Did Tether Just Drop $1.5 Billion in Bitcoin?

In This Issue

- David shares his thoughts on Tether HODLing BTC, BTC and ETH retail trading in Hong Kong, SEC vs Coinbase, G7 Finance Minister’s meeting.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik explains how likely is it that nation-states will engage in hash wars?

- This week’s trending coins by Rebecca.

A comprehensive deep dive on altcoin investing

EXPLORE THE ALTCOIN COURSEThe News Now

Tether HODLS BTC as Company Grows Stronger

A new Tether reserves report shows for the first time ever that the company, as of March 31st, holds approximately 52,000 BTC, worth a cool $1.5 billion.

For context, Tether’s BTC holdings account for 1.8% of the company’s total assets. For more context, when comparing the BTC holdings of all public and private companies (the latter that have disclosed this info), Tether ranks 4th behind Block.one, MTGOX, and Microstrategy.

Currently, Crypto Twitter is speculating about when Tether might have started making these purchases. But given it’s Tether, no one really knows. The only available data comes from comparing Tether’s Q4 2022 and Q1 2023 numbers. In the Q1 report, Tether intentionally separated its bitcoin allocation from where it – presumably – was previously lumped in under the “Other Investments” category.

So why is Tether now disclosing its bitcoin allocation? And did they buy in Q1 or have they been holding for longer? It’s a mystery. But what’s important is that they are holding! And guaranteed all eyes will be on their quarterly reports moving forward, now that we have a baseline.

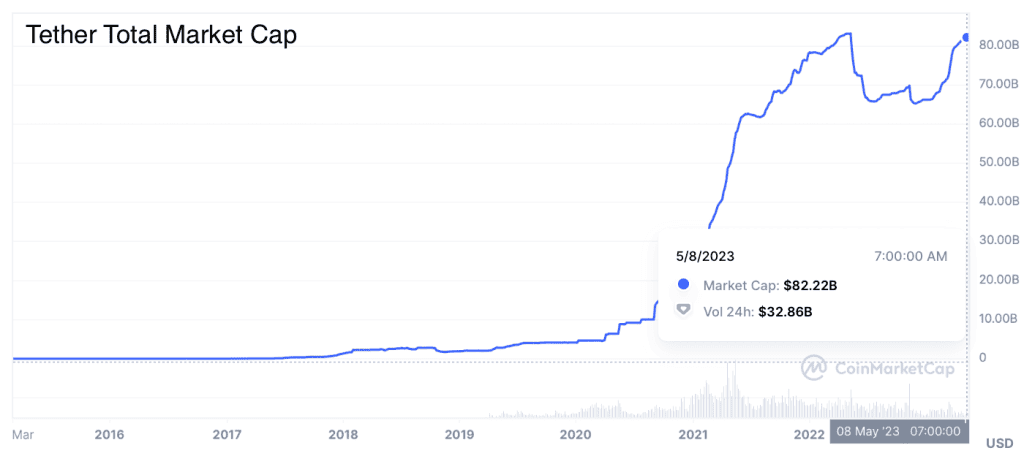

The other interesting Tether news is how the company is growing stronger while its competitors wither. Tether set record net profits in Q1 at $1.48B, bringing their total excess reserves to $2.44B. Another ATH. What are they doing right?

Well, they’re flipping more and more depositors’ funds into U.S. treasury bills (currently 64% of their total assets). So as the Fed’s been raising interest rates, Tether’s been raking in more cash . . . or BTC.

Meanwhile, Tether’s total market cap is close to an ATH while USDC and BUSD (Dear God) are getting hammered. USDC has been jumping from one bank to another like a school boy out for a good time while BUSD is taking regulatory fire from our friends at the SEC and NYDFS.

Hong Kong BTC & ETH Retail Trading Begins June 1st

We’re only 15 days away from when Hong Kong retail investors can begin trading large crypto assets like BTC and ETH through licensed Hong Kong exchanges.

Open the flood gates!

Hong Kong. Adobe Free Licensing.

This June 1st opening is the culmination of months of regulatory crafting by Hong Kong’s Securities and Futures Commission (SFC). To be clear, crypto exchanges have been operating in Hong Kong, but trading has generally been restricted to accredited investors with portfolios above $1M USD.

