ZK Rollups Airdrop, Bitcoin TA, Chainlink Functions & The Latest News

In This Issue

- I share my thoughts on the state of the market, CFTC Binance lawsuit, Cosmos the underdog & ZK Rollups airdrop.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has a report for you on Chainlink Functions.

- Rebecca breaks down the latest news.

Monthly Crypto Alpha Report

Hello, friends!

Quick reminder that the Monthly Crypto Alpha Report is being released today (March 31st)!

This is the resource that we share monthly to our premium members! It provides you with:

- 📉 An overlook of the crypto markets

- 🎈 The top airdrops of the month

- 👀 The top altcoins to watch

- 🧑🌾 The best DeFi farms

- 🙊 The most exciting NFT mints

My team and I analyze the crypto markets for countless hours and we put all of our findings from the previous month into THIS report.

Value-packed & exclusive for the Premium Subscribers of the Wealth Mastery Newsletter!

Want a taste of the report?

Unlock the Monthly Crypto Alpha Report right now with a 7-day free trial! 🚀

What’s On My Mind by Lark

The State of the Market

Bitcoin has largely spent the last 2 weeks in a tight price range moving up and down between $26,700 and $28,700. The key area for Bitcoin now is to put in a weekly close over 28k, and ideally 30k.

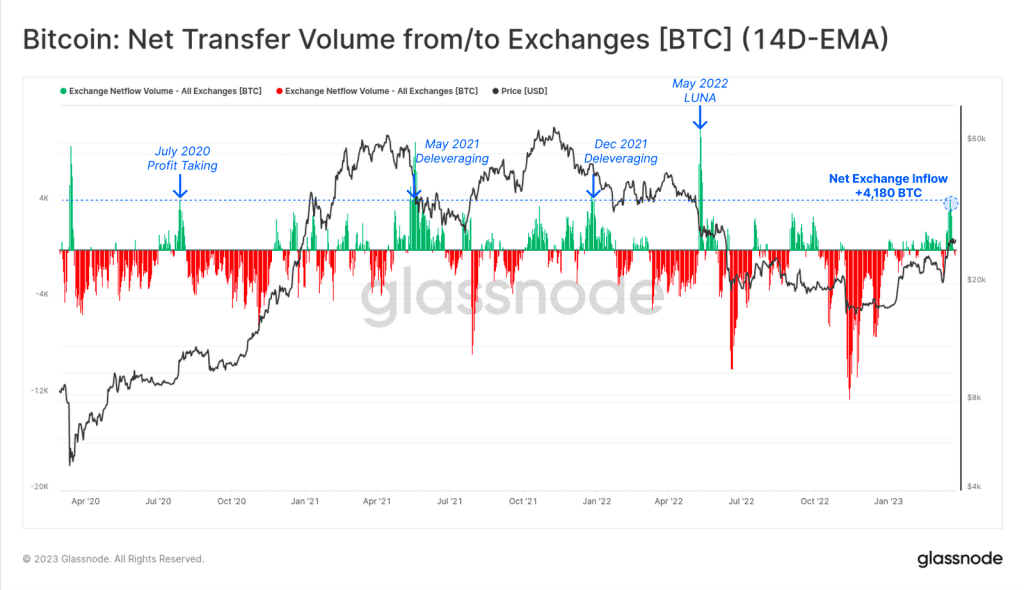

There has been a net inflow of coins to exchanges as profits got booked as Bitcoin stalled at $28,000 earlier this week.

Although this is largely from short-term holders. Who were swing trading the reversal.

