Is This The Next Rug Pull?

In This Issue

- Rebecca shares her thoughts on the new EU crypto regulatory framework, the Multichain CEO goes missing, Honk Kong kicks off crypto trading with a stablecoin, crypto job cuts continue & Nvidia hits $1 trillion market cap.

- Altcoin alpha by David.

- This week’s airdrop by Jesse.

- Sam has an NFT report on how brands are using NFT loyalty programs.

The June Alpha Report Is Here

Hey friends, Lark here 👋

The Monthly Crypto Alpha Report for June was released Yesterday!

I know I’ve been mentioning it quite a bit lately, but today is your final chance to get your hands on the Monthly Crypto Alpha Report for June with a 7-day free trial!

Time flies, and opportunities don’t wait for anyone, so let’s make sure you don’t miss out on this comprehensive, value-packed resource that my team and I have spent countless hours researching and analyzing just for you.

The entire goal of our Monthly Crypto Alpha Report is to provide you with the necessary insights you need to make the most of the opportunities arising in the crypto space in June.

Here’s what’s inside:

- A macro overlook of the crypto markets to help you navigate the market trends

- The top airdrops of the month for potential quick gains

- The top altcoins to watch, selected based on in-depth analysis

- The best DeFi farms to maximize your passive income

- The most exciting NFT mints for those looking to explore the NFT space

Are you ready to embrace the wealth making opportunities that will arise in June? Then get your hands on the Monthly Crypto Alpha Report with a 7-day free trial today!

Getting your Free trial today will not only grant you access to the Monthly Crypto Alpha Report, it’ll also add you to my Premium Wealth Mastery list and you’ll receive 2 Premium issues over the course of the next 7 days.

Don’t let the opportunities in June slip away.

The News Now

EU Signs Crypto Regulatory Framework 🫣

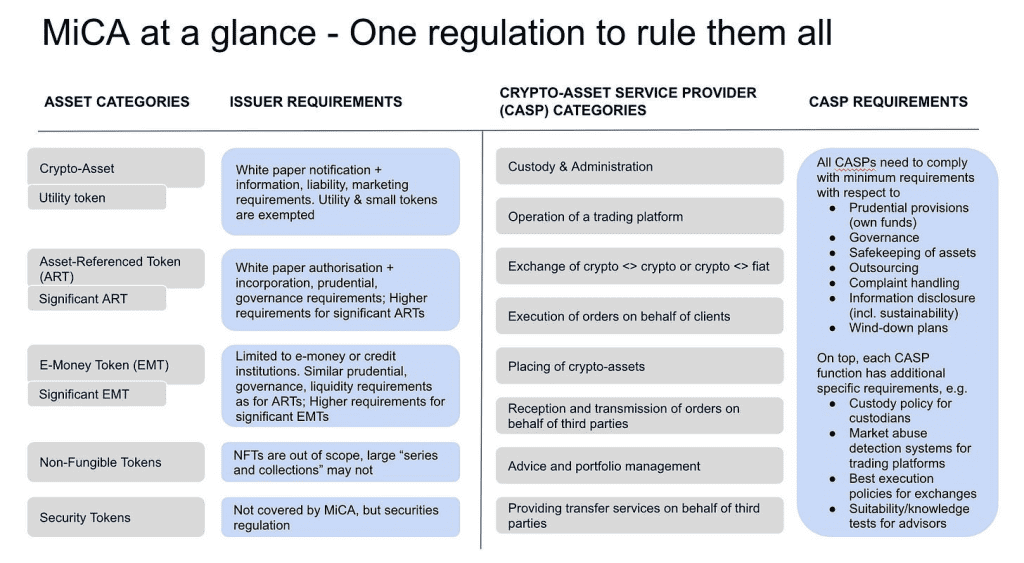

Brace yourself! The EU is about to make crypto history. It’s set to become the first major jurisdiction in the world to launch a regulatory framework for crypto. MiCA is the Markets in Crypto-Assets Regulation, the European Union’s rules for all. The EU has been teasing the framework since 2020, but this week it was signed, sealed, and delivered with a formal vote. MiCA covers all forms of token offerings, stablecoin issuance, crypto exchanges, and custody, as well as market abuse rules.

I know what you’re thinking, Europe isn’t the global crypto hub. Instead, it’s the US and Asia that are locked in a battle. Elizabeth Warren and her latest case of “crypto funds the fentanyl trade” just shows who is winning the battle right now. So why is Europe leading the regulatory race?