The SFC is apparently working through a back-log of approximately 80 applications from companies wanting to set up shop, while other institutions are eyeing the region as a friendly place to do crypto business. The retail trading launch is part of a larger plan by Hong Kong authorities to transform the region into a regarded international crypto hub.

What will be particularly important to watch is how this development affects crypto trading for residents of mainland China. The country has had a full crypto ban in place since September 2021, but that hasn’t stopped some Chinese citizens from doing it anyways via work-arounds. Given Hong Kong’s unique and close business relationship with China, I’m wondering if Hong Kong’s retail opening will present mainland Chinese residents with more creative opportunities to get in on the action.

SEC to Coinbase: “Nah, we good.”

Now, a legal update for you in the litigation war between Coinbase and the SEC.

In case you need background, here’s a primer:

- In the summer of 2022, Coinbase petitioned the SEC to formally provide and adopt some rules that govern the regulation of digital assets (i.e. provide regulatory clarity).

- The SEC said, “Nah, we good.”

- Then in March, the SEC issued a Wells notice to Coinbase for allegedly violating securities laws. A Wells notice is a formal SEC letter which informs the recipient that the agency is about to drop the hammer (enforcement action) on them.

- Frustrated, Coinbase responded in April by suing the SEC in Federal Court, demanding that the SEC issue a public answer to Coinbase’s 2022 petition.

- Well this past Monday, the SEC formally replied to Coinbase’s demand in court. They said, “Nah, we good.”

Basically, the SEC responded stating that it’s under no legal obligation to provide regulatory clarity, and certainly not within Coinbase’s requested time-frame. Dealing with the SEC is like playing with a kid who changes the rules mid-game.

Keep in mind that Coinbase claims they met with the SEC more than 30 times over the course of 2022 and early 2023, in response to Gensler’s invitation for crypto companies to “come in and register”.

G7 Finance Ministers Have a Productive Meeting

A committee of G7 finance ministers are meeting early before the larger G7 summit scheduled for next week in Japan. What’s got these ministers working overtime? Crypto and CBDCs.

The big headline is that this past Saturday, this committee committed to implement crypto regulatory frameworks “consistent” with the Financial Stability Board’s upcoming recommendations, the latter scheduled for completion in July.

Translation: some intergovernmental finance people met to announce their commitment to make crypto rules based on recommendations that aren’t finished yet by some other international group. Hey G7 finance bros, you guys working hard or hardly working?

Klaas Knot, Chair of Financial Stability Board. AKA, dude who tells G7 what to do.

Specifically, the committee signaled support for an international crypto travel rule. The basic idea here is that financial institutions would be required to collect and share the transactional and personal identifying information of their customers when they’re involved in a crypto transaction.

And with regards to CBDCs, the committee said they “welcome[d]” the release of an upcoming IMF CBDC Handbook and that CBDCs “could have a substantial role to play” in ensuring a sound global monetary system.

Market Analysis by Rekt Capital

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed and discussed:

- Ethereum (ETH)

- Fantom (FTM)

- Chainlink (LINK)

- Polkadot (DOT)

- Nano (NANO)

- Fetch ai (FET)

Let’s dive in.

