SEC Drops Nuke, Bitcoin Eats it for Breakfast

In This Issue

- David shares his thoughts on the SEC suing Binance & Coinbase & what this actually means.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has a report on ERC-6551 (Token Bound Accounts).

- In case you missed it by Rebecca.

A comprehensive deep dive on altcoin investing

EXPLORE THE ALTCOIN COURSEThe News Now

SEC Sues Binance

On Monday, June 5th, the SEC sued Binance, Binance.us, and CEO Changpeng “CZ” Zhao for allegedly violating multiple federal securities laws.

Here’s the SEC’s main allegations (137 pages reduced to 6 points):

- Binance operates unregistered trading platforms which allow U.S. investors to buy and sell crypto securities. BNB, BUSD, SOL, ADA, MATIC, COTI, ALGO, FIL, ATOM, SAND, AXS, and MANA are all securities, as well as Binance’s BNB Vault, Simple Earn, and staking programs.

- Two Binance.us parent companies lied to U.S. investors about safety controls on Binance.us that don’t exist.

- CZ was secretly running Binance.us through a web of corporate structures while publicly claiming that Binance.us was an independently controlled company.

- CZ and Binance were secretly helping certain U.S. VIPs get access to and trade on Binance.com, while publicly claiming that controls were in place to prevent U.S. customer access.

- CZ and Binance diverted and mixed customer funds into other entity accounts that they owned. Most of these funds were then transferred to a third party for the purchase and sale of crypto assets, but $11M was spent on a yacht.

- Entities controlled by CZ and Binance engaged in wash trading on Binance.us, which thereby artificially inflated the exchange’s trading volumes. These same entities also acted as counterparties to customers on Binance.us.

Within 24 hours of this news, two more events happened. First, the SEC filed a temporary restraining order (TRO) seeking to freeze all assets in U.S. accounts held by Binance, Binance.us, and CZ. The SEC justified their TRO from the allegations of Binance diverting customer funds. And second, this occurred . . .

SEC Sues Coinbase

On Tuesday, the SEC sued Coinbase for allegedly violating federal securities laws by operating an unregistered trading platform that allows U.S. investors to buy and sell crypto securities.

The Coinbase complaint mentions several of the coins listed in the Binance complaint, and then adds CHZ, FLOW, ICP, NEAR, VGX, DASH, NEXO, and Coinbase’s staking program as securities.

Talk about whiplash. And it’s only Wednesday.

The Big Picture

Let’s discuss what’s really going on here.

This is the SEC’s big salvo against crypto. It’s been building for a long time, and now it’s here. Make no mistake, Gary Gensler, Elizabeth Warren, and several other politicians and bureaucrats are the purchased henchmen for Jamie Diamond and the U.S. banking cartel. Their mission: kill the crypto industry in the U.S.A.

They’re carrying out their mission, strategically, by putting U.S. crypto companies in a catch-22. “Registering” with the SEC effectively kills a crypto company’s existing business model, and not registering gets these lawsuits. This is the reason why Coinbase is willing to wage a litigation war against the SEC. Their back is against the wall, and fighting is their only U.S. survival option.

In terms of worst case scenarios, if Binance or Coinbase were to lose their lawsuits (which could take years to determine and assumes no reasonable legislation arrives before), then they’d surrender the U.S. market and move overseas. For Binance, this isn’t as huge a deal since they’re firmly established in Asia. It’s a much bigger deal for Coinbase given their founding and listing as a U.S. publicly traded company. But clearly their backup plan is either the U.K. or Dubai if the U.S. falls.

SEC’s Timing and Public Relations Moves

The SEC’s timing and subsequent public relations moves reveal their motives.

If you think it’s a coincidence that the SEC dropped these two lawsuits 24 hours apart, then you’re crazy. This was a coordinated hit with the hope of scaring the market and tanking crypto prices.

Accompanying their lawsuits were these Twitter posts with really nifty digital graphics.

And to top it all off, after both lawsuits were filed and released to the public, Gensler on Tuesday goes live on the U.S. banking cartel’s main propaganda arm – CNBC – to discuss the lawsuits with Jim Cramer. It’s jaw-dropping.

