How to use Uniswap? | Step-by-Step Guide to using Uniswap

What is Uniswap?

Before talking about how to use Uniswap, let’s give a quick overview of what Uniswap is.

Created by Hayden Adams, a former Seimens mechanical engineer, Uniswap was launched to the public on November 2, 2018. It was inspired by an idea in 2016 from Ethereum founder, Vitalik Buterin, for a Decentralised Exchange (DEX) that would employ an on-chain automated market maker with other special characteristics. A tool built for the Ethereum blockchain to enable users to trade ERC20 tokens.

In contrast to most centralized exchanges, which are intended to receive trading charges, Uniswap works for public welfare. Tokens can be exchanged without any platform charges or the need to deal with a centralized entity. Centralized exchanges such as Binance and Coinbase are governed by a single authority that operates the exchange and requires users to deposit assets that are under their control and use a traditional order book to facilitate trading. They also require KYC.

Uniswap on the other hand is a very different type of exchange. Firstly, it is decentralized, meaning it isn’t operated or controlled by a single authority. It also adopts a different trading model known as an Automated Market Maker (AMM). Uniswap uses smart contracts to set prices and execute trades. Tokens can also be listed for free, unlike major centralized exchanges which adopt very strict criteria for new listings and often charge exorbitant fees. Some other key differences pertain to privacy and security. Unisa does not require user registration or KYC information and users retain full control of their assets by integrating a non-custodial wallet to interact with the platform.

As an AMM, Uniswap relies on a series of smart contracts built on top of Ethereum that automates price matching. It allows users to swap one token for another by interacting directly with the smart contracts, with no intermediaries needed. Liquidity providers (LP) can create these markets, called pools, by deploying them using the Uniswap factory contract. Once a pool is created, anyone in the ecosystem can provide liquidity to it. Liquidity providers earn a share of the trading fees generated based on their share of a pool. Shares of the pooled liquidity are accounted for using a liquidity token, commonly known as an LP token. You can think of each LP token as a share unit in the pool.

In September 2020, Uniswap made headlines when they announced that they were launching their own governance token called $UNI. This token was aimed to further decentralize the platform and enable token holders to participate in future decision-making and protocol development. Early users of the platform were richly rewarded with free airdropped $UNI tokens.

Despite originally supporting trading on the Ethereum network exclusively, Uniswap has now added functionality for other networks. Namely Arbitrum, Optimism and Polygon. Additional networks are likely to be added in the future.

Today, Uniswap is the largest decentralized exchange in crypto and is a pillar of the DeFi ecosystem.

How to Use Uniswap?

- Firstly, users need to install a non-custodial Ethereum compatible wallet. There are several choices available however two of the most popular options are Metamask and Trust Wallet. Users should be aware that because these wallets are non-custodial, there is no technical assistance available to help recover passwords or seed phrases. So, it is essential this important information is carefully recorded and stored in a safe place. Never store passwords or seed phrases digitally. See ‘DeFi Risks’ section of this guide.

- Visit Uniswap.org and click on the ‘Launch App’ button.

- Connect wallet. Click on the ‘Connect Wallet’ button.

- The platform will now prompt you to connect the wallet of your choice. In this case, we will be using Metamask on the Ethereum network which is the default network when you install Metamask in your browser.

- Tick the account in your Metamask wallet that you wish to connect and click on the ‘Next’ button.

- Then click the ‘Connect’ button.

Once you have connected your wallet to the Uniswap app, and assuming your Ethereum wallet is already funded, you’re now ready to begin trading on Uniswap.

