What Is NFT Finance?

One problem with NFTs is that they’re illiquid and–when it comes to well-established collections–can be expensive to buy into. At the same time though, there’s a lot of price volatility, which equals endless opportunities to profit.

Tapping into this situation is the emerging world of NFT Finance, or NFTFi, which basically means protocols and platforms that allow users to trade around and utilize NFTs in more flexible ways than just flipping for profit (although there’s nothing wrong with flipping for profit too).

Let’s look at some key NFT Finance products, what they have to offer, and how they might alter the NFT and DeFi landscape.

<h2 id="nftperp“>NFTperp

Operating on Arbitrum, NFTperp is a perpetual futures DEX based around NFTs. What that means is you can take long or short positions on NFT collections, without actually buying and selling the NFTs themselves. This way, you can profit from price movements on blue-chip NFTs (BAYC, MAYC, CryptoPunks, Azuki and Milady Maker are currently supported) without needing a huge stack of ETH to get started.

If you’re good at predicting price changes, then this is the platform for you, particularly as it allows you to trade with leverage (but be careful, leverage increases your risk), and because you can bet on prices going down.

Very usefully, NFTperp has a paper trading option, so you can try it out in simulation mode first before moving on to the real thing, which is actually still in beta mode.

<h2 id="jpeg’d“>JPEG’d

If you’re looking to unlock NFT liquidity and also earn passive income, then there’s JPEG’d. It’s a DeFi-style peer-to-protocol system whereby you deposit NFTs as collateral against which to mint and borrow PUSd (the platform’s stablecoin) or pETH (the platform’s synthetic Ethereum derivative).

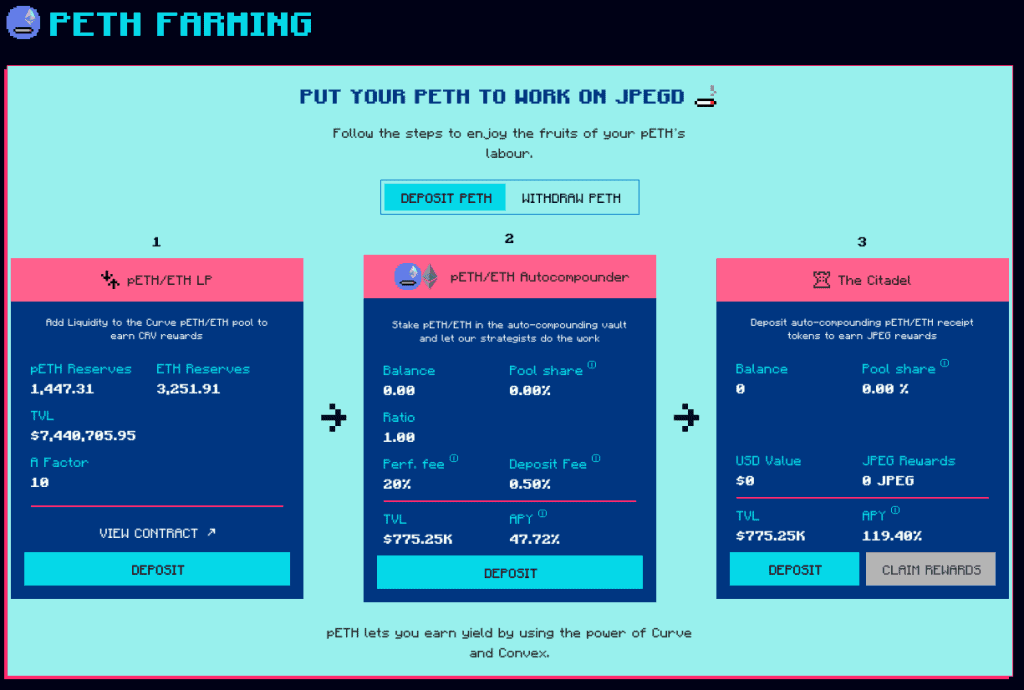

You can swap PUSd in the app for ETH, DAI, USDC or USDT, or there are mechanisms which use pETH to generate yield.

By providing liquidity in the pETH/ETH Curve pool, you can earn rewards in CRV, the Curve utility token, and you can stake to the JPEG’d Auto-compounder, which will make use of Curve and Convex to earn and compound CRV and CVX rewards (CVX is the native token of the Convex system).

And by using the Auto-compounder, you’ll get receipt tokens which can be used in a JPEG’d vault called The Citadel to earn $JPEG, which is the protocol’s governance token. Although this sounds a little complex, the process is all laid out clearly within the app.

