NFTs – 2021 Year in Review

2021 has been a wild ride in crypto, and NFTs have been a central player in this year’s ups and downs (and looking back from the end of December, it’s mainly vertiginous ups).

Which is not to say that everyone in crypto likes NFTs, but there’s no doubt NFTs have exploded into mainstream consciousness, created wealth, and on-boarded new people into crypto. What’s more, they’ve done all this in a manner which can be, on any given day, colourful, provocative, scammy, generous, absurdist and even, occasionally, philosophical.

2021 Key Moments for NFTs

Cryptopunks and Beeple

These were the big sales and the mind-blowing price tags that captured the public attention, and got people talking. Beeple’s piece, The First 5000 Days, sold for $69m, while Cryptopunks have come to be representative, for better or worse, of what NFTs are in 2021.

Baffling to the outsider, you could argue that Cryptopunks are an inside joke rather than an art collection, but either way, they are and always will be the JPEG face of early phase NFTs, and you really knew something was up when, in August, Visa acquired Punk #7610 for 49.5 ETH.

Bored Ape Yacht Club

The year’s other iconic collection, now a part of history, is Bored Ape Yacht Club, which has a current floor of 59 ETH, some pieces owned by the likes of Jimmy Fallon and Post Malone, and ownership of which marks you out as belonging to a very exclusive community.

But what’s astonishing is that when they launched back in April, they took 12 hours to sell out, and you could have picked one up for 0.08 ETH. Why it’s Apes in particular that then flew to the top is open to debate, but they helped kick off the JPEG summer, when opportunistic, copycat collections rained down on OpenSea, gas fees soared, and flipping NFTs from mint to secondary became, for some people, a full-time occupation.

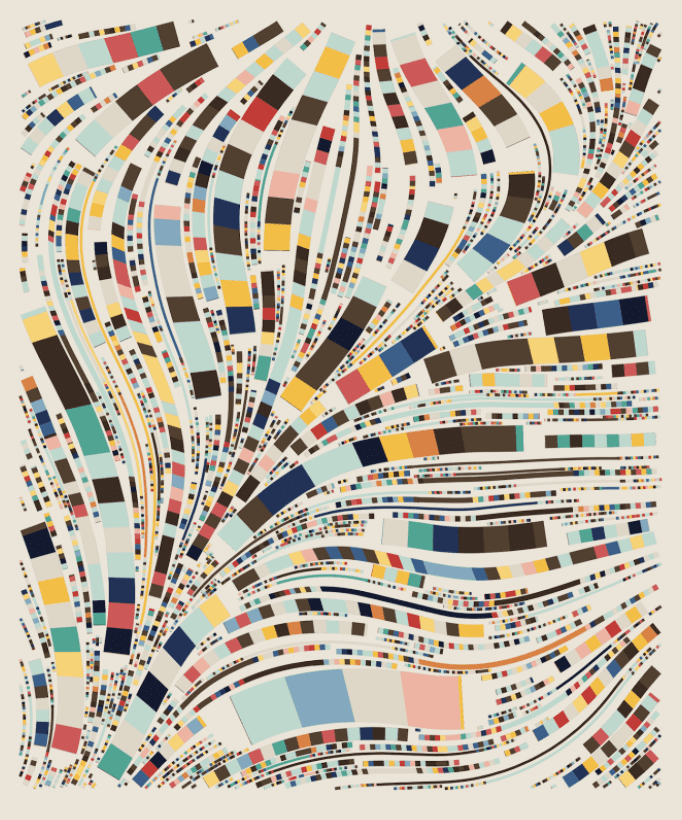

The Tulip and Generative Art

Amidst the derivative animal-based PFPs, there were some programmer-artists creating generative art projects that have lasting quality. Art Blocks is the prestige curation, and Fidenza is the biggest name within Art Blocks.

And yes, it wouldn’t be NFTs in 2021 without some huge injections of cash and an incredibly short time frame, the most notable example being Fidenza #313 (The Tulip) selling for 1,000 ETH, after the seller had acquired it for just 0.58 ETH only two months earlier.

Other Players

Ethereum shot up in price in 2021, its network became congested, and its gas fees became (and continue to be) prohibitively high. As a result, there’s considerable opportunity for other blockchains to offer low-fee alternatives, and NFT ecosystems began to develop away from Ethereum.

The three most outstanding are Solana, Cardano and Tezos. At the moment, Solana is the most high profile of these, offering a good UX and attracting developers and artists.

Cardano has a dedicated community but suffered, perhaps, from its lack of a slick marketplace and smart contracts. However, that’s been changing, and smart-contract-powered marketplaces are now operational.

Tezos has the distinction of offering many fascinating, relatively low-cost collections positioned at the arty end of the spectrum, but for sale on some genuinely confusing and difficult-to-navigate marketplaces.

Metaverses and Gaming

After the froth and exuberance of JPEG summer there was a slight lull, but that was soon disrupted by a lot of noise about the metaverse. Metaverse projects are not new (Decentraland and The Sandbox have been in development for some time), but what was novel and headline-grabbing was, in October, Mark Zuckerberg releasing a video announcing that Facebook was rebranding as Meta and building its own metaverse.

Was Zuck’s video kind of weird? Arguably so, but it had an instant impact, initiating a price pump for any crypto assets related to metaverses and gaming. And it seems certain that metaverse projects and (being closely intertwined) blockchain gaming are going to be major areas of development in the coming years, and that NFTs and crypto will be core components.

Where Next for NFTs in 2022?

You will always hear claims that NFTs are a fad or a bubble, and will soon have had their day, but even in a worst case scenario, I think that’s too simplistic an analysis to be accurate, and tends not to look at NFTs beyond the angle of JPEGs and PFPs.

NFT and Web3

It looks like we’re moving into the web3 era, and NFTs will be integral to this technology shift. The fact that there’s so much Twitter heat around this topic, with some in the crypto space (including, recently, Jack Dorsey) expressing skepticism about web3 doesn’t indicate that a major change is not occuring.

In fact, quite the opposite, as even those who are less than enthusiastic about web3 are being dragged in by its gravity and find themselves arguing about it.

A good approach is to tune out the drama, be highly skeptical about each individual NFT project, but remain open about NFTs as a whole, and aware of their necessity within the future of the web.

I’m looking in particular at how NFTs will be used in the construction of metaverses and play-to-earn games, but also of great interest are use cases within the music, entertainment and creative industries. Alongside fan tokens, NFTs are likely to become part of a new approach to monetization and building two-way relationships between creators and buyers.

It’s true that in an extended bear market some current NFTs could be hit hard, and there are tokens that might become worthless. That’s something to be well positioned for in advance, but it’s not even close to a takedown of the underlying technology itself, or of the zoomed-out direction in which we’re heading.