Huge Wallet Hack! Is Your Crypto At Risk?

In This Issue

- Sam shares his thoughts on Atomic Wallet being hacked for millions, crypto clarity in the US, headset wars and the metaverse, Japanese stablecoin development & lightning in the cloud.

- This week on chain.

- This week’s trending coins by Rebecca.

The News Now

Atomic Wallet Hacked for Millions in Crypto

Big crypto losses were sustained over June 2nd and 3rd as it became clear that Atomic, a non-custodial crypto wallet, had been seriously exploited. Some users reported that entire portfolios had disappeared, one victim reported that they were down 2.8 million USDT, there were other six figure losses, and many smaller amounts are gone, with losses occurring across multiple blockchains.

Total identified losses have been estimated by blockchain security firm Slow Mist to be at around $14.83 million so far, and Slow Mist has also published a list of hacker addresses. At the time of writing this, Atomic are investigating the attack but have yet to provide an explanation of what has occurred.

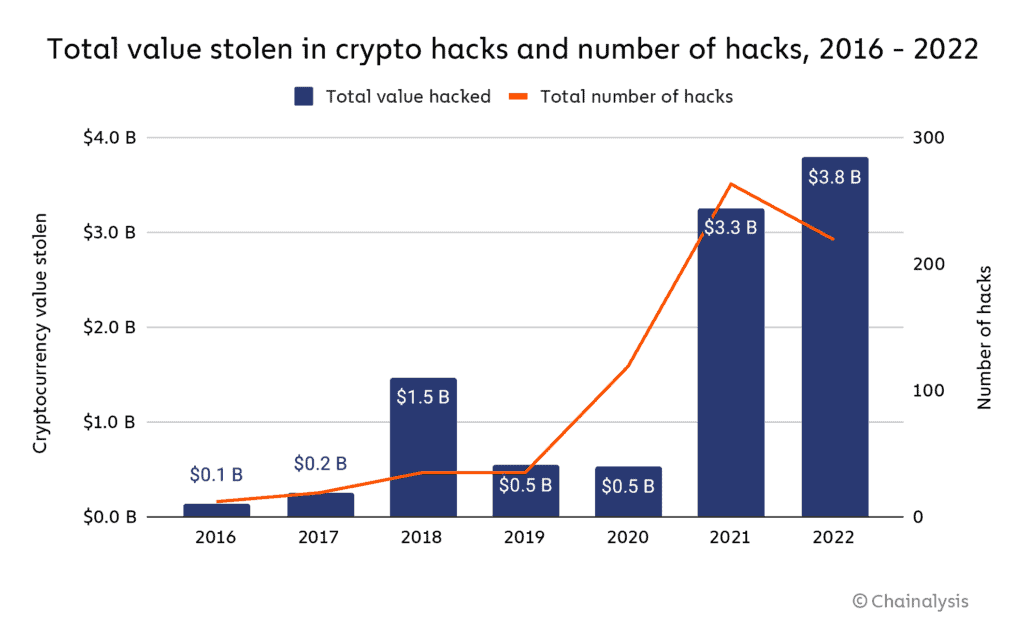

To put these events in context, a report earlier this year demonstrated that 2022 was the worst year ever for crypto hacks in terms of total value stolen, and was the second worst in terms of the number of attacks.

The Atomic hack is particularly hard to swallow, since the ongoing instruction in the crypto space since the collapse of FTX (and before) has been to get your coins off exchanges and into self-custody, which is exactly what Atomic users did.

One more curious point is that back in February 2022, security audit firm Least Authority highlighted security vulnerabilities in Atomic. And though Atomic CEO Konstantin Gladych responded at the time with a statement addressing the problems, the obvious question now is whether there’s a connection between those old issues and the current breach.

In the interests of caution, if you’re using Atomic Wallet then you might want to get your funds off there ASAP, or face the risk of losing everything.

Can a New Draft Bill Bring Crypto Clarity?

New draft legislation aimed at constructive crypto regulation in the US looks initially promising. The Digital Asset Market Structure Discussion Draft has been published by the House Committee on Financial Services and the House Committee on Agriculture, and it’s a hefty 162-page volume. Notably, the chairs of the two committees, Patrick McHenry and Glenn Thompson, are both Republicans, and it’s yet to be seen how Democrats respond to this opening up of discussion.

The draft identifies that current frameworks hinder innovation while also not providing consumer protections, and puts emphasis on clarifying which parts of crypto are commodities (and under the jurisdiction of the CFTC), and which are securities (and the concern of the SEC). A short summary of the content is available, and some key points include:

- Requirements to prove decentralization in order for an asset to be classified as a commodity.

- Trading platforms registering as Alternative Trading Systems, with the capacity to offer digital commodities and stablecoins.

- A new platform classification: digital commodity exchanges, registered with the CFTC.

- Separation of customer funds on digital commodity exchanges, and protections against market manipulation.

As with MiCA in the EU, NFTs and DeFi are not yet covered but can be addressed later. It’s only a first step but, well, anything is better than America’s current state of confusion and hostility towards crypto.

