Monero vs Zcash | ZEC vs XMR | Everything You Need To Know

Let’s have a look at two important coins that were designed to solve an interesting puzzle: to make transactions on the most public ledger ever – a blockchain – private. Monero vs Zcash, the longest-standing and most important privacy coins. What do they have in common and what are the important differences?

Monero and Zcash are so-called privacy coins: they use advanced cryptography to allow users to transact while protecting privacy. A user’s address and balance are not visible. Monero is the biggest privacy coin in terms of market cap. Zcash is slightly smaller. Monero is widely accepted on darknet markets, which is not the case for Zcash. Both are way ahead of the pack in terms of market cap and history.

Both coins are mined and have similar issuance to Bitcoin. Like Bitcoin, Zcash will top out at 21 million coins. Monero has no cap but has a constant inflation rate of 0.6 per block.

Why does Privacy Matter?

That we close our curtains in the evening doesn’t mean we’re engaging in illegal activities. Same with spending money: wanting privacy in our spending habits doesn’t mean we’re all buying illegal stuff on the dark web. Privacy should be thought of as the default.

But it’s not. Just think of the trail you leave if you transact with a non-privacy network like Bitcoin or Ethereum. On Etherscan or another block explorer, it’s there to see for everyone and forever: entire series of purchases and wallets can be linked to your identity indefinitely.

The problem with privacy settings of protocols, according to Zooko Wilcox, co-founder of Zcash: ‘Privacy isn’t a thing you can add [to applications]. It’s not a feature like a new button or dark mode. You can add features but you can’t really add privacy.’

For that reason, Monero and Zcash approached the entire design with privacy in mind. It’s important to realize that both coins can’t solve the entire privacy problem. In both cases, it’s likely (but not necessary) that you buy the privacy coins at an exchange that knows your data. But how you spend your coins after that, is invisible.

Comparing Monero vs Zcash

So let’s compare some basic facts about Monero and Zcash.

| Monero (XMR) | Zcash (ZEC) | |

| Launch | April 2014 | October 2016 |

| Founders | Anonymous | Team from Johns Hopkins Uni |

| Developer community | Big (60+) | ? |

| Funding | Venture capital | Venture capital |

| Market cap (August 2022) | $ 3 billion | $ 1 billion |

| Circulating supply | 18 million | 15 million |

| Supply cap | unlimited, fixed inflation rate | 21 million |

| Consensus mechanism | Proof-of-work | Proof-of-work, talks of moving to proof-of-stake |

