Portfolio Reflection Exercise, 2022 NFT Review & This Week’s Trending Coins

In This Issue

- For this weeks portfolio tip, I’ve got an portfolio reflection exercise that everyone should do.

- Sam has a 2022 review of NFTs.

- Rebecca breaks down this week’s trending coins.

Crypto Alpha Report

Happy New Year friends! 🥳

To celebrate, here’s the Crypto Alpha Report, the resource that provides you with:

- 📉 An overlook of the crypto markets

- 🎈 The top Airdrops of the month

- 👀 The Top Altcoins to watch

- 🧑🌾 The best DeFi Farms

- 🙊 The most exciting NFT mints

My team and I analyze the crypto markets for countless hours and we put all of our findings from the previous month into THIS report.

Value-packed & exclusive for the Premium Subscribers of the Wealth Mastery Newsletter!

Want a taste of the report?

Unlock the Crypto Alpha Report right now with a 7-day free trial! 🚀

Lark’s Portfolio Tips

Year In Review

As we embark on a new year in markets, it is worth reflecting on what we did right and wrong in 2022 in order to try and be more profitable and successful in 2023.

So here are some questions for you to consider. A bit of homework if you will.

I find that it can be very useful to have these self reflection moments, so do take the time to read over these questions and really sit down and answer them.

- What was your best performing investment in 2022? This could simply be the investment that lost the least, or maybe you found some market beating opportunities. But think about why this investment did well relative to the market and what lessons you might be able to learn from it.

- What was your worst investment and why did it go so bad? How could you have better managed this investment? Did you FOMO buy high? Did you not have a stop loss? Why did you not cut it sooner? Why did you initially like this investment and then what changed?

- What is one thing you wish you knew more about or had tried? IE NFT flipping or shorting on Bybit. It is never too late to learn. So use this slower time in the markets to upskill.

- Are you happy with your portfolio balance? Not the total number haha, I don’t think any of us love that number right now, but instead the percentage between assets. Personally, while I love crypto, I have been working over the last year to 18 months to diversify away from crypto by putting more money into stocks and metals. I know that some of you are 100% crypto, and while the stock market has been far from a safe haven, the truth is that diversified portfolios held up much better in 2022. So if you are not happy with your distribution across asset classes then what is your plan to fix it? Will you start studying stocks or real estate in 2023 to be ready to move profits from crypto to other sectors on the next big market cycle?

- How many income streams do you have? How can you get more? For many investors their income streams will look something like A) Their job B) Staking coins like Cardano C) Maybe a little bit of DeFi or stock dividend income. The question will be how to get more of these in 2023, especially those less correlated to crypto volatility? Time to start a new side hustle? Finally take the plunge into real estate? The key word here is cashflow. Do what it takes to increase it.

- What about risk? Well, as 2022 proved to many investors it is time to have a serious look in the mirror and talk about risk tolerance. Do you have too much risk in your portfolio? IE all in on NFTs, meme coins, and tech stocks! How can you reduce risk in your portfolio? Dividend stocks, metals, and real estate are all good risk mitigation investments as they are much less volatile than other asset classes. Bear markets are normal, but the truth is that many of us, especially those heavy in crypto, take too much risk in their portfolios.

- Are you ready for taxes? For many the tax year will have just ended. Do you have adequate cash on hand? Did you tax loss harvest where relevant? Are you locking in as many deductions as possible? Is your accountant actually prepared to deal with crypto?

Remember, this is just an end of year review. And when looking at an individual year, especially one like 2022, you can feel a bit disheartened. But, we often overestimate what we can accomplish in a year and underestimate what we can accomplish in 5 or 10 years. This bear market like others will come to an end at some point, so don’t be hard on yourself for 2022’s mistakes. Focus on how to make 2023 a profitable year, and how you can set yourself up for massive success for the rest of the decade.

Start your Wealth Mastery Premium Subscription today!

NFTs: 2022 in Review by Sam

After the highs of 2021, the beginning of 2022 saw NFT positivity continue to bubble, even as the wider crypto environment was taking early steps along a year-long downhill path.

While that NFT bullishness couldn’t last forever, the rest of the year still saw plenty of drama, although the 2022 JPEG rollercoaster was a lot more erratic than the up-only rocket-ship of the previous year.