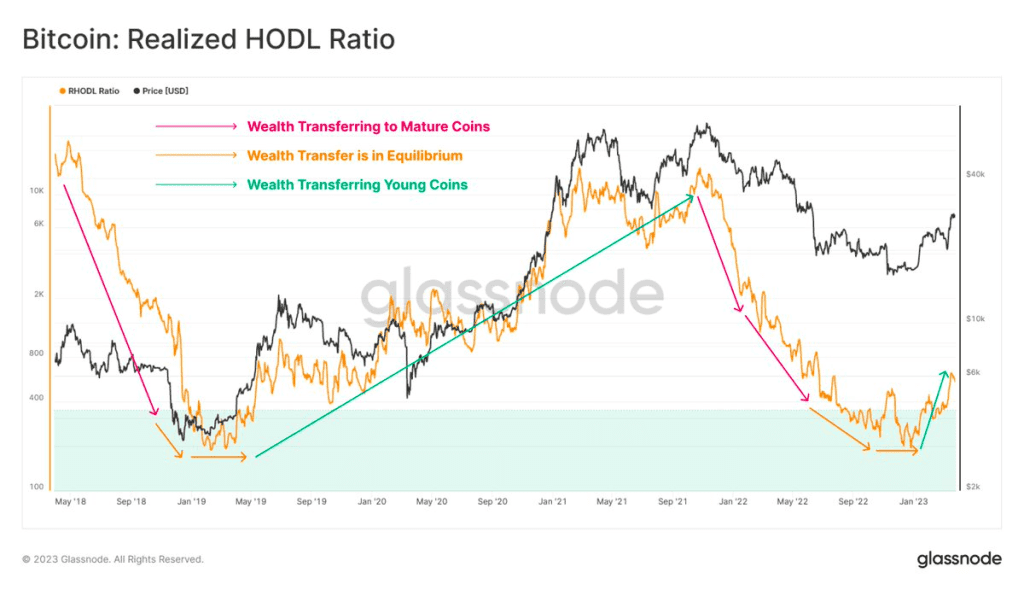

This chart underlines the fact that we are seeing a transfer of realized wealth moving from long-term holders over to new holders. Historically this has marked major cycle transition periods.

Oh, and Microstrategy bought more Bitcoin. They now have around 139,000 BTC. Or put another way 1 in 151 of every BTC that will ever exist. Their average price right now is about $29,000. This remains the corporate bet of the century.

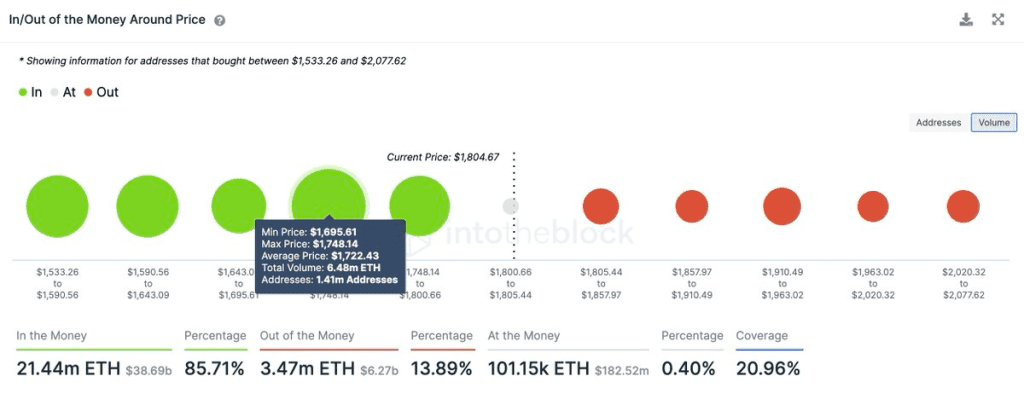

Ethereum would ideally put in a weekly close over the area from $1,700 to $1,780. This is an area where about 6% of the supply has changed hands.

Although this does largely remain Bitcoin’s show with dominance rising from 38% at the start of the year to 44% now. Coins like Ethereum are actually down against Bitcoin, although they are up in dollars.

In other Ethereum news, the date for the Shanghai upgrade has been announced for April 12th. Technically it is not scheduled for a date, but a block number, which is most likely coming on the 12th. This is a major event for Ethereum, but also one which could cause a bit of uncertainty in the market since we will see an unknown number of validators looking to unstake and cash out as well as the 1 million ETH plus staking rewards that will enter the market within the first week. Often such upgrades are “sell the news” events, and this one actually has a sell-side element to it. Will be interesting to see how the market reacts. But regardless of the short term, this is a fundamentally bullish event for Ethereum long term as it will allow for greater certainty for stakers.

XRP has been on the move this week sparking a fresh wave of rumors that they could be nearing an end to their trial with the SEC and that they may actually be winning. Although, such speculation has been floating around for a long time. Regardless of whether or not this time is true, I for one am cheering on Ripple to win its court case versus the SEC. Also, it seems that Gary Gensler the chief of the SEC is being called in to answer to an oversight committee in April to answer for the SEC’s many failures in regulating crypto. There is hope yet that the USA doesn’t completely screw this up. PS, if Ripple wins their court case then it will likely have a strong positive impact on the altcoin market.

CFTC Binance Lawsuit

In the latest attack by US regulators on the crypto industry we are now seeing the CFTC going after Binance. Here is what the CFTC is alleging.

- Binance offered derivative products to US-based customers from 2017-2019.

- Binance encouraged employees and customers to use VPNs to be able to access the exchange.

- Binance encouraged rich clients to set up shell companies in places like the British Virgin Islands.

- Binance has been involved in a web of insider trading with 300 house accounts trading against customers.

