What is Cronos Chain (CRO)? | Crypto.com Review

What is Cronos Chain?

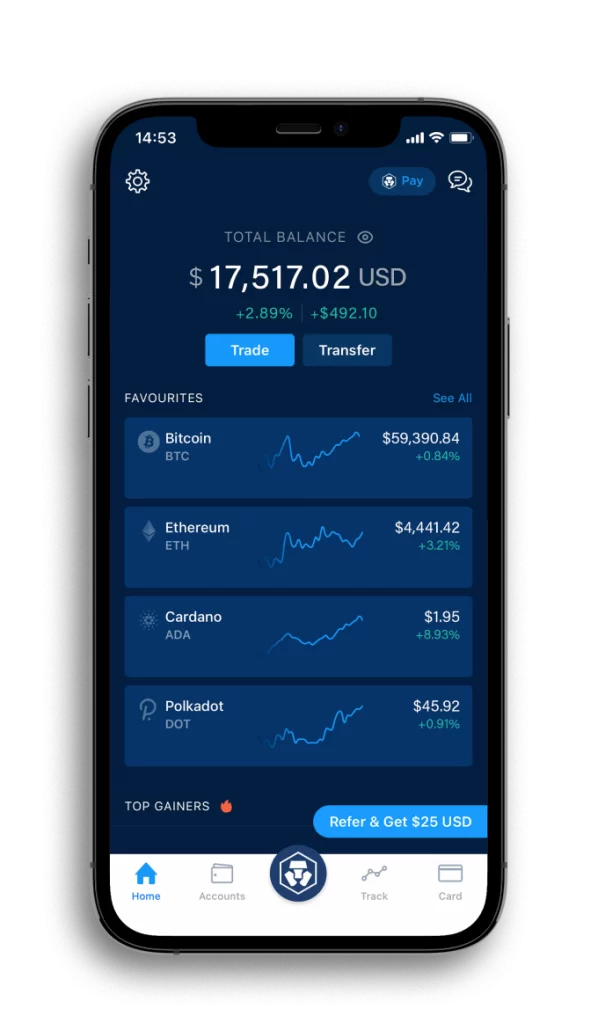

You may have heard of the popular crypto exchange Crypto.com. This platform offers trading and DeFi (Decentralized Finance) services to users and they are well known for their popular crypto Visa debit card product. Since early 2021, they have made tremendous progress in terms of adoption, in part due to their high profile marketing initiatives such as their sponsorship of UFC, the 2022 FIFA World Cup, and Formula 1 to name but a few. Crypto.com already has over 10 million users, which they see as just the beginning of a journey towards onboarding 1 billion global users.

Cronos is the first blockchain network that operates with both the Ethereum and Cosmos ecosystems, supporting DeFi, NFTs and the Metaverse. Cronos chain runs in parallel with the Crypto.org Chain which is a fully decentralized, open source blockchain with high speed and low fees.

Cronos is a sidechain powered by Ethermint, a high-speed, proof-of-stake blockchain built on the Cosmos SDK, which is EVM (Ethereum Virtual Machine) compatible. It aims to massively scale the Web3 user community by providing builders with rapid porting of apps, smart contracts and assets from Ethereum and EVM-compatible chains. Built with IBC protocol, Cronos allows for interoperability and bridging to the Crypto.org Chain and interoperability with other IBC-enabled chains such as Cosmos Hub and Terra.

Bridging selected assets on Cronos is very easy. There are a number of options including their Crypto.com app and DeFi wallet, Cronos web app, and the Crypto.org desktop wallet. The Cronos.org website contains detailed information on using each of these options.

With a current TVL (Total Value Locked) of $3.4 billion, Cronos is already making a considerable impact on the DeFi sector, offering investors a new playground to earn yield, while enjoying low transaction fees and high transaction speed.

Cronos’s base settlement currency is $CRO which is the native token of its parallel blockchain, the crypto.org chain.

The $CRO Token

$CRO is the native currency that powers the Crypto.com ecosystem with the following utility;

- Payments: Crypto.com Pay, Crypto.org Chain and Visa debit card.

- Trading: Crypto.com App & Exchange.

- Financial services: Crypto.com staking rewards, Crypto.com Visa debit card rewards (earn CRO rewards based on card type and transaction volume) and Crypto.com Defi Swap.

Current Market Cap: $10.5 billion

Circulating Supply: 25.2 billion tokens

Maximum Supply: 30.2 billion tokens

The $CRO token can be purchased on the Crypto.com exchange and leading exchanges such as Coinbase, FTX and Uniswap.

Must read: CRO staking, is it worth it?

Wallet Support

In order to store, send or receive $CRO tokens, wallet support is available with the Crypto.com DeFi wallet, Crypto.org Chain desktop wallet, Metamask, MathWallet and Trust Wallet.

The $CRO token is also supported by Ledger.

Ecosystem Tokens

VVS Finance ($VVS)

Also known as ‘Very, Very Simple Finance’, VVS was launched in November, 2021 and is the largest project on the Cronos network with a TVL of $1.34 billion. The platform is an AMM (Automated Market Maker) DEX (Decentralized Exchange) and offers a token swap service along with liquidity farming and staking pool options. The platform has a very clean, easy-to-use interface which helps to simplify the user experience.

VVS also has a token launchpad service called IGO (Initial Gem Offering). Single Finance was their first ever launch on January, 2021. More launches are planned, presumably when overall market conditions improve.

The native token on the platform is the $VVS token. It can be used to deposit into farms/pools and acts as the primary reward token for yield farming activities. The $VVS token also acts as a governance token.

As DEXs rank, VVS Finance is already the 8th largest DEX in the space.

MM Finance ($MMF)

MM Finance (Mad Meerkat Finance) is another major player in the Cronos ecosystem with a TVL of $1 billion. The platform is an AMM and DEX (Pancake Swap clone) that offers fee rebates via trade mining. MMF has the lowest trading fees on the Cronos chain and were the first to introduce POL (Protocol Own Liquidity) into their ecosystem. POL sees a portion of trading fees used to buy back the $MMF token and adds MMF/CRO LP to the METF treasury.

MMF offers high yield farms such as the MMF/CRO option which is currently yielding 305% APR and the MMF/USDT farm which is offering 342% APR. There is also a range of pools where users can single stake their $MMF tokens to earn yield such as the MMF pool, which is currently offering a 121% APR. There are also Vaults, including a yield optimiser called MMO (Mad Meerkat Optimiser) which auto-compounds earnings to maximize rewards for users.

The native token on the platform is the $MMF token which can be used to deposit into farms/pools and acts as a reward token. Users can also spend their $MMF tokens to participate in new projects via their launchpad service.

In addition, there is the $MMO token which is minted and utilized in the MMO and acts as a reward token for the yield optimiser.

MM Finance has grown rapidly in recent months and if this trend continues they are likely to overtake VVS Finance in terms of TVL in 2022.

Tectonic Finance ($TONIC)

Tectonic Finance is a decentralized, non-custodial algorithmic money market protocol. Users can deposit assets to earn passive income or borrow against funds to unlock liquidity. Funds deposited by users are provided as liquidity to borrowers, who may borrow at variable rates. Tectonic Finance currently has a TVL of $540 million which makes it an important part of the Cronos ecosystem.

Users can deposit popular crypto assets such as USDC, USDT, WBTC and WETH, to name a few. Yields are modest, but so are the borrowing rates which can be as low as 3%. The platform has a very easy to use interface and there are plans to add more utility in the future, such as a leveraged yield farming service.

$TONIC is the native token of the platform and can be used to stake to earn rewards in the Community Insurance Pool and acts as a governance token.