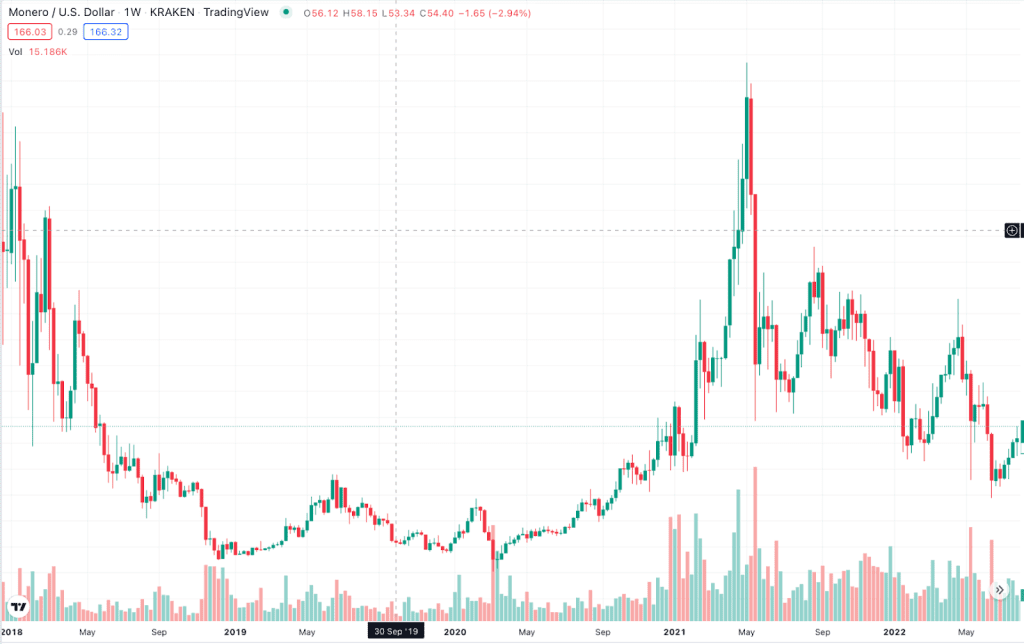

| All-time high | $516, May 2021 | $900, Jan 2018 |

| Transparant transactions optional | No | Yes |

| Block size | Adaptable | 2 MB |

| Block time | 2 minutes | 75 seconds |

| Private verification method | Ring signatures | Zero knowledge (zk-snark) |

| Transaction fees | varies, recently much less than $ 0.01 | 0.0001 ZEC (about $ 0,007) |

| Acceptance on darknet markets | high | low |

How does ZCash Work?

Zcash is based on the bitcoin protocol. The most important addition is privacy-preserving transaction data using zero-knowledge proofs. Zcash also includes some non-privacy changes to bitcoin, including its proof-of-work algorithm. Just like Bitcoin, the Zcash block mining reward is cut in half every four years. All 21 million are expected to be mined by 2032.

In a recent upgrade (NU5, June 2022), Zcash has introduced features like switching the default setting for transactions to anonymous

Transparent and shielded Zcash transactions

Zcash uses two types of addresses and transactions: transparent ones (starting with a t) and private ones (starting with a z). So privacy is like a switch that can be put on and off. Fully transparent Zcash transactions are like BTC transactions: sender, receiver and amount are publicly visible. In fact, most ZCash transactions are transparent.

However, with a fully-shielded Zcash transaction, the sender, recipient, and amount are fully encrypted and completely private. These transactions are heavier to process and thus not supported by every wallet.

In the recent upgrade, Zcash introduced unified addresses. With unified addresses, people don’t have to choose between privacy and convenience or between multiple address types.

The origin of Zcash’s privacy technology

This protocol was developed in 2014 by scientists and research cryptographers at Johns Hopkins University, Massachusetts Institute of Technology (MIT). Zooko Wilcox, one of them, talks about how they were looking to solve the issue with Bitcoin’s privacy characteristics:

“The bitcoin architecture so pervasively leaks information about all of the users that [adding privacy would be] kind of like plugging a sieve. You know, you can’t really plug all the holes when you start with that as your basis.”

At the time (the early 2010s), zero-knowledge proofs – a verification technique that shields data – were not sufficiently developed. According to Wilcox, Satoshi Nakamoto realized this too and settled for Bitcoin without solid privacy features. Only after Satoshi disappeared, cryptographers came up with zero-knowledge proofs that were good enough to use.

Zcash was the first project to implement zk-SNARKs, a novel form of zero-knowledge cryptography. It is a proof protocol that ensures privacy, anonymity, and fungibility of Zcash coins. Zero-knowledge proofs in the case of Zcash mean that the protocol can know that you have enough funds to make a transaction without actually gaining access to the exact amount.

Move to Proof-of-stake?

Currently, the company that is responsible for Zcash research (Electric Coin co.) is researching if the network should switch to a proof-of-stake consensus mechanism.

Where can you buy Zcash (ZEC)?

Major exchanges like Coinbase and Kraken offer ZEC. Zcash itself recommends Gemini, as that exchange offers more privacy options to users.

Which wallets support Zcash?

There’s the full node wallet Zcashd, for advanced users. Then there’s the distinction between wallets that offer the option of shielded transactions versus ones that only support transparent transactions. The Zcash site lists 5 mobile wallets that support shielded transactions.

