The Guessing Game, Synthetix vs UMA, Big Brand NFTs & Top Trending Coins

In This Issue

- For this weeks portfolio tip, I’ll be talking about the “guessing” game.

- David compares Synthetix and UMA, two synthetic asset platforms on Ethereum.

- Sam has a report for you on big brands & NFTs

- Rebecca has this week’s top trending coins.

Premium Subscription highlights this week:

- Lark’s Portfolio: An inside look at all my crypto investments and their exact size in relation to my portfolio.

- Jesse’s altcoin report: Jesse dives deep into Pancakeswap so you can make an informed decision before investing.

- NFT mints: 3 upcoming NFT mints to keep an eye on.

Lark’s Portfolio Tips

No One Knows

This chart is not for some some random shitcoin or dog coin meme, it is for a company called Carvana which is a company dealing in used cars that is down 97% from its all-time-high.

Less than a year ago Morgan Stanley analysts were calling for this stock to go up to $420, now they are calling for it to go to $1. This is not a dig at the Morgan Stanley analysts though, predicting the ins and outs of the used car market a year in advance is tricky business.

The point though is that we are all just guessing. The more data, charts and models you have on hand the better your guessing becomes. But it is still just guessing.

Also keep in mind that if I were to for example make a tweet saying “Bitcoin will end the year at $30,000” that there would be people who think something else. Bitcoin is going to $10,000. Bitcoin is going to $40,000. Bitcoin will end the year at $20,000. And they will be making those statements with utter conviction that they are indeed correct. And in the end someone will be right, or at least close, but not everyone will be right. They can’t be.

Plus, who the hell really saw the FTX collapse as a likely scenario in 2022? This market remains super high risk. I mean, imagine if the New York Stock Exchange went bust? That is the crypto equivalent of what just happened. Again, no one knows.

But it underlines the reality of markets. You are alone in your decisions. No one can make your decisions for you, because no one truly knows what is going to happen.

So many people will get obsessed with “timing the bottom”, but you don’t need to do that to make money in the next bull run. Dollar cost averaging now or waiting for a reversal are both good plays in the current conditions. Macro is still largely shit, but won’t be forever.

Another bull run will come for crypto, the only question is when, and if you will be ready to make the decisions necessary both now and then to make it big.

The bear market is a gift. The bear market buyers stand a much better chance at massive wealth creation in the next bull run. It also gives you a chance to regroup and to educate yourself as much as possible on the markets before things get hot again.

Start your Wealth Mastery Premium Subscription today!

Big Brands & NFTs by Sam

A sure sign of crypto maturing is mainstream brands showing signs of adoption, and that’s been especially apparent with NFTs, which can be used in various ways.

NFTs are distinct because they’re often centered around a visual or artistic element, but at the same time, they’re absolutely a part of the crypto world, and so they can easily act to onboard people into crypto more generally.

There’s been a lot of activity around mainstream brands and web2 platforms integrating NFTs and web3 concepts, and some notable developments are unfolding.

Image credits: Reddit

One of the NFT stories of the year, that has bucked the bear market trend, is Reddit’s foray into the JPEG world. Reddit doesn’t actually call its items NFTs, they’re referred to as Collectible Avatars, but, well, they’re NFTs, and fall most closely into the PFP category.

The Reddit NFT marketplace has only been active since July, but Reddit’s NFTs have now done over $10 million in sales volume. This all came as a shock, since mention of NFTs doesn’t always elicit a positive response in non-crypto social media circles.

However, if it indicates a shift in general sentiment, then perhaps all it took was a minor rebranding. Either way, we have a huge platform making use of NFTs and onboarding users into web3.

Reddit Collectible Avatars are on the Polygon blockchain, and they can be traded on OpenSea and elsewhere, just like any other Polygon NFTs.

Image credits: Instagram

It was announced this month that Instagram will allow creators to mint, showcase and sell NFTs within its platform. This makes sense, since Instagram is owned by Meta, which, as we know, is all-in on the metaverse, which by extension means all-in on digital assets.

