Ethereum vs Polygon: The Powerhouse L1 & L2 Compared

Ethereum vs Polygon: Two powerhouse blockchains in their own right.

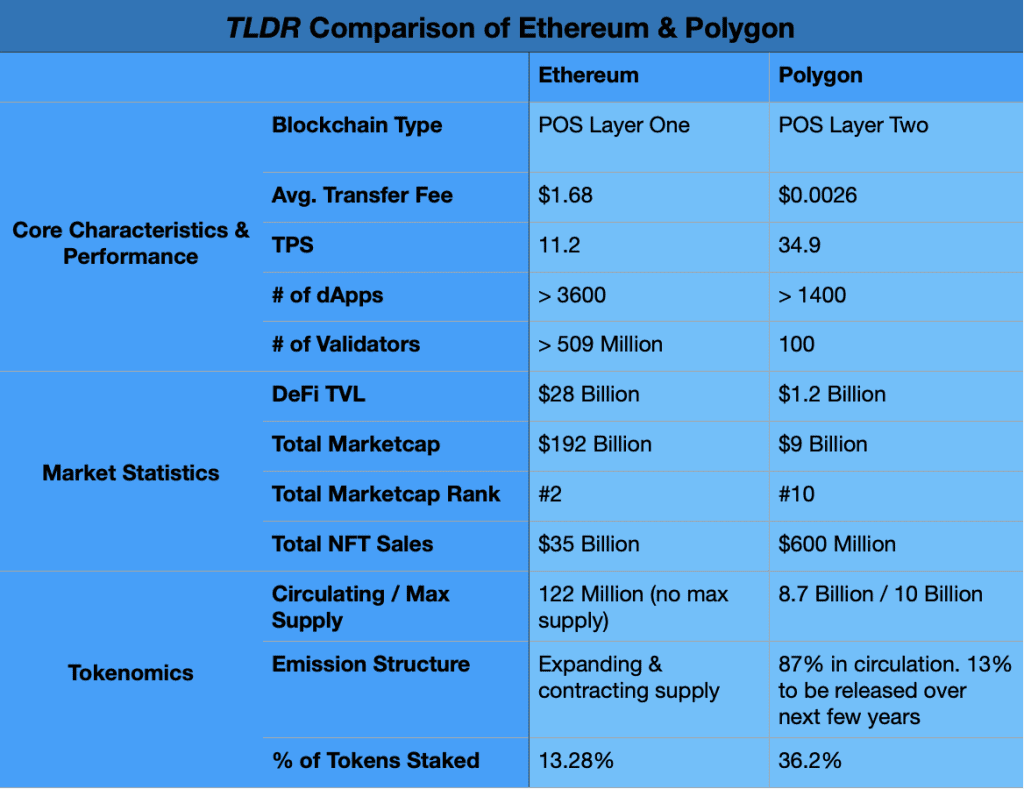

Ethereum is staking its claim as the powerhouse Web3 blockchain for the 21st century digital economy. The network enjoys a 20% crypto-market dominance with a $192 billion market-cap. Meanwhile, Polygon is the most dominate layer-two (L2) blockchain for Ethereum. The network is ranked #10 by market-cap and is facilitating some serious economic activity.

This article compares these two networks. Specifically:

- What are they, and how do they interact together;

- How do they compare in terms of performance, product statistics, and emerging technologies;

- Tokenomics; and,

- What are the high level positives and criticisms of both.

Let’s get started.

What are Ethereum & Polygon

Ethereum is a decentralized, proof of stake (POS), programmable, layer one (L1) blockchain protocol. Conceptualize Ethereum as a global computer network where users build and deploy applications (dApps) within it. These dApps form an ever-expanding digital marketplace that connect users together for commerce and other activities.

Polygon is also a decentralized, POS, programmable blockchain protocol. However, Polygon is a L2 network built “on top” of Ethereum for the purpose of improving Ethereum’s scalability and efficiency. Polygon achieves lower gas fees and increased transactions per second (TPS) for Ethereum by processing transactions on the Polygon chain, and then using roll-up technology to batch over synthesized transaction data to the Ethereum chain for ultimate finality.

Let’s keep it simple. Ethereum is a ground-level super-highway. All the action ultimately starts and stops here. Polygon is a smaller highway built above and running with Ethereum, all for the purpose increasing the super-highway’s scalability and efficiency.

