Ethereum vs Solana: Updated 2023 Comparison

Ethereum vs. Solana. Two of the most recognized blockchains in the crypto-economy.

When it launched in 2020, the big question was if Solana was the “Ethereum Killer”. Well a few years have passed, so let’s set these protocols side-by-side and draw some fresh conclusions with regards to this competition.

This article explores the following:

- What exactly are Ethereum and Solana;

- What are their technical specifications;

- How do they compare in terms of performance and economic activity; and,

- How do they compare with regards to tokenomics and staking.

Let’s roll.

What are Ethereum & Solana

Ethereum and Solana are decentralized, proof of stake (POS), layer one (L1), blockchain protocols. Both are open-source and have smart contract functionalities.

In simple terms, both are global computer networks that anyone can access, use, or build applications (dApps) within. These protocols are open, ever-evolving, digital marketplaces that allow people to connect for commerce, entertainment, and self-expression.

Ethereum has the largest, most diverse economy out of any POS L1. The protocol commands a 20% market dominance (with a $200 billion market cap) and is the DeFi and NFT leader. The network did suffer congestion and exorbitant transaction fees throughout 2020 and 2021, but those issues appear to largely be resolved due to a successful POS transition and newly developed layer two (L2) infrastructure.

Solana is the fourth-largest POS L1 blockchain with a market-cap of $8 billion. Known for its super cheap transaction fees and extremely high transactions per second (TPS), Solana has previously been called an “Ethereum killer.” However, this narrative appears to no longer be in play in part due to chronic outages that plague the network.

Ethereum and Solana’s native currencies are ETH and SOL, respectively.

Ethereum vs Solana: Technical Specifications

Tech is the foundation from which everything else follows (utility, adoption, price).

So let’s explore Ethereum and Solana’s decentralization characteristics, consensus mechanisms, other specifications, and developments in progress.

Decentralization

POS decentralization can be measured from the following three metrics:

- The number of active validators in the network;

- The percentage of staked tokens compared to total supply; and

- The staked token supply distribution across the validators.

Here’s the Ethereum vs Solana decentralization breakdown:

Ethereum’s large (and growing) number of active validators is fantastic! It shows the network is healthy. However, the percentage of staked tokens to overall supply is low (and might drop further due to the Shanghai / Shapella upgrade). Moreover, a lot of staked ETH is in the hands of just a few custodians.

Solana’s active validator count has also been steadily increasing over time, although the total number is much lower than Ethereum’s. The percentage of staked tokens to overall supply is high, which is a positive. However, just the top 32 SOL validators collectively control 33% of all staked SOL. This means that these 32 could halt the network if they colluded together.

But Solana’s glaring decentralization issue is that the network uses only one validator “client.” Thus, the entire network is exposed to one single point of failure because all validators must connect through one software service. Not good.

In the end, Ethereum is a more decentralized and secure network than Solana.

Proof of Stake

Ethereum and Solana use POS consensus mechanisms to validate transactions and secure their respective networks.

Validators in both systems stake either ETH or SOL into a special smart contract to run a dedicated validator node. This stake is collateral. If a validator misbehaves, they can be subject to slashing by other validators on the network. Thus, validators are economically disincentivized to misbehave.

Solana’s Proof of Stake

Solana takes this POS system and adds a proof of history (POH) consensus mechanism on top. This is novel and makes Solana technically complex.

POH means that all validators run “cryptographic clocks” that are synchronized with each other. This time synchronization provides for faster ordering of transactions, and it’s the reason why Solana can achieve such high TPS. If you want to nerd out on the finer details of POH, you can do so here.

Layer One Protocols

Ethereum and Solana are both L1 platforms. This in part means that anyone can build and launch dApps on either platform.