Instagram has a habit of referring to NFTs as digital collectibles, so it looks like, as at Reddit, new terminologies are gaining traction where web2 meets crypto. Another similarity with Reddit is Instagram’s decision to utilize Polygon for its NFTs.

Initially, Instagram’s new feature will only be open to selected creators and artists, so we’ll have to wait and see whether it rolls out more widely.

This is not Instagram’s first integration of NFTs, as since May, it has–along with Facebook–allowed users to connect a wallet and display NFTs, and there are plans to expand support to include Solana and the Phantom wallet (Ethereum, Polygon and Flow are currently supported).

Starbucks

Image credits: Starbucks

Coffee and NFTs have always gone well together, and now Starbucks is getting into the web3 shift. Announced back in September, the move is called Starbucks Odyssey, and it utilizes NFTs as part of a loyalty program.

The idea is that rewards stamps come in the form of NFTs, which can be earned and traded, and which unlock benefits and coffee-related experiences. There will be limited edition stamps and a marketplace, and purchases can be made with a credit card rather than with crypto.

The project is due to launch this year, and there is a waitlist open for current Starbucks Rewards members.

Toys R Us

Image credits: Toys R Us

Another huge brand showing interest in NFTs, and perhaps inducing some nostalgia, is Toys R Us. The famous toy store already released an NFT collection last year, and, more recently, has worked with Vee Friends, along with Macy’s, on physical collectibles.

It now appears that Toys R Us is pushing forward with more NFT-related plans, having set up a Toys R Us NFT Twitter account and indicated that it will be working with Solana. The project is being implemented in collaboration with a web3 creative agency called Anybodies.

There are no firm details about exactly what Toys R Us are working on, but, going by the company’s second tweet (of only two) it looks like they’re going phygital.

One potential issue is that there is concern around the future of Solana, due to the fallout from catastrophically imploding crypto exchange FTX, so we’ll have to keep an eye on that developing situation.

Shopify

Image credits: Shopify

Earlier this year, leading ecommerce platform Shopify integrated NFTs, allowing users to mint, sell and trade NFTs as part of their business, with what’s being called tokengated commerce.

Shopify utilizes Venly, which markets itself as a blockchain-agnostic service provider, with Avalanche as the latest addition to its supported blockchains. Venly allows brands and projects to easily integrate crypto and NFTs, and lets buyers pay with credit cards rather than crypto.

Some big NFT projects have partnered with Shopify, including Doodles, Cool Cats, and World of Women, while traditional entities using the NFT service include Budweiser and the Chicago Bulls.

It’s worth keeping in mind that these integrations have all been occurring during what’s been a very rocky year for crypto, suggesting genuine belief in the long-term benefits of NFTs and blockchain development. However, the program is still in its beta phase, and is only available in the US.

Polygon

Image credits: Polygon

A special mention must go to the Polygon network, which sometimes appears to be onboarding the whole of web2 into crypto.

Polygon is a leading Layer 2 sidechain running alongside the Ethereum blockchain, offering low-cost transaction fees and enhanced scalability. The native token of the Polygon network is Matic.

Of the developments listed above, Starbucks, Reddit and Instagram are all utilizing Polygon, and it’s integrated–through Venly–with Shopify. Some other big names working with Polygon include Mercedes-Benz, Stripe, Adobe, and the NFL, taking in use cases as wide-ranging as data sharing, payments, and NFT collections.

To find out about NFT, gaming and metaverse development that’s happening on Polygon, and how that ties in with existing brands, it’s a good idea to keep up to date with Polygon Studios.