Ethereum & Polygon Technical Specifications

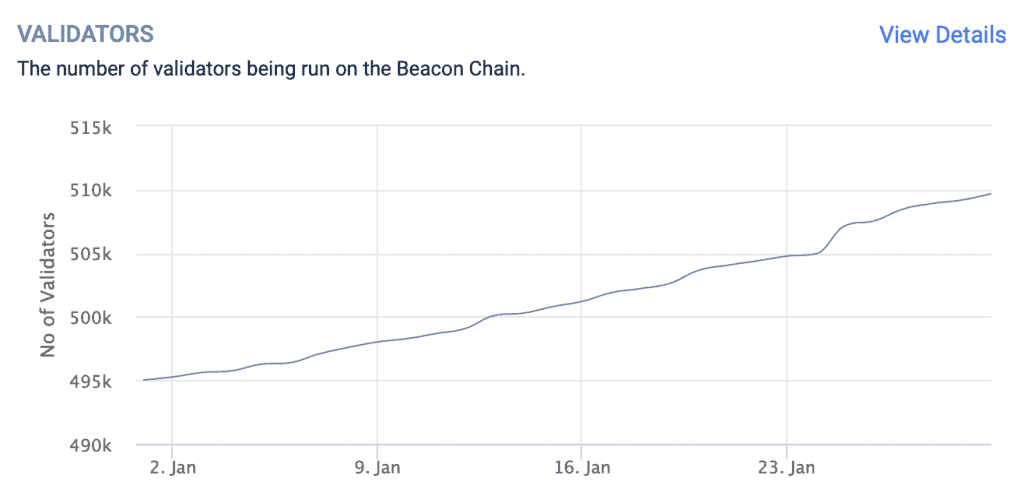

- Proof of Stake: Both blockchains use networks of decentralized, permissionless validators for security. Ethereum has about 509,000 validators. One must deposit 32 ETH (about $50,000) in order to run a dedicated staking node on Ethereum’s “Beacon Chain”. Polygon’s uses 100 validators. Anyone can be validator, but they must stake enough MATIC into special management contracts in order to break into the top 100 to assume validation duties.

- Programmable (aka Smart Contracts): Anyone can build and launch dApps on either network. The engine behind these dApps are smart contracts. Smart contracts are computer programs that automatically execute actions whenever certain stimuli are triggered. Ethereum broke ground with the development of smart contracts, and Polygon, as well as many other L1s and L2s, adopted the technology. DeFi, NFTs, gaming, and other Web3 applications owe their existence to smart contracts.

Ethereum vs Polygon: Performance, Product Statistics & Emerging Technologies

Performance

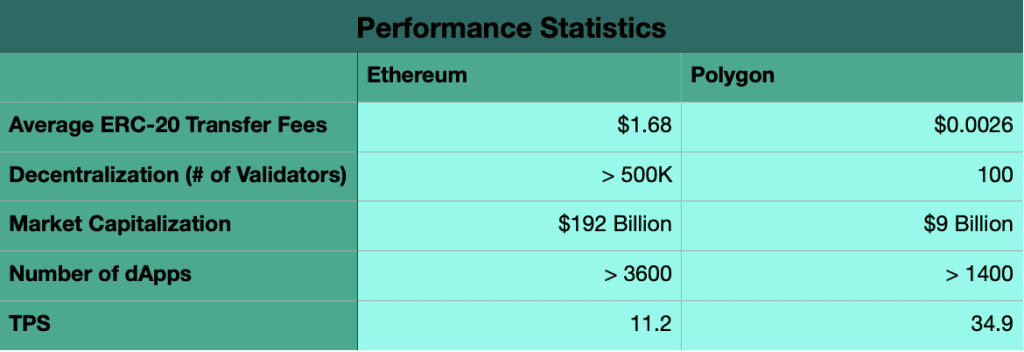

Regarding performance metrics, Ethereum shines with concerns to decentralization (security), market capitalization, and the number of offered dApps. This makes sense given Ethereum is one of the older and most innovative blockchains in the crypto space. Regarding decentralization, the number of ETH validators continues to increase. And given the network has famously never experienced a major shutdown or security issue, it’s becoming increasingly clear that Ethereum can be relied upon.