- Binance execs knew about and turned a blind eye to money laundering and terrorist financing.

- The CFTC claim to have logs of conversations between top execs at the firm.

Obviously, Binance is refuting all of these allegations saying that they have high standards for compliance, KYC, and work with law enforcement globally and they deny the insider trading claims. So it will be up for a judge to decide it seems.

What is true and not? Who knows. At this time I will remain a user and affiliate of Binance. Part of me feels like this is just another day in America’s war on crypto. I could be wrong.

Here is your reminder for any time we hear such stories. Exchanges are not banks. They are marketplaces. Don’t keep your funds on any exchange. They are safest in a cold wallet like a Ledger.

I am also reminded of the statement from Coinbase in their suit with the SEC, “Tell us the rules and we will follow them” which was met with silence and a lawsuit from the SEC.

To make matters even worse, the CFTC has stated that ETH, BTC, and LTC are all commodities, but remember Kraken was just fined 30 million dollars because the SEC claimed that staking Ethereum is a security. Can they make up their minds already!!!

The USA could quickly lose its leading role in the crypto space. The UK is looking to pass sweeping legislation, Russia and China are warming up to crypto again, the UAE wants to become a global crypto powerhouse, and on and on. In fact, in China, the situation is so crazy that there is a coordinated effort to get crypto companies bank accounts at some of the biggest state-run banks! What madness is this? Meanwhile, the USA is trying as hard as possible to stifle the industry. When will they learn that crypto is like Pandora’s Box in that it will cause chaos and cannot be put back in the box.

Cosmos The Underdog

Cosmos is a massive blockchain ecosystem that supports many major altcoin networks. Although many investors are unaware of both the tech and the growing influence of this coin.

Here are a few noteworthy things happening in the Cosmos space:

- DYDX is moving from Starkware, an Ethereum layer two, to its own Cosmos based blockchain this year.

- USDC is launching on Cosmos.

- Tenet, an EVM-compatible chain, is launching which will allow ETH dapps to enter the Cosmos universe.

- 21 Shares has launched a Cosmos ETF.

- A big project is underway in Japan with major players for stablecoins.

I don’t have a position in Cosmos, but I respect the hustle this team has shown. And the fact that so many builders keep showing up says a lot.

ZK Rollups Airdrops

The airdrop alpha is flowing hard and fast these days. And while the Arbitrum airdrop just gave early users thousands of dollars. The next wave of speculation is already here for ZKSync.

Layer Two Madness is well and truly in full swing! Arbitrum was just the tip of the iceberg. Layer two Myria is launching its token soon. Polygon just launched their zkEVM. ImmutableX and Polygon teamed up to launch Immutable zkEVm, which is yet another layer two scaling network. Coinbase launched BASE. Bybit is launching Mantle, Consensys just announced their zk-rollup called Linea, and then comes zkSync. They launched their mainnet last week, thus becoming the first zk rollup powered layer two to go live on mainnet, just 3 days before Polygon released their zkEVM.

zkSync has already raised over 450 million dollars, which is nuts. zkSync like other layer twos is all about low gas fees and high speed while maintaining network security.

No one knows for sure what could qualify for a future airdrop.

But here are some likely ideas:

- Bridge funds to zkSync.

- Use dapps (Zig Zag make a trade, Syncswap provide liquidity, buy or sell an NFT on Mint Square, do all kinds of stuff on SpaceFi.)

- Do this consistently over time say at least once per month

Also, as we have seen with Arbitrum, simply being early to farm some of these coins and invest before the wider market wakes up has been a big way that some investors have made a lot of money. I wonder if we will see a similar kind of situation play out on zkSync?

The usual disclaimer applies. It could be a long time before any airdrop happens. You might get nothing. What you get might be worth nothing. There are risks in using new chains and new protocols, hacks, exploits, rugs, and smart contract flaws all happen. You could lose all your money. Caution. This is not an endorsement to buy any coins associated with protocols mentioned.

Market Analysis by Rekt Capital

In today’s newsletter, I will cover Bitcoin as well as 5 Altcoins, specifically:

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Algorand (ALGO)

- Fantom (FTM)

- Band Protocol (BAND)

Let’s dive in.

