Inflation Cools as Ethereum Heats Up

In This Issue

- Rebecca shares her thoughts on US inflation continuing to cool, Ethereum staked deposits surging, MakerDAO’s Spark lending protocol, BlockFi customers losing fight over funds & Avee activating on Metis.

- Altcoin Alpha by David

- This week’s Airdrop by Jesse

- Sam has a report for you on how Blur, Amazon and Sotheby’s are shaking up NFT marketplaces.

Premium Subscription highlights this week:

- Portfolio Updates: The crypto markets move fast and Premium Subscribers stay up to date with my weekly portfolio updates.

- DeFi Tutorial: Defi Dad has a tutorial for you on how to earn up to 42% APR on a new Arbitrum DEX with stablecoin LPs on Cronos.

The News Now

US Inflation Continues To Cool 📉

PSA: US inflation has fallen from 5% in March to drumroll please…4.9% in April. The Fed has gone all Captain Cold and managed to cool inflation for the 10th month in a row. It’s the first time in two years that inflation has been under 5%, even if just a smidge. Core CPI (excluding food and energy) rose 0.4% month on month and 5.5% from a year ago, both in line with expectations. The Fed would argue the plan is working.

Lower inflation is positive for both Bitcoin and broader markets. But let’s face it, inflation has been sticky, to say the least. Your money is still losing at least 4.9% in purchasing power—that’s not exactly something to celebrate.

Cognitive dissonance is rearing its ugly head again bringing mixed sentiment. The data is saying one thing, the forecasts say another, and our real-life experiences paint a completely different picture. Plus, there was a little post-CPI panic after it was thought the US government was potentially selling its Bitcoin. But that was fake news.

All of this makes it a confusing time for even seasoned investors to anticipate what’s coming next. Soft landing or complete collapse? Let’s explore both sides of the coin before you place your bet.

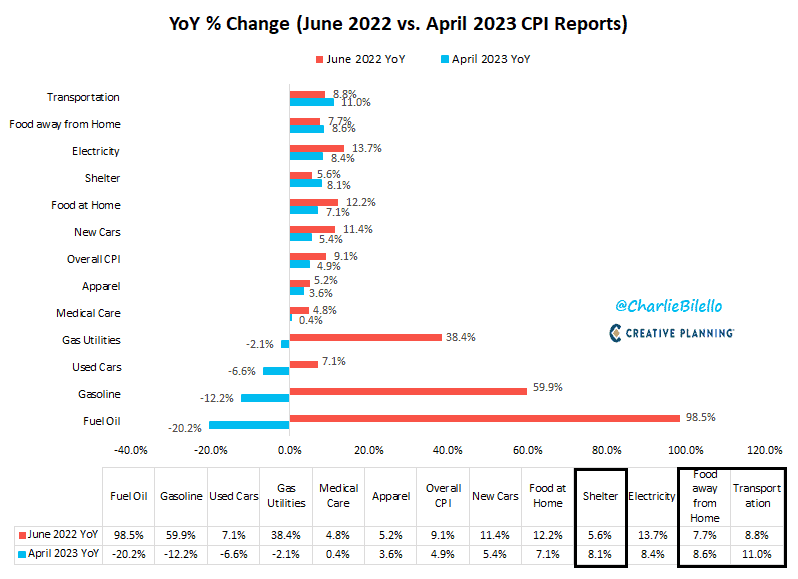

Basket items are largely trending down. What’s driving that decline? Lower prices in fuel oil, gasoline, new and used cars, gas utilities, medical care, clothing, food, and electricity. But, on the sticky inflation side, transportation has crept up to 11%, and essentials like shelter (8.1%), food (7.1%) and electricity (8.4%) all remain way higher than the official CPI print.