- They say crypto assets pose substantial consumer protection and money laundering risks.

- To avoid fragmentation with a one-size fits all approach–it presents a united front.

- To front-run the mass adoption and provide legal clarity.

- To become a global leader in technology regulation.

Stablecoin issuers will face much stricter rules under this new framework. But unlike the US, this framework provides clarity on asset classification. Minus some details around staking, NFTs, and DeFi. Now it’s official, what happens next? The regulatory framework will be published in the official EU journal shortly and will come into force 20 days after that. Stablecoin issuers will have 12 months to be compliant whilst other crypto businesses will get 18 months.

With clear rules for crypto businesses, this should give the industry a boost. And give the US a kick up the ass too! But with a separate bill passed to ban anonymous crypto transactions of more than €1,000 in a crackdown against money laundering, the line in the sand is still unclear for users. The question still remains of how much freedom we will be left with as more governments tighten their control as the debt spiral worsens.

Crisis Continues For Multichain As CEO Goes Missing 😱

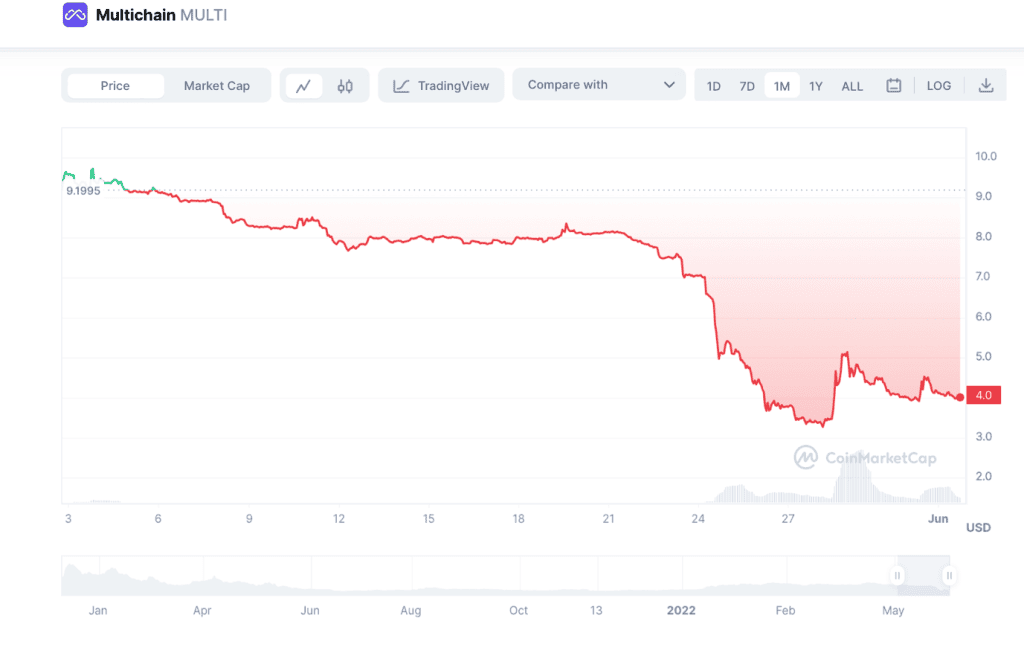

Multichain Bridge is up there when it comes to May’s Biggest Losers. MULTI is down 43% in just the past week alone. Now the CEO is reportedly missing taking the server access along with him…this story keeps getting weirder. But let me back up and rewind to the start.

Asian-based bridge, Multichain, formally known as Anyswap, started suffering from withdrawal delays. Why does this matter? Multichain is the fourth-largest bridge in the crypto ecosystem—it’s a billion-dollar bridge with around $1.5B in total value locked. It’s a cross-chain bridge that helps users move assets between 30 different chains and is integral to Fantom’s functioning. Multichain is a big freaking deal so when it rains, it pours.

Here is a timeline of events:

- May 21: Developers notify the community an upgrade was taking longer than expected

- May 21-24: Users report withdrawal delays

- May 24: The Fantom Foundation remove almost 450K MULTI tokens and 1,363 ETH from a liquidity pool on SushiSwap

- May 24: Rumors begin that Multichain team members were arrested by Chinese authorities and law enforcement has control of its $1.6B wallet

- May 24: $3.1M of MULTI is transferred to Gateio

- May 24: Liquidity on all DEXs drops from 6.5M to 0.7M

- May 25: Binance suspends deposits for 10 bridged tokens

- May 31: Multichain announce they’re unable to reach its CEO and don’t have access to the servers

Since then, there has been nothing but silence. This is giving me bad vibes. With everything the crypto industry and investors have experienced in the past year, the last thing we need is another Do Kwon or SBF. Let’s hope this isn’t another rug pull!