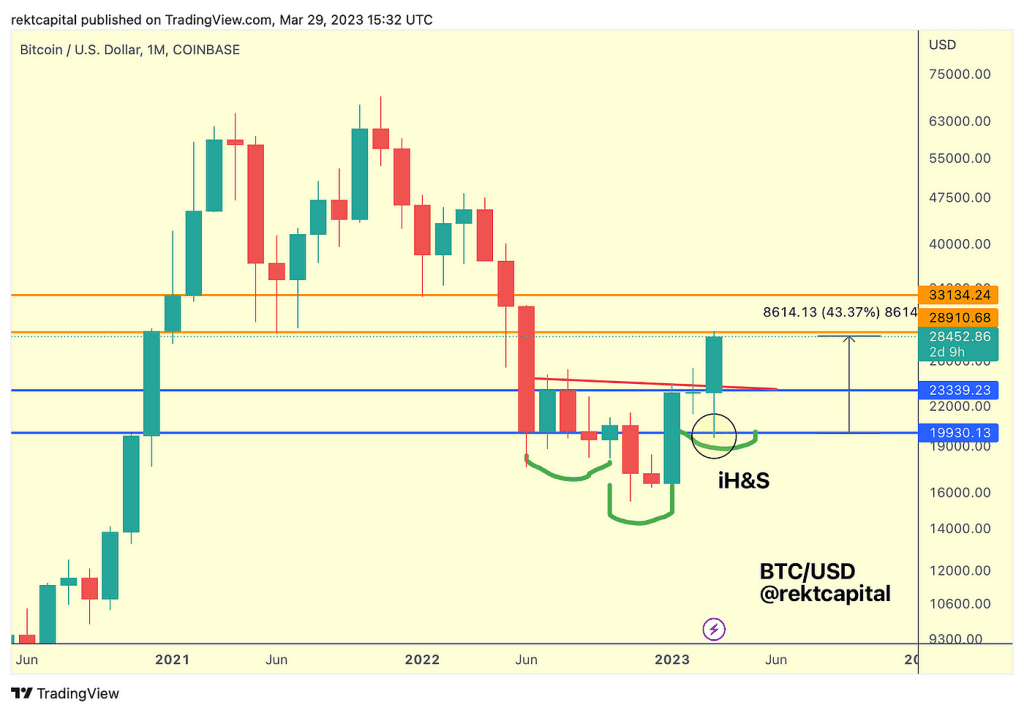

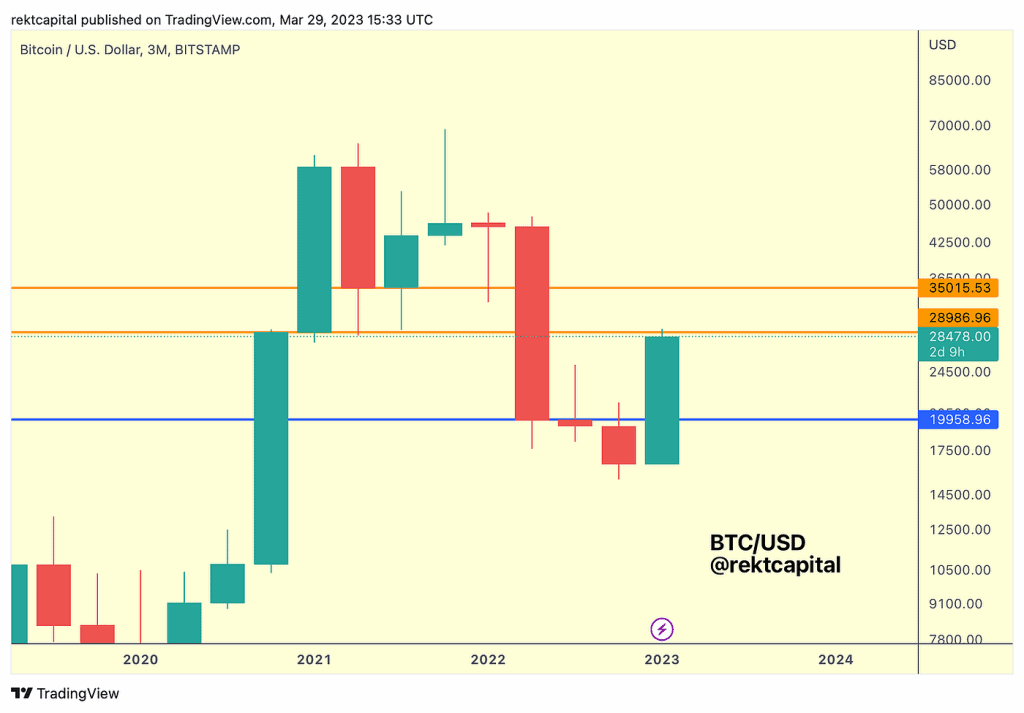

Bitcoin — BTC/USD

We’ll briefly cover BTC today just to mention a few key levels as important Monthly Candle Closes as well as Quarterly Closes are on the horizon.