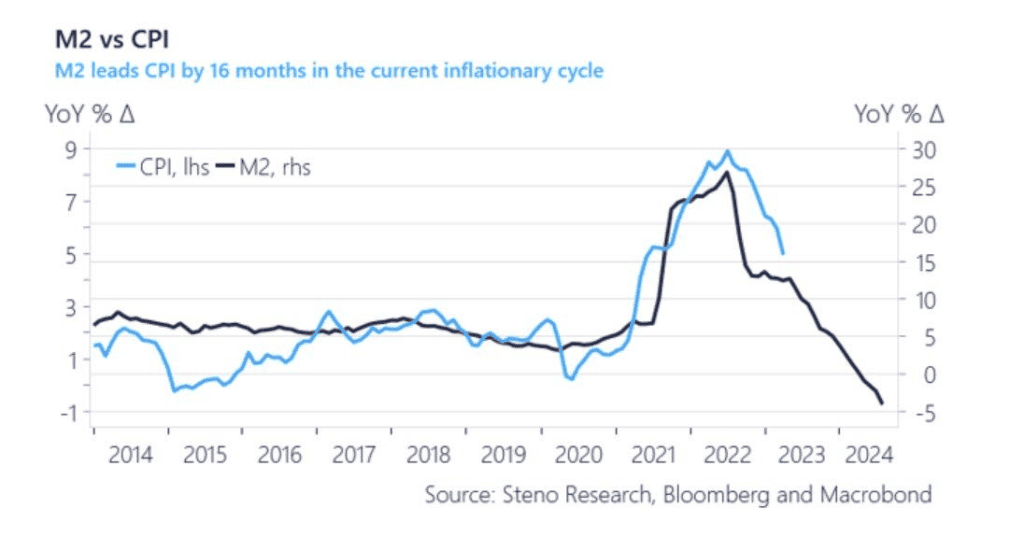

However, forward-looking data suggests that in around 6 months’ time, inflation could no longer be the word on the tip of everyone’s tongues. Instead, the problem will shift to the risk of deflation. The chart below shows that the M2 money supply leads the CPI data by 16 months. From here, we could see a sharp decline in the inflation number.

Soon they’ll have no choice but to fire up the money printer again. US Congressman Brad Sherman even said the quiet part out aloud in a hearing this week “They’ll accuse the US government of making money out of thin air. Maybe we do, but we’re the US government.” And when it happens…🚀

Ethereum Staked Deposits Surge 🚀

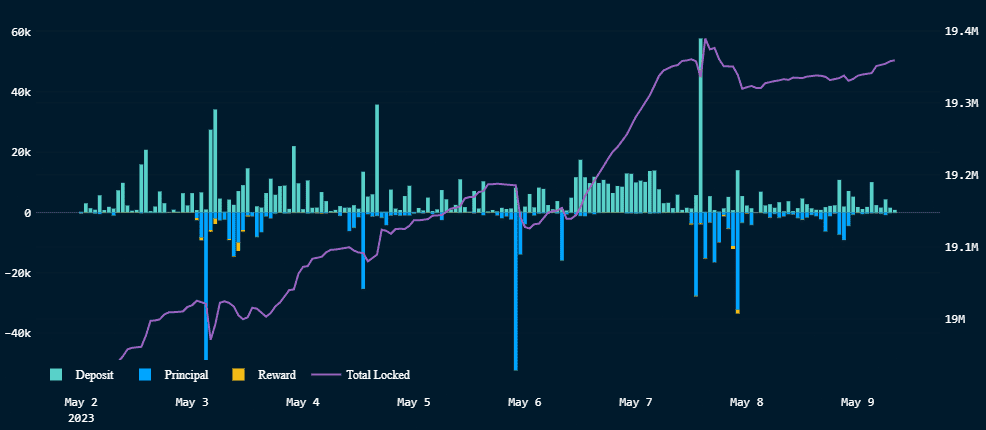

Ethereum gas fees have hit a 12-month high because of dare I say the “M” word again…so let’s just say frog frenzy. But it’s because of that, that Ethereum’s staking rewards also hit a post-Merge high of 8.6%. Validators are enjoying earning ETH at insane levels. In just the first week of May alone, validators earned $46M or around 24,997 ETH. That’s a 40% week-on-week increase!

Despite these annoyingly high gas fees right now, Ethereum continues to set more records—the good kind. Ethereum staking deposits have outpaced withdrawals for the first time since the Shapella upgrade. This week started with over 200K ETH deposited whilst only 29K ETH were withdrawn, according to on-chain data from Nansen. This brings the total ETH locked up for staking to over 19M tokens, accounting for around 15% of the total circulating supply.

Centralized exchanges such as Binance, Coinbase, and Kraken still lead the withdrawals, accounting for over 50%. Users are continuing to favor DeFi over CeFi with over 6M staked ETH now held on liquid staking platform, Lido Finance. This is due to the 6.6% in annual yield rewards. Another piece of good news is the significant increase in the ETH burn rate. The first week in May saw 61K ETH burnt with almost half coming from Uniswap.