How to Swap Tokens on Uniswap

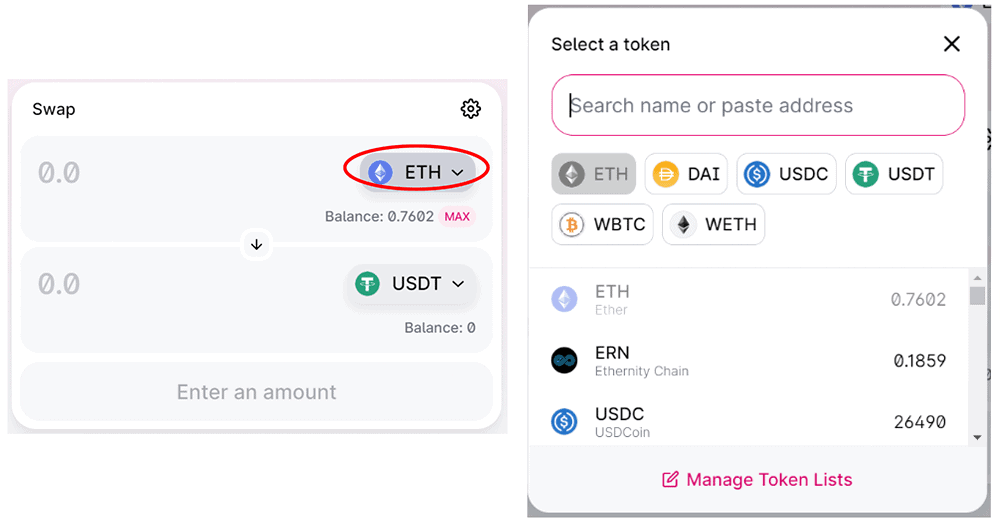

- Select the token you want to trade and the token you wish to buy from the lists provided in the drop-down boxes. You can also search for tokens by name, symbol or contract address. In this case we will be trading ETH and buying USDT.

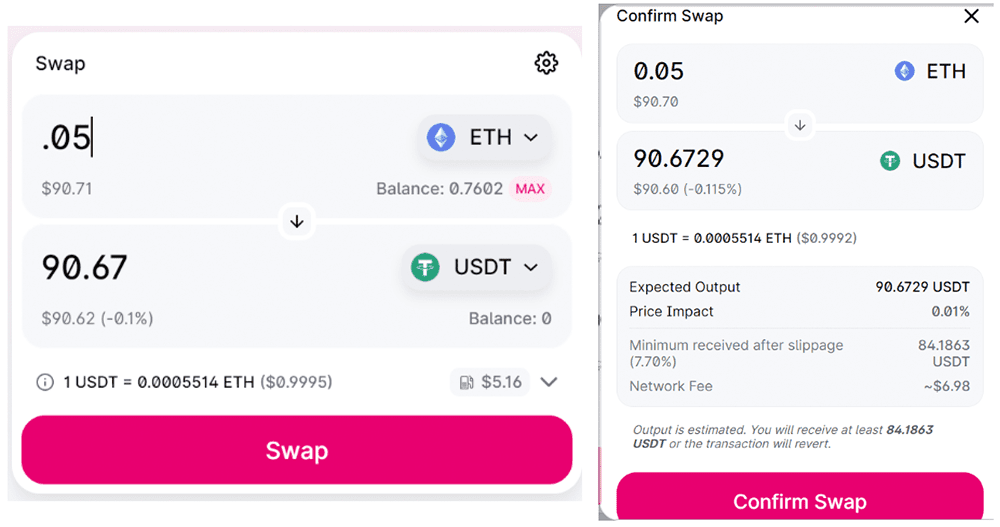

- Enter the input or output amount. In this case we will be trading .05 ETH. The system will automatically calculate how much USDT that will buy. Note, if this is the first time you have traded the token on Uniswap, you’ll need to ‘approve’ that token when prompted first. This step grants Uniswap permission to swap it out of your wallet for the transaction.

- Click the ‘Swap’ button to preview your transaction. Check the information displayed to ensure that the swap details are as intended.

- After reviewing the details of the proposed transaction, and if ok, click the ‘Confirm Swap’ button.