Headset Wars and the Metaverse

When it comes to the metaverse, there’s no shortage of cynicism out there, although a lot of it comes from people who are deeply immersed in the online world but claim that no-one could possibly want to be immersed in an online world.

Besides which, if you take the view that the metaverse is really just another way of doing things on the internet, then it looks plausible some kind of metaverse-like experience will evolve from the web as it currently exists.

It’s also likely that Web3, VR and AR can overlap to create new online experiences (along with AI, which is inevitable), and the Web3 part means crypto is an important part of the mix. Basically, if we want real ownership of our digital identities and assets without relying too much on any mega-powerful tech overlords, then crypto and blockchains are how we get there.

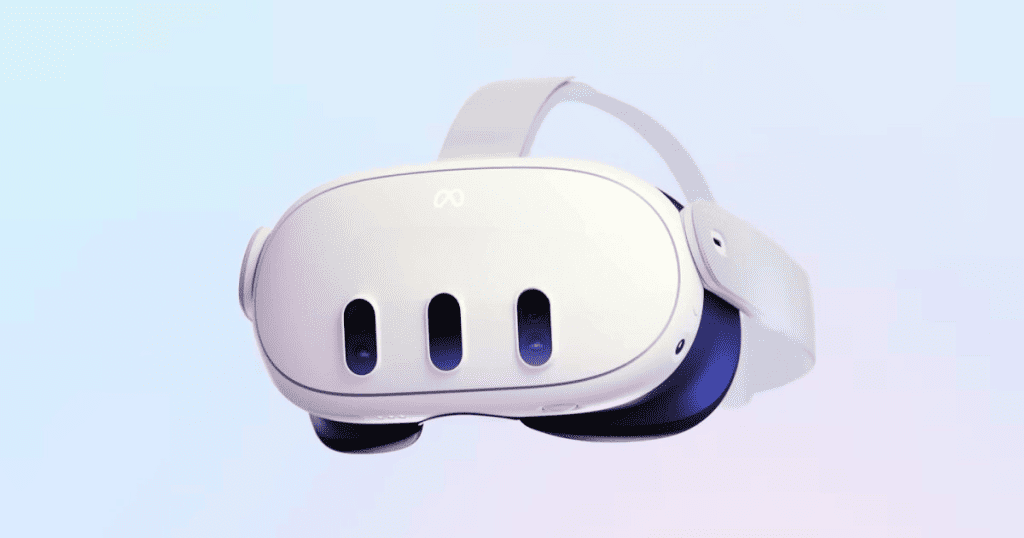

Speaking of those mega-powerful tech overlords though, it’s starting to look like a VR hardware mini-battle may be taking shape between Meta and Apple.

Last week, Meta released a sharp-looking, gaming-oriented video announcing the Meta Quest 3 VR headset, priced at $499.99 and scheduled to go on sale this fall. More details are due to be revealed at Meta’s Connect conference on September 27th.

Meanwhile, Apple’s Worldwide Developers Conference begins on June 5th, amid expectation that its VR/Mixed Reality headset will be unveiled. And last week, an Apple analyst at Morgan Stanley named Erik Woodring explained in a research note (according to MacRumours) that supply chain checks suggested mass production to start in October, leading to a possible December release, with–according to those same rumors–a $3,000 price tag.

This corporate rivalry has the potential to draw attention to metaverse development (whatever the metaverse eventually comes to resemble), so when considering metaverse coins and NFTs, it’s worth keeping up with developments on the hardware front.

Mitsubishi UFJ Leads Japanese Stablecoin Development

Over the last year or so, stablecoins have been in the spotlight, and not always for the right reasons. Following on from Terra imploding in 2022, we’ve seen USDC lose its peg (temporarily) and its market share (with Tether claiming top spot), and BUSD issuer Paxos has been targeted by the SEC.

There have been some new decentralized stablecoins launching, with Curve Finance’s crvUSD making a recent impact, but stablecoins also have advantages for trad-fi institutions, and Japan’s largest bank, Mitsubishi UFJ Financial Group (MUFG), is pushing ahead with plans for stablecoin development.

MUFG is developing a platform called Progmat to enable yen-pegged, bank-backed stablecoins across public blockchains (including Ethereum, Polygon, Cosmos and Avalanche), and it will be usable by any Japanese trust bank. Development is taking place in collaboration with Datachain, which specializes in blockchain interoperability, and with cross-chain bridge TOKI.

Also, although Progmat was initiated by MUFG, it has since expanded to become a joint venture with over 200 other companies, including major Japanese banks Mizuho and SMBC. This is all happening as, from June 1st, revisions to Japan’s Payment Services Act have taken effect, allowing stablecoin use.

A recent announcement from TOKI forecasts that it will have Japanese stablecoins in circulation in Q2 of 2024, and also mentions the possibility of a future airdrop.

Voltage and Google: Lightning in the Cloud

Will Bitcoin alter the world of payment processes? If so, then the Lightning Network will be critical, and so news of Lightning-as-a-Service provider Voltage partnering with Google Cloud looks significant.

