How to Borrow Against NFTs

One issue with NFTs is the opportunity cost of holding them, and it would be useful to be able to borrow against NFTs and unlock their value. If NFTs continue to grow and be further adopted, this capability will become more sought after.

Some NFTs might be usable as stores of value, while others will provide utility. Particularly in the latter case, holders won’t want to sell their asset, losing the benefits or utility that it provides, and so in-demand mechanisms that provide loans against NFT collateral can create a meeting point between NFTs and DeFi.

One way to achieve this kind of lending is through a peer-to-peer design, meaning the platform is acting as a secure means, and an escrow service, by which lenders and borrowers can connect.

The alternative is through an automated protocol, meaning that the platform pools liquidity to be lent out, rather than connecting individual borrowers and lenders. This is more similar to an AMM (automated market maker) style decentralized exchange.

<h2 id=”jpeg’d”>JPEG’d

From a user point-of-view, JPEG’d has developed a very simple system. You deposit your NFT, and it then acts as collateral, allowing you to take out a loan for a portion of its value. As in the DeFi world, you don’t need permission or a review process, as the whole system operates through smart contracts.

When an NFT is deposited in the JPEG’d vault, credit is paid out in the native PUSd dollar-pegged stablecoin, creating what’s called an NFDP (non-fungible debt position).

Currently, JPEG’d only allows CryptoPunks to be utilized, but has stated that BAYC, EtherRocks, CloneX, and Doodles are on the way. If the platform takes off, then it’s reasonable to expect that further collections will be added.

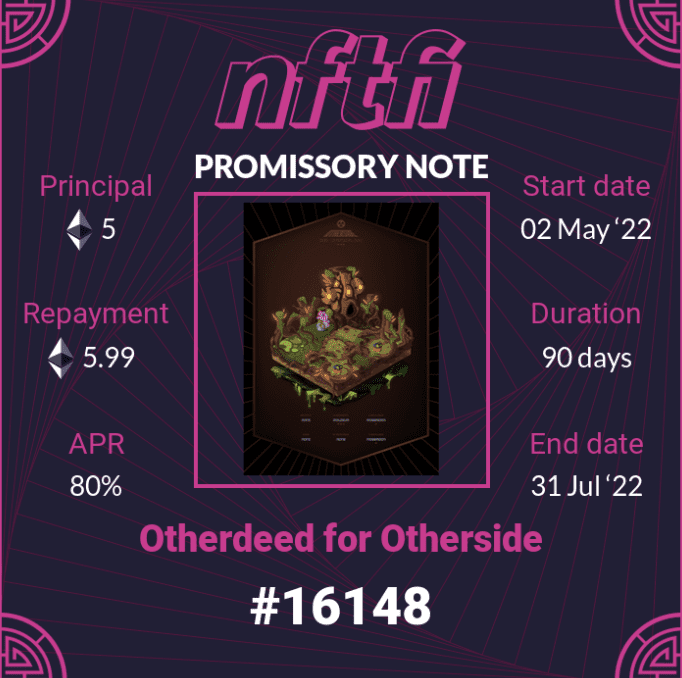

<h2 id=”nftfi”>NFTfi

Pre-dating JPEG’d, there is NFTfi. With so little competition at the intersection between NFTs and DeFi, both platforms could still grow, but NFTfi adopts a different approach.

In this case, it’s peer-to-peer, so once you’ve connected up your wallet, you can explore the options as both a borrower and a lender. If you put up an NFT as collateral, it will be placed in a loan marketplace, and you’ll receive offers from lenders, detailing terms. Accept an offer, and the transaction will be locked into a smart contract.

Take on the opposite role, and you can offer loans against NFTs in the loan marketplace. In this case, you set terms and then profit from the interest you’ll make, or in the case of a default, receive the NFT that was used as collateral.

On NFTfi, all transactions are conducted in wETH or DAI. There are over 150 NFT collections listed, with more being added regularly.

<h2 id=”honey-finance”>Honey Finance

Over on Solana, you can find the Honey Finance NFT lending and DeFi platform. Honey will soon no longer be Solana only, and has shown off a demo of their Ethereum dapp, so it looks like they’ll be covering both chains.

Honey is not a peer-to-peer protocol, instead creating liquidity pools from which lending will be provided, and the platform also incorporates NFT staking and token farming. Its lending function is not operating yet, so this is one to keep an eye on as it develops.

<h2 id=”solvent-protocol”>Solvent Protocol

Also on Solana, there is Solvent Protocol, which is a little different from the other platforms listed here. Solvent has created a system in which you can deposit NFTs from particular collections into what are called buckets, creating pools that it compares to index funds.

If your NFT is in a bucket, you earn tokens specific to that collection, that can be traded for USDC, or used to buy NFTs from the buckets (you can also put NFTs you placed in a bucket up for sale).

Solvent is now in collaboration with Honey Finance, as part of the latter’s Honey Ecosystem Partners system.

<h2 id=”lending-pond”>Lending Pond

If you want to borrow against Cardano NFTs, or earn interest on lending out some ADA, then there’s Lending Pond, on Cardano, which acts as a peer-to-peer platform.

If you’re a borrower, then you set the terms you want and list your deal, and if you’re a lender, then you can browse the deals on offer. Lending Pond is more basic than NFTfi, but operates in a similar way.

Kraken NFT Marketplace

With Coinbase having already entered the NFT space, Kraken is now planning to launch its own NFT marketplace. The waitlist is open, and Kraken has announced several planned features.

One standout aspect that distinguishes it from OpenSea, is that after users have custodied an NFT with Kraken, there won’t be any gas fees charged on further trading activity.

Purchases will be payable in cash or crypto, and there are plans to incorporate multiple blockchains, starting with Ethereum and Solana.

A launch date has not yet been announced, but it will be interesting to see whether it puts pressure on OpenSea–which recently added Solana NFTs–to make changes or add new features.