Perpetual DEXs: A 2023 Crypto Beginner’s Guide

On-chain, perpetual, decentralized exchanges. This sounds like something from Bladerunner 2049.

But as of late 2021, numerous perpetual DEXs have come online. These protocols offer some of the most cutting-edge, exciting, and consequential technology to the crypto, blockchain, and larger trading industries. And they’re taking more and more derivatives trading marketshare away from the centralized exchanges. They’re a big deal and the future.

This article explores perpetual DEXs. Specifically:

- What are they;

- Why do they matter; and,

- What are some of the best perpetual DEXs available now?

Let’s get started.

What’s a Perpetual DEX?

A perpetual DEX is blockchain-based crytocurrency exchange. These DEXs are decentralized, non-custodial, and permission-less. They use liquidity pools for liquidity, can incorporate order book models, and allow for leveraged perpetual contract trading.

That’s a ton of technical jargon. Let’s break it all down.

- Decentralized: Perpetual DEXs operate on the blockchain, across a network of distributed computers. Smart contracts form the core of perpetual DEXs. These smart contracts automatically execute actions and trades according to their programming and users’ inputs.

- Non-Custodial: User’s keep possession of their crypto assets when they trade on perpetual DEXs. Users never hand over their keys to a centralized custodian.

- Permission-less: Like most other Web3 dApps, no permission is required to access a perpetual DEX. With just a Web3 wallet, anyone can connect to a perpetual DEX in one click. No KYC. No BS.

- Liquidity Pools: Liquidity for trading comes from liquidity pools. Individuals, groups, and institutions elect to provide these DEXs with liquidity for trading. This liquidity is pooled together on the blockchain and is under the control of specific smart contracts. In exchange for the liquidity, providers are paid a percentage of trading fees generated by the exchange.

- Order Trading Book: Perpetual DEXs can combine the power of decentralization with the familiarity and utility of an order book trading model and interface.

- Leveraged Perpetual Contracts: Perpetual contracts are agreements that allow traders to bet on the prices of underlying real-world assets. They’re “perpetual” because there’s no expiration date. A trader can enter into a long or short position bet and keep the trade open indefinitely. Leverage can be applied, usually anywhere between 2X – 100X.

Why Perpetual DEXs Matter?

If Bitcoin is the democratization of currencies, then perpetual DEXs are the democratization of exchanges. Here’s why.

Secure (AKA No Central Points of Failure)

Because perpetual DEXs are decentralized across the blockchain, they’re not exposed to centralized points of failure. Thus, perpetual DEXs are immune from the risks of negligence, recklessness, or fraud from centralized actors. With perpetual DEXs, there’s no more wondering if your exchange will become the next FTX blow-up, because neither Sam Bankman-Fried, nor anyone else, is at the helm. Moreover, users always retain their crypto keys when using these DEXs.

Transparent and Accessible

Perpetual DEXs are fully transparent because they’re ultimately reduced to smart contract code on the blockchain. Anyone can review the code at any time. And all trades are visible on the network. No more centralized black boxes and unknowns. Everything is out in the open.

Perpetual DEX’s don’t discriminate and are resistant to nation-state interference. With a VPN and a Web3 wallet, anyone can access a perpetual DEX with complete anonymity no matter where they’re located.

Retail Investment Opportunities

Perpetual DEXs present a unique investment opportunity for retail investors. That’s because these DEXs depend on lots of individuals and groups choosing to pool their money together to create liquidity for the exchange. Anyone can become a liquidity provider and receive payments from the DEX’s transaction fees. A DEX’s documentation, tokenomics, and code can all be reviewed before any investment takes place. No more gatekeeping from the big investment firms. No more exclusion because your investment bag is too small. No lock-up periods.

Some Top Perpetual DEXs for 2023

Now that we’ve got an idea of how perpetual DEXs work, and why they’re important, let’s review some of the top-contenders operating now.