Neither “reporter” asks Gensler a single critical question. Instead, they just tee-up softballs for him as he takes shots at industry. Cramer hyperventilates during the entire segment. He’s a clown and a shill. And half-way through, Gensler says this:

“We don’t need more digital currency.

We already have digital currency.

It’s called the U.S. dollar.”

Those three sentences by Gary Gensler tell you all you need to know.

Bitcoin: The Honey Badger

Look, I know everything above paints a really dark picture.

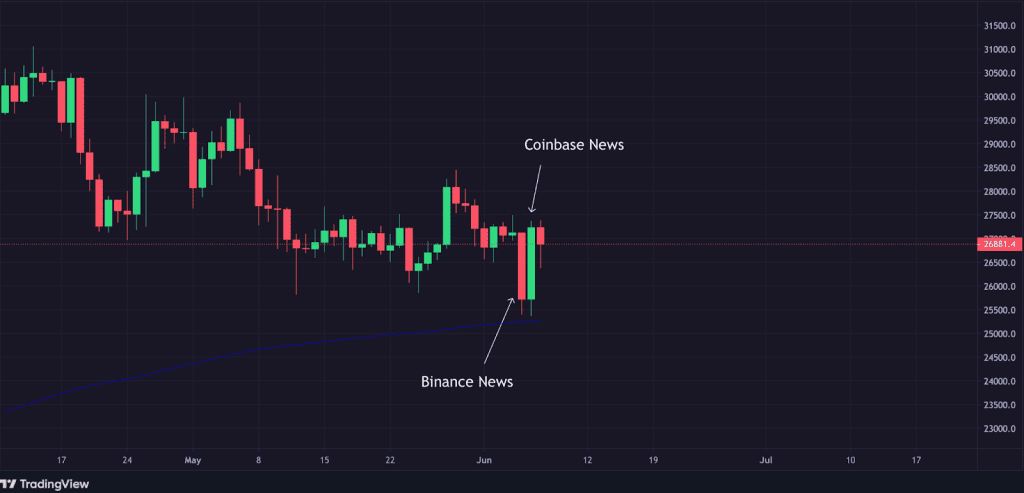

But the truth is I’m more optimistic than ever about bitcoin. Despite being “irresponsibly long”, I slept like a baby last night. Why, you ask. Well, for a bunch of reasons. One is because bitcoin did this:

That’s right folks. As the Coinbase news was breaking, bitcoin’s price bounced off the 200 day EMA and went right back to the level before the Binance news.

Bitcoin is the honey badger because bitcoin’s holders are honey badgers. We don’t care. We hold bitcoin because it’s a fair and transparent monetary system. It’s an exit ramp from the U.S. dollar, which in its current form, is a ponzi scheme, a weapon used to crush dissent, and unsustainable.

Imagine if in 2019 I told you that the SEC in 2023 would sue Binance and Coinbase back to back in U.S. Federal Court, and bitcoin’s price wouldn’t break below $25,000. Would you have believed me?

The SEC dropped their nuke, and we ate it for breakfast.

Market Analysis by Rekt Capital

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed and discussed:

- Linear Finance (LINA)

- Dusk Network (DUSK)

- Polygon (MATIC)

- Fetch ai (FET)

- SushiSwap (SUSHI)

- Cosmos (ATOM)

Let’s dive in.

