withdrawals during the summer of 2022, during a period of particular instability in the crypto financial system. Users on Binance can avoid this risk by utilizing Trust Wallet.

Thus far, it does not appear that ByBit has ever seized or frozen a broad swath of user funds, and there is zero risk of an exchange seizure or freeze on the Apex Pro Exchange.

Risks of Privacy Leaks

With regards to privacy leak risks, again, there is a greater chance of a privacy leak on Binance because (1) Binance requires KYC (Bybit does not), and (2) Binance has suffered from privacy leak incidents in the past where users’ KYC information was exposed or extracted by outside hackers.

ByBit users can reduce their privacy leak risks to 0% if they utilize ByBit with no KYC or use the Apex Pro Exchange.

Ease of Access, Control, and Use

ByBit and Binance are approximately equal when it comes to ease of access, control, and use. ByBit is extremely convenient for those who only fund and withdrawal from their account with crypto, as there’s no required KYC. But Binance is more convenient for those needing fiat gateways.

Availability

With regards to availability, ByBit and Binance are offered in most countries. Of course, neither are available for residents in the U.S.A. or mainland China. VPN Armies Unite!

Opening an Account

With regards to opening a new account, individuals can open a Bybit account in less than two minutes, given the system does not require any KYC. Only an email account is required. ByBit does require KYC for users wanting to withdrawal more than 20K or 100K of USDT per day or month, respectively. Apex Pro offers ultimate ease of access as all that’s needed is a Web3 wallet connection.

Conversely, Binance requires KYC for every account holder, and collects the following for level 1 verification: personal information, government issued IDs, and selfie photos.

Deposits and Withdrawals

Let’s discuss exchange deposits and withdrawals. Generally, the more options, flexibility, and frictionless access between bank accounts and exchanges, the better.

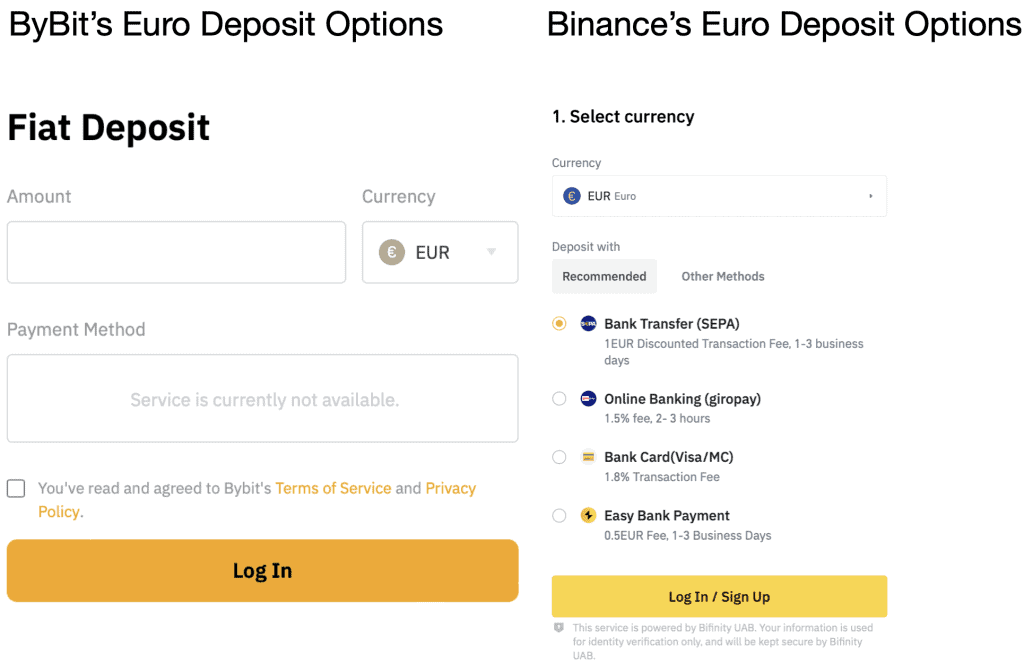

With regards to fiat deposits, both ByBit and Binance technically offer deposits via debit cards, bank account transfers, e-wallet, and third-party wallet options. However, Binance offers many more fiat deposit ramps as compared to ByBit. For example, Binance users can deposit Euros via debit cards or bank transfers, while none of these Euro options are available for ByBit users. It all depends not the specific currency and the applicable country.