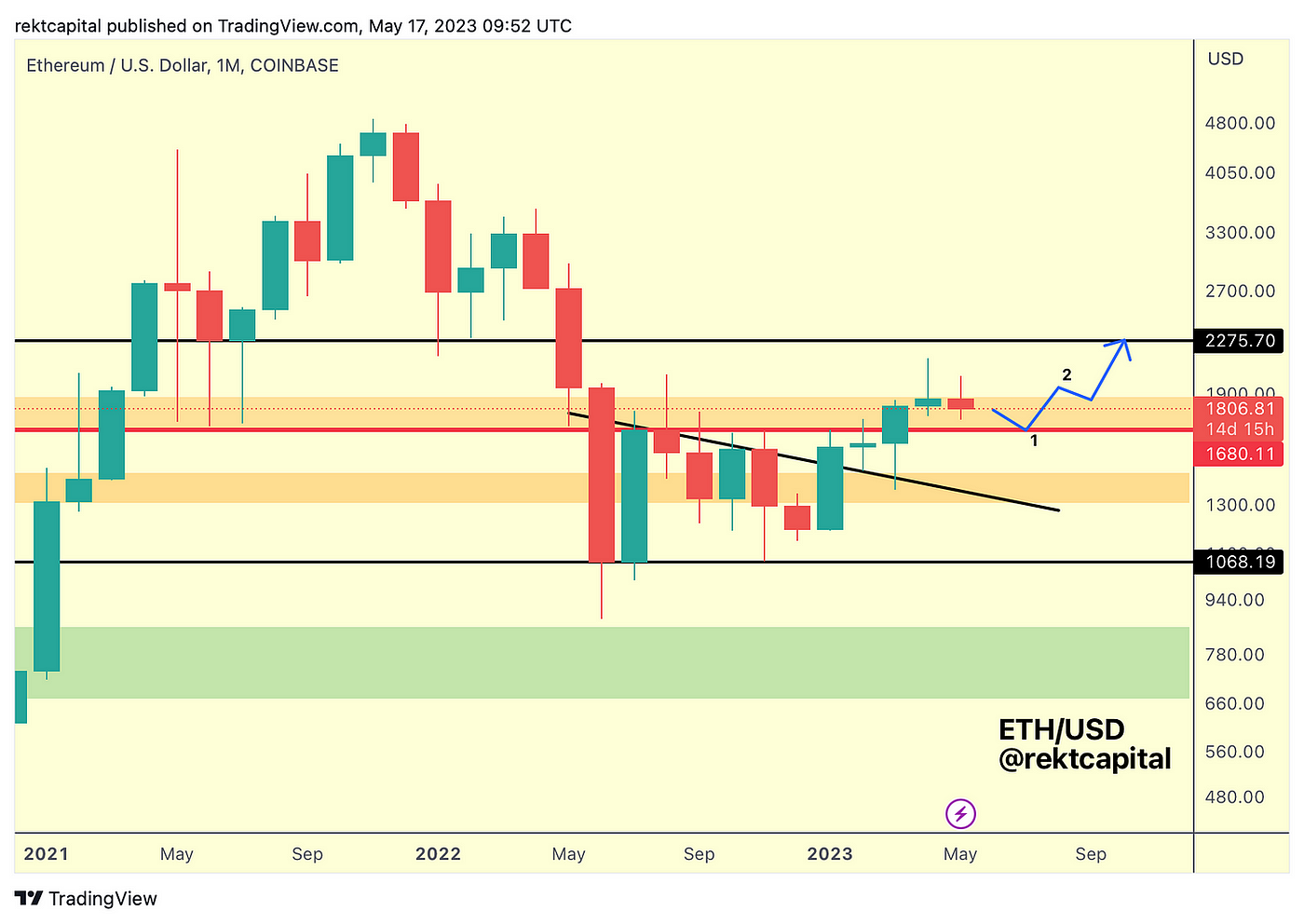

Ethereum — ETH/USD

Two months ago, ETH broke beyond the red resistance level, which plagued price from mid-2022.

But on that move, ETH never retested this level as support.

In fact, since breaking that level, ETH has overextended itself beyond the next immediate resistance which is the top of the orange box and has since rejected there, forming a new Lower High in the process.

Could ETH dip into the red level for a retest?

Such a dip would be healthy of course and successful price stability there would enable another revisit of the top of the orange box, which itself needs to be reclaimed as new support to enable further upside via the blue path.

Could ETH skip step 1 and go on to step 2? Technically yes, but ETH hasn’t been able to reclaim the top of the orange box as support for the past two months so there’s certainly scope for a small reset to the red level below.