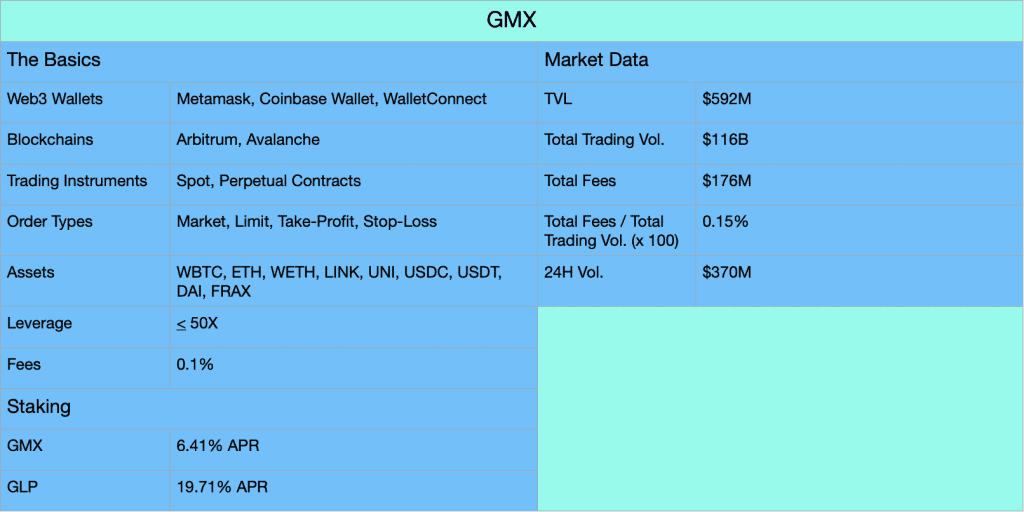

GMX

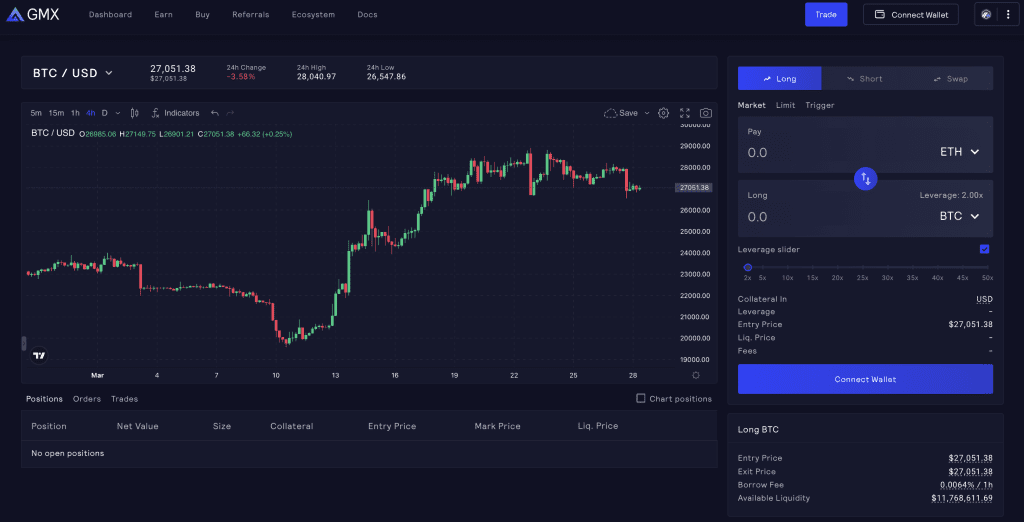

Launched in late 2021, GMX is currently the largest perpetual DEX by total value locked (TVL). The dApp and trading desk features a clean, simple, and straight-forward presentation.

GMX uses a dual token model. GMX is the governance token, and GLP is the liquidity pool token. Essentially, GMX liquidity providers purchase and stake GLP to the protocol. This pooled GLP is used to create liquid trading markets on the exchange. As the protocol generates revenue from swap, trading, and liquidation fees, it pays these fees back to the GMX and GLP token stakers. 30% and 70% goes to GMX and GLP stakers, respectively.