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Here’s what the investment community says about the Wealth Mastery Premium Investor Report

Synthetix vs UMA by David

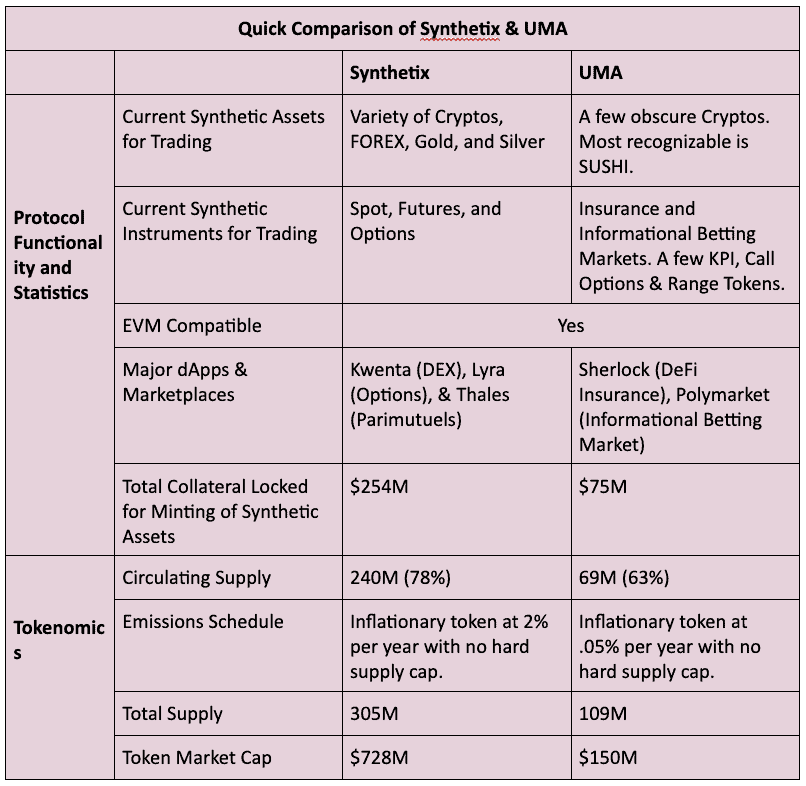

This might be a first-ever when it comes to a crypto comparison article, but I’m going for it. When it comes to a heads-up comparison between two Ethereum-based, synthetic asset protocols – Synthetix and Uma – Synthetix is the winner. Things could change quickly, given the nature of crypto. But as of now, Synthetix has the action.

This article compares the Synthetix and UMA protocols, and their native tokens, in order to provide crypto investors an edge as to what technologies and economic opportunities are coming around the corner.

Let’s roll.

What are Synthetix and Uma

Synthetix and UMA are both decentralized protocols that allow users to mint and trade synthetic assets on Ethereum. These synthetic assets are technically ERC-20 tokens that are pegged to the price of real world assets. As the price of the real world assets fluctuate, so too does the value of the ERC-20 tokens. Thus, Synthetix and UMA both provide crypto-native investors an innovative way to trade and get exposure to traditional asset price action, without having to depart from their crypto-based infrastructure, payment rails, and dApps.

Within both protocols, the represented real world assets are never actually bought, held, or sold. Instead, both Synthetix and UMA require their synthetic assets to be sufficiently overcollateralized to ensure that holders can always redeem their synthetic assets for the current value of the represented real world assets.

Even though Synthetix and UMA are at different developmental stages, these protocols have the potential to be revolutionary. With this technology, anyone with an internet connection can get investment exposure to any tradable asset under the sun. If there is sufficient market demand for price exposure to a real world asset, users will gather the funds necessary to make a tradable market for that asset on the blockchain. In that sense, these DeFi protocols are attempting to bash in the doors to a traditionally restrictive and highly-regulated $540 trillion dollar derivatives market.

How do Synthetix and UMA Work

While both Synthetix and UMA are similar in that they both allow users to mint and trade synthetic assets on Ethereum, their foundational and technical aspects are very different. Let’s examine the details.

<h3 id="protocol-design“>Protocol Design- Synthetix: A smart contract protocol with its own developed dApps. Thus, users can easily access these dApps to mint, buy, or trade synthetic assets (called “synths”). The dApp Mintr is for minting. Kwenta is the premier decentralized exchange. Lyra is for options trading. Thales is for Parimutuels trading. Because these assets are ERC-20 tokens, developers can create their own dApps and integrate them on top of Synthetix’ functionality.