It’s the same story with regards to fiat withdrawals. Binance has many fiat withdrawal options. But ByBit’s fiat withdrawal ramps are limited to only two currencies: the Turkish Lira (TRY) and Brazilian Real (BRL). Thus, it’s recommended that most users only make crypto deposits and withdrawals on ByBit.

And speaking of crypto deposits and withdraws, it should go without saying that both exchanges offer seamless crypto transfer rails within their platforms.

Fees

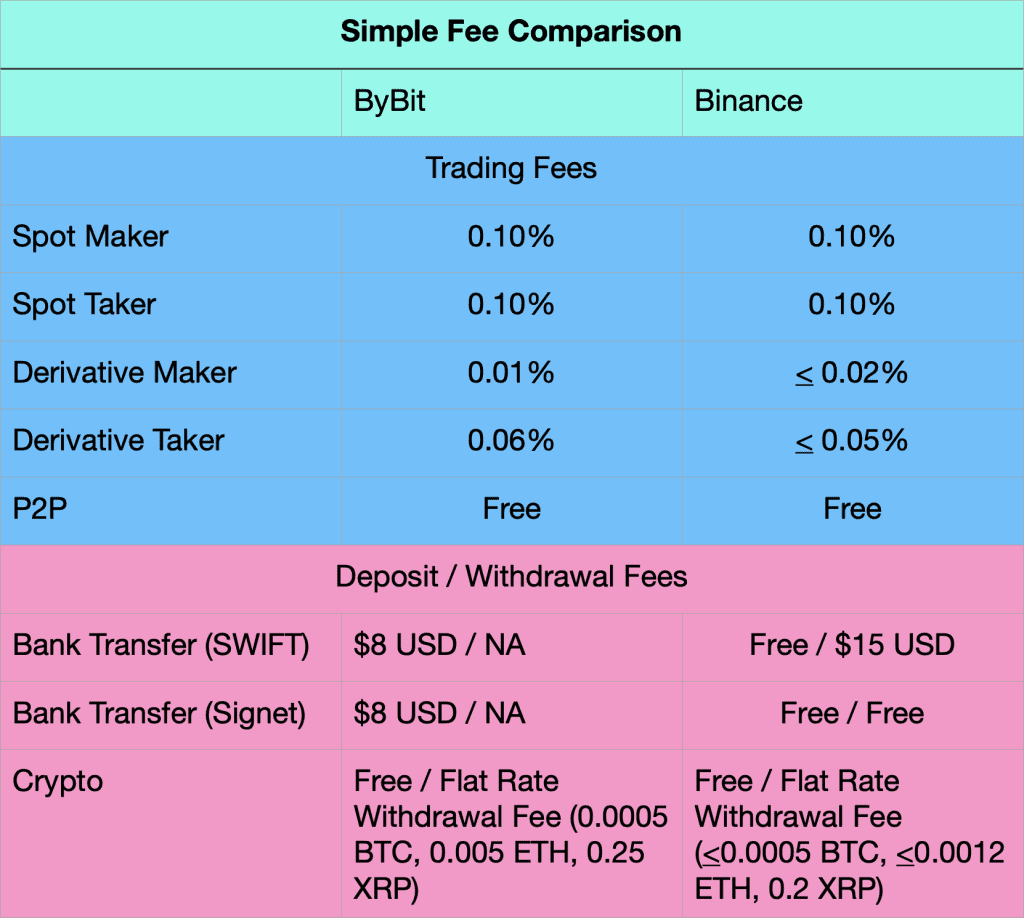

Overall, ByBit and Binance fees are approximately competitive.