In other trend reversal news, Ethereum’s OFAC-compliant blocks have dramatically fallen to 27% from 80% in November 2022. This is a good sign. Last August, some relay operators started to filter specific transactions on the network. This was in response to the Office of Foreign Assets Control (OFAC) which were responsible for sanctioning Tornado Cash and associated ETH addresses. Since then, censorship has been a major concern. Now that the percentage of blocks created using OFAC-compliant blocks has significantly reduced, so too has the network’s protocol-level censorship.

MakerDAO Launches Spark Lending Protocol ⚡️

Ethereum’s MakerDAO has launched Spark, a new lending protocol. Spark Lend is MakerDAO’s first version of the lending platform that will allow DAI users to supply and borrow crypto at competitive rates. Users will be able to access ETH, staked ETH, DAI, and staked DAI.

Spark can offer rock-bottom rates due to its connectivity to Maker’s Direct Deposit Module (D3M). D3M is a direct wholesale credit line between Maker and third-party lending protocols. It can inject fresh DAI into Spark Lend. This gives a massive benefit to users, allowing them to borrow DAI at the initial annual rate of 1.11%. Users can also take advantage of Spark’s new DAI savings token, sDAI, to earn yield.

Spark Protocol is part of MakerDAO’s Endgame journey. MakerDAO is currently undergoing a massive transformation which will see the dial cranked up to 100 on decentralization, transparency, and efficiency. The transition will see MakerDAO move through the journey of “Endgame Era” to “Endgame State”—resulting in the ultimate decentralization of the DAI stablecoin.

BlockFi Customers Lose Fight Over Funds 💸

There is finally progress in the BlockFi bankruptcy case…some of it good news, and some bad news. A US Judge has ruled that BlockFi custodial wallet users will get almost $300M back. These are assets sitting in wallets belonging to customers, not BlockFi’s estate.

But in the next breath, the Judge ruled against repaying customers a further $375M which is tied up in accounts relating to BlockFi’s interest product. The Judge, in this case, states that users with a BlockFi Interest Account gave up legal rights to their crypto assets “with the full knowledge that they were undertaking certain risk.” These assets are now the property of BlockFi. That’s brutal.

Aave Is Activated On Metis 🧲

Ethereum Layer-2’s continue to act as giant magnets for some of the biggest players in DeFi. Lending protocol Aave has launched on optimistic rollup platform Metis, to bring the world of DeFi to its ecosystem. The move also aims to boost liquidity on both platforms. With that in mind, it’s no surprise Aave’s community unanimously voted in favor of the proposal. And you can bet Metis is doing everything it can to sweeten the deal for new users, with the launch of two brand-new initiatives.

Metis is giving away 100K METIS tokens as a liquidity mining incentive for Aave users on the network. These will be distributed over a six-month timeframe. There will also be a token mining reward program that will distribute 4K METIS tokens across the participating protocols based on the percentage of monthly transactions generated.

Altcoin Alpha by David

Existing Projects / Tokens

- CETUS, a DEX on Sui and Aptos, surpassed its fundraising goal within 30 seconds of going live with its initial decentralized exchange offering. Public sale metrics indicate Cetus has an initial valuation of $45.8 million.

- Chiliz [CHZ] has just launched the Chiliz Chain, an L1, EVM-compatible blockchain purpose-built for sports and entertainment infrastructure related transactions.

- MANTA is working with Arbitrum to release a private, on-chain identity verification system for Arbitrum users on the L2 ecosystem. This system will allow users to verify their identities when using certain L2 dApps without releasing any private data to any party.

- Uniswap [UNI]’s DAO is considering a proposal to begin rewarding UNI token holders with a portion of the protocol’s trading fees. The proposal is the latest iteration of a longer debate within community about how the token can accrue value.

- Vega [VEGA], a blockchain built specifically for crypto derivatives trading, has just launched on mainnet. Vega’s first market is cash-settled futures, and other futures and options trading products are on the way.

New Projects / Tokens

- Levana Protocol, a Sui leverage trading DEX, has just launched beta testing on the Sui testnet. A mainnet launch is on the way and plans are being developed for a token airdrop.

- Pika Protocol, an Optimism leverage trading DEX, is dropping its new utility token – PIKA – on May 23rd. Devs say the token will be released via a fair launch “Token Generation Event” with no VCs or private investors.