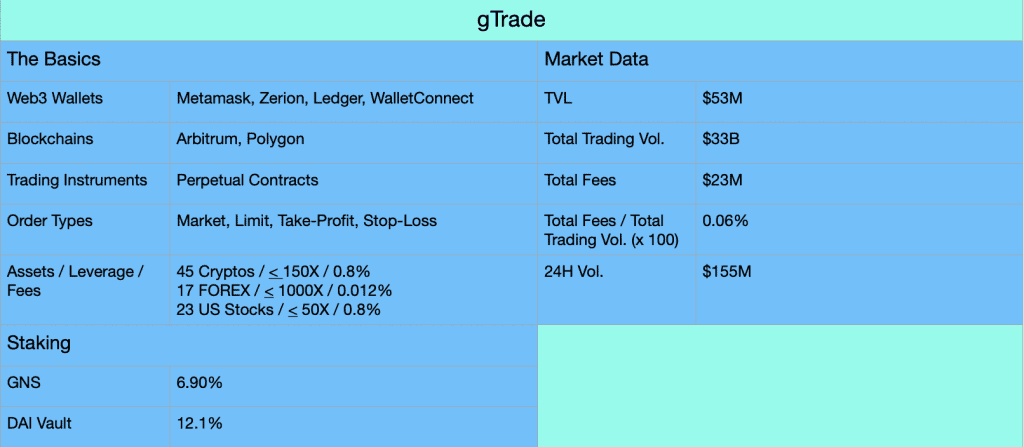

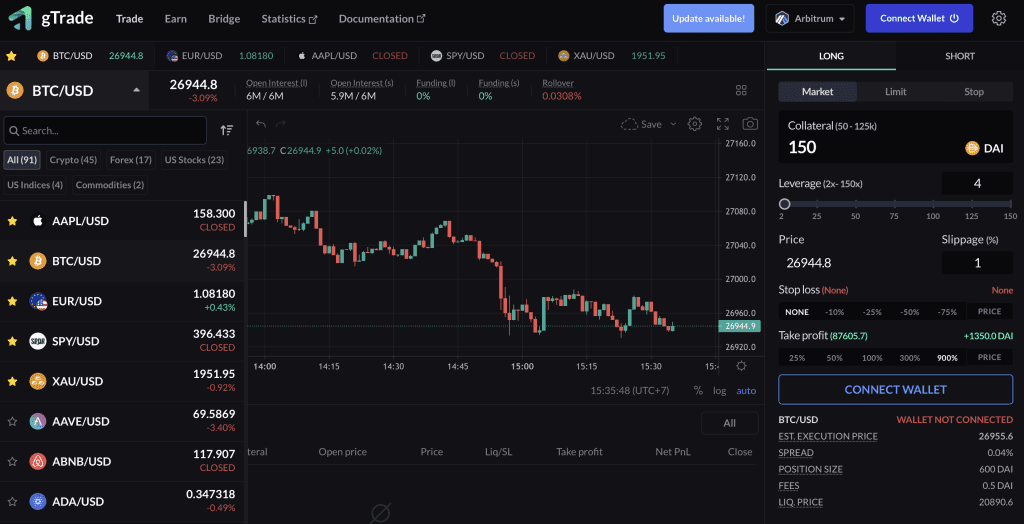

gTrade / Gains Network

Also launched in late 2021, gTrade (part of the Gains Network) is a much smaller perpetual DEX, but it offers the largest selection of tradable assets out of any protocol featured here. Users on gTrade can access perpetual contracts for 45 cryptos, 17 FOREX markets, and 23 US stocks. gTrade also allows for aggressive leverage. Up to 150X for crypto, 1000X for FOREX, and 50X for US stocks. Wow.

GNS is gTrade’s native utility and future governance token. With regards to the latter, gTrade documents state that the protocol will eventually be full governed by DAO, but the transition is still in progress.

With regards to GNS as a utility token, GNS works in a mint and burn system with DAI. DAI serves as the trading liquidity on the protocol. Anyone can stake DAI inside gTrade’s vault in order to become one of the protocol’s liquidity providers. GNS serves a few functions different functions, but its main purpose is to help stabilize the DAI vault.

As gTrade generates revenue from trades, approximately 32.5% of trading fees are paid to GNS stakers, and 67.5% are paid to DAI stakers.

