Surviving the Crypto Bear Market of 2022

Crypto bear markets are brutal, and understandably but unfortunately knock out investors that are new to the game: ‘I’m done with this shit!’ Experienced investors, however, love bear markets. They see them as a great time to accumulate coins and generate future wealth. But to thrive, you first need to learn how to survive.

The Crypto Bear Market of 2022

In the way that Tolstoy stated that each unhappy family is miserable in its own peculiar way, every bear market is painful in its own unique fashion. The 2022 crypto bear market unfolded as a perfect storm of external forces exposing self-inflicted damage.

The American Central Bank started raising interest rates and slowing down the money printer. This was bad for stocks and crypto – bad, really, for everything that wasn’t called the dollar. As crypto prices kept slumping, it became clear which projects and companies had taken on too much risk. When the Terra ecosystem collapsed, we saw hedge funds and lending platforms being exposed to leveraged positions. This caused forced selling left and right: a brutal capitulation event that tanked prices by more than 50% in a few weeks.

Dealing Psychologically with your Bear Markets Losses

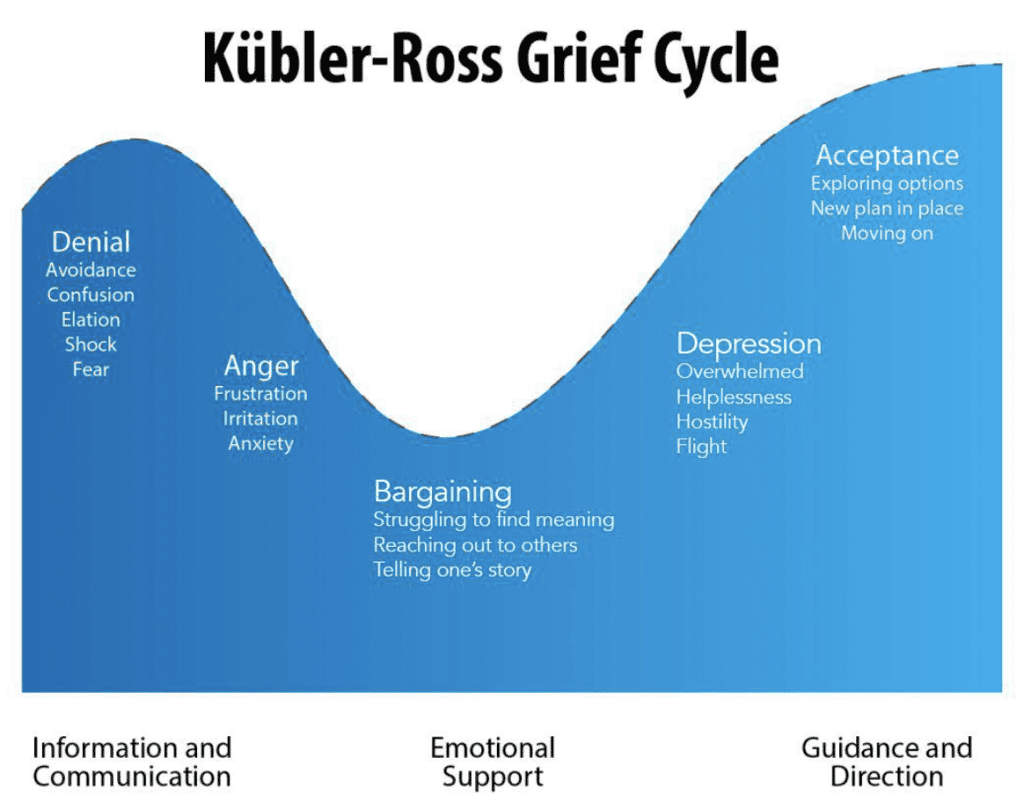

Let’s retrace a bit and linger on how you are feeling in this bear market. Unless you magically sold the top, you might be looking at pretty steep losses in your portfolio app – at least compared to the top. As it sinks in that these are not just numbers on a screen, but losses that might impact the way you live your life in the coming years, it is no wonder that you feel bad. It’s ok to mourn these losses. Grief comes in five stages, and, as the guys from Bankless point out, these can apply to financial losses as well:

- denial

- anger

- bargaining

- depression

- acceptance

It’s to be expected that you go back and forth a bit between these stages until you reach the stage of acceptance. This is crucial. To learn from what happened, you’ll have to face some hard truths. And that’s when you can get productive again and build your wealth. So let’s do it.

Should you Invest in the Crypto Bear Market?

