CRO Staking: Is it Worth It?

Staking any cryptocurrency should be viewed as a long-term investment. Staking reward payouts are not near as important as the fundamentals of the investment asset. Anyone caught holding a bag of UST earning that incredible 20% knows what I’m talking about.

So, in order to answer the question of whether CRO staking is worth it, one should understand the company and blockchain along with the token and staking reward details. The following will do precisely that!

What is Crypto.com

Crypto.com is a Singapore-based company offering an encompassing menu of blockchain-focused trading, payment, and financial services to a global client base. Known for its sleek advertising campaigns (Fortune Favors the Brave with Matt Damon and the Los Angeles Crypto.com Sports Arena), the company ranks among other tier-one blockchain trading providers such as Coinbase, Binance, and FTX.

Crypto.com was founded in 2016. The company offers approximately 250 cryptocurrencies and several financial products including a crypto-backed Visa debit card to roughly 50 million users across 90 countries.

What is Cronos

Cronos is a decentralized, proof-of-stake blockchain developed and maintained by Crypto.com. The Cronos blockchain is Crypto.com’s foray into the blockchain payments industry. This blockchain, backed by a private brokerage company, is somewhat analogous to Binance’s BNB blockchain.

Cronos is an EVM-compatible blockchain built on Cosmos. Crypto.com markets Cronos as an “easy-to-port platform” for Ethereum and EVM compatible dApp projects that want to plug into it. Cronos uses the Tendermint proof of stake consensus mechanism and is integrated into the Inter Blockchain Communications Protocol.

At a high level, Crypto.com’s mission is to use Cronos and its native token CRO to allow users to seamlessly pay for real-world goods with cryptocurrency. Please see our interview with Ken Timsit, Managing Director of Cronos for a behind the scenes look at Cronos

What is CRO

CRO is the Cronos blockchain’s utility token. CRO is mainly used as a medium of exchange and as an intermediary settlement fee currency for all Cronos blockchain transactions. Any participant that transacts on Cronos pays fees in CRO. The cryptocurrency is also used for staking and staking rewards for delegators and validators.

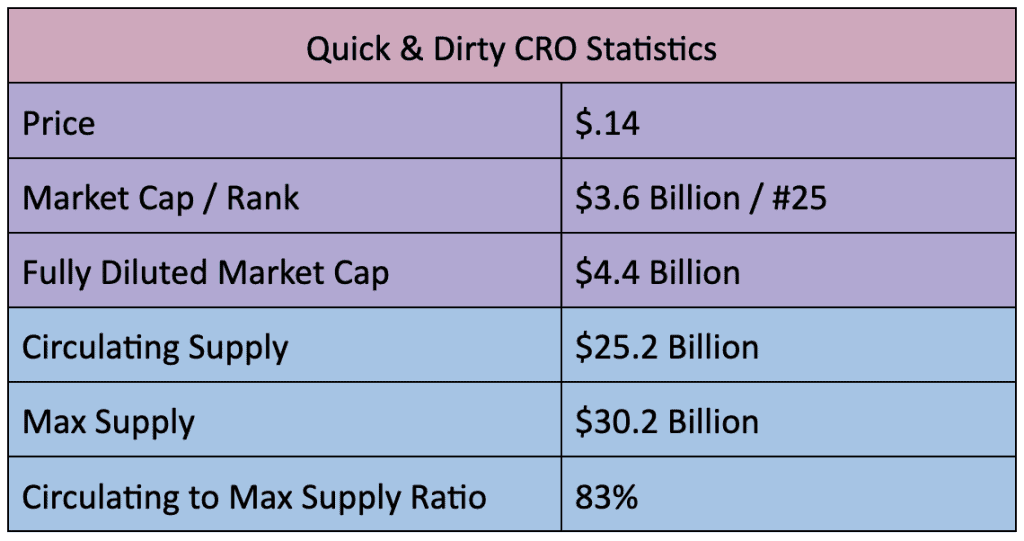

CRO currently has a market cap of $3.6B, ranking it at #25 of all cryptocurrencies. Due to its tokenomics, CRO might also be considered as a store of value coin. It has a max and circulating supply of 30.2 and 25.2 billion tokens, respectively. Thus, approximately 83% of CRO’s total supply has already been created.

CRO Staking

CRO staking uses a delegate proof of stake system. Investors delegate their CRO to validators, the latter of whom secure the network. Block rewards are paid in CRO, which are distributed to delegators after validators have been paid their commission.

