What is Arbitrum Nitro? | Arbitrum Nitro Explained

August 31st is a big day for the team at Offchain Labs and the broader Ethereum layer-two (L2) community. On the one-year anniversary of the Arbitrum One release, Offchain Labs is conducting a major mainnet upgrade from Arbitrum One to Arbitrum Nitro. Arbitrum has already gained a reputation as the premier Ethereum L2 scaling solution; so understandably, there is anticipation as Nitro is supposed to further increase the network’s efficiency, resulting in even lower gas fees for Ethereum users.

To help celebrate the upgrade, this article will provide a background and summary of L2s, optimistic roll-ups, Arbitrum One, and Arbitrum Nitro.

Let’s go!

The Problem: High Ethereum Gas Fees

This problem doesn’t need much explaining. During times of high demand, the Ethereum network becomes congested and fees rise as competition for limited block space ensues. 2020 saw average ETH fees from $100 to $500. 2021 had extended periods where average fees ranged from $50 to $150. Not good.

One Solution: Layer 2s

As the free market tends to do, a range of solutions was deployed to cope with the high fees. One solution is L2 blockchain protocols. L2s are built “on top” of the underlying L1 for the purpose of improving the L1’s scalability and efficiency.

Imagine a congested highway. Now imagine a new highway constructed and stacked directly above, and running along with, the congested one. Ramps are built so that cars can get onto the new highway and get moving. Naturally, the first highway becomes less congested. L1 and L2 blockchains work the same way.

One Type of Layer Two: Optimistic Rollups

There are several types of L2 solutions, Optimistic Rollups are one. Optimistic Rollups process and execute transactions on an L2 chain. They then bundle the data of multiple transactions together into a compressed version and send it to the L1 for validation.

What separates Optimistic Rollups from the rest is the fact that they are . . . well . . . optimistic. Optimistic Rollups assume that the L2 transactions are valid when sending over the transaction data to the L1. Thus, Optimistic Rollups are more efficient than other types of L2s because they do not have to expend energy to prove the validity of every transaction.

Optimistic Rollups do have a way to counter fraud and abuse, and this will be discussed in the next section. But at a high level, Optimistic Rollups are ingenious. I think their underlying philosophy is sound – most economic actors, most of the time, act with honesty and integrity. And when the occasional dispute does arise, Optimistic Rollups require the disputing parties to do the heavy lifting to prove validity instead of the network.

Arbitrum One: An Optimistic Rollup L2 for Ethereum

Arbitrum One, launched on August 31, 2021, is an Optimistic Rollup L2 for Ethereum. Its stated purpose was to scale the Ethereum blockchain, which would naturally result in lower gas fees and faster transactions.

And it’s been successful. At the time of this writing, Arbitrum One commands approximately 49% of the Ethereum L2 market share with $2.5B in TVL. Transactions average less than 10 cents, and hundreds of projects are live on the ecosystem, ranging from wallets, dApps, tools, bridges, and NFT products. dApps range from various DeFi products, stablecoin products, exchanges, margin and perpetual trading, and gaming.

Part of Arbitrum’s success is its accessibility. Users connect an applicable Web3 wallet (e.g. Metamask) to one of Arbitrum’s bridges and then move over their assets onto the L2. That’s all it takes to enjoy the power and diversity of the Ethereum blockchain for pennies per transaction.

Let’s dig into some details of Arbitrum One:

- Security: Security is provided from the larger L1 Ethereum blockchain. Any party can ensure correct Layer 2 results, presumably because any party on the L1 can challenge a transaction that they believe to be incorrect. This will make sense after reading 5 below.

- Compatible with ETH: Arbitrum runs an EVM-compatible execution environment for smart contracts. Smart contract programmers can write code on Arbitrum as they would on Ethereum because both systems are essentially written in the same language.

- Scalability: We’ve covered this one. Contracts, computation, and storage are moved onto the Arbitrum network, allowing for higher overall throughput for Ethereum.

- Minimum Cost: Arbitrum was designed to be lightweight and cheap. Proof is in the product, so the design works. Again, part of what makes Arbitrum lightweight is that it’s optimistic – it doesn’t expend energy to prove the validity of transactions unless participants notify the system that there might be a problem.

- Bisection Fraud-Proofs: This is how Arbitrum counters fraud and abuse. Arbitrum assumes that submitted transactions are correct. Bisection Fraud-proofs are the safety net when an infrequent dispute does arise. Here are the details:

- After Arbitrum sends over its compressed transaction data to Ethereum, a seven-day challenge period opens where anyone can challenge the validity of a proposed transaction. If one party (Bob) disputes a transaction with another party (Alice) during this challenge period, then the Arbitrium code activates a dispute resolution protocol via Bisection Fraud-Proofs.

- Because a single transaction actually has multiple technical steps, the protocol will divide all the steps into two baskets, and ask Bob to identify which basket has the problem. After Bob selects the basket, the protocol will take all the steps in that selected basket, divide it in half, and ask Bob to select which one has the problem. The protocol will keep doing this until the dispute centers on one technical step. Once that step has been identified, the L1 smart contract will compare what the step actually does to Alice’s claim about it.