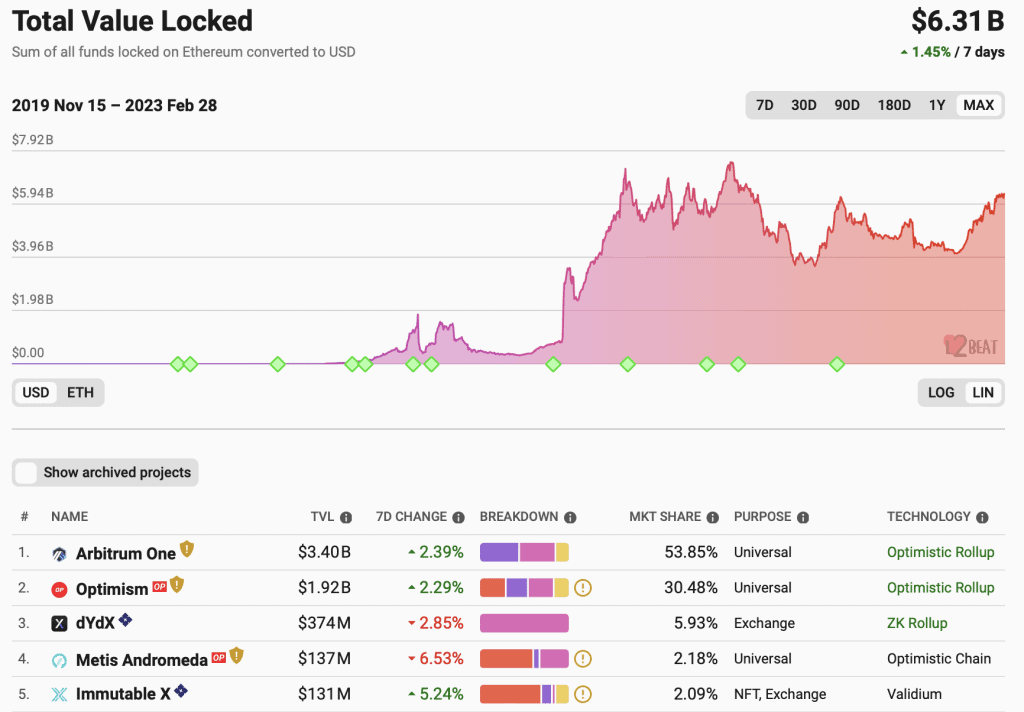

The major difference here is with regards to L2s. A vibrant L2 network has been built around Ethereum. Polygon, Arbitrum, Optimism, Immutable X, etc. This was all driven by organic market demand as L2s were needed to combat periods of network congestion and high transaction fees on Ethereum.

What’s interesting is that some of Ethereum’s L2s have become innovative and large economic centers of their own. Thus, the Ethereum network has evolved into a dynamic and competitive multi-chain ecosystem.

In contrast, Solana uses what’s known as a Single Global State. The idea is that Solana’s consensus mechanism is so fast and efficient, there’s really just no need for sharding, scaling, or sidechain solutions. Just one blockchain, simple and seamless.

Developments in Progress

Both blockchains have positive technical upgrades currently happening or just around the corner.

Ethereum

Everyone’s talking about the Shanghai / Shapella upgrade, happening as these words hit the page. This upgrade implements five Ethereum improvement proposals (EIPs). One of these EIPs unlocks all the staked ETH on the network, giving holders the ability to withdraw and do as they please with their ETH. The other EIPs are aimed at lowering transaction fees and increasing the network’s TPS.

After Shanghai, Sharding is the next big development. Sharding upgrades will happen in phases during late 2023 and 2024. Sharding should further lower transaction fees and boost TPS into the thousands, because it allows the blockchain to engage in what’s known as “parallel processing”.

Solana

For Solana, the fresh news is that the entire Helium network (accounts, tokens, chain state, wallet dApps etc.) is shifting over to the Solana blockchain. This is scheduled for late March. Helium’s total market cap is currently at $370 million.

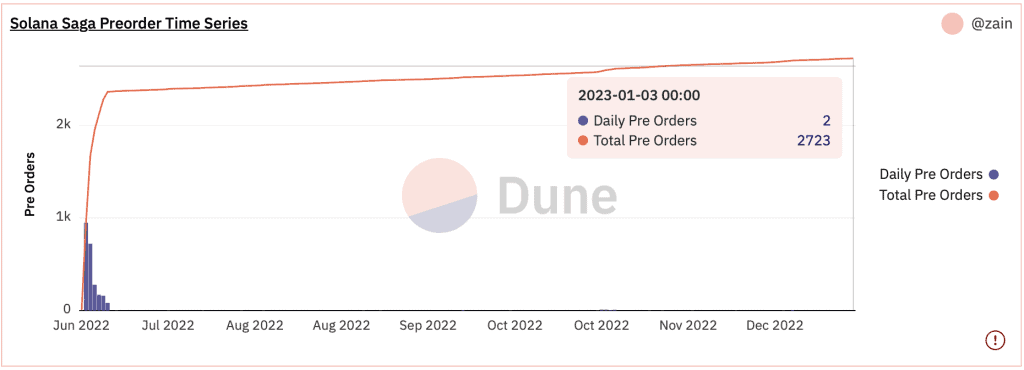

Additionally, Solana Saga smart-phone shipments should be any day now. The Saga is an Android phone engineered to interact with the Solana blockchain and its dApps ecosystem. Initial news stirred positive sentiments, but lackluster preorders have made some wonder if the product is dead on arrival.