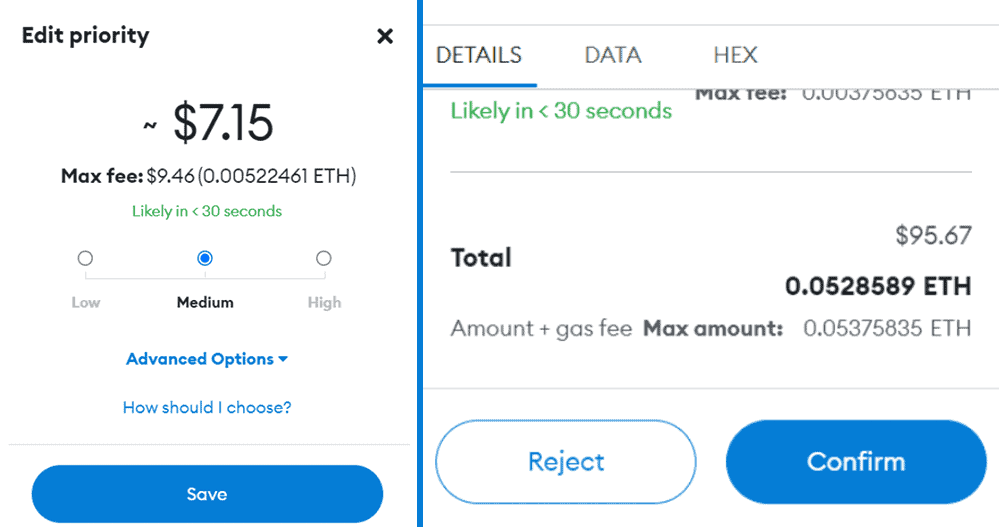

- Confirm the transaction in your wallet when prompted. However, before confirming, be sure to check your gas fee selection. Choose a ‘medium’ or ‘fast’ transaction speed. Note that if your transaction speed is set to ‘low’ it may fail, causing you to pay gas on a transaction which has not been executed. After reviewing your gas fee, complete the transaction by clicking the ‘confirm’ button.

- Your transaction will initially show as ‘pending’ however once it has been executed you will see a message displayed in the top right-hand corner of the Uniswap app.

Adding Liquidity on Uniswap

For more advanced users, adding liquidity on Uniswap is a way to earn fee income based on their share of any given pool. Adding liquidity involves pairing 2 assets, usually in equal value, creating an LP token and then depositing those LP tokens into a liquidity pool. Users should be aware of the risks associated with impermanent loss, a subject which has been discussed in the ‘Defi Risks’ section of this guide. The example below demonstrates how to pair ETH and USDT and then add the LP to the Uniswap liquidity pool. This example assumes that the user already has ETH and USDT as single assets in their wallet.

- Click the ‘Pool’ tab on the top left-hand corner of the Uniswap app page.

- You’ll now arrive at the Pools Overview page. Click the ‘+New Position’ button.

- Select the 2 assets that you would like to pair from the drop-down boxes. In this case we will be pairing ETH with USDT.

- Input the ETH deposit amount. The system then matches this with an equal value of USDT. Then click the ‘Preview’ button.

- Review the proposed transaction details and click the ‘Add’ button.

- Now click ‘Confirm’ in your wallet when prompted to process the transaction. Once the transaction is approved, you’re all done. Note that you can check any open LP positions in the ‘Pools Overview’ section of the app.

Removing Liquidity on Uniswap

- In order to remove/unpair your LP, firstly visit the ‘Pools Overview’ section of the app which is found by clicking the ‘Pool’ tab on the homepage of the app. In this case, the open ETH/USDT LP position that we created is displayed. Click on that pair.

- Then click ‘Remove Liquidity’.

- Select the amount of LP that you want to remove. In this case, we have selected 100% (Max). Then click the ‘Remove’ button.

- Check the details displayed and click ‘Remove’.

- Click the ‘Confirm’ button in your wallet when prompted. Once the transaction is approved, you’re done. The unpaired single assets will now appear in your wallet.

Note that you can check that your LP position has been closed by visiting the ‘Pools Overview’ page.

Gas Fees on Uniswap

The Ethereum network has become extremely congested in recent years, leading to soaring gas fees. Given that Uniswap is built on top of Ethereum, one needs to be mindful of the impact these fees can have when transacting on the platform. While Uniswap itself charges very modest fees, users of the platform also have to pay Ethereum gas fees to facilitate transactions. These fees can be expensive and prohibitive for many smaller traders. Gas fees fluctuate based on the level of congestion on the network, however transactions often cost between $20 to $40 and even more for complex transactions such as providing liquidity. So, for a trader looking to buy say $500 of a token, these fees become very significant. As discussed in the ‘Arbitrum’ section of this guide, users can save on gas fees by interacting with the Arbitrum network, or perhaps Optimism or Polygon if the token they want to buy is supported by those networks on Uniswap.

Must read: How to Use Uniswap on Polygon

Responses