If you use JPEG’d, always beware of liquidations, which occur if the debt/collateral ratio becomes too high (the critical level here is 36% or above). If this happens, then your NFT will be lost to an auction process.

As for the protocol’s governance token, if you just want to hold exposure to what looks like a solid platform in an expanding new corner of crypto, then you can trade $JPEG on Sushiswap. There is also a bond program within JPEG’d, whereby the $JPEG token can be acquired by depositing CVX tokens.

The JPEG’d platform has integrated eleven top-tier NFT collections and has plans to add more, and while valuations take floor prices as their guide (utilizing the Chainlink oracle), there is a Traits Boost system that takes into account rarity, although this currently only operates with CryptoPunks and BAYC.

<h2 id="renft“>reNFT

As NFTs evolve to possess utility–perhaps in gaming and metaverse worlds, or as real-life access passes–there’ll increasingly be people who want to get hold of particular tokens for a limited period of time, and that opens the door to NFT renting.

One protocol developing this utility is called reNFT, which has built a rental marketplace where NFTs can be lent and borrowed for a flexible term, at a daily rate. NFT rentals are a developing area, and reNFT emphasizes that its protocol can be easily integrated, meaning, for example, that it could be slotted into a gaming project to allow players to access or lend in-game assets.

Also, reNFT allows NFTs to be rented out while they are being utilized in other protocols, meaning there could be the possibility of unlocking liquidity against an NFT in one protocol, while simultaneously renting it out in reNFT.

<h2 id="nftfi“>NFTfi

If you want uncomplicated, peer-to-peer lending, then NFTfi is the platform of note. Borrowers list NFTs, lenders make offers detailing their terms, and when an agreement is reached, the two parties are locked into an escrow smart contract. Keep in mind that if you’re putting up NFTs as collateral for loans, then failure to repay means the lender has the option to foreclose, and you could lose your precious JPEGs.

NFTfi now also has the option to list multiple NFTs together in loan bundles, saving on time and gas fees if you want to borrow against several assets at the same time.

As an alternative to NFTfi, there’s also the Arcade platform, which operates on a similar, peer-to-peer basis, and has been growing consistently in monthly loan volumes.

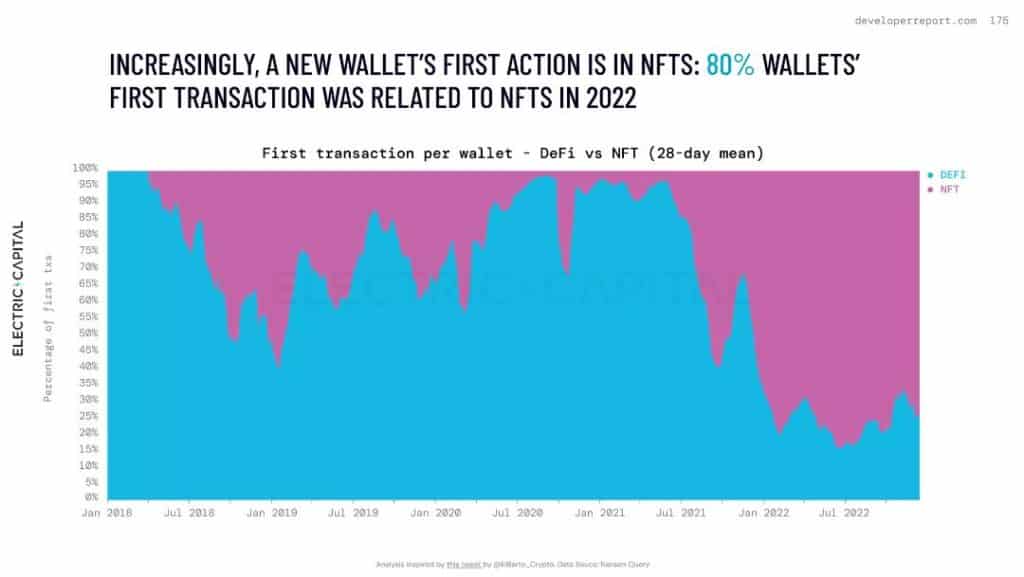

Overall, you can think of the NFT Finance world as being closely related to DeFi, but with NFTs as its base assets. Interestingly, a report from Electric Capital showed that in 2022, the first transaction by 80% of new crypto wallets was with NFTs, rather than with DeFi.

As NFTs come across as simpler than DeFi and continue to attract greater levels of mainstream attention (taking in art, fashion and established brands), NFT Finance could become a more approachable, user-friendly version of DeFi, and may experience a rapid surge in interest if NFTs go on a future bullish run.

Responses