Polygon shines with regards to transfer fees and TPS. Again, this makes sense given Polygon’s main purpose is to increase Ethereum’s efficiency and scalability. Doing business in Polygon is dirt cheap!

Decentralized Finance

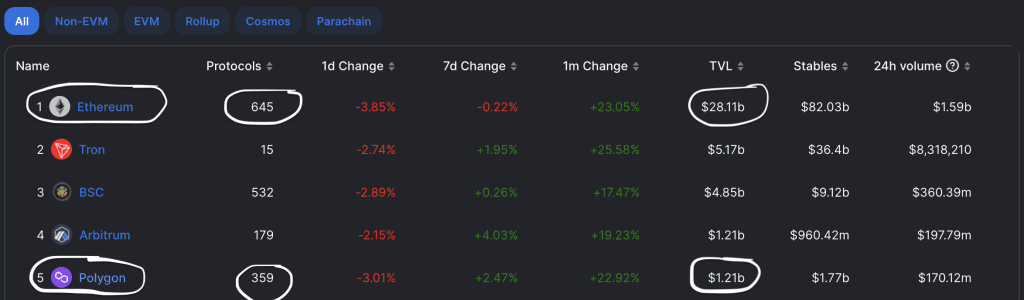

Ethereum is the king of DeFi. The network hosts approximately 645 dApps with $28 billion in total value locked (TVL). Polygon trades with Arbitrum as the fourth largest DeFi blockchain. Currently, Polygon hosts 359 dApps with $1.2 billion in TVL.

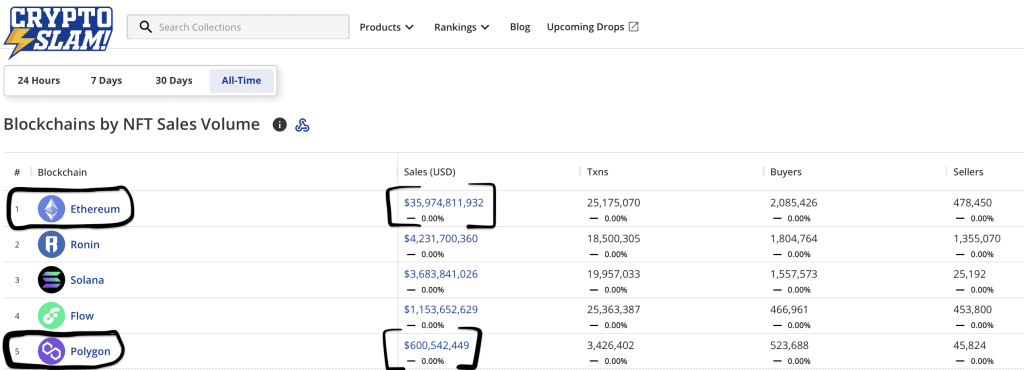

NFTs

Ethereum is also the king of NFTs. The network is ranked #1 in all-time NFT sales volume by blockchain with $35 billion in sales. Polygon ranks #5 with $600 million in sales.

Keep an eye on Polygon’s NFT ecosystem. The network landed huge NFT partnerships in 2022. Reddit, Adidas, Adobe, Disney, Instagram, and several other heavy-hitters all decided to build out their NFT marketplaces on Polygon. The Reddit partnership alone increased Polygon’s NFT trading by 770% in Q4 2022. This occured when Reddit Digital Collectibles launched, where users initially minted 5 million NFTs, generating roughly $10 million in revenue.

Emerging Technologies

Both Ethereum and Polygon are unveiling potentially revolutionary technologies to the blockchain marketplace.

Ethereum is making strikes in terms of decentralized social networks, identity, and science.

- Decentralized social networks are blockchain-based social network platforms that protect user privacy and data by distributing information across network nodes. These networks are immune to censorship, control, or incompetence by one centralized authority. Peepeth, Mirror, and MINDS are all Ethereum-based social networks that are live now.

- Decentralized identity is a framework that flips the current, traditional identity system on its head. Our current model requires users to hand over private data to centralized entities for access to products or services. A decentralized identity framework consists of only users having access and control to their personal identifying information (PII) on the blockchain. Users can submit cryptographic proofs of their PII to service providers in order to gain access to services. Thus, users preserve their anonymity and providers can verify that their users are who they say they are. Working projects include SpruceID, Proof of Humanity, and BrightID.