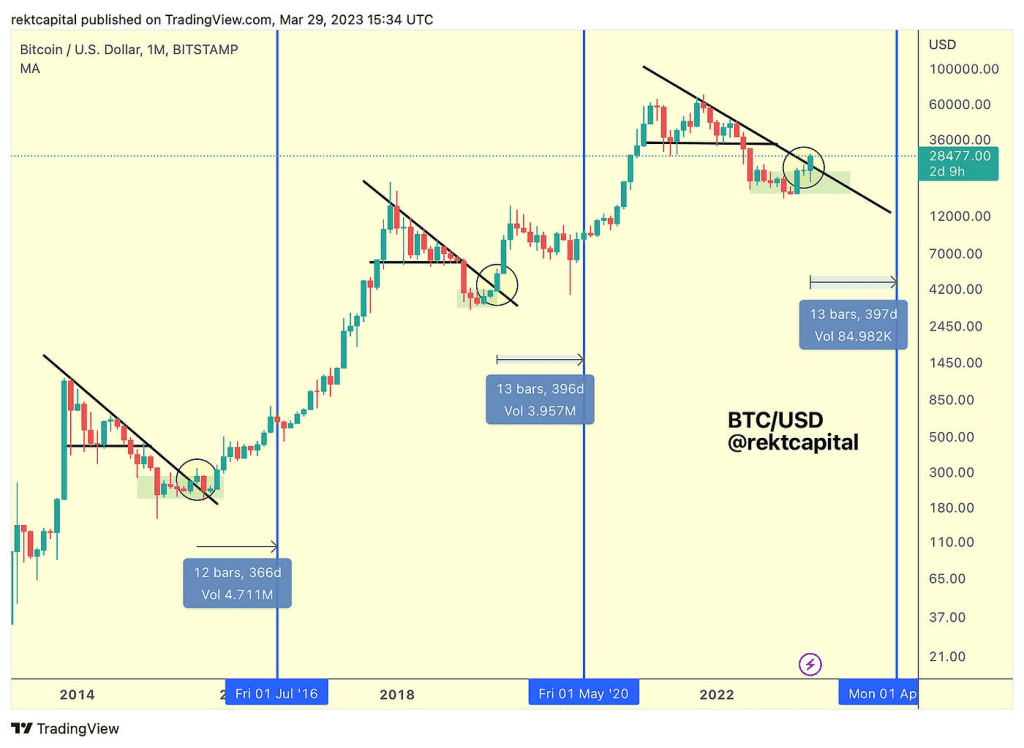

BTC is above the Macro Downtrend right now and so a Monthly Close above ~$25,000 is looking increasingly likely, especially given the reaction from ~$27,000 most recently.

A breakout beyond the Macro Downtrend is looming large and a Monthly Close will confirm the breakout and the beginning of a new macro uptrend.

What happens next after the Monthly Close beyond the Macro Downtrend?

It’s something we’ve been discussing on Monday issues in the Rekt Capital Newsletter as well as the Tuesday video Deep-Dives in much more detail.

As for the Monthly timeframe, BTC has validated its inverse Head and Shoulders, broken out from the blue Monthly Macro Range and has rallied to the first Monthly resistance of ~$28900 (orange).

A Monthly Close below this resistance would set BTC up for a rejection, so BTC would need to quickly reclaim this level as support to shake-off that positioning.

A Monthly Close above the ~$28900 would be better as that would set BTC up for a retest of that same level, and set price up for a move within the orange-orange range which is $28900-$33150.

As for the Quarterly, it’s clear BTC is forming its first Bullish Engulfing Quarterly Candle formation since March 2020 which is a major development in price as previous such engulfing candles preceded multiple quarters of upside for price.

Once again, the ~$28900 is a resistance here, just like on the Monthly, so it is a confluent resistance that could prove difficult if the Monthly & Quarterly Closes don’t occur above this level.

For the Quarterly, the next key major levels to the downside is the psychological level of ~$20000 (blue), with the upside wicks in the previous and even more previous Quarters representing $21400 and $25100.

Generally, a Monthly and Quarterly Close below the ~$28900 resistance could set price up for a rejection, and if the rejection is strong enough, then BTC could see a 2015-like retest of the Macro Downtrend.

Really important how BTC reacts to the ~$28900 level in the coming days as these crucial Monthly and Quarterly Closes develop.

Let’s now take a look at the Altcoins in today’s edition, including LTC, ETH, ALGO, FTM, and Band Protocol.