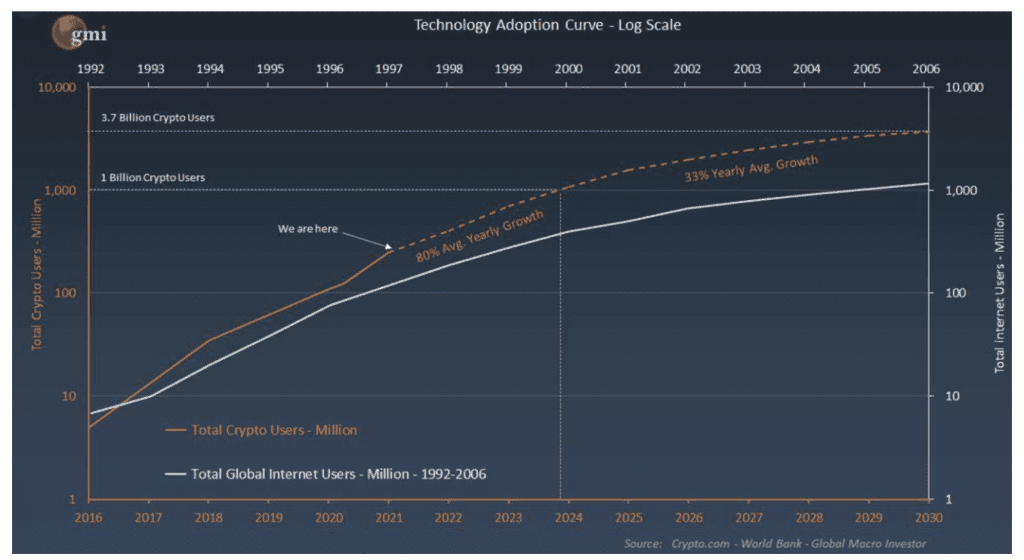

After having picked yourself up, you can proceed with asking yourself a key question. Is crypto here to stay? Have the events that led to the 2022 bear market (monetary tightening and irresponsible behavior by crypto companies) led you to believe crypto is dead? You can answer that question for yourself, but in the meantime look at this adoption curve. In the end, adoption is what drives prices.

The Key Question

Do I believe that crypto is here to stay? That it will be bigger than it is now in let’s say 5 or 10 years?

If you answer this question with ‘probably yes’, then it’s worth staying around and investing. And what better time to do that than during a bear market? If you are very unsure about this answer, educate yourself and answer the question again.

Rules for Making Money in a Crypto Bear Market

#1 Psychological Survival is Key

So you’ve decided to keep investing during the bear market. How much? Not so much that in case the market tanks, you will lose sleep over it, freak out and sell the bottom. So we’re talking psychology here. Most investors will tell you survival is a game of psychology. This is also the opinion of crypto veteran and NFT philosopher Punk6529. Know yourself, he says.

Why? Only when you know your risk tolerance, can you take calculated financial risks. Of course, you can only really experience a bear market once it happens. Still, a few questions can help to gauge your behavior. Honestly confront yourself with the following thought experiment:

“Whatever you invest, write it off to zero the next day on your balance sheet, and don’t look at it for 10 years.”

Could you live with that if it actually went to zero? Can you honestly look yourself or your partner in the eye and say: my portfolio is down 80% and that’s cool? Then you are in a good place for long term survival. Your psychology is key.

#2 Make a Plan

So the first pillar of survival is the psychology part. Second, to survive, you have to have a plan to manage your investments. A lot of investors have been wrecked because they didn’t have a plan and just threw money at the market without a long-term plan.

If you had no plan before, now is the time to make one.

- What percentage of your total investment portfolio will be in crypto?

- What coins are you going to buy? How do you diversify between ‘blue chips’ and more risky projects?

- How frequently do you buy and in what amounts?

- Will you hold those coins for a long time or will you take profits – if so: at which price points?

Make a plan and stick to it – unless the assumptions you based the plan on changes drastically.

How long will the crypto bear market last? Be prepared for multiple scenarios

Bear markets can last for years. In crypto, a year or two. But there’s no guarantee. So don’t try to predict the duration of this bear market. As nobody knows where markets will go, you want to think in scenarios. For example:

- The market goes sideways for years.

- There is a catastrophic crash after the US government unexpectedly bans possession of Bitcoin.

- Crypto goes up only after Central Banks put Bitcoin on their balance sheets.

You want to make sure that your investment plan and your psychology can handle all these outcomes. Thinking in scenarios beforehand can help you stay grounded: you are prepared to at least survive each outcome in good financial shape.

#3 Get your Security in Order

If you see investing in crypto as a game of survival then you have to figure out what can kill you and what could knock you out of the game. What can kill you is poor custody of your coins. Not your keys, not your coins. Get your key management and backup in order. If you lend out crypto to earn yield or want to experiment in DeFi: fine. But you probably want to do that with a part of your portfolio.

#4 Get a Life Outside of Crypto

Crypto trader and ‘personality’ Cobie has said how he knew people who were very stable personalities but because of crypto, they gradually lost it. They couldn’t look away, they couldn’t unwind. Make sure that is not you. Don’t get too hung up on how much your portfolio was worth at the top. That number is fiction anyway: no one sells the top. If you took profits 50% before or after the top you did great. And as a newbie, it’s totally expected to end your first bull/bear run with a loss. All the OG’s have been through it.

Work out, and take care of your health in general. Walk away from crypto Twitter and get social with friends and family. Get new hobbies or pick up what you used to love outside crypto.

#5 Delete your Portfolio App

It’s fun looking at your portfolio app during a bull run, but it’s less pleasant on the other side of the cliff. So maybe just delete that app from your phone. After all, unless you are an active trader, why check the prices every ten minutes? It’s no use and won’t cheer you up. Also, the more you look at prices, the more you’ll be inclined to make impulsive decisions that were never part of your plan.

#6 Go Build Something

Bear markets are for building. Many crypto companies feel that they can finally focus on what matters during bear markets. The hype has died down, and instead of frantically onboarding clients, they can improve their products. What could you do?

- Educate yourself on finance, crypto fundamentals, and specific sectors of the market like NFTs

- Apply for a (freelance) job in crypto. As a coder, a writer, an artist that sells NFTs, you name it. Or even just a ‘normal’ occupation like as a customer service agent at a crypto company.

Read how to approach NFTs in a bear market by Sam if you want to know more about NFTs during this crypto winter.

Conclusion

Accept where you are now and learn from your behavior in the previous cycle. Know yourself. Make a plan based on some scenarios you can envision and stick to it. In the meantime, work on your crypto knowledge (or new job) as well as your life outside crypto. Really, there is one!

Responses