- Decentralized science is a movement that leverages the blockchain to change how scientific research is funded and shared. Blockchain-based funding models are coming online that allow scientists and science-based DAOs to use token launches for funding. Ways to put published research on-chain are being explored so that information is universally accessible to all.

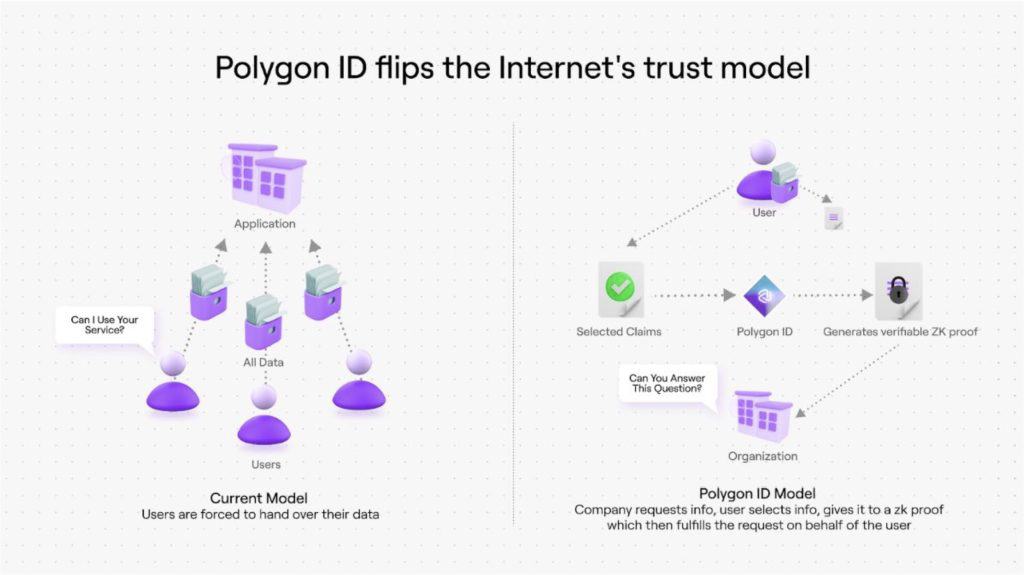

Polygon is innovating in the areas of decentralized identity, blockchain building platforms, and roll-up technology.

- Polygon ID is Polygon’s blockchain-based decentralized identity management solution. The solution is conceptually the same per the description above. Polygon ID is live now.

- Polygon offers two blockchain building platforms that give third-party developers the ability to build customizable, EVM-compatible blockchains. Polygon Edge is a toolkit that allows for public or private, smart contract enabled blockchains. Polygon Supernets is an infrastructure system that helps third-party builders quickly achieve decentralization by tapping into Supernet’s professional validator partners. These third-party Polygon chains essentially function like L3s. They connect with both the Polygon and Ethereum chains.

- Polygon is pushing the boundaries of roll-up technology. A zkEVM rollup solution is in a public testnet phase now. Under development is Polygon Miden (STARK-based zk-rollups) and Polygon Zero (recursive proof, ETH-friendly rollup solution).