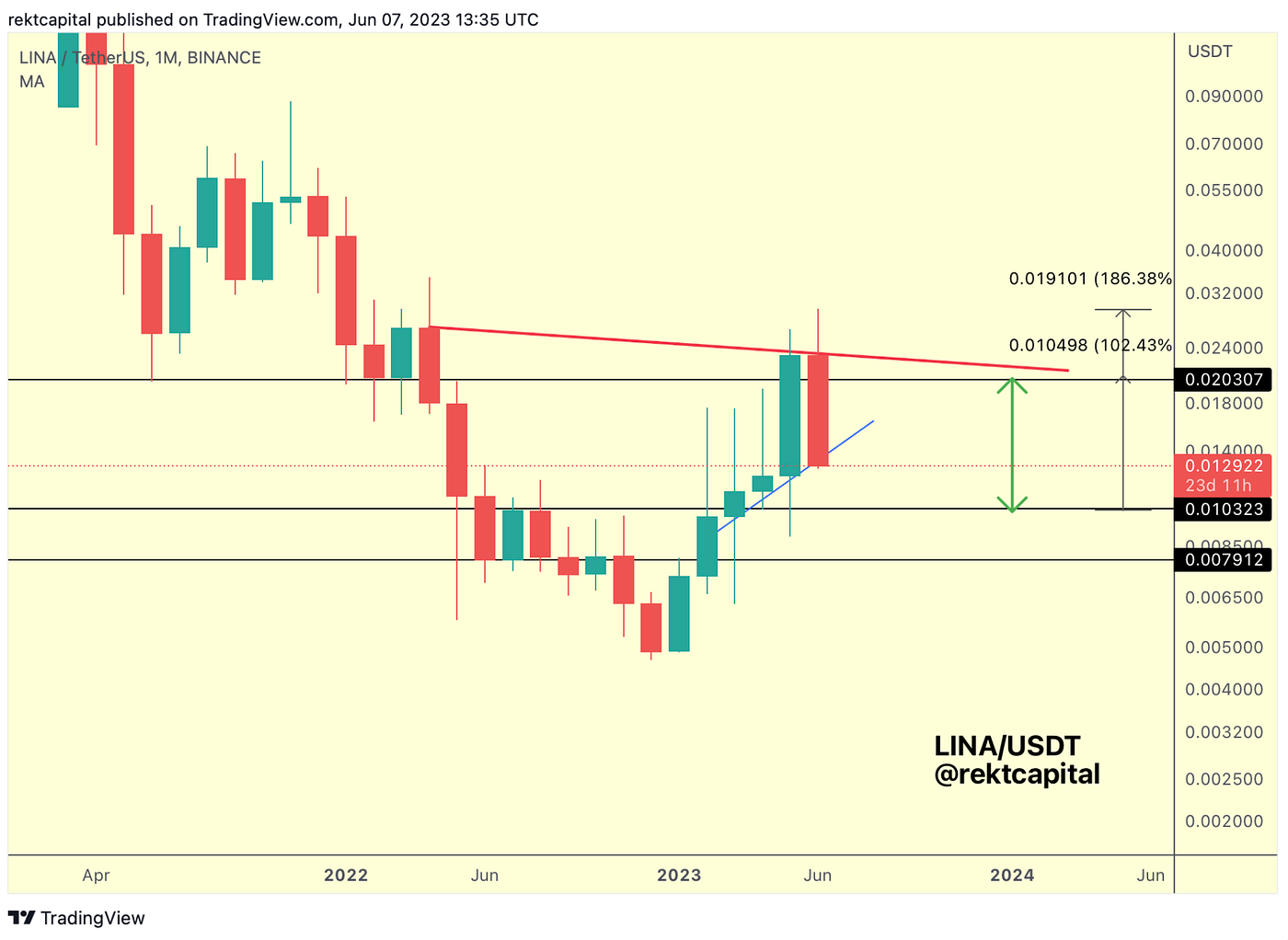

Linear Finance — LINA/USDT

As a preface to today’s analysis on LINA, here is my view on LINA featured in the mid-May edition of the Newsletter:

And here’s an update:

LINA rallied +100% after successfully retesting the Range Low as support before rallying to the Range High resistance, even overextending beyond the Range High considerably for a total +186%.

Since rejecting at around the Range High resistance area, LINA formed a new macro Lower High (red) and has rejected tremendously, dropping deeper into the range.

At this stage, LINA is now testing the technical uptrend line that price has been maintaining to support this exponential move (blue).

If this technical uptrend lapses, then there is a possibility that LINA would drop to the Range Low for a retest attempt, but this time in a downtrends opposed to a few weeks ago when price was in a clear uptrend.

Generally, the Range Low and Range High levels are in all likelihood going to be the most reactive levels for LINA.