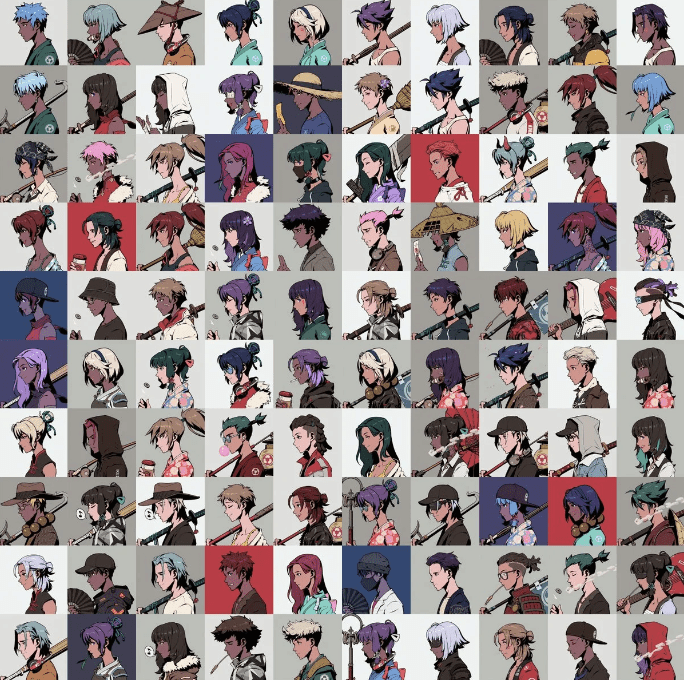

<h3 id="collections-that-drove-the-narrative“>Collections That Drove the NarrativeAzuki

Image credit: Azuki

The first big drop of the year, when sentiment was still positive, was Azuki. This anime-themed PFP collection set a new meta (manga and anime), and established itself in the upper NFT tiers.

Azuki is maneuvering to be a web3 innovator, with its Physical Backed Token concept drawing a link between real-life goods and NFTs, and with major partnerships that have covered fashion and F1.

Moonbirds

Image credit: Moonbirds

This was a hyped-up, high-caliber drop, linked with the PROOF Collective NFT community, and headed by well-known web entrepreneur, Kevin Rose.

Moonbirds hinted at the connections emerging between the existing web, and the in-development world of NFTs, crypto and web3, and it has great potential, despite sometimes lacking clarity about its intentions.

Otherdeeds

Image credit: Yuga Labs

Yuga Labs, the creator of Bored Ape Yacht Club, is now the dominant force in NFTs, and so there was huge anticipation around its Otherdeeds drop.

Otherdeeds NFTs represent virtual land in Yuga’s Otherside metaverse development, and when it came to minting these virtual assets, hype was sky high and sales volumes were immense.

However, immediately after the launch, there was vocal criticism of the drop, as gas fees had soared, transactions failed, and it was claimed that Yuga hadn’t properly optimized their sales process.

That all said, Yuga’s status has only grown throughout the year, despite such bumps in the road, and Bored Apes are still–along with CryptoPunks–the premium NFT collection.

Goblintown

Image credit: Truth Labs

By mid-year, wider crypto chaos was making people nervous, NFT sentiment was buckling, and Goblintown perfectly captured the darkly nihilistic mood that had descended over everything.

The collection seemed to drop out of nowhere as a free mint, had no Discord or roadmap, and yet, fuelled partly by speculation about who had created it, soared to a floor price over 7 ETH, and all while markets were crashing.

The reckless degen spirit that usually fuels NFTs was temporarily restored, and we later found out Goblintown had been created by Truth Labs. However, while the collection was well executed and fun, activity has been subdued towards year-end, and prices are down.

Renga

Image credit: Renga

As we progressed past the summer, crypto looked ragged and NFT markets were operating at diminished volumes. Then, just when everyone was starting to look a little too down-and-out, along came Renga, with a novel new way of revealing its artwork.

Several months prior, Renga had distributed Black Box NFTs to holders of a related collection called The Art of Seasons, and in September, box holders could finally, at their own leisure, crack open their boxes to reveal a PFP from the Renga collection.

Box-smashing beat the hell out of regular old reveals, the PFPs looked immaculate, and the NFT space became giddy when Renga prices took off and provided some welcome relief, and a party atmosphere.