ETH vs. MATIC: Tokenomics

ETH

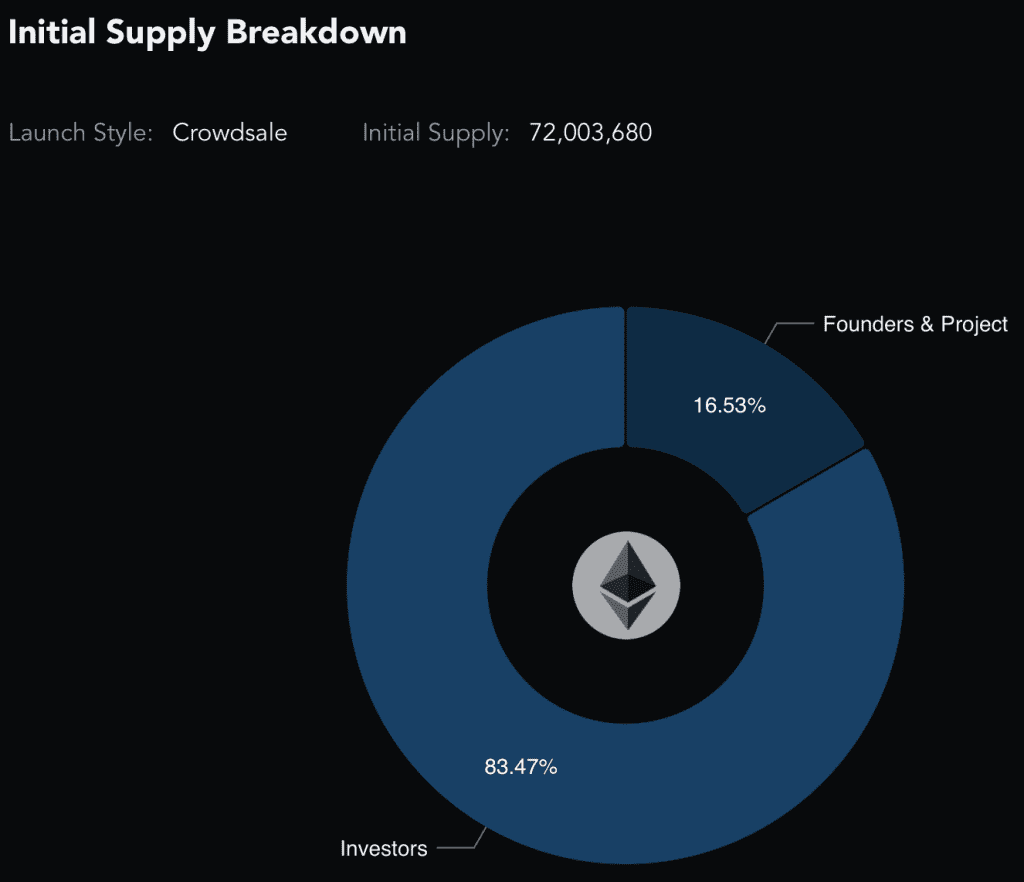

- Total supply of approximately 122M tokens, all of which have been issued and released.

- Approximately 16 million ETH (13.28% of total supply) are locked into staking contracts. These tokens are inaccessible until the network’s Shanghai upgrade, scheduled for March 2023.

- ETH’s total supply continually expands and contracts depending on network activity. Due to EIP-1559, a burn-mint mechanism burns ETH during periods of higher network activity (thereby decreasing the total supply) and mints new ETH when network activity is low (thereby increasing the total supply).

- The 2015 initial distribution of ETH allocated 83% of tokens to a public crowdsale, while 17% went to the Ethereum Foundation and early contributors. Approximately 50 million new ETH have since been minted and released to miners in the form of block rewards.