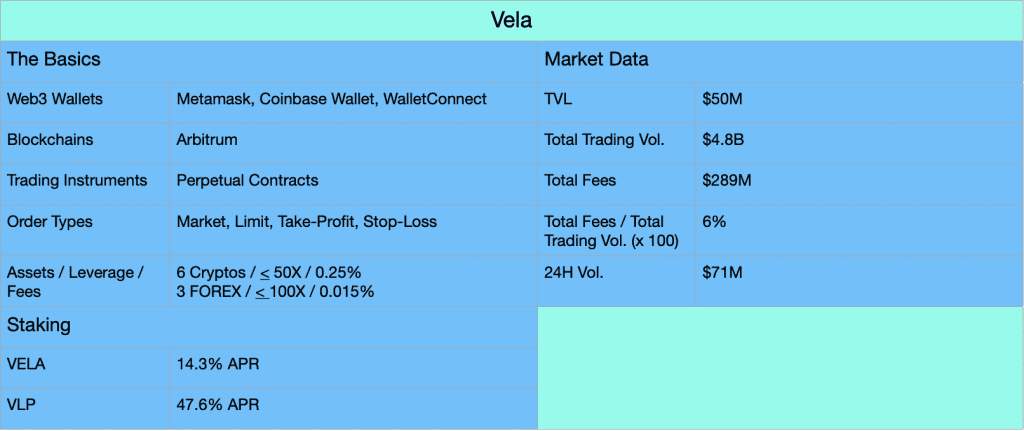

Vela

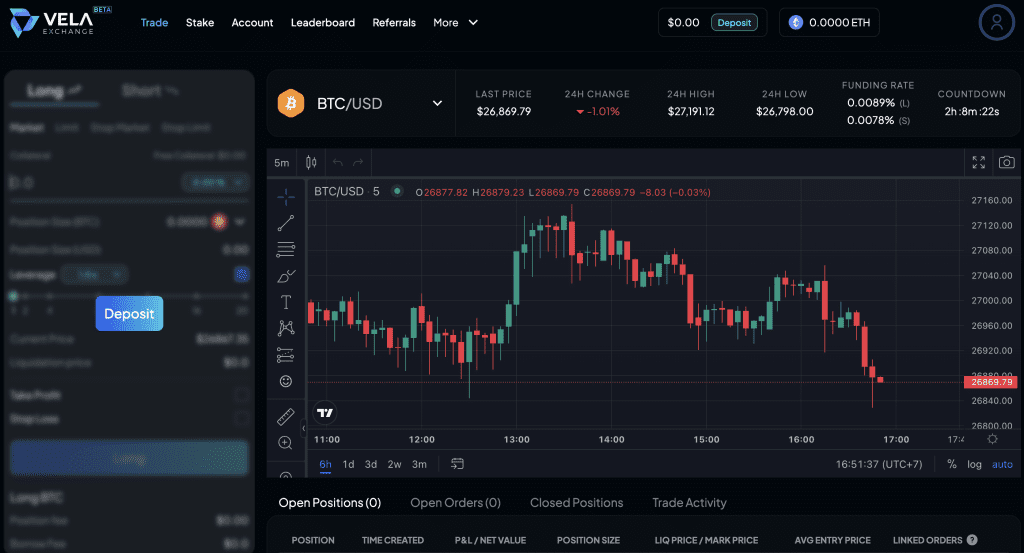

Vela is newest perpetual DEX to hit the scene. With a Beta launch in February 2023, Vela features a sexy, silky, futuristic interface and trading desk. The protocol has a decent selection of tradable assets. Vela currently has the highest fee / total trading volume out of any exchange on this list. However, given the exchange is still in Beta, this number will likely go down over time.

Similar to GMX, Vela uses a dual token model. VELA is the utility token and VLP is liquidity pool token. Vela stakers enjoy discounted trading fees and 40% of the protocol’s revenue. And in exchange for providing liquidity to the protocol, VLP stakers receive 60% of the total transaction revenues.