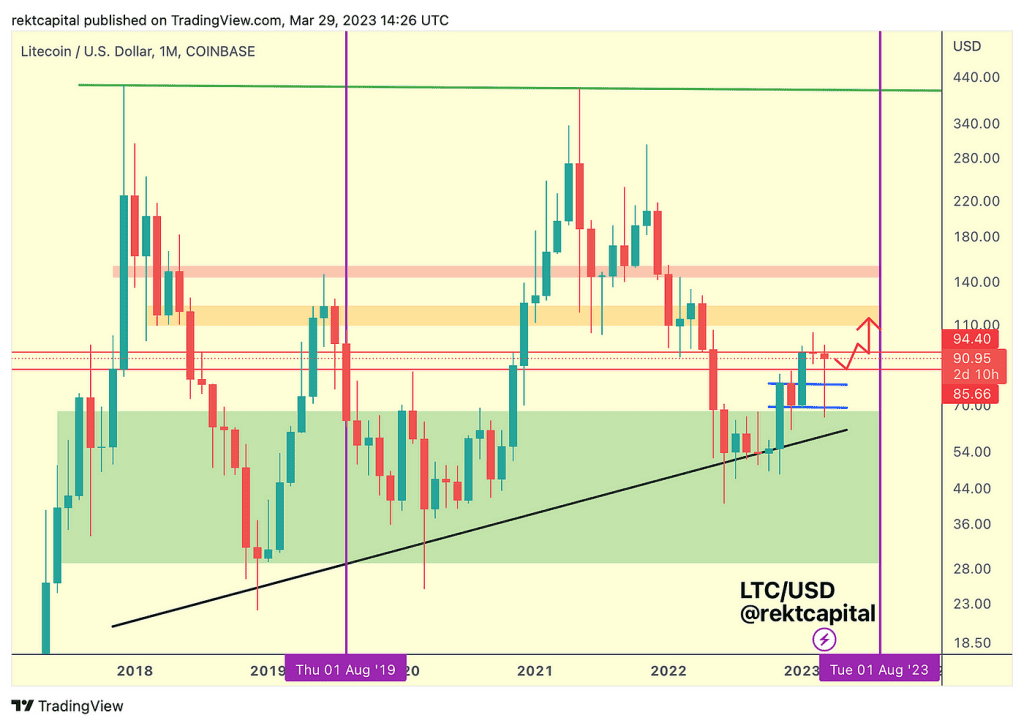

Litecoin — LTC/USD

LTC has performed a fantastic, very volatile retest of the top of its blue Bull Flag, a breakout pattern from a couple of weeks’ back.

In fact, the retest was so volatile that even the bottom of the Bull Flag was tagged as support.

Generally, the retest has been successful.

However, LTC hasn’t been able to break beyond the red ~$94.40 resistance.

And if the Monthly Closes just like this, then LTC could set itself up for another dip, but this time to turn the ~$85.66 level into support.

This sort of ascending in price, level by level, would be an indication of growing buy-side pressure, with new investors happy to buy LTC at a premium with each passing dip.

This is the psychology that I am watching for in the charts for LTC and once LTC retests the ~$84 level as support, that will be a confirmation that the ~$94 level may not be able to resist LTC for too much longer.

Go Premium to Keep Reading

Subscribe to the Wealth Mastery Premium Investor Report to read the rest of this article AND gain full access to the premium archives.

Chainlink Functions: 4 Examples of Applications That Go Beyond Price Feeds by Erik

Ever since Defi summer, we’ve relied on Chainlink price data whenever we swapped stablecoins or looked up interest rates across lending platforms. So much so that we forget that there are also ‘real world’ use cases for Chainlink. Hard as it may seem to believe sometimes, there is also a world outside of DeFi! We list four examples of Chainlink connecting various sorts of data to smart contracts, using its upcoming Chainlink Functions.

Chainlink Functions is now in closed beta: it’s live on the Ethereum Sepolia and Polygon Mumbai testnets. With it, Chainlink’s new raison d’être becomes to connect decentralized blockchain applications (dApps) to Web2 applications (the ‘old’ internet, read more about the difference between Web2 and Web3). It will allow smart contracts to link with any API and obtain decentralized, verifiable consensus on the outcome of any code executed.

Let’s dive into four examples.

Bridging the World of Smart Contracts and Off-Chain Data

Chainlink wants to bridge and automate interaction between smart contracts and reliable data. As you no doubt know, most honorable and well-read crypto enthusiast, smart contracts are self-executing agreements written in code that run on a blockchain, ensuring that the terms cannot be altered. However, these smart contracts are limited in how they can access off-chain data. And that’s where Chainlink comes in.

Chainlink uses a network of data providers called oracles. These oracles act as intermediaries between smart contracts and the ‘real world’ (quotation marks because ‘real’ here means data outside of blockchain ecosystems), facilitating two-way data transfers. This connection between smart contracts and off-chain data is challenging. Chainlink ensures the reliability of data by incentivizing oracles with its native token, LINK, to provide accurate information.