<h3 id="art-that-made-a-splash“>Art That Made a Splash

Image credit: Grant Riven Yun

Arguably, the breakout NFT artist of the year is Grant Riven Yun. He has been creating art almost his whole life, and was active in the NFT space the previous year, but when a piece titled Cow sold for 22 ETH in 2022, Yun’s profile elevated rapidly amid discussions about art and utility, and his neo-precisionist style became widely admired.

Image credit: Harvey Rayner

The Art Blocks platform maintains a constant flow of eye-catching generative work, but if you had to pick an Art Blocks drop of the year, then Harvey Rayner’s Fontana collection stands out, and attracted plenty of demand.

Image credit: Amber Vittoria

Painter and poet Amber Vittoria is an established artist who started working with NFTs in 2021, and has been prolific throughout 2022. She has an instantly recognizable style, has worked with well-known names from the web3 space, including Gary Vaynerchuk and Bobby Hundreds, and recently dropped a collection through MoonPay.

Image credit: QQL

In 2021, Tyler Hobbs created the iconic Fidenza series, through Art Blocks, and in August 2022, he launched a new project in collaboration with artist Dandelion Wist. It’s called QQL, and is a platform allowing users to initiate generative artworks, with holders of QQL’s Mint Pass NFTs able to mint a creation.

And speaking of Art Blocks, the influential platform, which first launched in November 2020, restyled itself in 2022 to become Art Blocks 2.0. This meant improving its smart contract, releasing an updated website, and changing the organization of its collections.

Marketplace Expansion

Image credit: Blur

Throughout 2021, OpenSea was the NFT marketplace of note, and while it’s still dominant, 2022 was the year when competitor trading platforms made a real impact.

Challengers appeared at the start of the year with LooksRare and X2Y2, and, in the second half of the year, Sudoswap and Blur introduced new approaches to NFT trading.

We’ve also seen marketplaces expanding support across chains, with OpenSea adding Solana and Avalanche, among others, while Solana marketplace Magic Eden incorporated Ethereum and Polygon.

Key Takeaways

Memorable Meta

Anime and storytelling are the persistent NFT meta as the year draws to a close. Of those, the anime style looks as popular as ever and is likely to stick around, while the storytelling concept remains a little vague.

Free mints and CC0 seemed like side-plots of the summer, when the entire crypto space was in a state of panic and NFTs stripped down to the basics. However, CC0 now looks like a distinctive feature that could continue to set NFTs apart from traditional formats.

Web3 Leaders

Image credit: Starbucks

Attempts to build out mainstream web3 brands are way ahead of the corporate curve. There are long-term NFT ventures such as Moonbirds, and well-known companies are incorporating web3 strategies.

Some established brands leading the way are Reddit, with its Collectible Avatars, Starbucks, through its Odyssey rewards program, Instagram, Shopify, Toys R Us, and a growing list of other household names.

Could NFTs onboard the world into crypto? We’ll have to wait and see, but they seem to be exerting a pull on a wide range of companies.

Solana and Polygon

Image credit: Polygon Studios

Solana spent much of 2022 making itself the highest-profile NFT ecosystem after Ethereum, but then got hit hard by the FTX shambles, and towards year-end, two of the biggest Solana NFT collections announced that they were bridging to other chains, with DeGods moving to Ethereum, and y00ts using Polygon.

At the same time as Solana has run into trouble, Polygon, and its Polygon Studios offshoot, are becoming the go-to web3 option for big brands, including the above-mentioned Reddit, Starbucks and Instagram.

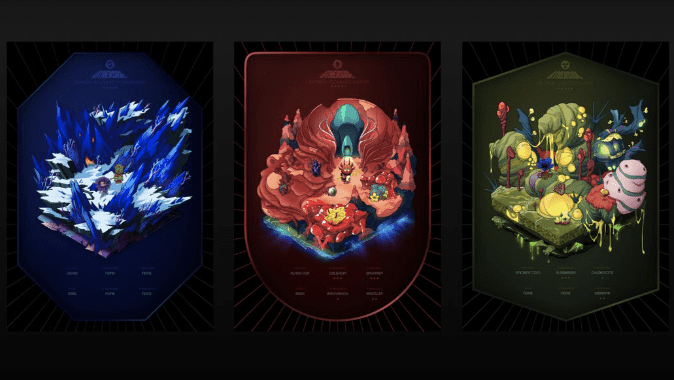

Gaming and the Metaverse

Image credit: Yuga Labs

Blockchain gaming continues to be an area of huge potential, but has yet to develop a definitive product that can win over skeptical gaming communities.