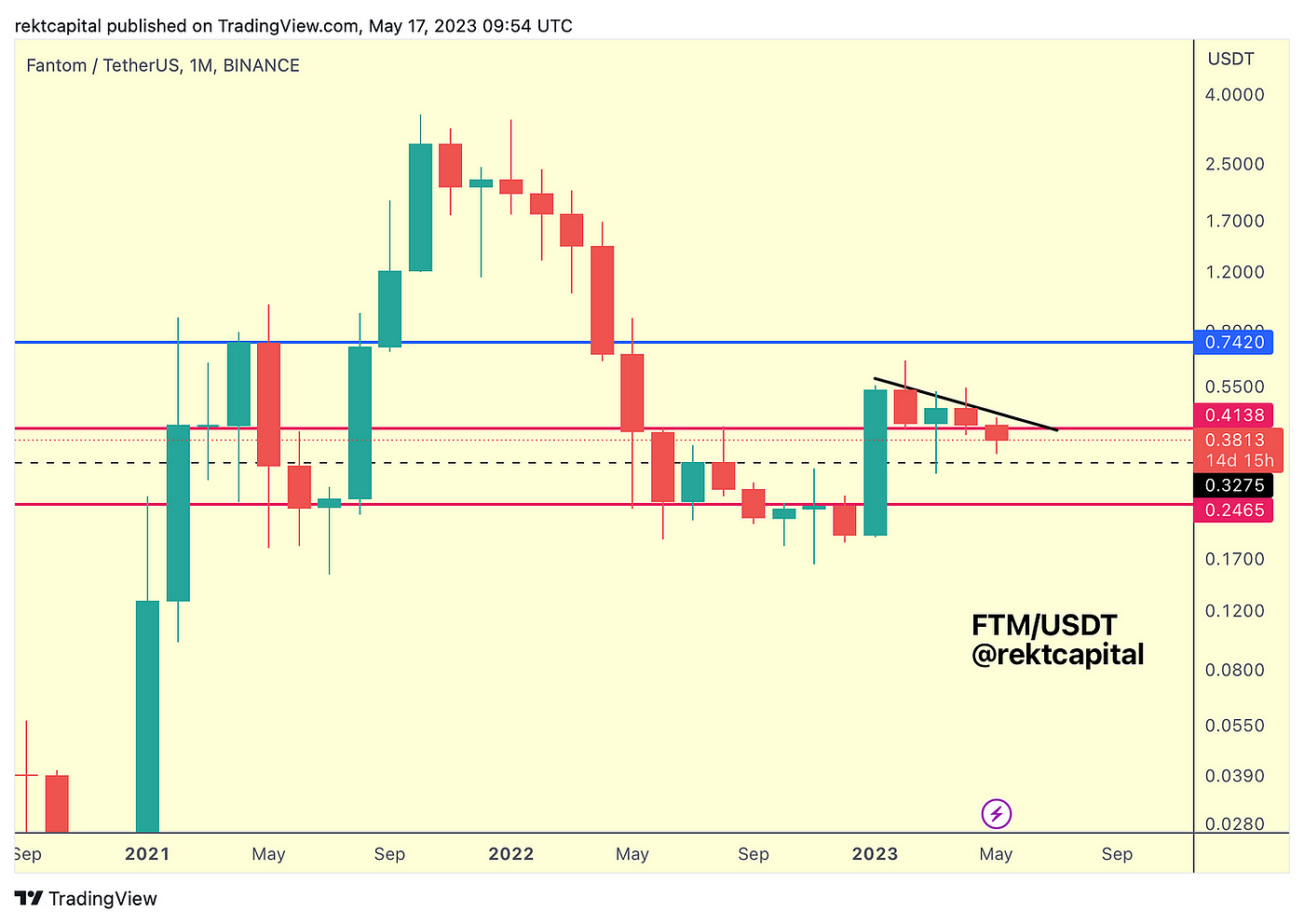

Fantom — FTM/USDT

Most important thing for FTM right now is the red level which is acting as support.

Monthly Close below it would signal a loss of it as support which could set price up for a drop into the dashed black level for support.

Overall, FTM has been struggling to break to new highs with this multi-month downtrend weighing down on price (black).

And this downtrend looks like it is still a stiff resistance, forcing price to lose the red level.

A confirmed loss of the red level as support would likely see FTM drop to the dashed black below which is the level that resisted price in mid-2022.

Generally, a Monthly Close below the red level would signal a return to the red-red range; the dashed black level will dictate whether price holds the upper half or the lower half of the range.

Go Premium to Keep Reading

Subscribe to the Wealth Mastery Premium Investor Report to read the rest of this article AND gain full access to the premium archives.

Will Nation-States Engage in Hash Wars by Erik

Major Jason Lowery (member of the US Air Force and MIT Graduate) envisions a path towards hyperbitcoinization. In such a world, where Bitcoin is the world reserve currency, the only logical choice for countries would be to engage in a peaceful arms race, mining as much Bitcoin as they can.

Let’s first have a look at Lowery’s view and then discuss his challenger’s.

Softwar: Bitcoin as a Matter of National Security?

A pillar of Lowery’s thesis Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin is that Bitcoin is digital property that will be fought over in an arms race between countries. That’s why in his view mining Bitcoin is a matter of national security. Being a Major in the airforce, he is allegedly in talks with government officials about this topic.