Voltage aims to provide payment settlement solutions to enterprises, particularly those in fintech and financial services, and can help enable cross-border payments and micropayments. Through this new collaboration, Voltage is hoping to assist customers in creating Bitcoin and Lightning nodes in Google Cloud, all of which is very positive for Bitcoin as it goes about addressing real world financial needs.

This Week On Chain

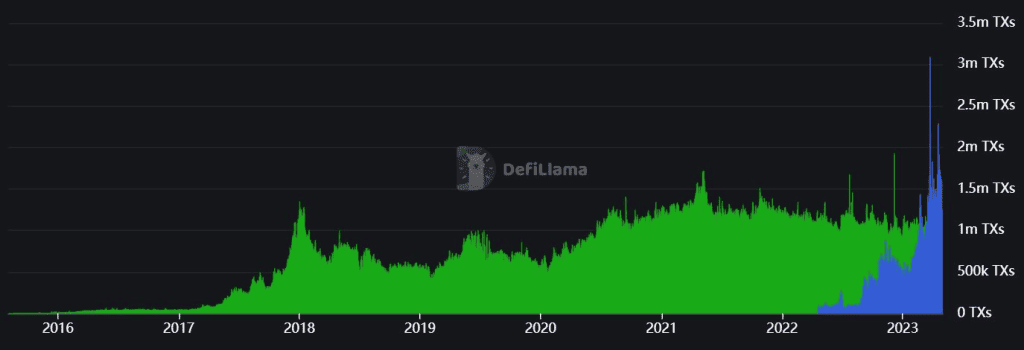

It’s all happening on Arbitrum recently, as the Ethereum Layer 2 solution powers ahead to grab an outsized slice of the market, while it was recently announced that Circle would be launching the USDC stablecoin natively on Arbitrum.

A direct comparison between Arbitrum and Ethereum shows the Layer 2 currently handling about double the number of transactions as the base chain.

Green = Ethereum transactions; Blue = Arbitrum transactions

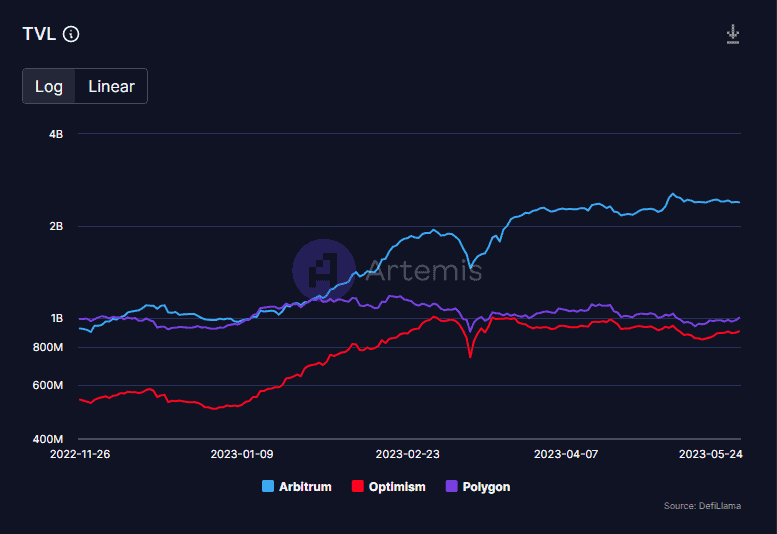

And a comparison with competing Ethereum scaling solutions Optimism and Polygon reveals Arbitrum taking the clear top spot when it comes to TVL, which is currently around $2.15 billion.

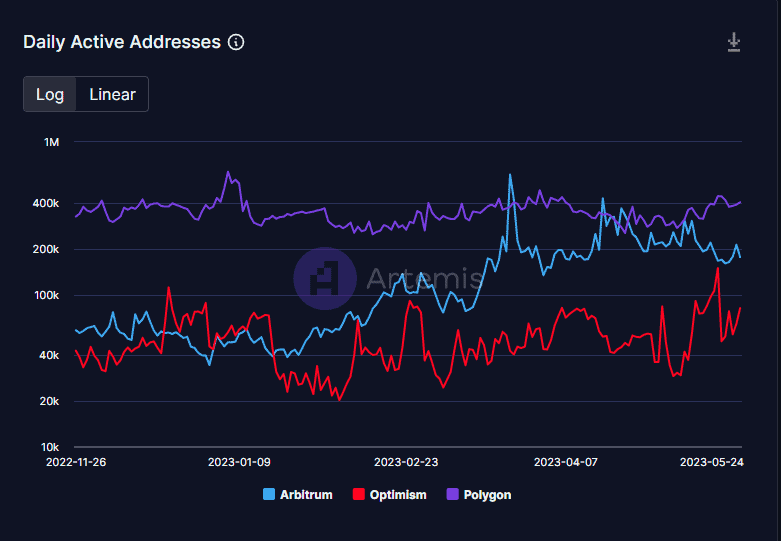

Although when it comes to active users, Polygon, which has become a popular choice for Web3 development, outperforms both Arbitrum and Optimism.