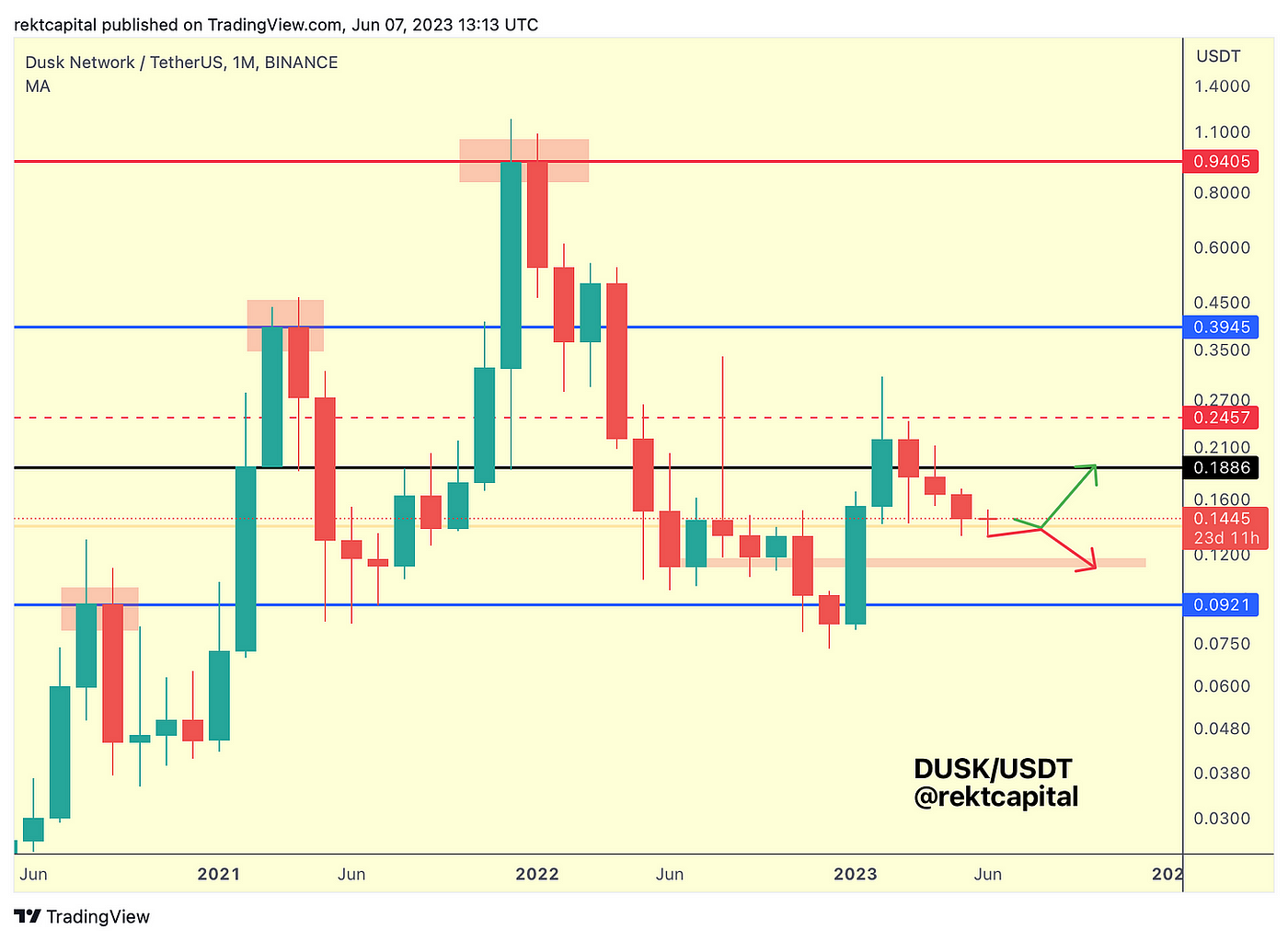

Dusk Network — DUSK/USDT

DUSK has been retracing for a few months now and is finding support at the orange area.

DUSK has been successfully retesting this area as support for over a month now and as long as this continues, there is scope for DUSK to follow the green path to revisit the black highs.

However, losing the orange area and in fact turning it into resistance could send price down via the red path, into the red area of support which would likely be a strong area of demand.

Go Premium to Keep Reading

Subscribe to the Wealth Mastery Premium Investor Report to read the rest of this article AND gain full access to the premium archives.