- Solunea, an upcoming skSync DEX, has announced a launch on Arbitrum. The plan is for 100M SLNA tokens to be minted with presale and airdrop opportunities available.

Airdrop by Jesse

Venom

Venom is a new layer 0 network with fast, low-fee transactions and infinite sharding that supports CBDCs and WEB3 applications. Venom has recently announced their incentivized testnet and their intent to reward testers with VENOM tokens. To get started, you’ll need a Venom wallet. You can add the Venom extension to your Chrome browser or download the mobile app available on Android and iOS. Once your wallet is set up, you can head to the Venom Testnet page and click Connect Wallet. Next, you must log in to your Twitter account and associate your profile with your Venom Wallet. After connecting your Twitter, you’ll want to move to step-3 and follow the Venom Foundation. Once all three steps are completed, you must sign a claim transaction to receive your 50 free VENOM testnet tokens. These are only useable on the Venom testnet.

You can claim additional VENOM by joining the Venom Discord on the Faucet Page of the testnet. Additional tasks will now also be available on the Task Page. One of those tasks includes the chance to mint the first NFTs on Venom for free. After minting your first free NFT, a new task will be available. This Wallet task will require sending a small transaction from your Venom Wallet to the address provided on the task page. Once completed, you’ll earn your second free NFT on Venom.

The next task available will be exploring the swap features of Venom through the Web3 World Task. This will take you to the Web3 World testnet page and allow you to begin swapping your VENOM tokens for other testnet tokens. Complete a few swaps to complete this portion of the testnet. Next, you’ll need to head over to the LP side by Providing liquidity to a pool of your choice. Once completed, you can switch to the Farming option and deposit your LP tokens. Completing these three processes on Web3 World will enable you to mint your third NFT. Several more tasks will become available, including Venom Pools, Venom Bridge, Oasis Gallery, Venom Pad, and Venom Staking. Once you’ve completed all these available tasks, you can head to Venom Discord and post your Venom wallet address in the #feedback section of the channel. This last step is one of the most important, as discord members who provide this information are certain to receive the highest rewards for participation.

Blur, Amazon & Sotheby’s Shake Up NFT Marketplaces by Sam

NFT marketplaces have moved on a lot since the days when it was OpenSea for everything, and despite NFTs going through a lull as attention switches to memecoins–there have been plenty of new developments recently when it comes to trading platforms.

Let’s go through some key developments, and get a handle on what effect they might have, near and long term.

Blur Blends NFTs and Finance

Image credit: Blur

The big news has been fast-moving and disruptive marketplace Blur launching its next innovation, a peer-to-peer perpetual lending protocol called Blend. It has no expiry dates on loans, doesn’t use oracles to track NFT values, and has two features: collateralized loans and buy now, pay later.

Loans

For the loans, NFTs can be used as collateral, and they’re offered at fixed rates decided by the lender. Borrowers can exit at any time by fully paying back the loan, while lenders can exit at any time by triggering a refinancing auction, meaning a new lender can come in and take over the loan on new terms, or if no-one takes on the deal, then the result is liquidation (in which case the borrower has to pay back the loan or lose the collateral).

Buy Now, Pay Later

The buy now, pay later facility means buyers are borrowing ETH to purchase NFTs, and the amount a buyer has to put down up front may be very low (you can currently pick up an Azuki for less than 0.8 ETH up front). Again, both parties can exit the deal at their leisure, by paying the owed amount or triggering a refinancing auction (and possible liquidation). And if the NFT goes up in price before the loan is paid off, the buyer can list it for sale, and then take profits after paying off the loan with the proceeds.

Opportunity and Risk

A criticism that can be leveled at Blend is that it potentially enables predatory lending. Lenders can trigger a liquidation auction at any time, a new lender moves in, and with zero protections for borrowers, you can imagine a scenario where rates get hiked on borrowers whose debt is not locked in with one counterparty.

One more thing to note is that lending activity is rewarded with Blur tokens, and, as a lender, the more ETH you offer and the lower your APY, the higher the rewards. However, once a loan is accepted, rewards are no longer given, which may actually incentive lenders to liquidate early so they can then earn further rewards on new loan offers.

On the whole, Blend makes for an interesting system to explore, with opportunities and risks for all parties. As this is a loan-related product tied to NFTs, users should tread very carefully and be prepared for volatility. Blend is currently active for four collections–CryptoPunks, Azuki, Milady Maker, and DeGods–but expect more to be added.