In his view, mining secures blockspace, in the same way that a navy or an air force secure maritime and air thoroughfare. A nation’s ability to protect its access to its money and data will be vital to its autonomy.

In Lowery’s view, Bitcoin’s use case goes beyond peer-to-peer online cash. Block space can be used to secure all kinds of data (the recent Ordinal NFTs and BRC-20 tokens on Bitcoin are an example of this). Maybe online cash was just the first use case? Lowery argues that many technological inventions, like gunpowder and airplanes, were initially used for different purposes. Gunpowder wasn’t called gunpowder by the Chinese – who invented it for medicinal purposes. That airplanes would have military significance seemed equally unthinkable when the Wright brothers let their rickety plane bounce off some fields.

Only later did armies realize that these inventions had a purpose. Lowery sees the same happening for Bitcoin: it will move from the use case of electronic cash to ‘digital warfare’.

Power Projection in Nature and Proof of Work in Bitcoin

Lowery goes to great lengths explaining how in nature, the use of physical power (‘power projection’), determines who owns what. Animals use physical power to battle over territory. It’s fitting that the ‘(block)chain of ownership’ in cyberspace is also determined by energy.

According to Lowery, the fact that energy (power) must be used to secure Bitcoin makes the protocol superior to proof-of-stake protocols, which only use abstract power structures (software) to protect the network. According to Lowery, that’s a brittle, ‘logical’ shield that won’t hold when push comes to shove.

Hashing Compared to Deer Fighting with Antlers

The hash wars are a new form of war: a non-violent battle for territory in cyberspace. Instead of mutually assuring each other’s destruction in a nuclear war, nation-states could compete for ‘online territory’ by building out the largest possible mining facilities. In this sense Bitcoin mining functions like a deer’s antlers: it allows us to physically battle it out without wounding each other. A beautiful analogy.

Reactions to Softwar From the Bitcoin Community

Two months after its launch, the bulky book is an Amazon bestseller in its category. But the reception of Lowery’s ideas has been mixed. While he has been a guest on respected podcasts of Anthony Pompliano and Preston Pysh, he has received fierce pushback from Bitcoin OG’s like Saifedean Ammous and Max Keiser.

This is ironic, considering this like-minded passage in Ammous’ The Bitcoin Standard:

“Bitcoin is an ingeniously efficient technological workaround for the political conflict that has been the hallmark of fiat. Instead of having the work done on battlefields, Bitcoin front-loads the work… “

The most detailed rebuttal of Lowery’s work I could find comes from mentioned Micah Warren.

Softwar Critique by Micah Warren: Bitcoin is Not Digital Warfare

Micah Warren, who is sometimes publishing (and ‘shitposting’) under the pseudonym Achim Warner, is an associate professor at the University of Oregon. He has written more than one publication about Bitcoin. His previous publication is Bitcoin: A Game-Theoretic Analysis.

He wrote a short book (or long essay) teasingly called Limpwar (free pdf, or buy here for 3 bucks on Amazon). He doesn’t believe Bitcoin mining will be a non-violent proxy for war. Even though he doesn’t mention Lowery and doesn’t present his book as a Softwar critique, he is clearly referencing Lowery’s understanding of proof of work. Warren can see no game theoretic path to countries opting into Bitcoin en masse. His conclusion is that Bitcoin functions well as an alternative to monopolized money, but won’t function as well as the reserve currency. The game theory of an arms race, leading to a stable stand-off, won’t apply.

Warren: “Leaders have ample tools at their disposal. Bitcoin is for those who are neither leaders nor followers. […] Bitcoin is designed for those who may not have better options for transacting or storing value or doing finance, not as a weapon of domination.”

Softwar Critique #1: Game Theory Between Nations Plays Out Differently

According to Warren, nations aren’t forced to opt-in participating in Bitcoin mining. Unlike an arms race over the control of a country, an arms race over blockspace gives players the choice of not playing the game or playing a different game.

These options are not available in wars over land. To put it bluntly: you can’t fork off land in ‘meat space’.You will have to fight over it or die. But you can fork off a new blockchain if you don’t like your odds in the hash wars.