ERC-6551 (Token Bound Accounts) Give NFTs Something to Do by Erik

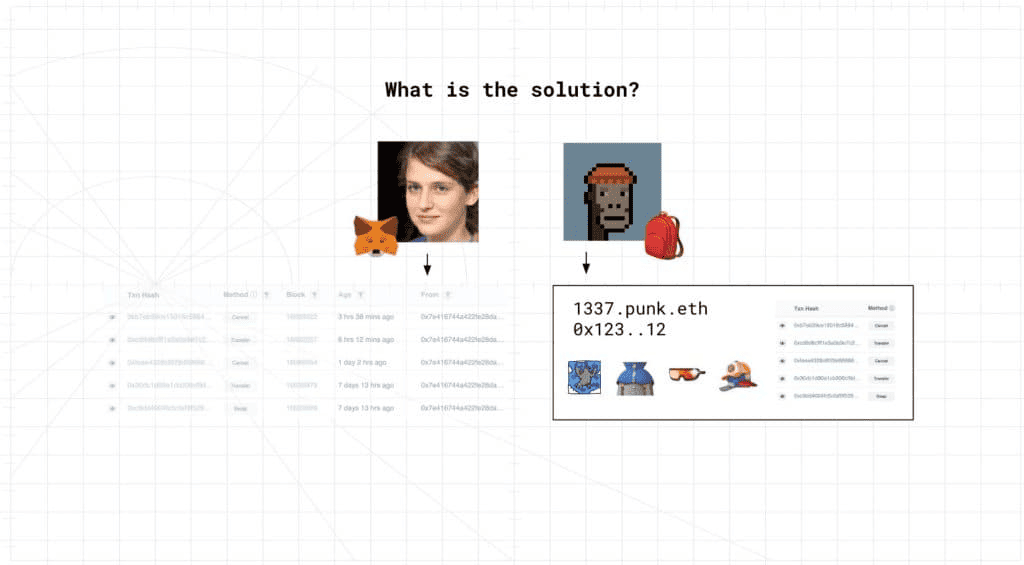

The idea is simple. What if NFTs… had their own wallets? Enter: Token Bound Accounts. These are smart contract wallets tailor-made for NFTs. Meaning that NFTs can then own ETH or other ERC-20 tokens and NFTs. Wait, so if an NFT can own an NFT, which can own an NFT, which can… yes, we are reminded of the Russian dolls.

NFTs can own NFTs that can own NFTs that… (source image: Pixabay)

Ethereum standard ERC-6551, titled “Non-fungible Token Bound Accounts,” went live on Ethereum mainnet in early May 2023. It can give each NFT a smart contract account.

Refresher: a smart contract account or smart account doesn’t require the storage of private keys. It doesn’t rely on the account holder to manually approve each transaction. Instead, the account can be customized and automated using code. That’s why smart accounts offer options such as automated regular payments, revenue sharing, and a host of other financial use cases that go beyond just sending a transaction.

Unveiled Last March

Unveiled at ETH Denver only last March, token bound accounts are making waves. It already works with existing apps such as MetaMask.

Picture this (or should I say: jpeg this – sorry). You will be able to subscribe to a service and do regular payments on behalf of let’s say your Crypto Punk or Mfer! Your Bored Ape could own a Punk and post this as collateral on Blur to get out a loan!

This is all explained in detail by one of the creators Benny Giang in this talk. The maker was inspired by Soul Bound Tokens (SBTs) and the idea is the inverse. Instead of an NFT bounded to a wallet, these are wallets bounded to NFTs: Token Bound Accounts (TBAs). Each token bound account is owned by a single ERC-721 token (NFT). It allows the NFT to interact with the blockchain, record a transaction history, and own on-chain assets.