Ethereum vs Solana: Performance & Economic Activity

Let’s look at how Ethereum and Solana compare with regards to blockchain performance and economic activity.

Performance

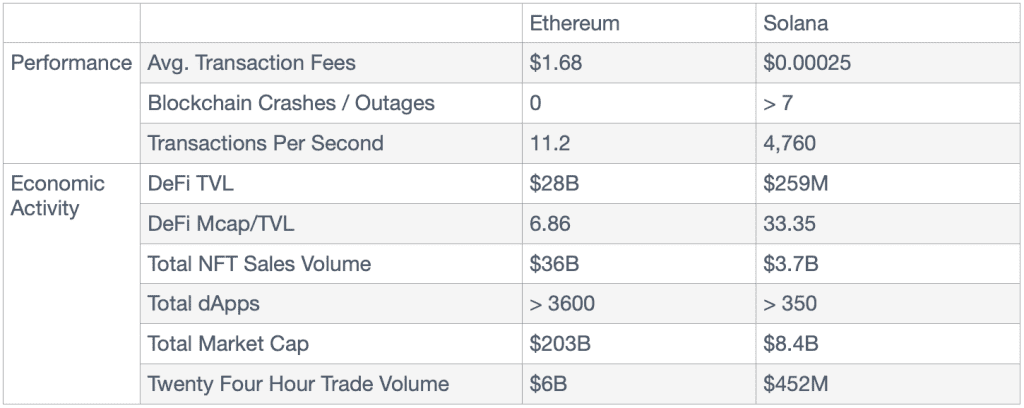

In terms of average transaction fees and TPS, Solana is the clear winner.

Solana offers insanely cheap transaction fees and blazing fast TPS. Solana’s all-time average fees are $0.00025 (compared to Ethereum’s $1.68), and Solana’s TPS is 4,760 (compared to Ethereum’s 11.2). These great numbers are due to Solana’s hybrid POS and POH system.

However, Solana’s Achilles heel is its network instability. Solana has suffered more than seven major outages, some lasting longer than 24 hours. The most recent outage was on February 25th, where the blockchain had to be “restarted” due to software update issues. These outages are why the “Ethereum Killer” narrative no longer holds, and it’s also why Solana’s market-cap dominance has been on the slow bleed to its competitors.

In contrast, Ethereum has never had a major outage. What the network has struggled with historically are periods of congestion, which in turn caused transaction fees to sore into the hundreds of dollars! However, due to the successful transition to POS, the newly constructed L2 network, and the incoming sharding upgrade, it appears that Ethereum’s days of congestion and insane fees are over.

Economic Activity

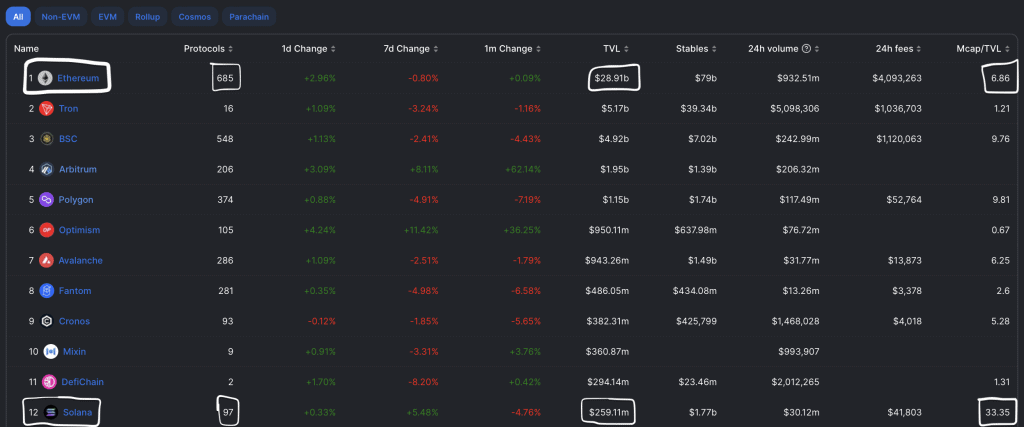

In terms of economic activity, Ethereum blows Solana out of the water.