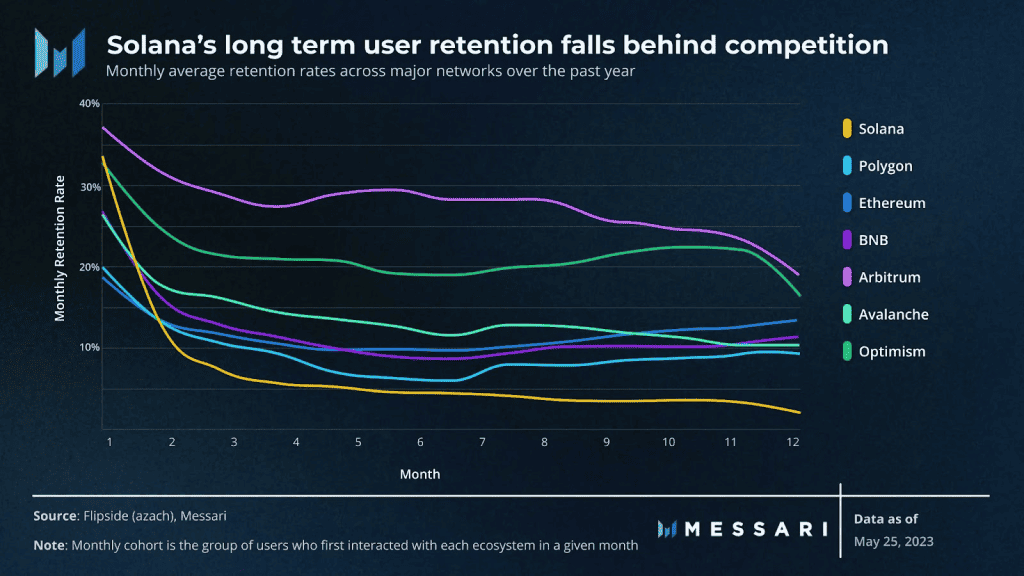

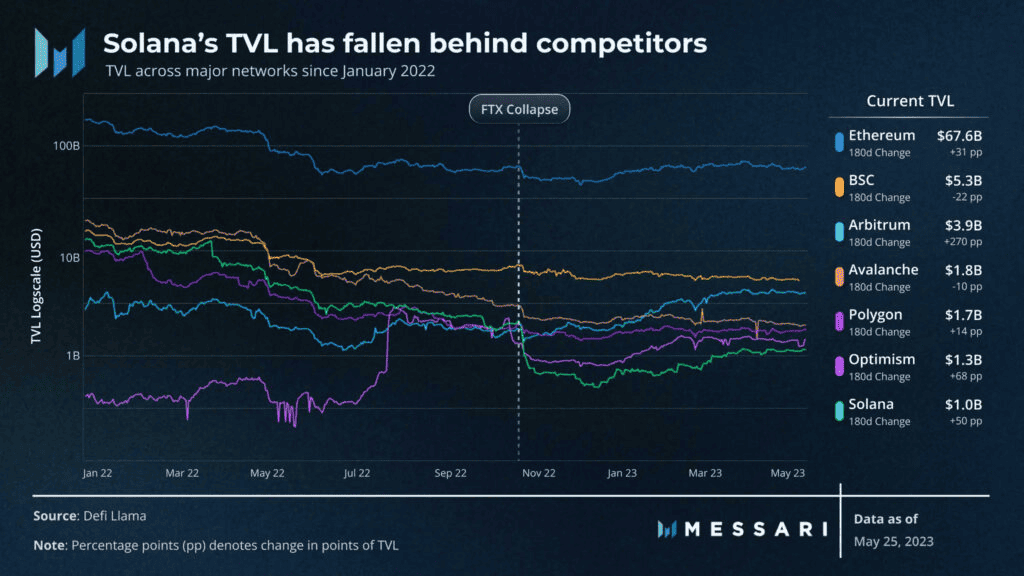

A major competitor with Ethereum, Arbitrum, and other Layer 2 alternatives, is Solana, and if we take a look, we can find that for long-term user retention and TVL, Solana has fallen behind.