According to Warner, the current dynamic between corporate miners – competing but with aligned interests – is an equilibrium we won’t see when nation-states would become miners. He gives a few scenarios which would lead to a ‘permissioned’ form of Bitcoin. In which a certain group fences off its miners and deems these miners the only valid producers of blocks.

Scenario 1: 51% Attack and Fork

The first scenario is where nation A is 51% attacked by nation B, a nation that formerly hadn’t adopted Bitcoin (to be honest, Warner makes this hypothetical attack come across as more feasible than it would be in practice. It would be a huge operation). If the threat is real, Nation A could fork a version of Bitcoin which invalidates blocks that are mined by nation B. This harms Bitcoin as a permissionless global monetary system.

“What would happen if China monopolized the Bitcoin blockchain? US users could abandon Bitcoin, could continue to use it, or could develop an alternative that doesn’t 100% rely on pure proof of work. […] The miners come to an arms agreement about hashrate reduction, slowly winding costs down so that costs become minimal and profits are huge.”

This threat isn’t as real with corporate miners. They all have a shared business model and after their primary interest of keeping their business afloat, number 2 priority is to keep Bitcoin intact. Nation-states, on the other hand, have different starting points. For example, nation A is mining, nation B not (yet). This creates a disequilibrium that is not as stable as the current corporate mining situation.

Scenario 2: WEF Approves Only Certain Miners

Let’s look at another scenario in which the system is not as stable. Imagine a ‘hyper-bitcoinized’ world where Lowery’s vision has played out. Every country is happily mining, people use Bitcoin all the time. The security budget burned by miners is 300 billion dollars per year.

“Now suppose in this super bullish scenario, in the following year, at Davos, the bankers get together and say “look, there’s $300 billion of fat we can trim, this is money we’re paying to settle transactions with each other, but we all know each other. We’re financial disruptors, we can solve this.” They also own stock in all the mining corporations, or are the mining corporations themselves. They then issue a statement that as of next November 1, Bitcoin will be only mined by a list of permissioned miners, chosen by the good folks at Davos.”

These two scenarios point out that there are continuous pressures on Bitcoin to be forked to a permissioned system. Either because of competition or because of collusion. Such a fork would break the ‘softwar’ equilibrium of everyone jointly mining in a happy competitive spirit.

“Disputes happen, wars happen, tension elevates. But this would not escalate in the sense that world powers would be increasing their hashrate to show force, they would be using traditional diplomacy, shoring up alliances, shaking hands, marrying princes to princesses, etc. It’s a political war just like it’s always been, but now any colluding interest with enough hashrate can shut down the blockchain at will.”

The current use case for Bitcoin is its alternative to the fiat system. It’s ‘outside money’. When the fiat overlords would move to a Bitcoin standard, it would put pressure on Bitcoin to become a permissioned system just like the current fiat system. It will become ‘inside money’. I think this is a fair thought by Warren, even though the game theoretic landscape is a difficult one to think through. The powers that be won’t move to Bitcoin unless they can wrest control over it.

Softwar Critique #2: Proof of Work is Not Needed for Permissioned Systems

Warner wonders if Lowery shares the same vision of proof of work as him. Lowery presents proof of work as the protective fence around software and this is a tantalizing thought: this is how Bitcoin is anchored to the real world. After reading his chapter Power Projection Tactics in Cyberspace you would almost conclude that cyber security is extremely brittle without proof of work: ‘Not being able to physically restrain computers is a major systemic security vulnerability.‘

But Micah Warren reminds us that the cryptography aspect in crypto (duh) is crucial here. No miner or mining pool can steal my BTC, no matter how much hashforce they deploy. Proof of work is only a mechanism to settle disputes in case of a double spend. It doesn’t determine the validity of a transaction. It doesn’t safeguard anyone’s private keys.

Warner: ‘The main security mechanism at play in software is cryptography. Cryptography does not rely on proof of work. Proof of work is no more than an arbitration mechanism to determine an absolute order of transactions. It is not something that can create or revoke valid cryptographic signatures.’

Indeed, as Warren points out, the Bitcoin-inspired social network protocol Nostr doesn’t use proof of work. It does use cryptography though, which ensures that you own your own content (‘notes’).

It is good to remind ourselves why proof of work was thrown into Bitcoin’s protocol. Prior to Bitcoin, proof of work functioned as an anti-spam measure. For example, an early proposal to discourage spam mail involved proof of work. If sending an e-mail comes with a (tiny) cost – let’s say one cent – ordinary users will be fine with this but senders of spam mail in bulk won’t be profitable anymore and simply not participate.