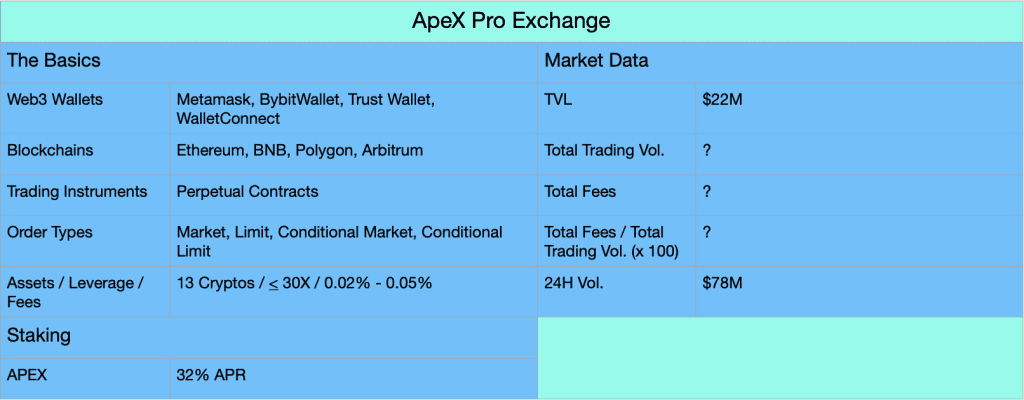

ApeX Pro Exchange

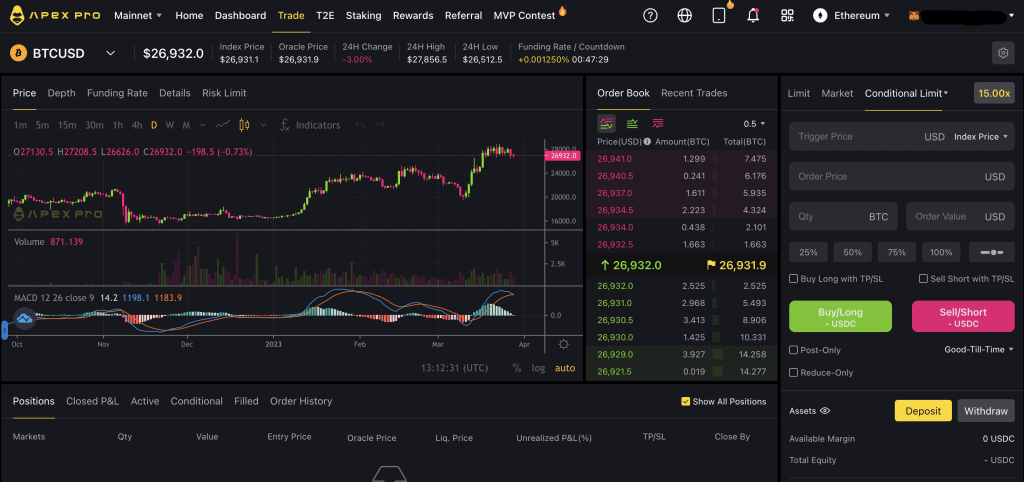

The ApeX Pro Exchange is the smallest perpetual DEX out of this list, but it has the widest availability across four blockchain networks. ApeX Pro also has the lowest crypto trading fees compared to the above three. And with its mainnet launch in late 2022, ApeX Pro is one of the newer perpetual DEXs to hit the market. Soon after launch, in December of 2022, Bybit purchased and integrated ApeX Pro into their larger platform suite.

APEX is ApeX’s native token. APEX is both a governance and a liquidity pool token. APEX stakers are currently earning 32% APR on their tokens. The exchange has another token named BANA, which essentially serves as a trade-to-earn rewards mechanism.

Final Thoughts

I think Perpetual DEX are the freest, most democratically-oriented exchange markets on Planet Earth. And this is why, over the long run, I believe they’ll continue to proliferate and eat up centralized exchange marketshare. And as we can see from gTrade and Vela, I also think these protocols will continue to expand beyond crypto, and incorporate more types of synthetic real-world assets onto the blockchain.

Every time a centralized exchange gets greedy, more user’s migrate to perpetual DEXs. And every time some bureaucrat attacks the industry, these protocols grow stronger. This is a good thing.

So get your hands dirty.

Responses