Trading Fees

Both exchanges use the maker – taker fee model. Market makers are those whose trade orders are not immediately filled (e.g. limit buy or limit sell orders). Market takers are those whose trade orders are immediately filled (e.g. market buy or market sell orders). Both exchanges charge 0.10% on spot maker and taker fees and offer free P2P trades. Both exchanges are approximately competitive when it comes to derivative trading fees.

Deposit and Withdrawal Fees

With regards to crypto deposits and withdrawals, both exchanges are approximately competitive. Crypto deposits are fee on both platforms and withdrawal fees are essential the same.

With regards to fiat deposits and withdrawals, it’s impractical to compare the two exchanges because ByBit’s options are limited.

Note that the fee comparison chart above is not comprehensive because both exchanges offer sliding scale fee structures and different user tiers. For more comprehensive details, please see the help information sections on both exchanges.

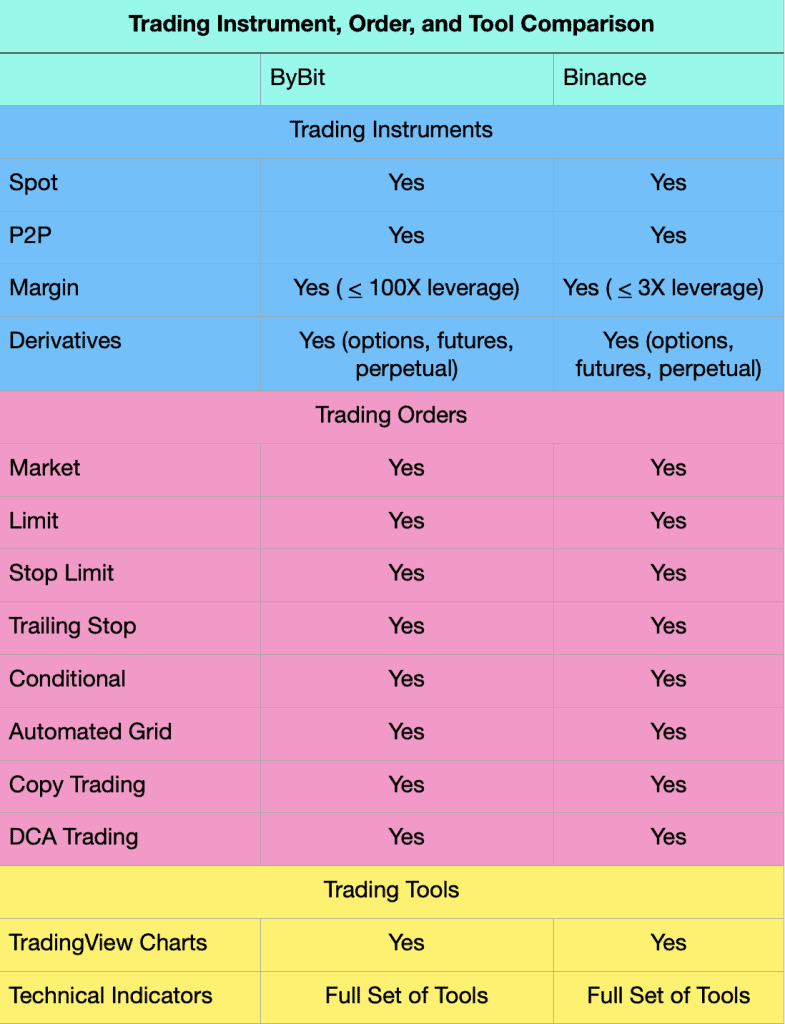

Supported Trading Instruments, Orders, and Tools

ByBit and Binance are approximately competitive in terms of trading instruments, orders, and tools. The only significant difference is leverage, with ByBit offering up to 100X and Binance generally offering up to 3X. Ultimately, users on both platforms will not be disappointed and have just about everything under the sun to work with.