So, proof of work can have a function in permissionless (or: un-permissioned) systems, as it has in Bitcoin. If makes it possible to allow anonymous users to a network.

But nation-states can safeguard their money and information without proof of work, argues Warner. In a permissioned database, where it is clear who is allowed and who is not to get access, proof of work makes not a lot of sense.

Conclusion

Lowery’s thesis is tantalizing, and his analogy comparing mining to antlers as tools for fighting without bloodshed is clever. But maybe his analogies are a bit… stretched? Sure, it is an exciting thought to equate the power needed for physical warfare to the power needed to fight over property in cyberspace. But does his portrayal of proof of work as a security fence around Bitcoin hold up to scrutiny? And will the current corporate hash wars move in a straight line to nation-states hash wars? Possibly. But I’m less inclined to think so, after reading Warren’s work.

Also, reading the Softwar critique by Warren for me was a nice reminder of why we’re into Bitcoin. Sure, we love it if number go up because more people start using it as an alternative to the problematic fiat system. But would we want Bitcoin’s price to go up because of the fiat system adopting it? That could be a pyrrhic victory that ends up morphing Bitcoin into something we don’t want it to be. Maybe we would be better off – with plenty of room for number to go up – if Bitcoin doesn’t become digital warfare but stays a peer-to-peer electronic cash system.

This Week’s Trending Coins by Rebecca

Here are my key takeaways from the trends this week and it’s a mix of memecoins, mishaps, and migrations.

- Ethereum suffered two outages after a technical issue caused the network to stop finalizing blocks. The Ethereum developers have released software updates for Prysm and Teku clients to resolve and restore the network.

- Sui is a Layer-1 blockchain that’s announced an NFT airdrop for active contributors and early supporters. Registration has also opened for Sui’s Builder House in Seoul from June 3-4.

- Bitcoin dropped over 10% in a matter of days as memecoin mania appears to have signaled a local top, for now. Bitcoin addresses holding 1 or more BTC have hit 1M according to Glassnode.

- Aptos is a Layer-1 blockchain that’s gearing up for its hackathon in Amsterdam in June.

- Pepe is a memecoin on Ethereum that’s seen its community boycott Coinbase using #DeleteCoinbase on Twitter. This was after a Coinbase newsletter accused Pepe of being a hate symbol by alt-right groups. Coinbase has since issued an apology.

- Milady is a memecoin that’s pumped after Elon Musk tweeted a meme featuring a Milady NFT. The floor price of the NFTs briefly hit an all-time high of 7.3 ETH. CryptoCom has also listed the LADYS token.

- Ben is a memecoin on Ethereum that’s seen crypto influencer Ben Armstrong announce he will be taking over the project with the founder staying on as an advisor.

- tomiNet is a Web3 infrastructure company on Ethereum that’s seen its TOMI token listed on Bybit. The tomi team also featured in a Twitter Spaces with several crypto influencers.

- Arbitrum is an Ethereum Layer-2 scaling solution that’s outlined a new rewards program. Arbitrum will distribute $6M worth of ETH to its DAO, as part of the rewards generated through fees.

- Wojak is a memecoin on Ethereum that’s been included in a poll by KuCoin for a potential listing on the exchange.

- Solana is an L1 blockchain that’s re-entered the top ten cryptocurrencies by market cap, overtaking Polygon. Solana founder Anatoly Yakovenko has been interviewed on crypto trader Scott Melker’s YouTube channel.

- ArbDoge AI is a memecoin created by AI on Arbitrum that’s announced a partnership with Degen Zoo.

- Optimism is an Ethereum Layer-2 scaling solution that’s seen OpenAI CEO Sam Altman’s Worldcoin wallet announce it will be migrating from Polygon to the Optimism network.

- Gala is a play-to-earn (P2E) gaming ecosystem that’s expected to launch V2 of its GALA token on May 15 with an airdrop. Coinbase has declined to support GALA V2.

- Polygon is an Ethereum side chain that’s seen co-founder Sandeep Nailwal join a Twitter Spaces with crypto trader Scott Melker.

Final Notes

Bitcoin’s BTC BRC20 token standard explained simply. Just click the video below to watch more.👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.