Earn Up to 82% APY on Spool with Stablecoins

Before we get started with earning high apy on Spool with stablecoins, this is not a recommendation or endorsement to buy any token(s) mentioned. DeFi Dad wanted to disclose his team at 4RC invested in the seed round for Spool.

What is 1-click DeFi?

The concept of 1-click DeFi started with vaults created by Yearn in 2020. In DeFi, we often require multiple transactions to execute even the simplest of strategies, but in order to truly democratize finance, DeFi developers have worked to further automate these strategies into vaults, which pool deposits and automate yield-earning strategies. One of the earliest and most popular Yearn vaults would simply deposit stablecoins into Curve liquidity pools, stake the LP, and then auto-harvest the CRV rewards, which were sold for more stablecoins and redeposited into the Curve pool.

What is Spool?

Years later, these 1-click DeFi vaults are still popular and have grown beyond the trailblazers of Yearn Finance. Spool is one of the newest permissionless middleware projects that allows for building customizable, scalable, and efficient DeFi products. Spool enables anyone to earn yield while gaining access to integrated DeFi protocols.

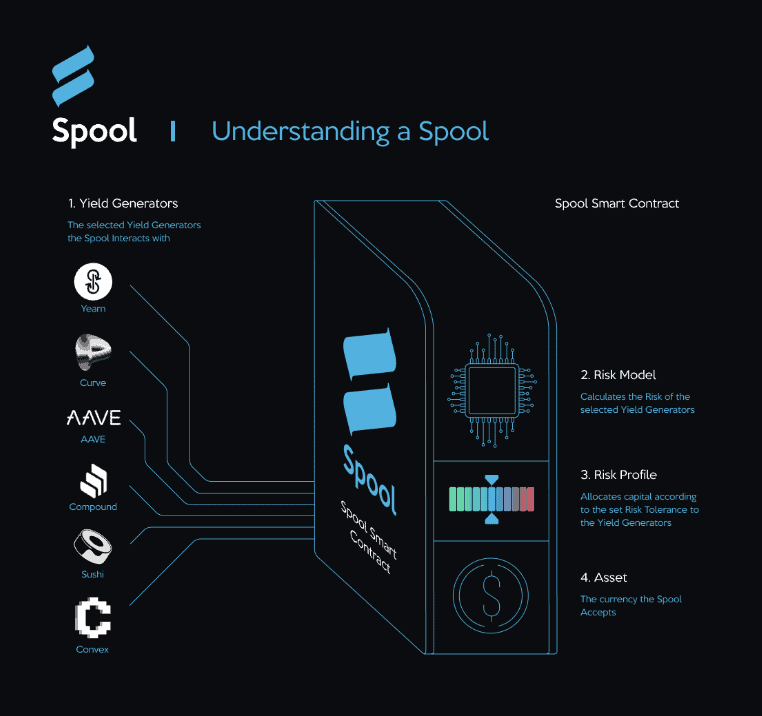

Similar to a vault, a spool is a smart contract that routes liquidity into an array of different yield generators in a risk-managed and yield-optimized manner. The difference between traditional vaults and Spool is that spools can be individually set up by users in a permissionless manner. A spool contains an assigned risk tolerance, a chosen risk model, and a subset of selected protocols. Spool helps route liquidity to major money legos such as:

- Yearn

- Harvest