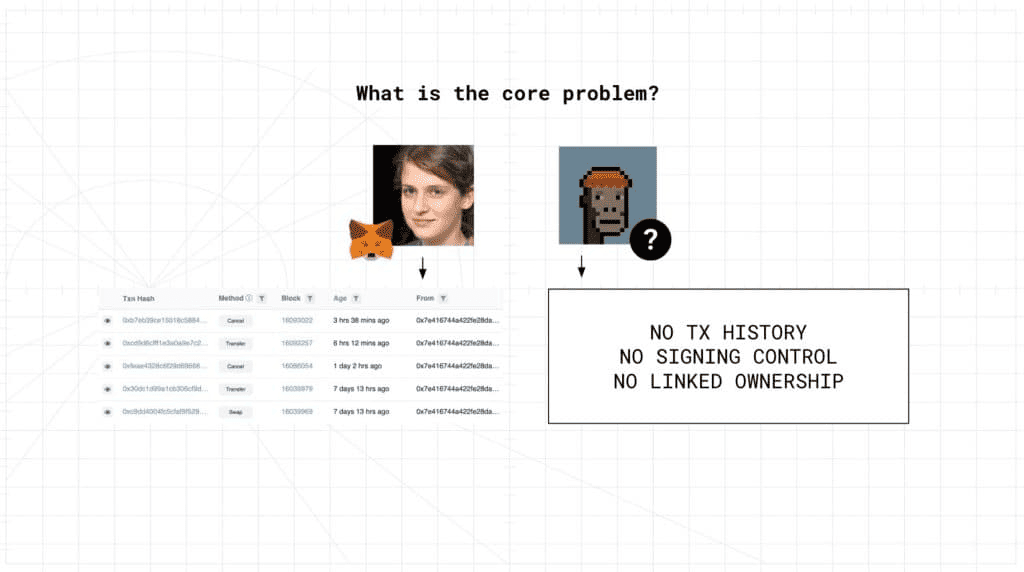

The Problem With the Current State of NFTs

NFTs on Ethereum (ERC-721 tokens) have a limitation: they don’t have agency. They don’t own things, they have no transaction history.

Now envision NFTs with tokenbound accounts. Let’s say an in-game character NFT accumulates assets and abilities over time. No longer a static jpeg!

Source image: Benny Giang

Of course, the control of each token bound account is delegated to you, the owner of the ERC-721 token. You can initiate on-chain actions on behalf of your NFT.

Why would you want such a thing? I already gave the example of gaming. But think for a second about profile pictures NFTs. For example @punk6529, the pseudonymous crypto analyst who expresses his views on the future of the metaverse. Would it not make much more sense if the owner of this Crypto Punk could also put ‘his money where his mouth is’? In other words, that the punk #6529 could express its beliefs by owning assets such as ETH and NFTs itself? After all, transacting is a form of expressing values.

Until now, NFTs were passive. In a sense, they were slaves that were passed around. With EIP 6551, they become owners. Of course, the NFTs are still passive in the sense that they don’t initiate transactions, their owners do. Still, every NFT now has a 4337 account (account abstraction). This leaves quite some elbow room to act independently in the way that arbitrage bots already perform a series of assignments.

A Benefit: Intuitive Way to Organize Assets in ‘Folders’

Crypto wallets can become messy. Especially influential owners get airdropped tons of worthless NFTs in their wallet. Wouldn’t it be nice for them to organize a wallet in folders, including a trash folder?

The ‘folder’ in this case would be a separate NFT to which they send all their trashy NFTs and worthless shitcoins. Similarly, they could send all their NFTs from the Bored Ape ecosystem to their primary Bored Ape. It’s all possible because NFTs now can contain other NFTs. (idea from Web3Academy).

A practical application of this is ticketing. An obvious use case for an NFT is to make a ticket for a sports match into an NFT. But an entire season pass can also be an NFT, containing the NFTs for the individual matches. Of course, bundling all these NFTs makes it much easier to sell tickets and season cards.

To use a cliche: The possibilities are endless. Not just tickets, but any online item that fits within a certain hierarchy. That’s indeed almost anything: songs and music albums as NFTs, for example. And what about gaming characters? All the swords, skins, and helmets that your character (an NFT) owns, don’t have to end up in one big pile in your wallet, but are stored where they belong: with the character.

By the way, this will make it much easier to transfer assets and switch between platforms. You can tie together all your on-chain belongings (as long as they’re EVM-compatible) to one NFT and transfer that one in a single transaction.

Another Benefit: Messaging

Blockchain isn’t just about owning your money but also about owning your data. Your messages on messaging apps or social media apps deserve the safety and uncensorability of logging in with Ethereum. Ethermail is an example (they’re airdropping tokens now by the way). If NFTs can have an account, their holders can message/mail each other. So it suddenly becomes extremely low-threshold to contact the holder of a mfer NFT: you simply message the NFT itself!

What Do I Need to Do?