The gaming-related NFT collection making moves towards the end of 2022 has been DigiDaigaku, which generates outsized hype thanks to its well-qualified founder, Gabriel Leydon.

Metaverse development was a major area of interest at the end of 2021, but 2022 saw periods of quiet building during which mainstream attention drifted away.

Still, metaverse development rumbles along convincingly on a long-term arc. Otherside, from Yuga Labs, is the blockbuster project to keep an eye on, and it can generate instant hype (and price moves) with any hint that it’s about to reveal something new.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Trending Coins This Week by Rebecca

Here are my key takeaways from the trends this week, and the Christmas break hasn’t stopped crypto builders from building — and launching.

1 – Mirror Protocol is a synthetics protocol that skyrocketed 150% over Christmas. This is due to a whale with 5% of the supply making a lot of bids and sending MIR from Coinbase to a wallet.

2 – Polygon is an Ethereum side chain that’s partnered with Mastercard to launch a platform that allows users to create a personalized, web3-focused NFT debit card. Polygon has also surpassed 200M unique addresses with a total of 201,024,643.

3 – Vaiot combines AI and blockchain to create Intelligent Virtual Assistants. Its first use case is coming soon, called Giveaway Contracts, to allow content creators to run social media engagement campaigns, and award users for interacting.

4 – Cosmos Hub (ATOM) powers the Cosmos ecosystem and crypto Youtuber, CoinBureau, has talked about the reasons to be bullish on the Altcoin Daily podcast.

5 – Terra Luna Classic (LUNC) is the original version of the Terra blockchain that’s rallied 9% in one day. This is due to rumors that Coinbase has bought $245M worth of the Luna Classic token.

6 – Aptos is a Layer-1 blockchain created by ex-Meta employees that’s integrated with OpenOcean, a DEX aggregator, to provide the platform with advanced support.

7 – The Graph is an indexing protocol for querying networks that’s closing the year with over 600 subgraphs. Total indexers has increased 24% this week alone, thanks to Gnosis and Polygon being added to the network.

8 – Solana is an L1 blockchain that’s launched Chainlink price feeds, making this the first time its oracle services have been integrated with a non-EVM blockchain. Two top Solana NFT projects, DeGods & y00ts, are moving to Ethereum and Polygon.

9 – Osmosis is a Layer 1 DEX on Cosmos that’s seen a MATIC liquidity pool launch on the platform. Support for Osmosis has also launched on Leap’s iOS and Android apps.

10 – Bitcoin is set to be legalized in Russia for international trade in January 2023. Around 40% of the Bitcoin network hashrate was offline on Christmas Eve, as US miners unplugged their machines during the storm.

11 – GMX is a derivatives exchange that’s partnered with Yield Yak to bring Avalanche Rush to its protocol. The partnership has included the launch of liquidity pools featuring GLP, the GMX liquidity provider token.

12 – Algorand is a self-proclaimed “green” L1 blockchain that’s seen interim CEO, Sean Ford, explain “now is the time to move forward. Our time is now.” Algorand wallet, MyAlgo, has also integrated swaps so users can now carry out asset swaps directly from their wallets.

13 – Fantom is an L1 DeFi blockchain that’s seen Andre Cronje confirm his return to the network, as a member of the board of directors for Fantom Foundation and Fantom Operations. Andre has shared the goals and priorities for the network in 2023.

14 – Shiba Inu is a meme token on the Ethereum network that’s hinted its layer-2 blockchain is coming “very soon.” Shiba Inu is also set for its lowest burn rate in 18 months.

15 – Optimism is an L2 Ethereum scaling solution that’s recently noticed USDC and USDT transactions have skyrocketed to surpass $1B. Optimism has also announced the Goerli testnet is migrating to Bedrock on 12 January 2023.

Follow Rebecca on Twitter and Instagram.

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

Don’t forget about the Crypto Alpha Report, where my team and I analyze the crypto markets for countless hours and put all of our findings from the previous month.

Value-packed & exclusive for the Premium Subscribers of the Wealth Mastery Newsletter!

Want a taste of the report?

Unlock the Crypto Alpha Report right now with a 7-day free trial! 🚀

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.