Trading Instruments

ByBit and Binance both really shine with it comes to their trading instrument menus. Both platforms offer an extremely diverse and exotic selection of instruments when compared to other crypto exchanges. Users on both platforms can trade spot, P2P, margin, and derivatives (options, futures, and perpetual contracts).

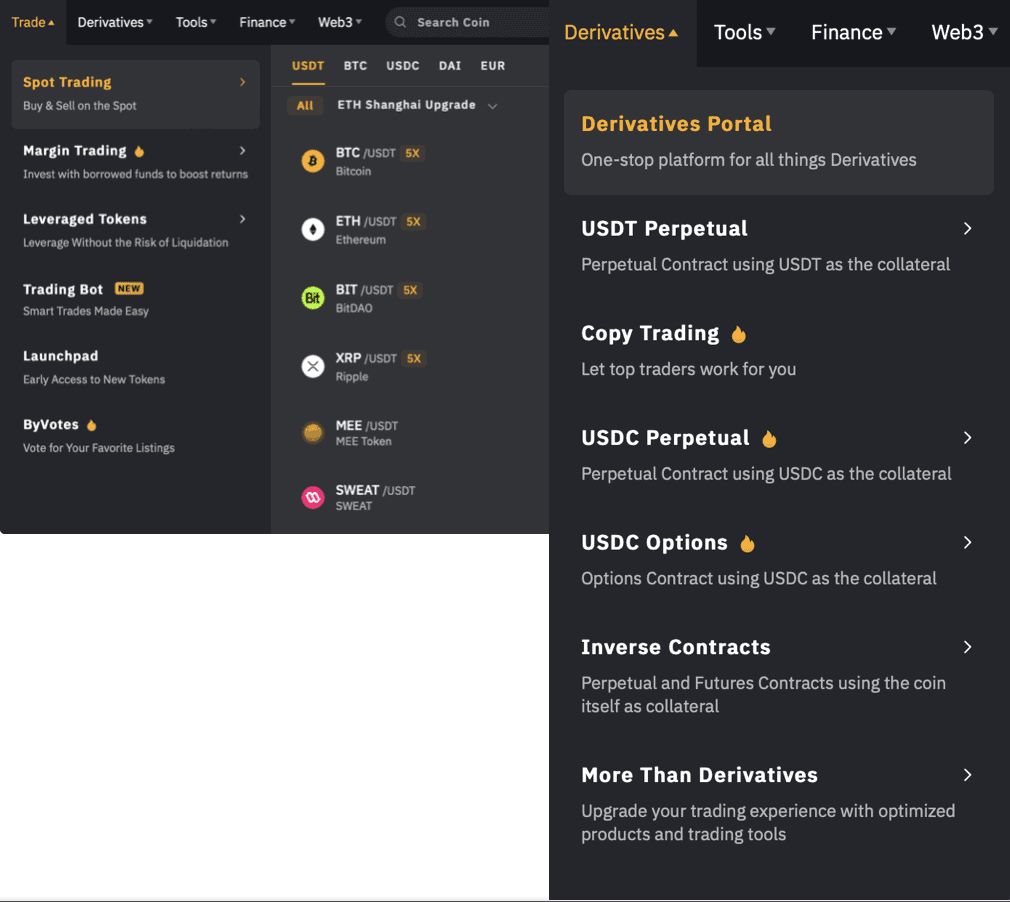

ByBit’s Trading Instrument Menu

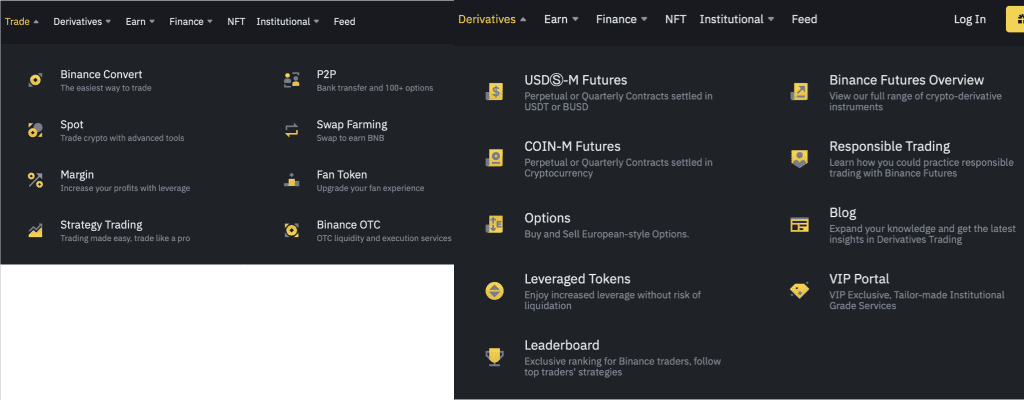

Binance’s Trading Instrument Menu

Trading Orders and Tools

Both ByBit and Binance offer a wide range of trading orders and tools.