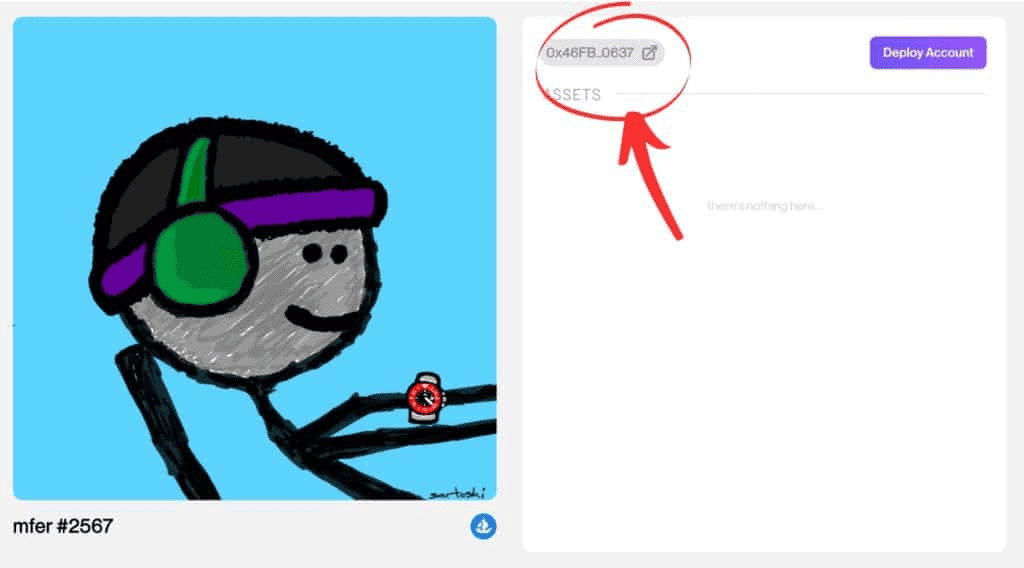

Token bound accounts are backward compatible with the ERC-721 (NFT) standard. With a permissionless registry, similar to ENS domains, every single NFT will automatically have a token bound address. This means your existing NFTs can implement ERC-6551 without undergoing any fundamental changes. Only the owner of an NFT will be able to use it when that wallet address is deployed. You can think of it kind of like a token-gated safe: the owner of the NFT will always own the wallet and all assets inside, and all execution permissions on the wallet.

If you own an NFT, here’s how you find out its wallet address:

- Go to Tokenbound.org and connect your wallet.

- Look up your NFT.

- Click on the address that’s popping up.

- Click Deploy Account.

- When the deployment is complete, the notation will change to “Use Wallet” and you can operate your wallet (token bound account) from here. Well, soon. At the time of writing, the Ethereum mainnet only allows deployment. So, it’s not yet possible to move assets in and out of ERC-6551.

Let’s wait which steps are next in the coming weeks and months, as an application ecosystem will no doubt develop. Then, your NFT will be able to vote in DAO’s, message other NFTs, get its own ENS name, etcetera…

Conclusion

NFTs are moving from a jpeg in your MetaMask towards self-sovereign identities. They can own assets, perform on-chain actions, in other words, they create their own history. This takes NFTs beyond ‘buy sell trade’ dynamics. By giving them something to do, these NFTs can populate the metaverse, engage in trades. It has always been clear from the speculative frenzy around NFTs that people yearn for a way to express their online personality with an avatar. With token bound accounts, these NFTs suddenly become much more expressive.

In Case You Missed it by Rebecca

Crypto Market News

- Binance, Binance US, and CEO CZ have been sued by the US SEC for failing to register as a securities exchange and have pressed 13 charges against them. Source

- The US SEC is also suing Coinbase for breaking its securities laws and offering unregistered securities. Source

- Trading volume on DEXs has grown 88% following the Binance and Coinbase lawsuits. Source

- Atomic Wallet, a centralized service, has been hacked for $35M worth of Bitcoin, ETH, USDT, and other tokens. Source

- Google searches for “crypto” have fallen to 2020 levels with a 17 out of 100 score, down from its maximum score in May 2021. Source

- Huobi has become the first member of the Hong Kong Virtual Assets Consortium which aims to provide a ratings service and crypto indexes. Source

- Nansen has announced job layoffs that will cut 30% of its workforce due to hiring too much in the bull market and a prolonged bear market. Source

- Bybit has announced it’s paused its Canadian operations, making them the third exchange to exit the country. Source

