Why Is There a Dip in NFT Prices?

TL;DR

- NFT prices, trading volumes, and numbers of active wallets have dipped significantly.

- Reasons may include: token farming on Blur, rotation into memecoins, high gas prices, over-saturation and over-complexity.

- Some projects have bucked the trend and performed well, including Azuki, Milady Maker, Mad Lads, Nakamigos, and Ravendale.

JPEG markets aren’t looking too bullish, to put it mildly. NFT prices are down almost across the board, including on major projects, and sentiment is, understandably, not very WAGMI. Did NFTs finally get found out and are they all heading to zero, or are better days on the horizon?

Let’s assess the current state of the space, figure out where the issues lie, and consider how things might play out from here.

The State of NFTs

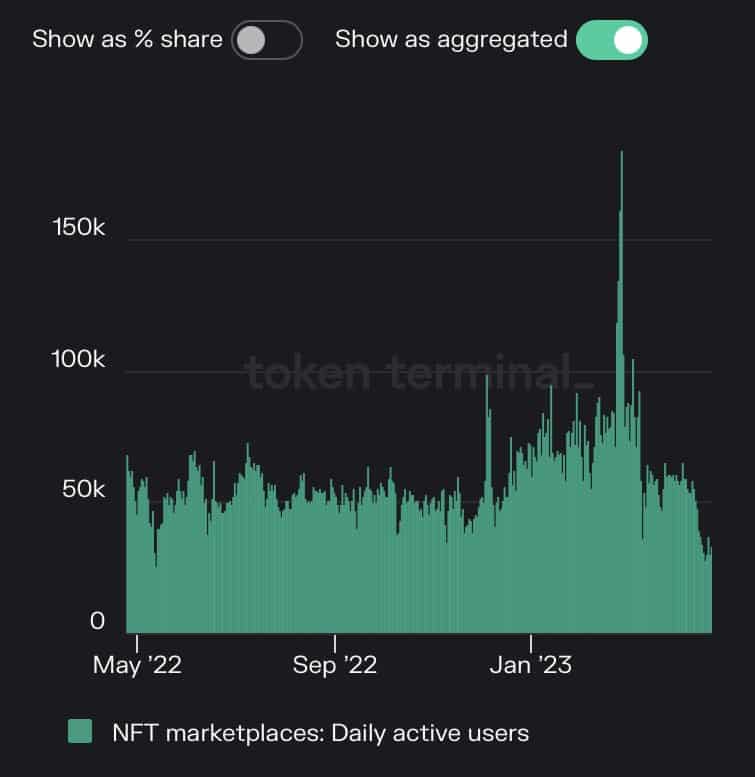

Data shows that daily active users of NFT marketplaces are at one year lows, and if you look at some dashboards, you’ll find active users down to below 10,000 a day. When you consider that many NFT collections contain 10,000 items, and there are now a lot of collections, you get an idea of how thinly spread attention and liquidity have become.

Following on from that, volume is down considerably, and we see floor prices dropping everywhere, from top-tier projects, to mid-level contenders, to the projects below those. For some examples, comparing prices in January with prices now, we’ve got Bored Ape Yacht Club down from over 80 ETH to 51 ETH, CloneX down from over 6 ETH to under 3 ETH, Renga down from approaching 2 ETH to about 0.6 ETH, and Degen Toonz down from around 1 ETH to around 0.23 ETH.

In other words, we have something that looks like capitulation, although no-one can be sure whether or not there might be more price drops still to come.

What Are the Reasons?

Although it’s not certain which are the most critical, there are several possible factors currently contributing to NFTs taking a hit, so let’s run through them.

The Blur Effect

When the Blur marketplace appeared last October, its strategy was to attract NFT traders by rewarding them for their activity, with a February airdrop of native token BLUR. A second airdrop is also coming soon, and until May 1st, rewards have been doubled.

However, this system has led to token farming, which then means traders are willingly taking NFT losses in order to secure upcoming token rewards, which, effectively, temporarily transfers value from NFTs to BLUR tokens.

And a knock-on effect of this is that even NFT buyers who aren’t token farming become reluctant to buy while this mechanism is at work, leading to sidelined participants and a further drop in prices.

Memecoins Grabbing Attention

So here’s the thing: a lot of the cohort we can call NFT people kind of enjoy gambling, or at least, enjoy risky trades where you can make quick, outsized profits. Yes, there are art enjoyoors collecting Grant Riven Yun drops because they like the pictures, and some PFP holders are in it solely for the community vibes, but flipping NFTs has been a big part of the culture up to now, and flipping is all about profit.