With regards to trading orders, both platforms offer everything spanning from spot, to limit, to conditional orders, to automated grid and DCA trading, and more. Both exchanges feature TradingView Charts with full sets of technical analysis tools.

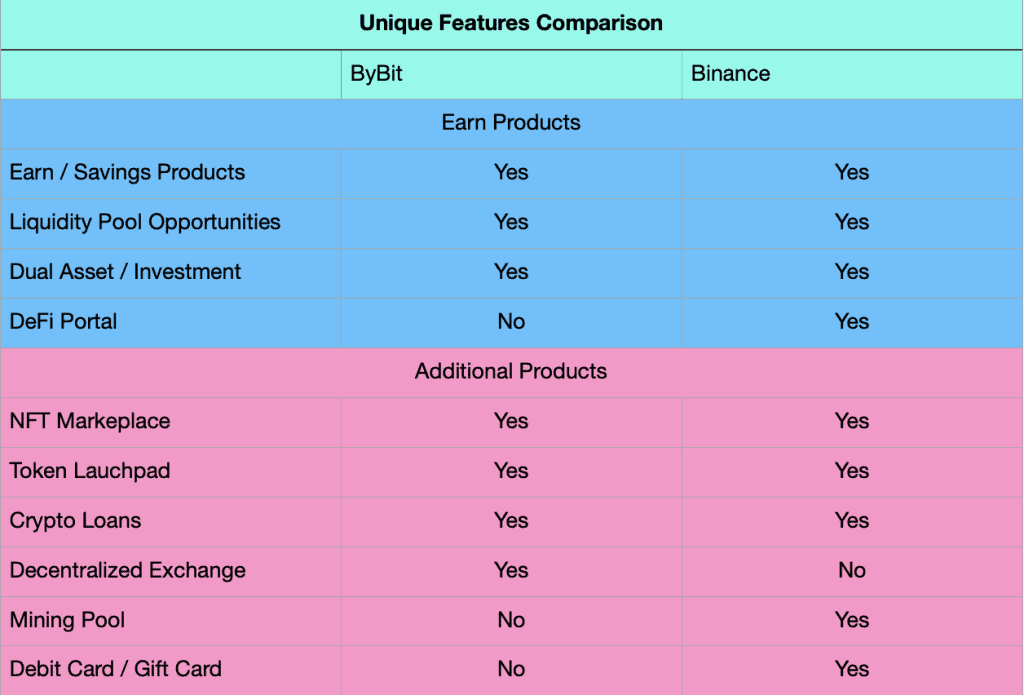

Unique Features

Both ByBit and Binance offer a large set of additional features for their users. Users on either platform won’t get bored as there are multiple ways to dig deeper into the crypto-universe and increase their investment opportunities.

