How to use Arbitrum | Full Arbitrum Guide

What is Arbitrum?

Developed by Offchain Labs, Arbitrum launched to the public on August 31, 2021. Arbitrum is an Ethereum layer 2 scaling solution which uses Rollups to enable high-throughput, low-cost smart contracts while remaining trustlessly secure.

Like all Rollups, the Arbitrum Rollup chain is built on top of and secured by the Ethereum blockchain, and all transaction data is logged on Ethereum. From a user and developer perspective, interacting with Arbitrum feels exactly like interacting with Ethereum. Arbitrum supports the same RPC interface as Ethereum, supports all EVM languages, and natively supports all Ethereum tooling without any special adapters. The only way in which an Arbitrum Rollup chain does not resemble Ethereum is the cost, with transactions on Arbitrum being just a fraction of what they would if run natively on Ethereum.

If you do not have Arbitrum already installed on your Metamask, you can click on the network drop-down box and manually add it as a Custom RPC by entering the following details:

- Network Name: Arb1

- RPC: https://arb1.arbitrum.io/rpc

- Chain ID: 42161

- Currency Symbol: ETH

- Block Explorer URL: https://arbiscan.io

How To Deposit ETH On Arbitrum And Get Started

Here is a tutorial which demonstrates how to use Arbitrum and the bridge from the Ethereum mainnet to Arbitrum L2 and back again.

It should be noted that you’ll be paying Ethereum mainnet fees when bridging assets across to Arbitrum. At the time of writing, the cost was around $20 and transfers take 10 minutes or less. Depending on where you live in the world, you might want to pick a time of day when gas fees are typically lower. Here’s a link for readers who would like to do some of their own research on this.

Once your transfer has been confirmed and your assets are now on the Arbitrum L2 network, you are now ready to explore a broad range of dapps (decentralized applications) within their ecosystem via their portal. Here you will find links to popular dapps such as Uniswap, Sushi, 1Inch, Aave, Curve, DYDX and many others.

Using Arbitrum on Uniswap

- Visit Uniswap.org and launch app.

- Select Arbitrum as your custom RPC in Metamask. This should be pre-installed if you have already bridged funds to the Arbitrum network.

- Select the Arbitrum network from the drop-down box located on the top right-hand side of the Uniswap app page.

You’re now all set to begin trading on Uniswap using the Arbitrum network. Note there are a limited amount of tradable assets but the list will grow as more projects bridge their tokens to the network.

How Big Are the Savings?

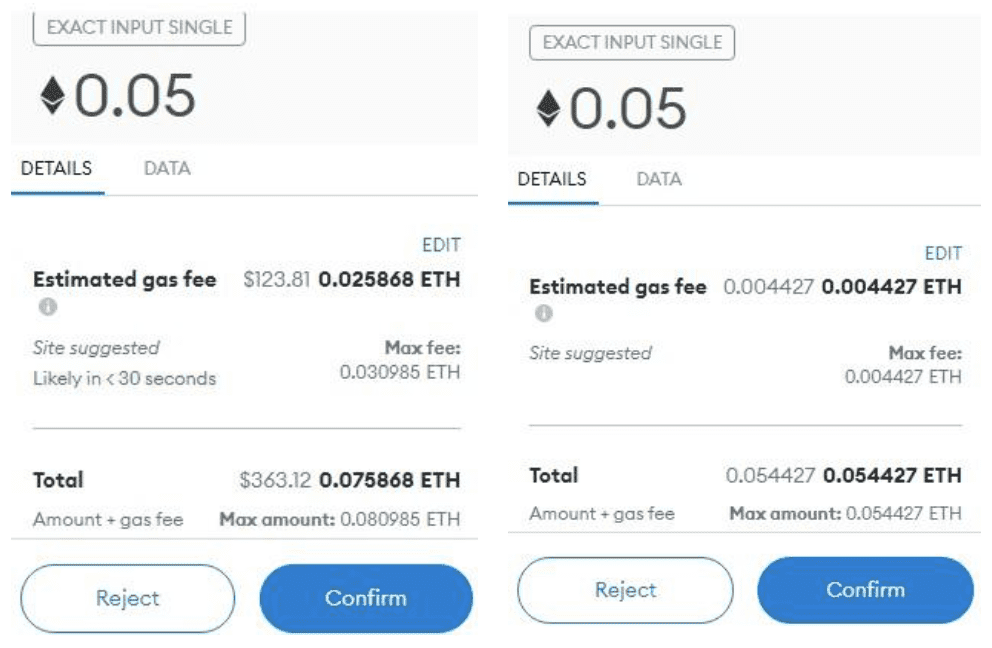

Below is a comparison of the gas fees associated with an identical Uniswap transaction made at the same time on Arbitrum v Ethereum mainnet (exchanging 0.05 ETH for USDC).

On Arbitrum the estimated gas fee was .004427 ETH (equal to $21.02 at the time of writing) v Ethereum which had an estimated gas fee of $123.81. That’s 87% cheaper!

9/11/2021 – Uniswap transaction comparison (Eth V Arbitrum)

You’ll find that many popular ERC20 tokens are available to trade through the various dapps on the Arbitrum network but not everything is supported. Therefore, users should take the time to check out the ecosystem before migrating funds.

Special Note

Although bridging funds from Ethereum Mainnet to Arbitrum only takes a few minutes, bridging funds back to mainnet takes a whopping 7 days in order to allow sufficient time for verifiers to detect any fraud on the Arbitrum network.

But there is a solution. Hop.Exchange provides near instant migration of assets from Arbitrum back to the Ethereum mainnet. They charge a fee for this service but if you need assets transferred quickly, this is a great option. At present Hop supports USDC, USDT, MATIC DAI and ETH transfers. You can also use Hop to transfer these assets between Arbitrum, Polygon, xDai and Optimism networks.

Another Choice Out There

Readers may also be interested in exploring the Optimism ecosystem which offers very similar benefits to Arbitrum and can be onboarded in much the same way. In fact, Arbitrum was originally a fork of Optimism, the pioneer of the Optimistic rollup technology. At the time of writing Arbitrum has a considerable lead on its rival with $2.79 billion in TVL (Total Value Locked) while Optimism has a more modest $336 million. However, one can expect the gap to narrow as the Optimism network adds more and more dapps to its ecosystem. You can keep up to date with the latest TVL stats by visiting DeFi Llama.

Responses