Hong Kong Kicks Off Crypto Trading With A Stablecoin 🤑

Pinch, punch it’s the first of the month! Hong Kong is open for business to around 7.4M crypto retail traders. Errrr…where was the market pump? It wasn’t total crickets when the clock struck 12, as Hong Kong kicked off this new era with a USD stablecoin. FDUSD is backed 1:1 to the US dollar and will be issued by First Digital, a Hong Kong-licensed trust company. The stablecoin will be multichain right away and issued on Ethereum and BNB. It will be backed by cash and cash equivalents in regulated financial institutions across Asia. Under requirements from Hong Kong, the reserves must be kept in segregated accounts, to avoid commingling of assets. Listings with major exchanges are in the works. But, until new stablecoin regulations are passed, it won’t be available to retail investors in the country. Boo!

Bear Bites Back As Crypto Job Cuts Continue 😬

Bulls stand down…we’re not out of the woods just yet. Cue another round of job layoffs in the crypto industry:

- Binance to axe 20% of its workforce

- Nansen to axe 30% of its workforce

Ouch. Let’s break down the details.

Binance isn’t laying off staff due to market conditions or to reduce costs. Instead, it’s a round of resource reallocation. Binance CEO, CZ, has said the company is saying goodbye to people who are no longer a good fit for the company. But what Binance is calling BS on is the reported percentage. The layoffs may be less than 20% and the company is still hiring, despite the bear market.

Nansen on the other hand, hired too aggressively in the bull market and didn’t prepare well enough for the bear market. In other words, they bought high and sold low. Sounds like a lot of crypto portfolios out there.