- UMA: Technically, UMA (Universal Market Access) is a smart contract builder and innovative oracle. Practically, it appears that UMA is more of an open infrastructure rails system that allows for the creation and price tracking of synthetic assets via smart contracts. At the time of this writing, it does not appear that UMA has its own native marketplace or decentralized exchange. Rather, it seems that UMA is depending on third-party developers to create user-interface dApps, while UMA focuses on building strong underlying synthetic asset infrastructure.

- Synthetix: (1) exchange ETH for sUSD on Kwenta; and (2) exchange sUSD for any synth available on any of the Ethereum-based platforms built on the Synthetix protocol. Top platforms include Kwenta (DEX), Lyra (Options), and Thales (Parimutuels).

- UMA: Minters determine the asset required to purchase an applicable synthetic asset. So theoretically, any ERC-20 token could be required to purchase any particular synthetic asset. UMA’s website is a good starting place for finding applicable market-places.

- Synthetix: Users can stake SNX (Synthetix native token) on Mintr (a Synthetix dApp that functions as a synth minting facility) in order to create synths. Users must stake and maintain a 600% collateral ratio for their synths. So into Mintr goes SNX, and out comes a fresh synth ERC-20 token.

- UMA: The resources available state that users should (1) typically supply ETH or DAI as collateral to UMA; (2) specify the contract terms, which typically includes identifying the underlying asset and specifying the contract expiration date; (3) minting the ERC-20 token; and (4) depositing the token to their preferred marketplace. At the time of this writing, it’s still not clear where in UMA one actually does this minting.

- Synthetix: Uses “pooled counterparty” economics to back their synths. Essentially, this means that Synthetix’ collective minter-base theoretically provides enough over-collateralization to the entire system so that any synth will be able to be redeemed for its current value. Thus, Synthetix provides greater back-stop security for any one synth at the expense of increasing the risk of a network-wide financial contagion.

- UMA: Uses contract-specific collateralization. In English, that means an UMA synthetic asset is only backed by the collateral that the minter staked to create it. Collateral from other synthetic assets cannot be tapped to back-stop the value of any other synthetic asset. Thus, UMA provides less back-stop security for any one synthetic asset in exchange for not exposing the entire network to possible financial contagion.

- Synthetix: Utilizes price feeds via Chainlink’s Price Reference Data. Thus, synth prices are completely dependent upon – and centrally exposed to – Chainlink.

- UMA: Removes third-party oracles from the equation entirely. Instead, UMA places responsibility for price accuracy onto its user-base, through a combination of collateralization, economic incentives, game theory, and a final dispute resolution process. UMA calls itself an optimistic oracle because – similar to optimistic rollups – the protocol only springs into action in the rare event that someone disputes a synthetic asset liquidation. UMA claims this process to be a more dependable method for securing correct price feeds as compared to using third-party oracles. UMA further claims that this method allows for the creation of any synthetic asset under the sun, so long as there is available price data for a real asset in the real world.

- Synthetix: Synthetix has dissolved its non-profit foundation, which was formally in charge of operating the protocol. In its place, three DAOs were established to resume control and operations. The SynthetixDAO manages funding to core contributors. The Grants DAO manages funding to Synthetix ecosystem partners. And the ProtocolDAO handles maintenance and upgrades for the protocol, user-interface, and related dApps.

- UMA: It appears that UMA operates with a core contributing team in conjunction with the UMA DAO and the SuperUMAn DAO. Stakeholders use UMA Improvement Proposals (UMIPs) to propose changes to the protocol, which are then voted on with UMA’s native token (UMA). The SuperUMAn DAO is in charge of UMA’s broader marketing campaign.