- The honest party is then rewarded and the liar is penalized via slashing.

To repeat, Arbitrum assumes all transactions to be correct unless someone initiates a challenge. Challengers are required to put in the work to show that they are correct. Not the network.

Arbitrum Nitro: An Ethereum L2 Optimistic Rollup on Nitrous Oxide

Arbitrum Nitro goes live on August 31st, 2022. Offchain Labs claims it will be simpler, faster, and cheaper than Arbitrum One. If this is realized, then Arbitrum Nitro should be a massive hit, given the success of its predecessor.

Here are the high-level details of Nitro:

- Optimistic Rollup Design – Nitro will retain its Optimistic Rollup design.

- Nitro functions by doing sequencing followed by deterministic execution.

- Nitro uses code that functions as a Sequencer. The Sequencer takes transactions on a first come first serve basis and puts them into proper order.

- Once the transactions are in the proper order, the Sequencer publishes a feed of the transaction sequence to all the Arbitrum validators. This happens in less than a second from when the transactions were sequenced.

- After the feed is published, the transactions are read and processed with another piece of code called a State Transaction Function (STF). The STF is deterministic. The same inputs will always produce the same outputs.

- The STF processes and executes the transactions and then updates the L2 chain with a new block.

- Arbitrum then batches all the transactions together, compresses the data, and then sends the compressed data to the ETH chain.

- The seven-day challenge period begins. And once the transactions have finality on Ethereum, then those transactions are final on Arbitrum.

- The takeaway is that any Arbitrum node can independently operate the STF and know what the new L2 block will be. This is because STF is deterministic. Arbitrum nodes can see the eventual state of the chain the moment the feed is published (step c). This provides the network additional oversight and security.

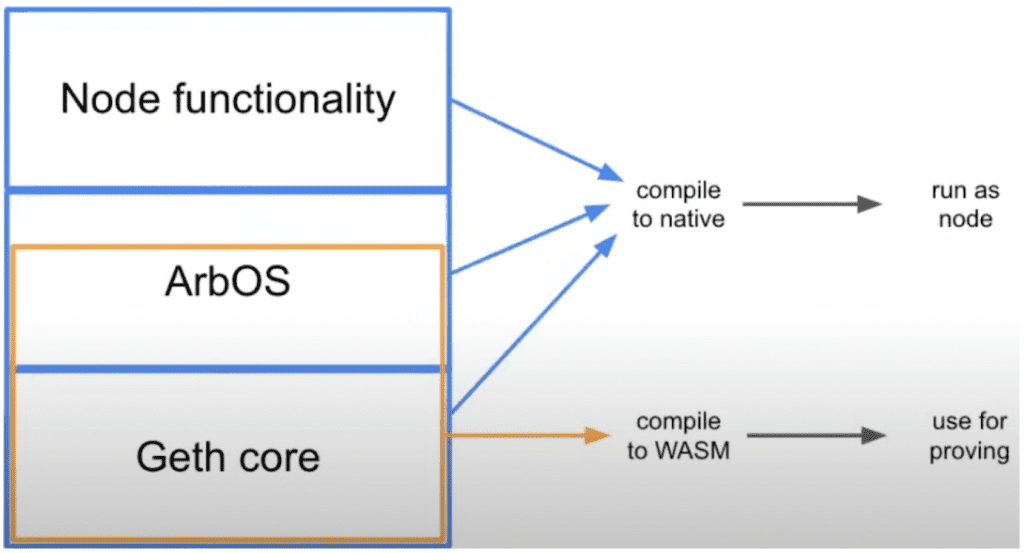

- Go Ethereum (Geth) is the core of Nitro’s software. Nitro differs from Arbitrum One in that Nitro is written in Geth, which is Ethereum’s most authoritative code. Ultimately, this makes Nitro even more seamless and compatible with Ethereum.

- Nitro separates transaction execution from proving the validity of a transaction.

- Arbitrum validators and users can run an Arbitrum node from their machine. This facilitates the execution of transactions. Running a node entails operating Getth and a program called ArbOS.

- Nitro uses the same bisectional fraud-proof design as explained above. But the difference is Nitro runs the fraud-proof software on WASM, a separate part of the network. This results in overall increased efficiency and speed. And according to Offchain Labs, this is the core trick that allows Nitro to be so fast as compared to its predecessor.

Final Thoughts on Arbitrum Nitro

Arbitrum Nitro is looking to improve on an already successful L2 solution. Nitro retains Arbitrum One’s Optimistic Rollup design and bisectional fraud-proof scheme. However, Nitro is an upgrade due to being written in Geth and having the execution and proving functions working on separate areas of the network.

Although there is no native token to invest in, the success of Arbitrum Nitro makes Ethereum more successful. Frequent Ethereum users would be wise to leverage Arbitrum, given the relative ease of bridging assets onto the ecosystem, the extremely cheap fees, and the rich ecosystem.

Interesting Read: How To Use Arbitrum | Full Guide

Responses