Amazon NFT Marketplace to Launch Soon?

Image credit: Amazon

At first there were reports that Amazon would be launching an NFT marketplace in April, and it then appeared that the launch might be taking place this month, with May 15th being speculated on as a likely date. However, that timetable has gone unconfirmed by Amazon itself, and it now seems as though the launch will take place later this year.

Firmer information currently circulating indicates that the platform will be called the Amazon Digital Marketplace, thereby avoiding the term NFT in favor of a more mainstream-friendly title. It’s also being reported that Amazon will allow purchases to be made in fiat with credit cards and an Amazon account, and that the company is looking at ways of combining NFTs with physical purchases.

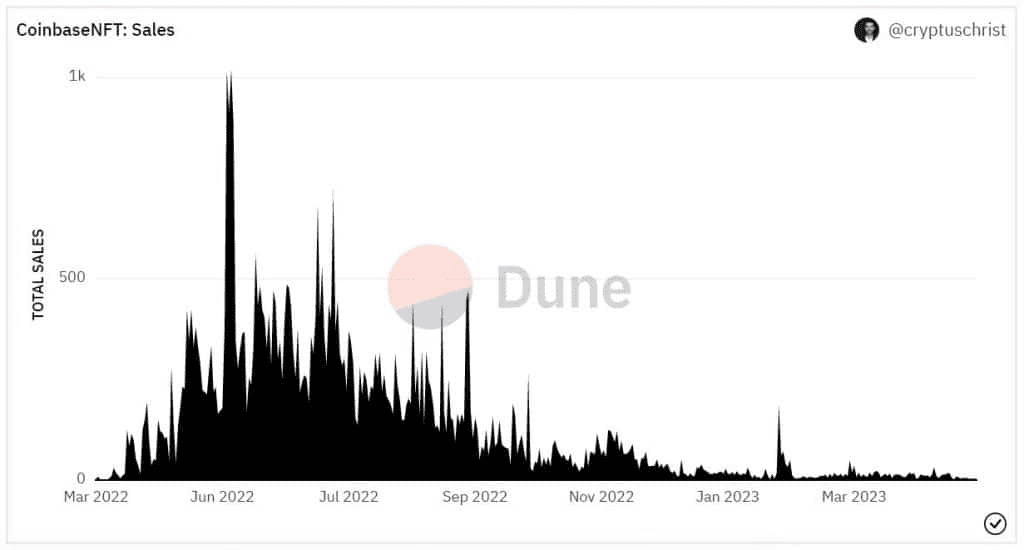

Relatedly, it’s probably a good idea to keep in mind what happened when Coinbase launched its own NFT marketplace last year. It’s understandable if that event has slipped your mind since it has subsequently turned into a washout.

Speculation that Coinbase would be the great NFT on-boarder to pump everyone’s bags (sorry, I mean, to spread the joy about NFTs) was just wishful thinking, and checking in on Coinbase NFT trading volume over the last 24 hours, it comes to a spectacular… $55. The point being that big name hype can go either way: sometimes it explodes, and sometimes it fizzles out.

NFT Art Finds a Home at Sotheby’s

Image credit: Sotheby’s

And for one more significant development in the world of NFT marketplaces, let’s turn our attention to Sotheby’s. The prestigious art auction house launched its own NFT trading platform at the beginning of this month, making use of both Ethereum and (as is recently very popular for Web3 builders) Polygon.

It’s called Sotheby’s Metaverse and, as you might expect, it specializes in curated artworks. The aim is to make it easier for collectors to navigate the world of NFT art, since 1/1 digital pieces tend to be scattered across a variety of platforms and are sometimes difficult to track down.

Included from the start are some famous artists who cross over comfortably between the degen JPEG casino and the respectably champagne-quaffing traditional art scene, such as Tyler Hobbs, Claire Silver and XCOPY, and, among others, the world-renowned high-tech installation creator Refik Anadol (who also releases NFTs) catches the eye as part of the initial line-up too.

For all the speculation about the long-term future of NFTs, and the constant questions around utility, it’s curious that they seem to have found a natural home in the high-end art world, where they’re viewed simply as collectibles with artistic value. As such, Sotheby’s Metaverse feels like a logical extension to the Sotheby’s name.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Final Notes

Bitcoin price volatility as crazy US crypto attacks increase and inflation news. Find out all about it in the video below. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 0% SPOT FEES AND $4,450 IN BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.