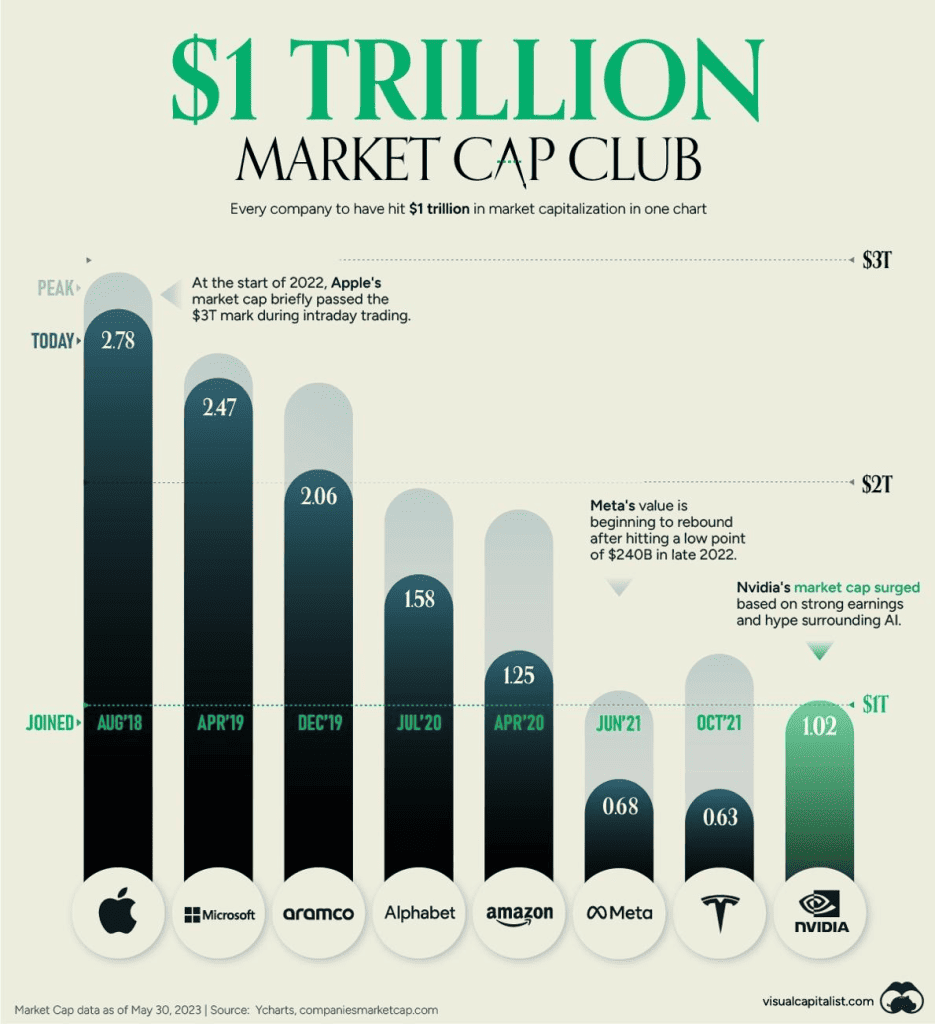

Nvidia Hits $1 Trillion Market Cap And Fuels AI Hype 🤪

Nvidia briefly became a $1 trillion company and joined the exclusive market cap club. Even if just for a moment.

Whilst Nvidia stole the limelight this week, the crypto market had an AI launch of its own. Enter, Talk2Satoshi. AI developers Pierre Corbin and Hugo Ferrer have launched the Talk2Satoshi chatbot to answer all your Bitcoin-related questions. It uses an API from ChatGPT and a dataset of Bitcoin resources such as old emails, forum posts, Bitcoin books like The Bitcoin Standard and The Price of Tomorrow, and of course, the documentary founded by Corbin, The Great Reset and the Rise of Bitcoin.

Something to look out for next week, Apple is rumored to be announcing its VR headset at its annual developer conference WWDC on June 5. Metaverse tokens could pump on this one condition: if Apple can convince the world that the Metaverse is indeed the future of the Exponential Age.

Altcoin Alpha by David

Existing Projects / Tokens

- Alchemix [ALCX] will soon be launching on Arbitrum. Alchemix is a self-repaying loan protocol, and this is the protocol’s first dip into an L2 network. The Ramses Exchange [RAM] will be hosting Alchemix’s liquidity pools on Arbitrum.

- Avalanche [AVAX] now has on and off ramps for Circle’s EUROC, a EURO stable-coin. EUROC currently has a market cap of $51M.

- Dopex [DPX] is launching a “call options as incentives” service for its users. This service is normally found in TradFi, but Dopex is bringing it to DeFi. Dopex is a decentralized options exchange on Ethereum.

- Polkadot [DOT] and Binance built a USDT bridge between the two. Users can now deposit and withdraw Tether [USDT] between this Layer-O and the world’s largest centralized exchange.

- Polygon [MATIC] has done the dirty with one of the world’s largest telecommunications companies, Deutsche Telekom. The company will become an official validator for the L2 network.

- Woo Network [WOO] has partnered with Trader Joe to begin launching new liquidity pools on Arbitrum. The first will be a WOO/ETH liquidity pool. Woo Network is a “liquidity network” that connects to CEXs, DEXs, traders, and other institutions together. Trader Joe is a top-3 DEX on Arbitrum.

New Projects / Tokens

- Quickswap [QUICK], a new perpetual DEX, just launched on Polygon. Users can long or short multiple derivatives with up to 50X leverage. The DEX is currently offering multiple incentives for early users.

Airdrop by Jesse

Magic Square is a new discovery and engagement platform that offers a complete Web3 application experience for users to connect with their favorite projects. Developed as blockchains answer to the Google Play store. The Magic Store hosts a select group of validated DeFi applications and games from over 30 of the most active networks in one easy-to-use website.

Magic Square has announced its Epic Quest Airdrop Event and will be giving away 1,000,000 SQR tokens to lucky participants who join the Zealy Questboard and complete various tasks. Earn XP by completing Learn & Earn Events, Magic Store Adventures, Community dApp Voting, Discord Digs, and many other fun interactions with the project. Tokens for participants will be rewarded once the project goes live in Q4 2023 and will be distributed through a vesting mechanism to ensure all participants are rewarded fairly for their contributions to the project.

How Brands Are Using NFT Loyalty Programs by Sam

Web3 can bring real utility to companies and brands, including through NFT loyalty programs which give perks to holders. There’s also the expanding crossover between physical products and digital items, and there are plenty of Web3 experiments looking at ways to link up the virtual and the real.