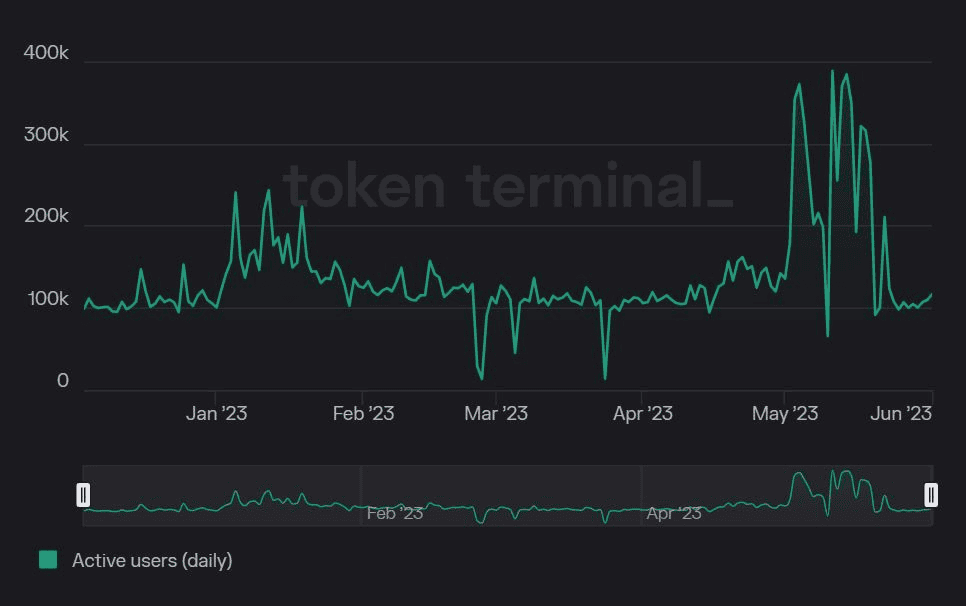

At the same time though, Solana saw a significant surge in daily active users throughout May, but these users need to be retained, and it’s still not clear whether or not the recent increase in activity–which has been attributed to the development of new apps and protocols–can be sustained.

Solana daily active users

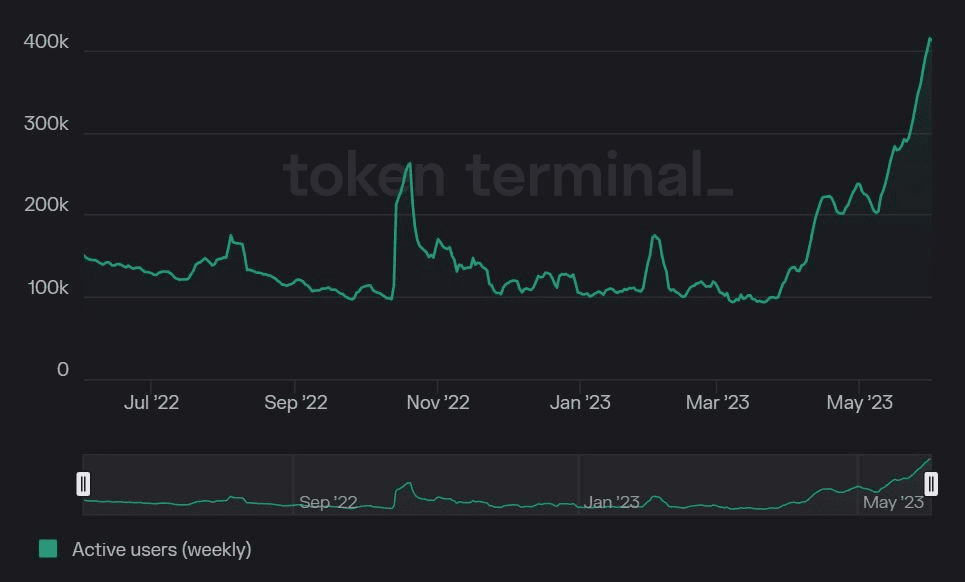

Avalanche is continuing to look strong, surging to a new all-time high in terms of weekly active users as the network–which isn’t hyped up as much as some blockchains and has at times been overlooked–establishes itself as a solid Layer 1 competitor.

Avalanche weekly active users

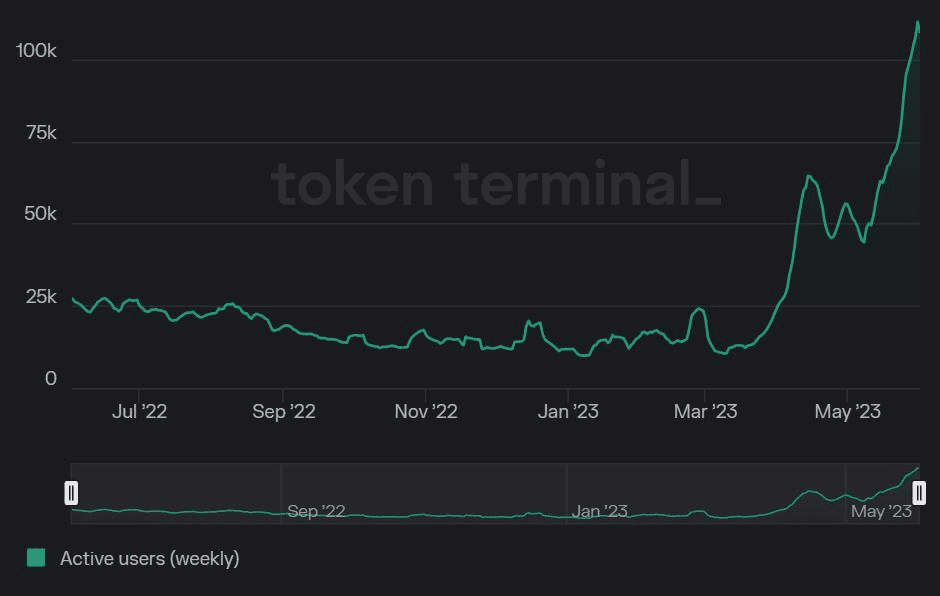

And speaking of Avalanche, when it comes to growth in active users, one project that can’t be ignored is Trader Joe, a formidable DEX built on Avalanche. Active weekly users on the platform were down at about 10.5K around the beginning of March, but hit 111.3K at the end of May: an increase of around 960%.