NFT Marketplaces and Launchpads

Both exchanges host respectable NFT marketplaces, which allow users to buy, sell, and auction a growing selection of NFTs. Both exchanges also have token launch programs that host new ICOs to their respective marketplaces.

Earn Products and Crypto Loans

Both exchanges offer a broad selection of interest-bearing products, as well as crypto loans.

- Earn / Savings Product: allows users to deposit multiple assets for a fixed or flexible lockup periods, and earn interest. ByBit users are currently receiving 3% on USDT and DAI, and 1.80% on BTC and ETH for a 60 day lockup period. Binance users are earning 5.5%, 4.35%, and 5.29% on USDT, ETH, and ADA, respectively.

- Liquidity Pool Investing: users can add liquidity pairs to trading pools and receive returns. This product essentially allows individuals to become market makers. Currently, the ByBit BTC-USDT pool pays between 1% to 6%, while the ETH – USDT pool pays between 3% to 9%. The Binance BTC-USDT pool pays 6.72%, while the ETH – USDT pool pays 4.21%.

- Dual Asset / Investment: users can earn high returns in low-volatility markets. It works by users predicting the short-term price movement of a particular asset within a predefined short-term period. Those who predict correctly can earn high APYs.

- Crypto Loans: users can borrow one type of crypto asset so long as they use another as collateral. Funds can be used for trading on the spot or derivatives markets. ByBit users enjoy a 75% loan to value (LTV) ratio with a 95% liquidation ratio, while Binance users have a 65% LTV with an 83% liquidation ratio.

ByBit’s Apex Pro Exchange

In late 2022, ByBit launched the ApeX Pro Exchange, a non-custodial, permission-less, decentralized trading exchange that uses an order book trading model. The exchange operates on Arbitrum’s layer-two network for Ethereum.

In practical terms, ApeX Pro is a DEX that feels like a centralized exchange (because it uses the familiar order book trading UI). Thus, users get the benefits of decentralization (no central custodian and complete privacy) with the insights and trading optionality that only the order book model can provide.

Binance’s Additional Products

- Mining Pool: mining pool program allowing retail miners to connect their ASICs to the Binance mining pool for steady earning and a one-stop mining shop.

- DeFi Opportunities: allows users access to various third-party DeFi pools via the Binance UI. Another one-stop shop when it comes to DeFi.

- Visa Debit Card and Crypto Gift Card: a Visa debit card that pays 8% BNB back on eligible purchases. Gift cards that can be loaded with crypto and given to friends or family.

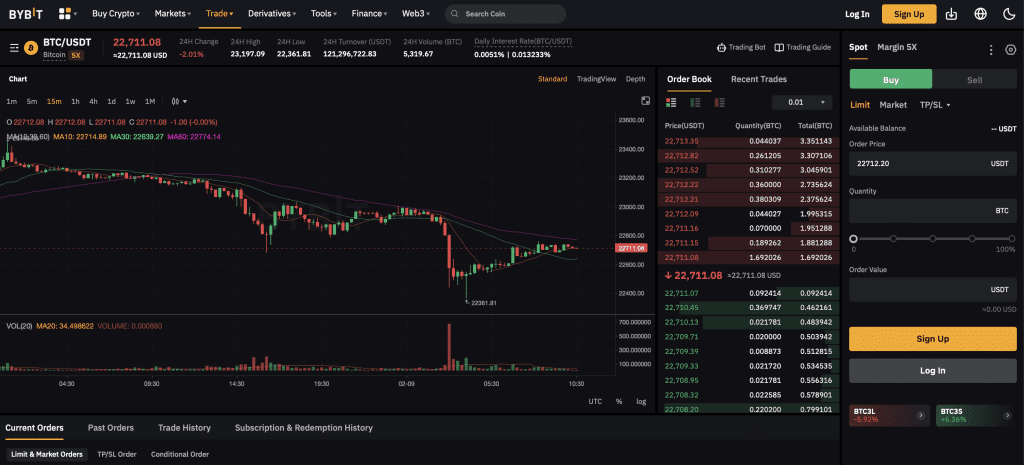

Aesthetic Experience

Subjective opinion incoming! However, given the amount of time that some people spend on these platforms, the aesthetic experience can be important.