Product Offerings and Accessibility

The difference between the two protocols with regards to product offerings and accessibility is striking. Given Synthetix’ total collateral locked is $254M, compared to UMA’s $75M, you can probably infer the difference.

Synthetix’ offerings are as advertised. Current synths for trading include a variety of cryptos, FOREX currencies, gold, and silver. These synths can be traded with spot, options, and futures instruments. All of these trades can occur on Synthetix flagship dApps Kwenta, Lyra, and Thales. Minting is done on Mintr. Easy-peezy.

For as much ink has been spilled writing about UMA, its product offerings and accessibility are disappointing. In terms of product offerings, there isn’t much. UMA’s main products currently are DeFi Insurance (operating on the Sherlock dApp), and an informational betting market (operating on the Polymarket dApp). Other than that, traders can get exposure to just a few very obscure crypto options and range tokens off UMA’s product website. It’s not clear how users mint synthetic assets. So accessibility is weird. The screenshot below appears to summarize all of UMA’s product offerings at this time. Yikes!

Tokenomics

Here’s a look at the tokenomics of each protocols’ native tokens.

Synthetix

SNX is used to provide the necessary collateral in order to mint synthetic assets. SNX holders are economically incentivized to create synths because they receive inflationary rewards and trading fees on their created synths.

There have been multiple changes with concerns to SNX’ supply limit and emissions schedule over the years. But currently, it appears that SNX is an inflationary currency at 2% per year with no hard supply cap. However, the founder of Synthetix, Kain Warwick, published a proposal to the ProtocolDAO in August of 2022, which would cap SNX supply at 300 million tokens. The current status of the proposal is as a “draft” with the release TBD.

<h2 id="”>The first 100M SNX were released in 2018, with an allocation as follows:

- 60% allocated to public investors

- 20% allocated to core contribution team

- 12% allocated to the foundation

- 5% reserved for partnership incentives

- 3% reserved for bounties and marketing incentives

UMA

UMA is used for two purposes. First, UMA token holders spend UMA as votes whenever contracts are disputed (this is integral to the process of how the prices of UMA synthetic assets are tracked). Those who vote correctly are rewarded more UMA. Second, UMA holders can spend UMA as votes with concerns to issues proposed in UMA’s UMIP process.

UMA’s 1M tokens were released in early 2020. However, the UMA protocol pays inflationary rewards to UMA users who respond to price requests and win disputes. Thus, the inflation rate is estimated to be at .05% per year.

UMA’s initial token distribution was as follows:

- 35M tokens are planned to be distributed to developers and UMA users.

- 33.5M tokens are held by the core development team.

- 15M tokens are allocated to investors.

- 14.5M tokens are reserved for future token sales.

- 2M tokens were deposited into a Uniswap liquidity pool.

Conclusion

Both Synthetix and UMA are Ethereum-based protocols that allow users to mint and trade synthetic assets on the blockchain. Essentially, Synthetix and UMA are creating permissionless, decentralized derivatives markets on the blockchain. Given the traditional derivative market is the world’s largest, it’s hard to overstate how revolutionary protocols like this could be to the global financial system.

UMA is a really interesting project. In a way, it’s analogous to a layer-0 blockchain network. UMA’s focus seems to be on developing high-quality synthetic asset infrastructure rails, so that other third-party developers can build consumer-facing dApps and products. UMA’s user-based price oracle system also seems like an interesting idea.

Having said that, when it comes to Synthetix versus UMA, Synthetix is the current winner. Synthetix has a broad menu of synths that can be traded across multiple types of instruments. Accessibility is easy. UMA and its third-party partners just don’t have the synthetic assets or accessibility …. yet.

The blockchain synthetic asset space has enormous potential. Investors would be wise to keep their eyes on these two protocols moving forward.

Trending Coins This Week by Rebecca

Here are my key takeaways from the trends this week, and it’s been one of those weeks: full of good, bad, and ugly.

1 – FTX is a crypto exchange and trading platform that’s trending for all the wrong reasons. Binance plans to sell its remaining FTT holdings due to fears of insolvency at Sam Bankman Fried’s Alameda Research, causing mass withdrawals from FTX.