Trader Joe weekly active users

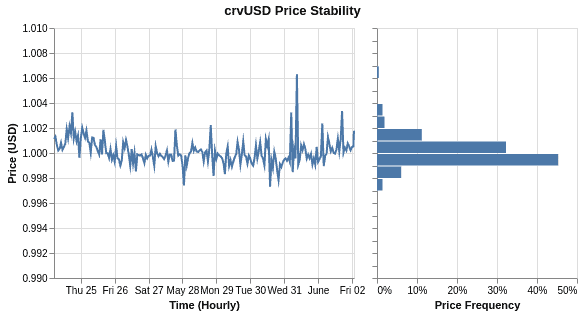

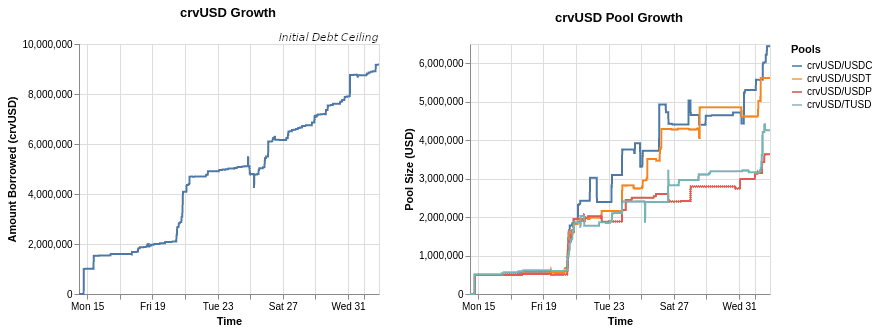

This year has seen plenty of ups and downs around stablecoins, with–as mentioned here previously–Tether now taking the majority of the market. There are, though, some interesting new products appearing, and decentralized alternative crvUSD is looking good. It was launched a month ago by DeFi protocol Curve Finance and its novel stabilization mechanisms have kept it within 0.5% of its peg, while growth has been impressive.

As Curve Finance put it, In Code We Trust, and it’s a rallying cry that seems to have been working out well up to now.

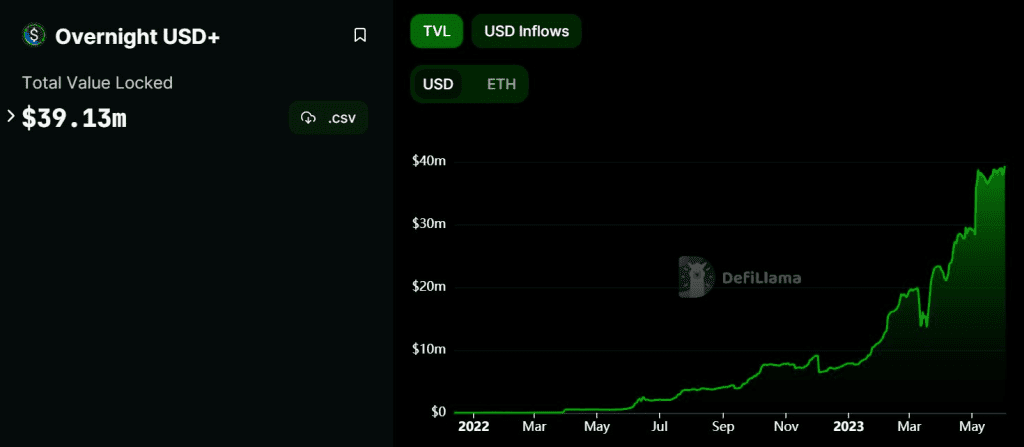

One more fast growing new stablecoin is the yield-generating USD+, issued by asset management protocol Overnight. It’s decentralized, backed by a portfolio of DeFi assets, and has seen TVL soar to a current figure of $39.13 million.