Ethereum’s total market cap, 24H trade volume, and dApp ecosystem are 24X, 13X, and 10X larger than Solana’s, respectively. Even Polygon, an Ethereum L2 scaling solution, has a larger total market cap than Solana.

Decentralized Finance

Ethereum is DeFi King with $28.9 billion in total value locked (TVL) across 685 protocols. This compares to Solana’s $259M TVL across 97 protocols. This makes Ethereum’s DeFi ecosystem 112X larger than Solana’s. And then compare their Mcap / TVL numbers (the lower the number, the better, as it signifies higher blockchain utility). Ethereum is 6.86 to Solana’s 33.35. Wow.

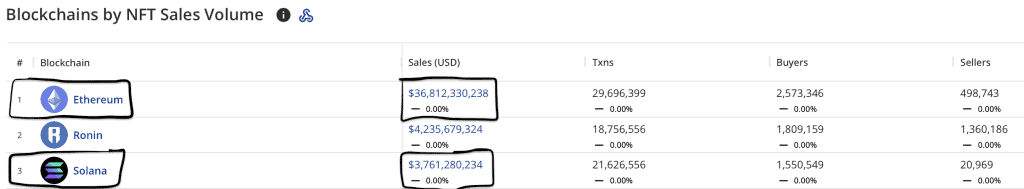

NFTs

Ethereum is also NFT King with $36 billion in total NFT sales, compared to Solana’s $3.7 billion, making Ethereum’s NFT market approximately 10X larger.

ETH vs SOL: Tokenomics & Staking

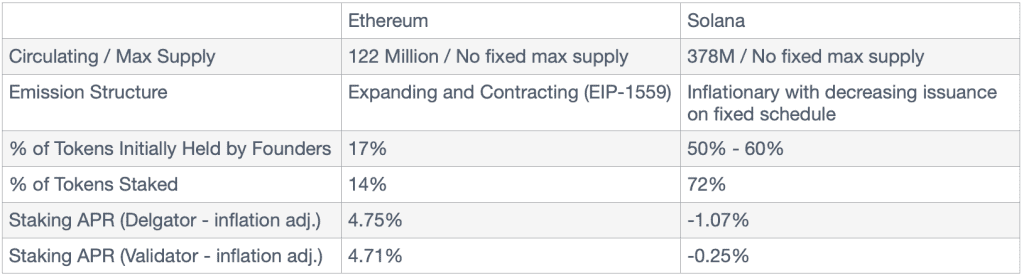

Let’s examine ETH and SOL in regards to tokenomics and staking. Here’s the numbers:

ETH

ETH has a total supply of 122 million tokens. All have been minted and released.

Per EIP-1559, ETH’s total supply continually expands and contracts in relation to network activity. Higher network activity results in ETH being burned, and lower network activity results in ETH being minted.