- Kraken’s Canadian deposits increased 25% after Binance announced its exit from the country. Source

- Nike has partnered with EA Sports to bring its SWOOSH NFTs to the gaming ecosystem. Source

- Bitcoin miner CleanSpark has bought 12,500 Bitmain machines for $40.5M. Source

- AI developers have launched a Talk2Satoshi chatbot which uses an API from ChatGPT and a dataset of Bitcoin resources to answer all your Bitcoin-related questions. Source

- Mercado Bitcoin, Brazil’s largest crypto exchange, has been given a license to operate as a payment institution. Source

- El Salvador’s Volcano Energy has received $1B in commitments to build a 241 MW Bitcoin mining facility. Source

- Louis Vuitton is set to launch physical-backed NFTs for $42,000. Source

Coins and Projects

- Bitcoin mining difficulty has risen to an all-time high level of 50.68 trillion after the latest adjustment added 3.4% on May 31. Source

- Bitcoin Ordinals has released an upgrade to rectify the 71,000 invalid inscriptions, allowing them to be traded. Source

- OKX exchange has proposed the BRC-20 Bitcoin standard implement a BRC-30 mechanism for staking. Source

- Ethereum liquid staking platform Rocket Pool has launched on zkSync Era. Source

- Optimism has initiated its Bedrock upgrade designed to lower gas fees and reduce deposit-confirmation times by 90%. Source

- Tether has announced it’s expanding in the Republic of Georgia through a strategic investment with CityPay, a local payment processing company. Source

- Tether’s USDT on Tron has hit a record high of $46B 5 years after Tron’s mainnet launch. Source

- USDC issuer Circle has sold off all US Treasury bonds from its USDC reserves as a precaution ahead of the debt ceiling deadline. Source

- Circle is to launch the official version of USDC natively on Arbitrum on June 8 and will replace the current Ethereum-based token that is bridged to Arbitrum. Source

- Binance is planning a resource reallocation with a round of layoffs that will cut its workforce by 20%. Source

- Binance’s market share has dropped to its lowest level since October 2022. Source

- Binance will delist 12 privacy tokens in France, Italy, Spain, and Poland from June 26. Source

- Polygon has been used to issue a Euro-stablecoin-denominated bond for Lamar Olive Oil using DeFi platform Obligate. Source

- Deutsche Telekom, T-Mobile’s parent company, has become a Polygon validator. Source

- Multichain has revealed it’s unable to reach its CEO which has fueled rumors that the leadership team could have been arrested in China. Source

- Gateio has released a statement to quash rumors of its involvement with Multichain and says its operations are running healthily. Source

- Sui has signed a multi-year deal with Red Bull Racing to become the Formula One teams’ blockchain partner. Source

- Avalanche has hit 1 million monthly active users for the first time a week after launching its AvaCloud platform allowing developers to create subnets. Source

- TON Foundation has proposed a burn mechanism which will burn 50% of validator rewards. Source

- TRON has launched on Ethereum via its BitTorrent bridge. Source

- Alchemy Pay has partnered with Mastercard to launch an “NFT checkout.” Source

- Coinbase is set to launch institutional Bitcoin and Ethereum futures from June 5. Source

- GameStop has partnered with Telos to pilot GameStop Playr, its new Web3 game launcher. Source

Macro News

- US Senator Elizabeth Warren has said crypto payments are facilitating fentanyl trade in China. Source

- US jobs increased 339,000 in May which is above the 190,000 estimate. Source

- US House Republicans have unveiled a new draft bill for crypto regulation. Source

- The European Parliament has officially signed into law the crypto regulatory framework known as MiCA. Source

- Chinese officials have issued a warning about AI as a risk to national security. Source

- Apple users of its new savings account in partnership with Goldman Sachs are suffering withdrawal delays. Source

- Jack Dorsey has thrown support behind Robert Kennedy Jr. to win the US presidential race in 2024. Source

- JP Morgan along with 6 Indian banks has settled dollar transactions on its Onyx blockchain platform. Source

- Apple has announced its mixed-reality headset, Vision Pro, which is its first product since the Apple Watch in 2014. Source

Final Notes

Crypto wallet hack, Big Bitcoin news from Brazil! Watch the video below to find out more. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.