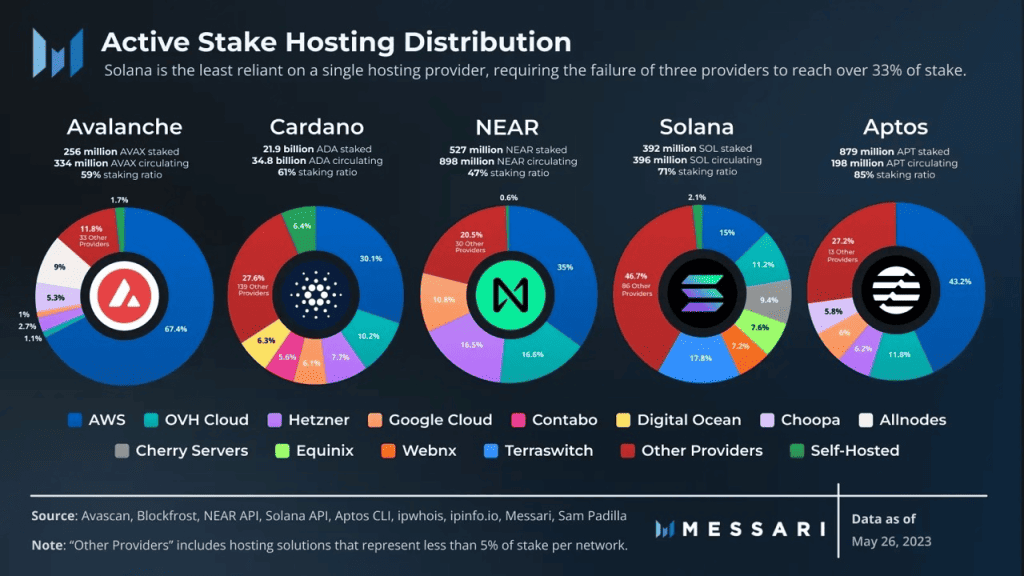

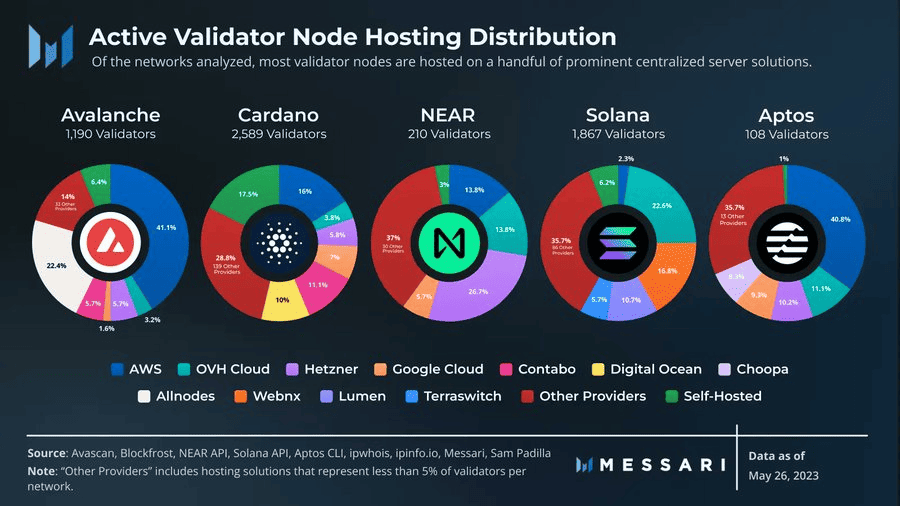

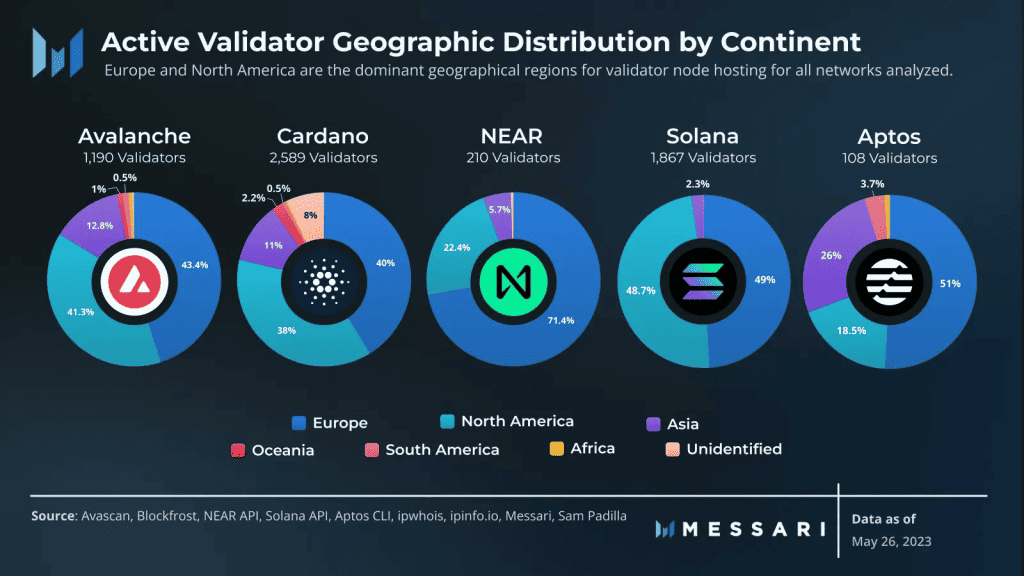

Decentralization is, of course, core to crypto, and when comparing the robustness of this aspect of proof-of-stake blockchains, a metric of interest is the distribution of stake hosting providers, with recent research suggesting that Solana has the least reliance on a single provider.

Other data demonstrates, across blockchains, an over-reliance on centralized server solutions when it comes to validator nodes, and, when it comes to geographical distribution, Europe and North America dominating, when a wider global distribution would be more secure.