2 – Aptos is a newly launched Layer-1 blockchain created by ex-Meta employees that’s having a turbulent time post-launch. After 300 people deposited to the DeFi platform, Arco Protocol, the website and social media channels have gone offline.

3 – Solana is an L1 blockchain that unveiled a partnership with Google Cloud at its annual conference, Solana Breakpoint. Google Cloud is now a Solana validator which sees SOL price spike 15% upon the news.

4 – Polygon is an Ethereum sidechain that’s seen its MATIC token jump 20% in a day after Meta announced it would be using Polygon for Instagram NFT minting. JP Morgan also announced its first live public blockchain trade took place on Polygon.

5 – Stargate Finance is a cross-chain DeFi bridge solution built on LayerZero. Stargate has announced integration with Magpie protocol to enable a full future of cross-chain swaps.

6 – Gala is a play-to-earn (P2E) gaming ecosystem that’s had to play damage control after investors feared a multi-billion-dollar hack or rug pull happened on the network. As a result, the GALA token plunged 90% on some crypto exchanges.

7 – Prosper is a non-custodial prediction market on Binance Smart Chain and Avalanche that’s released its updated roadmap and teased a World Cup event coming soon. Prosper also recently began beta testing its DAO.

8 – BNB is the native coin for the Binance chain that’s rallied 27% since Elon Musk’s Twitter takeover with hopes it will be integrated into the platform. Binance CEO, CZ, has also voiced concerns over FTX/Alameda Research’s finances including plans to sell all its FTT holdings.

9 – Bitcoin miners continue to struggle during the bear market, with Iris Energy on the verge of loan default and Stronghold Digital having completed its debt restructuring. Bitcoin has however been confirmed as less volatile than the S&P500 and Nasdaq.

10 – Optimism is an L2 Ethereum scaling solution that’s integrated with the oracle solution, Pyth network, allowing developers to use over 80 real-time data feeds.

11 – Fantom is a DeFi Layer 1 that’s seen its FTM token rise 20% in one week due to a potential Andre Cronje return. He took to LinkedIn to announce he was happy to start his new position as “Vice President of Memes.”

12 – Chiliz is an ERC-20 token that powers the sports fan token platform, Socios. The Chiliz token, CHZ, has continued to rally as the excitement builds for the FIFA World Cup 2022, which begins on 20 November. Check out our Premium Membership for recent TA reports on Chiliz.

13 – Evmos is an EVM on the Cosmos network that closed a $27M seed funding round led by Polychain Capital to help accelerate the growth of its dApps ecosystem. Evmos has also launched its new hackathon in collaboration with Covalent.

14 – Ethereum sees the minting of OFA-compliant blocks rise to 73%, adding to the growing censorship concerns. Vitalik Buterin has tweeted an updated Ethereum roadmap and MetaMask has partnered with NFTBank to allow users to track the value of their NFTs.

15 – Dogecoin is a meme coin that’s skyrocketed 116% in two weeks in anticipation of Elon Musk integrating DOGE payments into Twitter.

Follow Rebecca on Twitter and Instagram.

Final Notes

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you join us in the Premium Investor Report.

You’ll immediately get access to:

- Deep dive Altcoin report & The Trending Coin Report

- Technical Analysis on the crypto large caps and overall market

- Token sales, Airdrops and DeFi Tutorials

- Updates on the NFT Ecosystem and new mints

- My Investment Portfolio Updates

Lastly, the FTX collapse news is everywhere but if you’re wondering what actually happened check out my recent YouTube video: Crypto Crash Just Got Worse! [FTX Collapse Explained]

See you next time!

Lark and the Wealth Mastery Team

Legal Disclaimer

TCL Publishing ltd (director Lark Davis, owner of Wealth Mastery) is not providing you individually tailored investment advice. Nor is TCL Publishing registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. TCL Publishing is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.