Because this is all new and developing, the boundaries between different kinds of utility aren’t clear, and NFTs with utility don’t always fit into neat categories. As ideas are tested out, NFTs sometimes combine functions: rewarding loyalty, acting as tickets or proving attendance, opening access to services, or opening the doors to members’ clubs, and allowing holders to redeem physical goods, along with many other possible applications.

They might also, in some cases, simply function as limited edition collectibles or specially produced works of art, but these uses can also be combined with practical applications.

Early Movers

Although it’s still early days for NFTs, some early movers have been putting them to use and testing the mechanics, including famous, non-crypto names, and emerging, crypto-native newcomers, and ranging from the popular and easily accessible to the prohibitively expensive and deliberately exclusive.

Also, something you might notice around this area is how brands often prefer the term Web3 over referring to NFTs, and they pretty much never talk directly about crypto. Web3 perhaps sounds like an easier sell, but this preference also shows how crypto may start to operate in a more under-the-hood way as the tech becomes integrated with the mainstream.

Starbucks

Image credit: Starbucks

One of the biggest corporate names to embrace NFTs has been Starbucks, which is taking loyalty cards and enhancing them through NFTs. The company’s new membership scheme is called Starbucks Odyssey, and it launched in beta last December to selected waitlist participants.

Membership includes the ability to complete interactive online games and activities called Journeys, which earn points and NFTs called Stamps (issued on Polygon), which then lead to rewards including merchandise and access to events. There are also limited edition Stamp NFT releases, which act more like art and design collectibles.

There’ve been two limited edition Stamp drops so far, and a third is coming up on June 7th, to be airdropped to current limited edition Stamp holders who have completed at least two Journeys by June 6th.

Early Majority

Image credit: Early Majority

Fashion and Web3 seem to be getting along especially well together, with everyone from high-end labels to sportswear and streetwear makers exploring the new tech. From this sector, an interesting outfit called Early Majority has been experimenting with ways to bridge the gap between physical apparel and digital assets.

Early Majority is focused on stylish outdoor wear, coming at it from an artistic angle, and you can become a member of the project by minting a Digital Member Badge NFT. These assets bring a substantial list of useful benefits, including merchandise, access to IRL events, first access to new releases, and member-tiered pricing on the company’s products.

9dcc

Image credit: 9dcc

Launched in August 2022, 9dcc is a fashion and lifestyle venture that feels deeply infused with NFT culture (even that name, 9dcc, is the last four characters of an ETH wallet address). It was founded by influential NFT advocate and Web3 builder Gmoney, and its second collection, called ITERATION-02, was the product of a collaboration with Art Blocks founder and Chromie Squiggle creator Snowfro.

The clothing 9dcc has produced up to now comes fitted with NFC chips connecting buyers into the project’s network, and garments are only buyable through minting NFTs, and are not available for general sale.

Owners of 9dcc items can participate in reward-earning games, rack up the project’s Network Points, and distribute POAP (proof of attendance protocol) tokens to other people who scan their NFC chips, thereby expanding the 9dcc network. And by the way, forget about the phygital label, 9dcc refers to its garments as networked products, which is definitely a cool-sounding term.

Overall, 9dcc is unusual in that it garnered attention from traditional media, and its Network Points and POAP systems enable social connections, but at the same time, its complex sales methods come across as designed to be accessible only to deeply NFT-native buyers, and it sometimes feels like it’s aiming for digital exclusivity over mainstream onboarding.

Le Bristol Paris

Image credit: Le Bristol Paris

Elegant and iconic, Le Bristol Hotel has a formidable reputation and is one of the top places to stay in Paris, and if you go to its website now you might notice a prominent tab labeled L’H3ritage. This is a Web3 members-only club that can be accessed by holding one of eleven Bristol Unlocked NFTs, and those can be minted after first completing a KYC registration process.

The NFTs are, as you’d expect, expensive, clocking in at 8 ETH each, but for that outlay, holders receive benefits including a night in one of the hotel’s Signature Suites, and 5-year access to events and experiences, facilities, special menus, and–in true NFT style–whitelists “for future activations and collaborations”.

These NFTs are luxury items with a limited audience, but they demonstrate that NFTs can have a broad reach and a sweeping range of applications. The boundaries are still being tested, but Web3 can potentially take in everyone from crypto-immersed JPEG aficionados to guests at the highest-end Parisian hotels.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Final Notes

China Bitcoin, Ethereum, and Crypto news pump. Plus the debt ceiling update all in the video below. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.