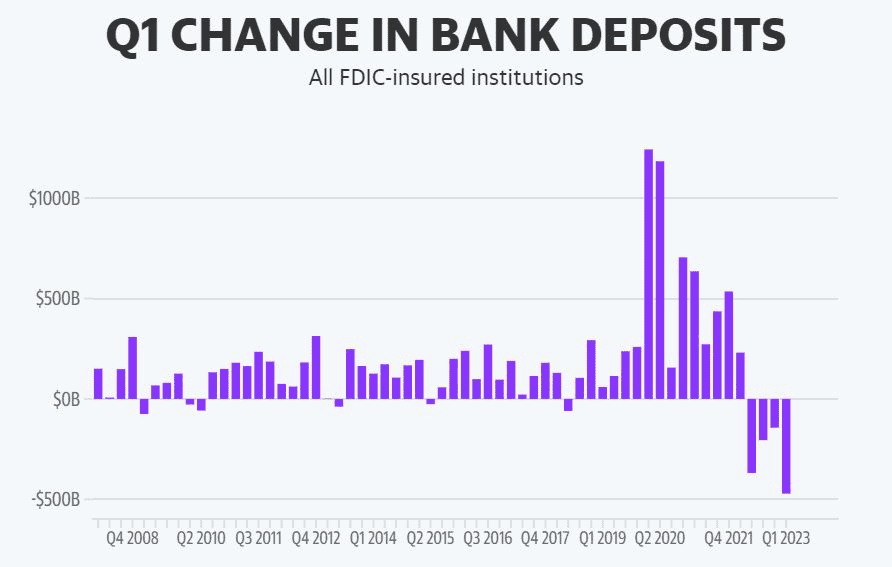

And just to zoom out from crypto and look at the broader financial context, the latest quarterly report from the Federal Deposit Insurance Commission (FDIC) has revealed that at the start of 2023, US bank deposits dropped by amounts not seen since the FDIC started reporting quarterly data in 1984, registering a decline of 2.5%.

What’s more, amounts were dropping for the three quarters prior, and then the most recent decline came during a banking crisis. Notably though, the reduction is driven by uninsured depositors, while insured deposits actually increased.

Overall, outflows like this suggest dysfunction within a stressed banking system, and–taking a long-term perspective–only bolster the case for resilient new alternatives. In fact, these kinds of scenarios, when you can’t trust the banks for banking, are exactly what Bitcoin was made for.

This Week’s Trending Coins by Rebecca

- Pepe is a memecoin that’s launched its 100th linear perpetual futures contract. PEPE token has also bounced 10% off the recent lows.

- XRP is a cross-border payments network that is hoping to see its lawsuit with the US SEC wrapped up in the coming weeks, not months. The XRP army also jumped into Elon Musk’s comment section by replying to his tweet that read “X.”

- Ethereum has seen Celsius Network redeem $813M of staked ETH from Lido Finance and deposit $745M of ETH. These transfers have pushed back the validator queue on the Ethereum network to 44 days.

- Sui is a newly launched Layer-1 blockchain that’s signed a multi-year deal with Red Bull Racing to become the official blockchain of the Formula One team.

- Aptos is a Layer-1 blockchain that’s hosting its hackathon event in Amsterdam from June 5-7.

- Bitcoin derivatives for institutions will be launched on Coinbase from June 5 and a proposal for BRC-30 has emerged which could see Bitcoin staking on Ordinals.

- Arbitrum is an Ethereum Layer-2 scaling solution that will see USDC launch natively on the network on June 8.

- BNB is the native token for Binance exchange that’s dumped 9% in a matter of hours as the US SEC has announced it’s suing Binance, Binance US, and its CEO, CZ, for violating securities law.

- Ovr is an AR platform on Ethereum that’s announced it will integrate Apple’s rumored new launches Apple Reality Pro and Apple Glasses. The OVR token is up over 20% going into Apple’s WWDC conference on June 5.

- Optimism is an L2 Ethereum scaling solution that’s undergone a massive token unlock which saw the price drop 17% in just a few days.

- Render is an image and video rendering protocol that’s seen hype as Apple is rumored to be announcing an AR headset at its WWDC keynote. Render is also celebrating reaching 100K followers on Twitter.

- TRON is a Layer-1 blockchain that’s expanded to Ethereum via its BitTorrent bridge. TRON is also celebrating the 5-year anniversary of its mainnet.

- Tether is a stablecoin issuer that’s announced it will build a sustainable Bitcoin mining operation in Uruguay. Tether’s USDT supply on TRON has hit a record high of $46B.

- Stargate Finance is a cross-chain DeFi bridge solution built on LayerZero that’s winding down its Fantom pool after the recent DAO vote.

- Solana is an L1 blockchain that’s seen the network’s co-founder, Raj Gokul, tell TechCrunch in an interview he thinks Solana could become “the Apple of crypto.”

Final Notes

Crypto wallet hack andBig Bitcoin news from Brazil. Watch the video below so you don’t miss out! 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.