That in mind, it’s significant that memecoins have been front and center recently, with a few people making attention-grabbing returns on the likes of PEPE and WOJAK. Basically, you’ve got memes, FOMO and volatility, so it’s no surprise if some of the people who liked the memes, FOMO and volatility of NFT markets might switch their attention over to the memecoin casino instead.

High Gas Prices

If you’ve been making any transactions on Ethereum recently, you’ll have noticed that gas fees are high, at least partly because of the memecoin gambling. Fees were high during the last bull market too, but that was ok, because everyone was sure their expensive transactions would make a profit. Now, though, the landscape is different, and potential buyers may be more likely to just sit things out until transaction costs drop.

Too Many Projects, Too Much Complexity

There may simply be too many NFT projects, while active participants are at a low point, for floor prices to hold. On top of that, some projects have created complex ecosystems in which it’s not entirely clear how anything works or what they’re working towards.

There are projects simultaneously (as in, within one project) building games, preparing to live in the metaverse, launching tokens and pseudo-staking mechanisms, selling T-shirts and sneakers, creating animations and toys, and launching multiple sub-collections.

The point is, to someone coming at these projects for the first time, it’s confusing, and you might wonder what exactly you’re buying into. From this perspective, a simple project like CryptoPunks (PFPs and nothing else), or some art collections (you’re simply buying art), may start to look like more attractive assets.

Bucking the Trend

There are a few bright spots in the doom and gloom, with Azuki making gains through this year, and Milady Maker climbing through April from around 1.1 ETH to, at one point, over 3 ETH. Also, some new drops have outperformed, with Mad Lads generating a buzz on Solana, Nakamigos going from about 0.04 ETH to a high of almost 0.9 ETH, but then back down to below 0.3 ETH, and Ravendale steadily climbing to approach 1 ETH.

Starbucks’ latest drop failed to sell out (4,579 out of 5,000 NFTs were shifted), but once the sale had halted and unsold supply was locked off, the floor price on secondary rose, taking it above the original launch price.

This is similar to the Porsche 911 mint in January (the sale was halted due to lack of demand, whereupon prices rose to higher than minting cost), and in both cases, buyers didn’t want the NFTs when they were easily available and cheaper, but bought when buying became more restricted and prices went up.

What Happens Next to NFTs?

Blur has temporarily broken the ecosystem, attention has wandered to memecoins, there isn’t enough liquidity to cover the number of projects, gas prices are too high, and as a result the market is in player vs player mode.

Looking at that scenario, is it likely that some NFTs will recover? Keep in mind that many projects have long-term plans, and we’re in an in-between part of the crypto cycle. When, at some point, bullish euphoria returns, then NFT prices can go up, and potentially by a lot. If BTC and ETH break new all-time highs in future, it’s entirely likely that hyper-enthusiasm sets in for a while, as in 2017 and then again (with NFTs in the equation) in 2021.

New participants inject liquidity, OGs feel rich, digital flexing becomes rampant, and that may mean certain JPEGs become sought after. However, that certainly doesn’t mean every project will survive until then to make a triumphant return, and some, or many, might crash out for good.

That all in mind, if you don’t need immediate profits, you might want to pick up some gems and forget about them until hype returns. On the other hand, NFTs are the kind of asset that trades on momentum, meaning when they start running, they’re likely to run some more. So an alternative plan is to keep some dry powder aside, wait for a collection you like to start moving in sync with wider market sentiment, and buy in then.

At the same time, if you’re willing to be active in a difficult market, there are profits for the taking. Nakamigos stood out recently, but there will be others that perform well. What’s more, if you follow along with the NFT landscape now–even if only as an observer–then you’ll have a huge advantage over newcomers entering for the first time when conditions picks up.

Another factor to note is that Blur’s doubled rewards end soon, and the second airdrop should be incoming not long after that. What the platform does then, we don’t yet know, but if token farming comes to an end, that should affect the market.

Also, memecoin madness will not last forever, and when attention shifts, then NFTs might benefit (although crypto is unpredictable, so we can’t say for sure).

It goes without saying, also, that none of this is financial advice and NFTs are a risky area with a lot of uncertainty, so if you are buying, then don’t over-allocate.