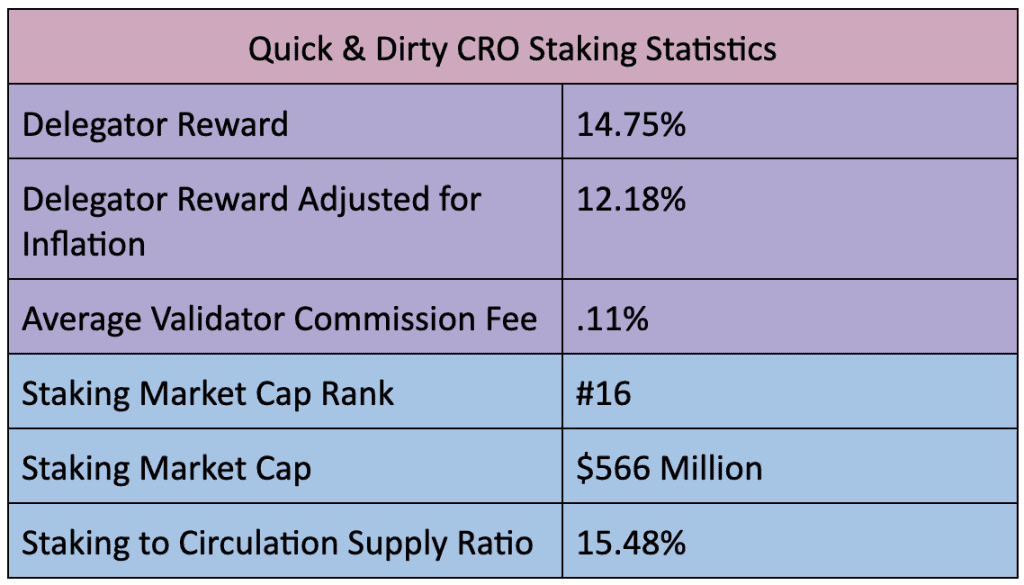

Currently, delegators (that’s you!) are receiving a staking reward of 12.18% (adjusted for CRO inflation) on their CRO. Not terrible! Here are some other important details:

- No minimum stake requirement;

- 28-day unstaking lock-up period. Users can unstake at any time, but unstaking triggers a 28-day lock-up where users cannot trade or sell that CRO; and,

- Slashing enabled! Select your validators carefully! Ideally, it’s recommended to choose validators with 99% uptime and over 8% voting power. Check the status of CRO validators.

CRO Staking: Is it Worth It?

Probably yes!

Not financial advice, but I think CRO staking is probably worth it if the investor:

- Purchases CRO at a relative market bottom,

- Considers purchasing no earlier than November 1, 2022, and

- Is willing to hold and stake for at least two to three years.

1. Buy and Stake the Bottom, Not the Top

Investors looking to purchase and participate in CRO staking should try to purchase the asset at a relative market bottom. 12.18% APR is excellent, but if the CRO was purchased at a market top (e.g. November 2021 for $.90 per token), then they’re in for a world of pain. Under such a scenario, and with the current market price at $.14, and assuming this price remains steady long-term, investors would need to wait approximately 7 years for the staking to break them even. Ouch!

Are we at a market bottom now? I don’t know, and neither does anyone else. But if I had to make a bet, I would bet yes. The CRO price is currently back in a bottom market channel that began in June of 2020. If BTC dumps to 10K, then CRO might fall another 50% to 75%. But I think a 10K BTC purchase will be the buying opportunity of a lifetime and very short-lived. Thus, once BTC bounces back to $20K, CRO will quickly regain traction too.

2. Why Consider Waiting for November 2022 to Purchase?

Because of the possible price implications from Crypto.com’s recent rewards cut to their Visa Debit Card program.

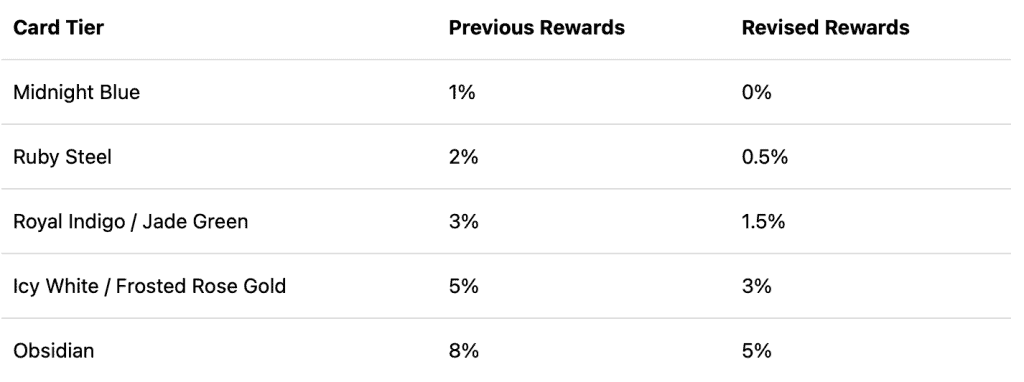

Crypto.com has a popular Visa Debit card product that lets users fund their card with fiat or crypto and then spend it anywhere Visa is accepted. This card has an additional rewards program that pays users cash back on purchases relative to the amount of dollar-denominated CRO that users have staked to the network.

See the image below. Before June of 2022, users were able to receive these cash back percentages according to the amount of CRO staked to the network.

But as of June 2022, Crypto.com implemented a revised reward schedule and required the same amount of staked CRO. See below.

Importantly, those with active 6-month stakes before May 1, 2022, are grandfathered in at the previous reward rates until their 180-day stakes expire.

Some users were vocally upset with the revised rewards announcement. So one concern is that some grandfathered investors will sell off their CRO after their 180-day lock-up period expires. This could create a negative feedback loop because other investors might decide to sell too, instead of topping off their staked amount to maintain their rewards category (remember, Visa rewards members must maintain a certain dollar-denominated CRO balance to keep their applicable rewards category).

The last grandfathered investors will complete their 180-day lockup by November 2022. Unless BTC moons before then, it might make sense to wait until near the end of the year to scoop up CRO.

3. Plan to Hold for Two to Three Years

This doesn’t need much explanation, but none of this makes any sense unless investors’ time horizons are at least two to three years. A longer time-period gives a certain buffer for price dips along with a bigger window for price pumps.

Conclusion

I think it’s likely worth it to stake CRO.

Crypto.com appears to be in the top tier of global centralized exchanges. Their financial products, marketing, and global reach lend them credibility. The Cronos blockchain appears relatively stable and functional, CRO’s tokenomics are favorable, and the staking reward percentage is high. Investors will want to purchase CRO at a reasonable market bottom and plan to hold for a few years. CRO might experience sell pressure as the 180-day lock-up periods end for grandfathered Visa rewards members. Thus, an ideal time for purchasing CRO might be near the end of 2022.

Responses