MATIC

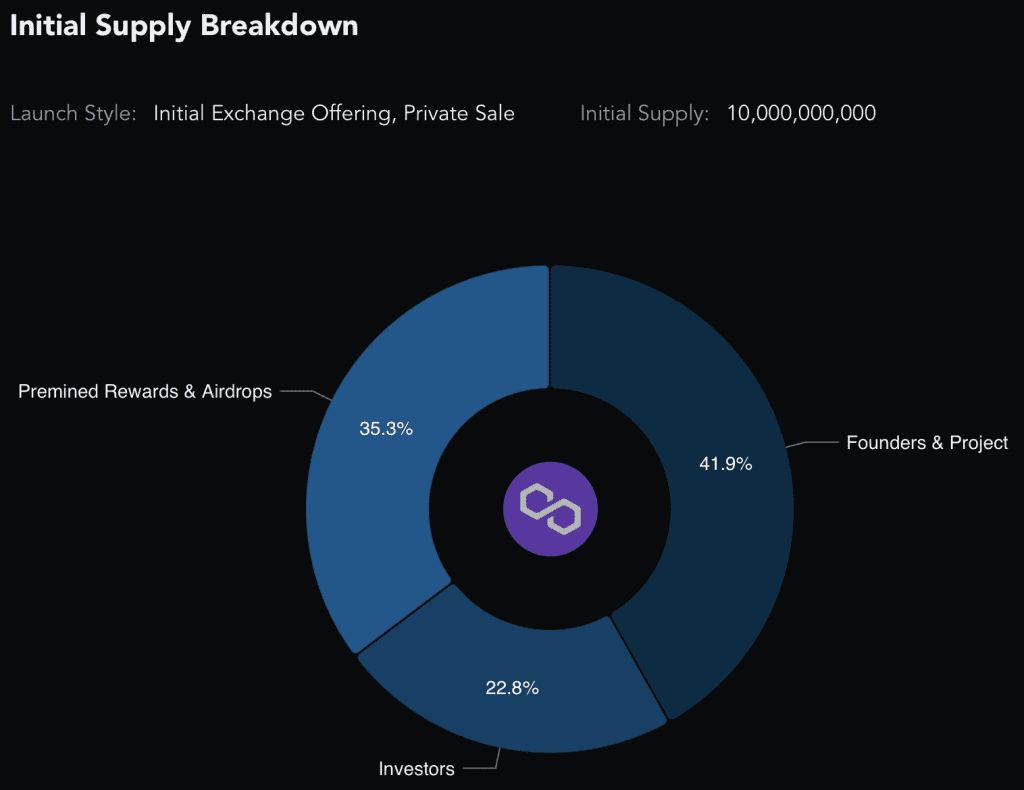

- Max supply of 10B tokens, all of which have technically been issued. 8.7B are currently in circulation, while the remaining 1.3B will be unlocked over the next few years via staking rewards.

- 36.2% of MATIC tokens are currently locked up in staking contracts.

- Initial coin distribution occurred in 2019 with 41.9% going to the Polygon team, advisors, and Polygon Foundation.

- Currently, the share of tokens held by Polygon’s centralized entities has increased to approximately 42.5% of total supply.

Ethereum vs Polygon: Concluding Thoughts, Pros & Cons

Ethereum and Polygon are both highly-regarded blockchains, but each serve different purposes in the larger blockchain economy. Ethereum is an absolute heavy-weight, responsible for approximately 20% of all economic activity in the blockchain economy. Polygon is an L2 primarily purposed to support Ethereum.

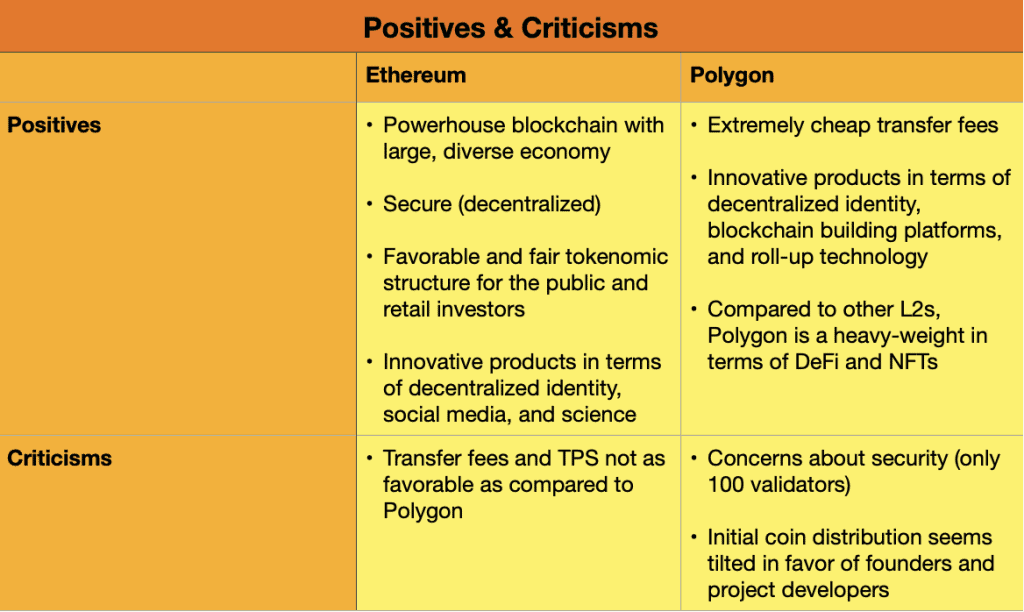

A comparison of both blockchains reveals the following high-level positives and criticisms of each:

Perhaps the most savvy way to approach these two blockchains is knowing how to best utilize both. For example, with concerns to activities where security is paramount, conducting business on Ethereum is likely the safest route. However, for those making high volume transfers and trades, utilizing Polygon will reap some serious transfer fee savings.

I recommend using both networks and keeping top of mind how you can take advantage of their respective strengths. And given the levels of economic activity and innovation happening on both, I do believe we will continue to see growth and ground-breaking contributions on Ethereum and Polygon for the foreseeable future.