There are around ten wallets that support Zcash transparent transactions. Hardware wallets Ledger and Trezor support transparent transactions. See an overview of all the wallet options.

How does Monero work?

Monero was created as a grassroots movement by mostly anonymous people, without a pre-mine. it was launched in April 2014.

A peculiar thing about Monero is that in times of network congestion, Monero miners can pay to be allowed to put more transactions in a block. This makes block production flexible and the mempool under control.

Another interesting part of the protocol is the so-called tail emission. Now that 18.4 million Monero have been mined, there is a fixed increase of the supply of 0.6 Monero per block. This will keep the supply steadily increasing and will make the Monero miners, unlike Zcash (or BTC for that matter) less reliant on fees in the future.

Stealth addresses and ring signatures

Monero transactions are untraceable. Coins sent to a recipient are rerouted through an address that is randomly created to be used specifically for that transaction. These addresses are called stealth addresses. It’s like generating a new key every time you make a transaction. The Monero ledger doesn’t record the actual stealth addresses of the sender and recipient.

Monero also uses so-called ring signatures as a means to hide the sources of funds. The ring signature ensures that every Monero transaction between two parties is grouped with other multiple transactions that occur among other unrelated parties. From the outside, you only see a pool of signatures (a ‘ring’) from people to whom the money could have been sent. In an upgrade in August 2022, the number of signers in a ring signature has been upped from 11 to 16, increasing untraceability.

Monero’s optional view key feature

Monero’s transactions are private by default. But it has a partial, optional transparency feature. All users get a “view key” that they can choose to give to others. In this way, they can let others view their account balance and/or access all historical and current transactions. Or access to only specific transactions in the account.

Monero wallets

The hardcore way to run Monero is running a full node and using Monero’s own wallet. Obviously, this offers the highest level of privacy. For users who settle for convenience, there is MyMonero wallet, an intuitive desktop application. Cake is a good mobile iOs wallet. To keep Monero in cold storage, Ledger is the standard option. Here’s a solid article comparing Monero wallets.

Where can you buy XMR?

There is apparently some pressure on exchanges to not list Monero. For US citizens, Kraken is the only big exchange that offers it. For buyers worldwide, Binance is an option (but not Binance US). A popular decentralized exchange to trade XMR is Bisq.

Conclusion on Monero vs Zcash

Alright, Monero vs Zcash, which one fits your needs best? Both Monero and Zcash have proven track records of preserving their users’ privacy. Both have active communities. Monero’s recent upgrade (aug 2022) shows it is very much alive, as did Zcash’s update of June 2022, introducing shielded transactions by default.

The number of markets that accept Zcash, is lower than Monero. Indeed, Monero has been establishing itself as the dominant privacy coin. That is probably why in 2020 the IRS put a 1.25 million bounty on cracking Monero. They still haven’t paid out, which tells you something about the robustness of Monero’s privacy features.

Zcash has faced the criticism that the option of transparent transactions weakens the usability and even creates an attack vector for private transactions. Zcash would no doubt contest this, and the fact remains that for day-to-day privacy features, Zcash will be more than sufficient – if you’re not at war with the Fed and their friends at Chainalysis. Still, the fact remains that from a usability standpoint (onboarding inexperienced users) Monero’s privacy-by-default looks like the more sensible option – for a privacy coin! It remains to be seen if Zcash’s recent update will improve this situation.

The price appreciation of Monero and especially Zcash isn’t as stellar as that of many other crypto projects. But maybe that’s not the point. Advocates of Monero and Zcash will often suggest keeping Bitcoin for saving and using their privacy coins for spending. How would that work? Through an atomic swap, you could convert some or their Bitcoin to a wallet with Monero or Zcash (so without relying on a third party and thus preserving privacy). You could then use your privacy coin wallet to do your private spending.

Responses