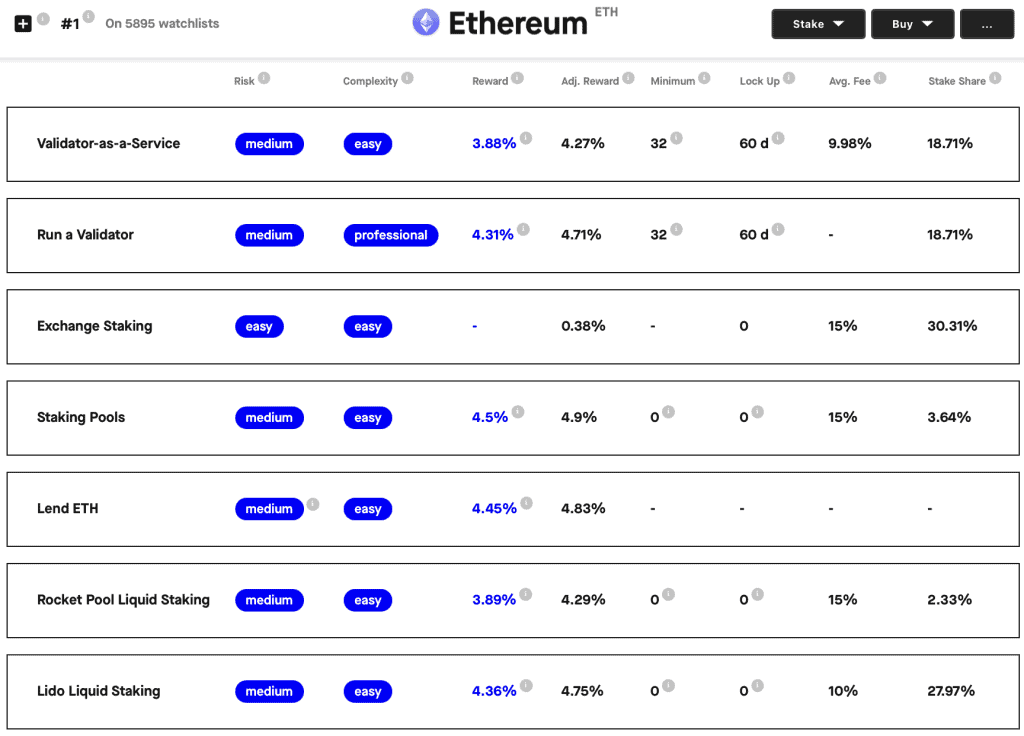

Approximately 16 million ETH (14% of total supply) are in staking contracts on the network. Again, these numbers might soon drop due to the Shanghai / Shapella upgrade.

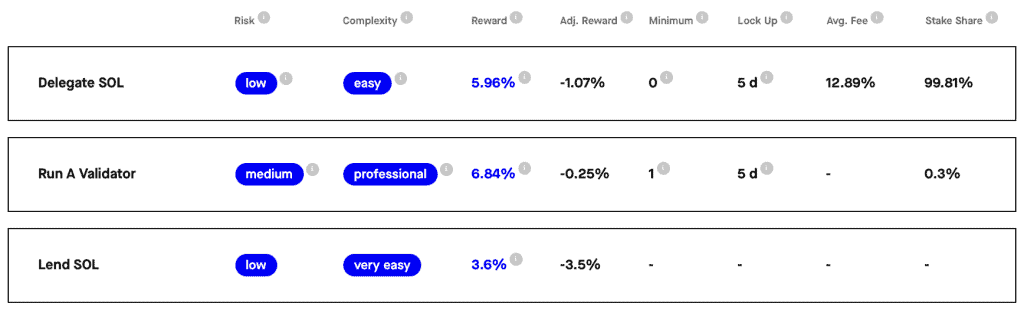

Ethereum validators and users staking via third-parties are enjoying 4.71% and 4.75% APR, respectively.