Examples of Chainlink Functions Connecting Web2 and Web3

This is Chainlink’s blog post where several examples are discussed. Let’s summarize them and strip them from their text blocks with examples in Javascript!

Example 1. Automating NFT Giveaway at Product Launch

In this Chainlink Functions use case, Chainlink streamlines NFT giveaways by automating the process of identifying winners and minting NFTs for their wallet addresses.

Let’s say a business celebrates a product launch with a limited NFT giveaway. Customers participate by sending their wallet address and a specific hashtag to the business’s Facebook or Instagram page.

After the promotion, Chainlink Functions and a smart contract identify eligible wallet addresses for NFT minting. The smart contract calls Chainlink Functions, providing JavaScript code to extract relevant conversations via the Meta Messaging API. The code filters messages containing the hashtag and identifies the first three respondents as winners.

So, Chainlink Functions…

- Compiles a list of eligible wallet addresses

- Sends a message to each winner via Meta API

- Returns the addresses to the smart contract

- The smart contract mints NFTs for each winner

Winners receive a private message and can view their NFT in their Instagram Digital Collectibles gallery or on OpenSea.

Example 2. Paying Musicians Based on Their Stream Counts

This is an exciting one, revolving around an agreement between a record label and a musician – in the form of a smart contract and automatic payments based on music stream data.

The example involves the well-known Spotify and Twilio, the cloud communication platform which allows developers to integrate messaging, voice, and video capabilities into applications.

A use case involves an agreement between a record label and a music artist using a smart contract. The smart contract is set up to pay the artist based on their Spotify streams. But the issue is: smart contracts cannot directly access the artist’s streams or send email alerts.

That’s where Chainlink Functions comes in: it bridges this gap by connecting to a music data API and calculating the payment amount. It then uses Twilio to send an email alert to the artist about their streams and payment amount.

More in detail, Chainlink Functions…

- Fetches the stream count

- Performs off-chain computation for payment

- Generates an email alert using Twilio’s email API

- Returns the listener count to the smart contract

- The contract then sends the USDC payment and updates the stream count.

This integration benefits both parties: the artist is guaranteed payment, and the record label automates and streamlines its payment process. Twilio can also be used to create professional-looking invoice emails, enhancing the functionality of the smart contract.

Example 3: Using Google Analytics Data to Trigger On-chain Logic

Google Analytics and BigQuery can be integrated with decentralized applications (dApps) and smart contracts using Chainlink Functions and Chainlink Automation. This allows live updates on-chain about a website or dApp user statistics.

For example, a developer can use Google Analytics data to drive on-chain smart contract logic. Let’s say a user can vote on some poll on a website. Their pick is sent to Google Analytics and then stored in Google BigQuery, a tool for analyzing large datasets.

Chainlink then retrieves the vote counts from BigQuery and updates the smart contract with the vote totals. Once the voting period is over, the smart contract processes the vote counts and determines the winner.

Example 4: Decentralized Insurance Based on Weather Data

This insurance example is a classic example. It’s already been pulled up for years to point at a use case for Chainlink: accurate and trusted (weather) data on which insurance payouts can be based. This is called parametric insurance: the payout doesn’t depend on damage but on an event that is measurable.

With Chainlink functions, this potential of disrupting lawyers at insurance companies (we love you, we all get disrupted!) comes a bit closer:

Chainlink Functions helps by accessing and aggregating data from multiple sources, ensuring a consensus on the final result before updating the smart contract.

Let’s say there is an insurance contract that pays out if the temperature in New York falls below 60°F for three consecutive days (forget for a second why someone would ensure against such average events). Using Chainlink Functions, weather data are collected from three different sources, aggregated, and a consensus is reached on the median value. This data is passed to the smart contract, which determines whether to pay the client.

<h2 id="conclusion“>ConclusionChainlink Functions opens up many possibilities for using smart contracts in various applications, including the creator industry and the insurance market. It is one of those instances where blockchain isn’t about monkey jpegs (bless ’em) but about expanding the realm of what is included on-chain. Chainlink devs have been making sure that blockchain tech can expand to use cases that the masses actually care about!

