MEV-Burn Proposal: ETH Even Scarcer

TLDR

The MEV-Burn Proposal is a proposed solution by Ethereum developers to redistribute the profits from MEV that currently are extracted. In the future, these MEV profits will be burned, according to the proposal. This will help make the Ethereum block production process more stable and reliable and also will make ETH more deflationary.

Ethereum developers have proposed a rigorous solution for the battles that break out from time to time because of mempool-related arbitrage. The solution? They will burn the ETH that MEV traders currently pocket! While the primary goal of this proposal is to make the tip of the Ethereum chain more stable, the not unwelcome byproduct is that Ethereum will become even more scarce/deflationary.

What is MEV Again?

A refresher on Maximal Extractable Value (MEV): it is the additional profit that validators can scoop up while adding blocks to a blockchain. They can maximize the money they make from block creation by reordering transactions within blocks and even inserting new ones. The classic example of how validators make money is called a sandwich attack: a so-called searcher (a bot) detects a large pending trade on a decentralized exchange and places a trade right before and right after it – and pockets the created price difference.

While MEV is not always a problem, it is a form of taxation on normal users. They pay higher gas fees or pay slightly more on a dex for their coins than they would otherwise have. Also, it can create instability, as we will see.

A Problem with MEV: MEV Spikes

MEV is a small industry. Currently, hundreds of thousands of dollars per day are squeezed from blockchain transactions by MEV bots. (see MEV-Boost.pics).

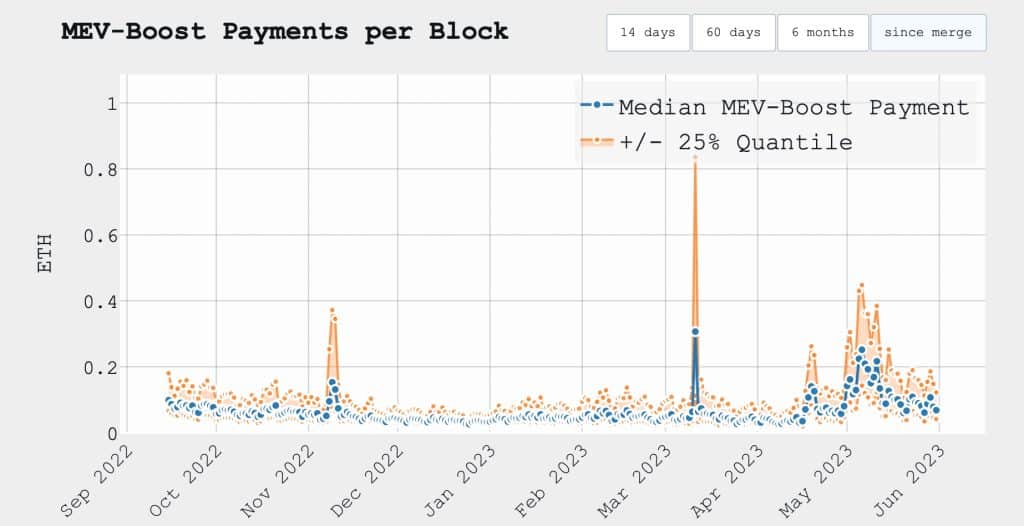

As you can see, the average MEV payment (the above graph depicts only blocks created through MEV Boost by Flashbots) is around 0.05 ETH per block. But it can spike violently to an insane 1 ETH per block on average during a few hours (remember that Ethereum produces a block roughly every 12 seconds). Within these periods of market upheaval, there have been Ethereum blocks where a lucky validator squeezed more than 100 ETH from a single block!

When do these spikes occur? Let’s say there is a launch/public offering of a popular new token or NFT project. At such a time of high traffic and congestion, validators can benefit from their ‘inside knowledge’ and front-run other people’s transactions.

As you can see from the two huge spikes in the above graph, they happened during the FTX implosion of November 2022 and the temporary de-pegging of stablecoin USDC in March 2023.

Solving MEV Instability

It’s these spikes that worry the Ethereum community and it’s why devs have been working hard on a new and more fair system of MEV.

Proposer builder separation (PBS) was already in the works: a fundamental design change of the Ethereum consensus mechanism. It isolates the building of blocks from transaction validation. It will decentralize the building of blocks.

Because we might have to wait a few years for the implementation of PBS, MEV-Boost is what we have to work with: a sort of proof-of-concept of the proposer builder separation. It’s an iteration of Flashbots, which seeks to democratize MEV opportunities. Flashbots lets validators outsource the work of building the most profitable block to parties called searchers (traders/trading bots) and relayers. Instead of passing through the public mempool, searcher transactions go to a relayer, where they are not visible to anyone. The relayer validates the transaction bundles and sends them to the validator, who can pick a block. The validator can’t see the transactions; it only sees how profitable different blocks are.

ETH in the Lion’s Den

But MEV-Boost still leaves plenty of room for undesirable MEV spikes, as we have seen. MEV Burn will have to get rid of those. MEV Burn is not to be confused with the ‘common’ burning of ETH which has happened since the EIP-1559 update from 2021.

What will the MEV-Burn proposal tackle? The nasty side effects of the MEV spikes. During these spikes, MEV rewards can be so big that virtual fights break out over the bounty.

Compare it to throwing a huge piece of meat into a lion’s den. The big male lions will fight over it, leaving nothing for the rest. In the same way, advanced MEV players, in their fight over a hugely profitable block, will try to denial-of-service attack each other and will attempt to reorg the chain. This is not good for the stability of the chain: it makes newly created blocks less final.

Burn and Pump Our Bags

The above issues are why Ethereum wants to get rid of the MEV rewards altogether. But won’t this burning rub the players who currently get rich from MEV the wrong way? Well, maybe. But they don’t call the shots. Plus, burning the rewards will make Ethereum more deflationary. And that will likely benefit the price of their ETH too. It is estimated that MEV-Burn could roughly double the deflationary rate of Ether, burning an extra 200 thousand to 400 thousand ETH per year, taking care of an additional deflationary effect of 0.2% per year. In the long run, that’s a lot. Want to learn more details? View this Bankless podcast with Ethereum developers Justin Drake and Dom.

Wen MEV-Burn?

It may sound straightforward enough: let’s burn some ETH. But it will likely take four years or so to be implemented. Why? Because Proposer-Builder Separation needs to be implemented first. This architectural overhaul is scheduled to go live in the splurge phase of the Ethereum roadmap. That’s quite a few years in the future. In the meantime, the MEV bots can enjoy those sweet profits.

Conclusion

The MEV Burn proposal has become a new and important part of Ethereum’s roadmap. It’s reassuring to watch the community address the pitfalls associated with MEV spikes and look for solutions. It’s yet another signal that Ethereum seems to be on the right path of continual improvement and innovation. Because Ethereum is the chain that is most in demand, new types of challenges pop up there first and force Ethereum devs to be at the forefront of blockchain technology.