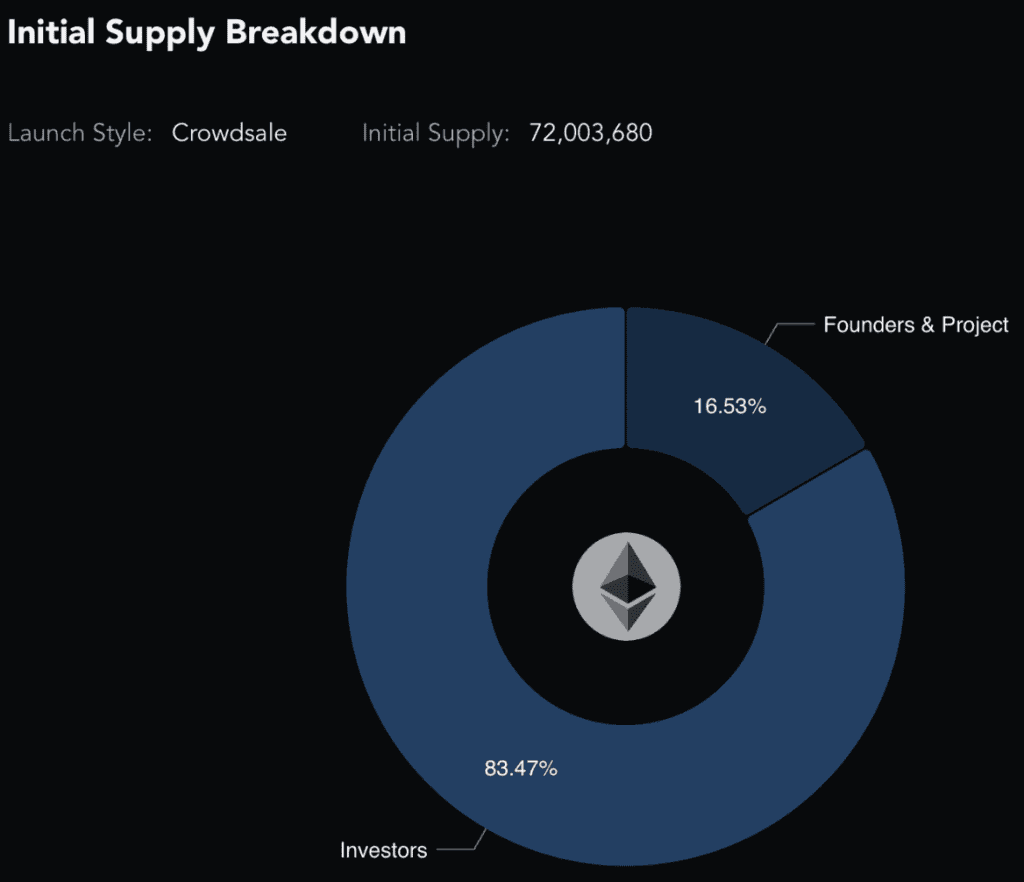

With regards to initial distribution, approximately 83% of ETH was sold in 2015 in a public crowd sale. 17% went to the Ethereum Foundation and early contributors.

SOL

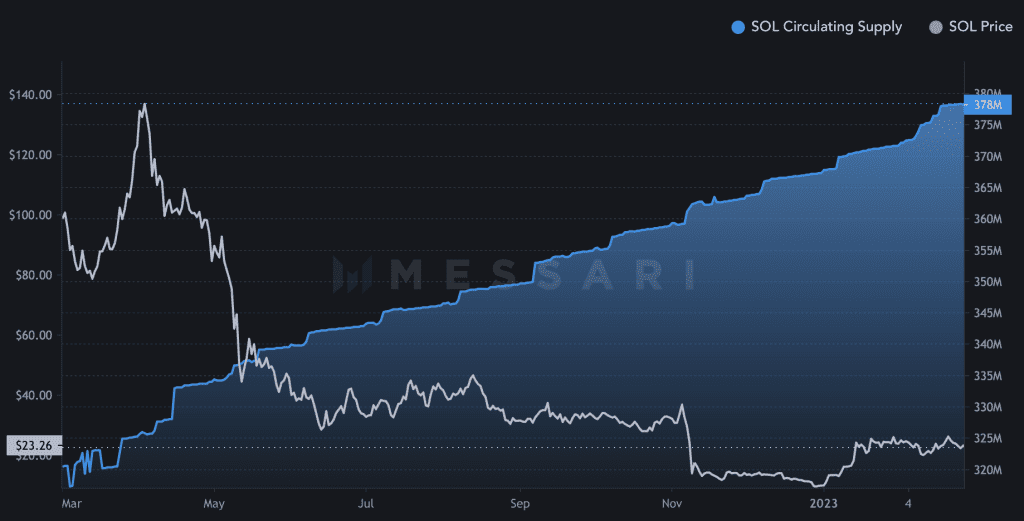

SOL has a current supply of 378 million tokens. SOL is an inflationary token, with no fixed max supply.

SOL’s inflation schedule is fixed. The inflation rate is currently 6.325%. This rate decreases 15% per year until 1.5% is reached, which is set to hold steady for the long-term. Approximately 272 million SOL (72% of total supply) are in staking contracts.

SOL’s initial coin distribution occurred between 2019 and 2020. Four of the five token sale rounds dealt with non-public buyers. Thus, an estimated 50% to 60% of the initial token distribution went to the development team, founders, insiders, and non-public purchasers.

And speaking of insiders, the FTX debacle revealed that FTX was one of Solana’s major supporters. Since 2020, FTX and Alameda Research had purchased 58 million SOL (15% of supply). This revelation has only further damaged the network’s reputation.

The APR for staking, after factoring in inflation, is dismal. SOL validators and delegators are making -0.25% and -1.07%, respectively.

Ethereum vs Solana: Concluding Thoughts

In terms of economic activity, the numbers are stark. Ethereum is dominating Solana. But why?

One reason is Ethereum has enjoyed a five year head-start. That’s a crazy amount of time to get the jump in crypto-land.

A second reason is Solana’s recurring outages. These outages severely hurt investor and developer confidence, and pull capital away from the network. Solana’s innovative POS + POH system does give it cheap fees and a high TPS, but it appears that this tech might be a double-edged sword due to the system’s instability.

And a third reason is Ethereum’s ability to adapt. The ETH 2.0 transition was a long time coming, but it was a flawless execution once it happened. All the while, the L2 infrastructure built around Ethereum helped ease congestion and reduce fees, and created a larger, more dynamic multi-chain ecosystem in the process.

So is Solana the “Ethereum Killer”? Well in 2023, it appears that Ethereum might just be the “Solana Killer”.

Responses