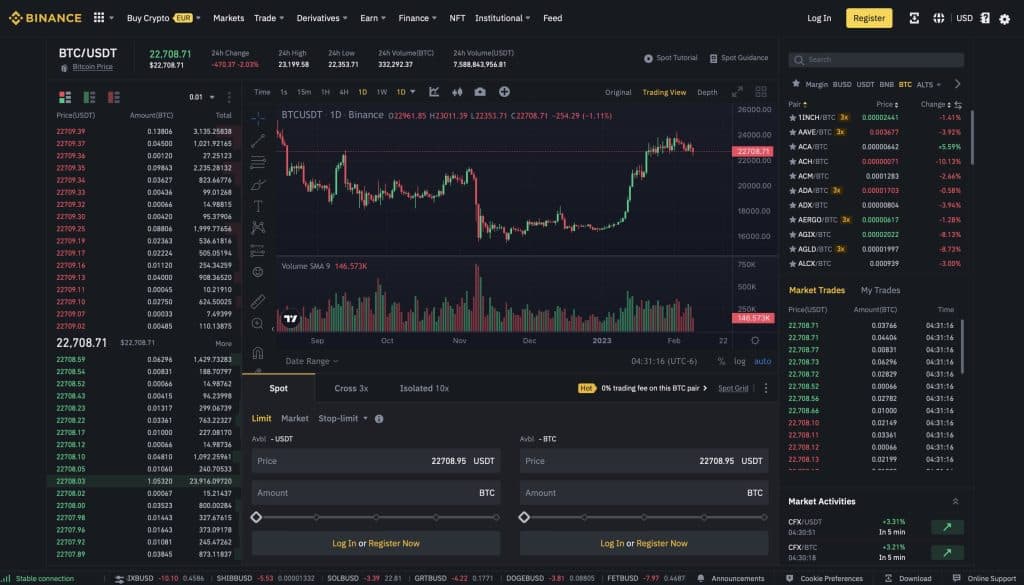

The ByBit and Binance user-interfaces are extremely similar. Both exchanges feature darker backgrounds with colorful and vibrant experiences and imagery build on top.

Both ByBit and Binance feature gorgeous trading desks with beautiful charcoal black background. I’m a fan of the trading desk UIs on both platforms.

Supported Cryptocurrencies

Binance has the slight edge on ByBit regarding the total number of supported cryptocurrencies. While these numbers are constantly changing, current estimates indicate that Binance supports approximately 384 different cryptocurrencies compared to ByBit’s 345. Of course, users will find all the major blue chips on both.

Final Thoughts

Both ByBit and Binance are fantastic exchanges. Both have many strengths and few weaknesses. So selecting the right one for you will likely come down to personal preferences or specific needs.

Personally, I like to use ByBit as a crypto in / crypto out exchange in a manner so that I don’t have to deal with pesky KYC. I have more than enough trading products and order types to work with, and a very nice selection of additional products that helps me put my crypto to work. I also really like the ApeX Pro Exchange. It’s 100% private, offers a seamless Web3 connection, and immune from centralized vulnerabilities.

Binance is a heavy-hitting exchange. To be the largest crypto exchange must mean that it’s doing something right. And it is. With plenty of fiat gateways, trading products and order types, and additional products, you can’t go wrong with Binance. There have a been a few incidents in the past with regards to customer withdrawals and privacy leaks. But these incidents were minor in the broader scheme. And utilization of the Trust wallet will protect you from any withdrawal issues in the future.

ByBit and Binance are both fantastic. Choose the one that works best for you!

Next Level Reliability, Products & Opportunities

0% MAKER FEES & $30,030 BONUS

Responses