In Case You Missed It by Rebecca

Crypto Market News

- MicroStrategy has paid off the remainder of its loan from Silvergate Capital and bought $150M worth of Bitcoin over the past 5 weeks. Source

- Coinbase has announced it has received an enforcement notice from the SEC relating to possible violations of securities laws due to its staking services. Source

- Coinbase has suspended Algorand staking rewards but reassured users the token will still be available to trade. Source

- Cathie Wood’s Ark Invest has sold $13.5M in Coinbase stock for the first time since July last year. Source

- Coinbase CEO Brian Armstrong sold almost $6M worth of COIN stock across three transactions on March 3, 5, and 21. Source

- Kraken has suspended ACH deposits and withdrawals following the Silvergate shutdown. Source

- The US SEC has charged Justin Sun, Jake Paul, and Lindsay Lohan, among others for pumping Tron’s tokens on social media. Source

- Terraform Labs co-founder Do Kwon has reportedly been arrested in Montenegro. Source

- German dwpbank is set to offer Bitcoin trading to 1,200 affiliate banks on its new platform. Source

- The Nasdaq stock exchange is planning to launch its crypto custody services by the end of June. Source

- El Salvador will introduce a bill to eliminate all taxes on technology companies. Source

- Amazon has confirmed its NFT plans include digital tokens, an NFT gallery, and resale opportunities. Source

- Greenpeace has blasted Bitcoin with its latest marketing campaign which uses artwork that depicts environmental damage. Source

- Fujitsu filed a trademark application with the intent to offer crypto trading services. Source

- Disney has scrapped its entire Metaverse division of 50 members of staff as part of a broader layoff of 7,000 over two months. Source

- Kraken has signed a sponsorship deal with the Formula 1 team Williams Racing which will include the Kraken logo on the race cars and an NFT experience. Source

Coins and Projects

- Bitcoin has debuted zk-proofs on the network as ZeroSync is using StarkWare’s technology to validate the state of the network. Source

- Tether’s USDT has been added to Telegram’s wallet bot allowing users to transfer the stablecoin through chats on the Tron network. Source

- Circle is bringing USDC to Cosmos via Noble, an issuance chain built on the network. Source

- Xapo Bank has partnered with Circle to integrate USDC deposits and withdrawals without fees. Source

- Ticketmaster has announced that Ethereum-token gating is live for artists having developed it in partnership with metal band Avenged Sevenfold. Source

- Ethereum developers have confirmed the Shapella upgrade will take place on April 12. Source

- MetaMask Institutional has launched a staking marketplace to give institutions a place to solo stake their ETH. Source

- MetaMask has added support for EIP-4361, allowing users to access websites with a “sign in with Ethereum” feature. Source

- Arbitrum has launched its ARB token airdrop with more than 300M tokens being claimed in the first few hours, but the token dropped 90% due to holders dumping coins. Source

- Matter Labs’ zkSync Era has become the first zkEVM on Ethereum and is expected to see 32-50 projects on the platform including Uniswap, Sushi, Maker, Chainlink, and Curve. Source

- Polygon Labs has launched its zkEVM in beta which has already attracted more than 50 Web3 projects. Source

- ConsenSys has launched a public testnet of its zkEVM called Linea. Source

- EOS has released a testnet for its EVM ahead of an April rollout. Source

- Binance suspended all spot trading transactions due to an issue with trailing stop orders. Source

- Binance and CEO CZ has been sued by the US CFTC for regulatory violations. Source

- Unstoppable Domains is launching a Web3 messaging platform allowing users to send encrypted messages from their Polygon domains. Source

- Aavegotchi will use Polygon’s supernet to launch a blockchain for gamers called Gotchichain. Source

- Polygon has been used to execute the first bond issuance without any banks for Swiss trading firm Muff Trading AG on its Obligate DeFi platform. Source

- Avalanche was temporarily suspended after some of the nodes failed to verify transactions. Source

- Solana-based derivatives protocol Cega has raised $5M in a seed extension round led by Dragonfly Capital, to expand on Ethereum. Source

- DYDX is set to launch a private testnet of its Cosmos-based blockchain. Source

- Yuga Labs has partnered with Gucci to bring luxury fashion to the Metaverse in a multi-year deal. Source

Macro News

- The US has increased interest rates by another 25 basis points and signals one rate hike is left in this cycle. Source

- Texas Senator Ted Cruz has introduced an anti-CBDC bill. Source

- The G7 is set to outline a global strategy with toucher crypto regulations in May. Source

- China is aiming to upgrade its national blockchain development standards by 2025. Source

- The UK has canceled its plans for a government-based Royal Mint NFT. Source

Follow Rebecca on Twitter and Instagram.

Start your Wealth Mastery Premium Subscription today!

Final Notes

Click the video below for Bitcoin, Ethereum, and Polygon news, and the real reason for the crypto crackdown. 👇

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend you to check out my new Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

Are you ready to make it?

See you next time!

Lark and the Wealth Mastery Team

Recommended Services

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 0% SPOT FEES AND $4,450 IN BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

Legal Disclaimer

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.