Biden Doubles Down on Crypto Attacks

Gm friends,

There’s been yet more political crypto drama unfolding in the US, so let’s start with a look at the latest from both the Biden and Trump camps.

The dividing lines on crypto are looking as clear as ever, although don’t forget, when you combine crypto and an American election year, anything can happen.

But first! The Monthly Crypto Alpha Report was released Yesterday!

Today is your final chance to get your hands on the Monthly Crypto Alpha Report with a 7-day free trial!

The entire goal of our Monthly Crypto Alpha Report is to provide you with the necessary insights you need to make the most of the opportunities arising in the crypto space this month.

Here’s what’s inside:

- A macro overlook of the crypto markets to help you navigate the market trends

- The top airdrops of the month for potential quick gains

- The top altcoins to watch, selected based on in-depth analysis

- The best DeFi farms to maximize your passive income

- The most exciting NFT mints for those looking to explore the NFT space

Are you ready to embrace the wealth making opportunities that will arise this month? Then get your hands on the Monthly Crypto Alpha Report with a 7-day free trial today!

Here’s what’s in today’s issue:

- Sam shares his thoughts on Biden vetoing pro-crypto resolution, Franklin Templeton announcing ETH ETF fees, Uniswap foundation delaying fee vote & Phantom integrating Bitcoin and Ordinals.

- Week 14 update on the 10x portfolio.

- This week on chain.

- This week’s trending coins by Rebecca.

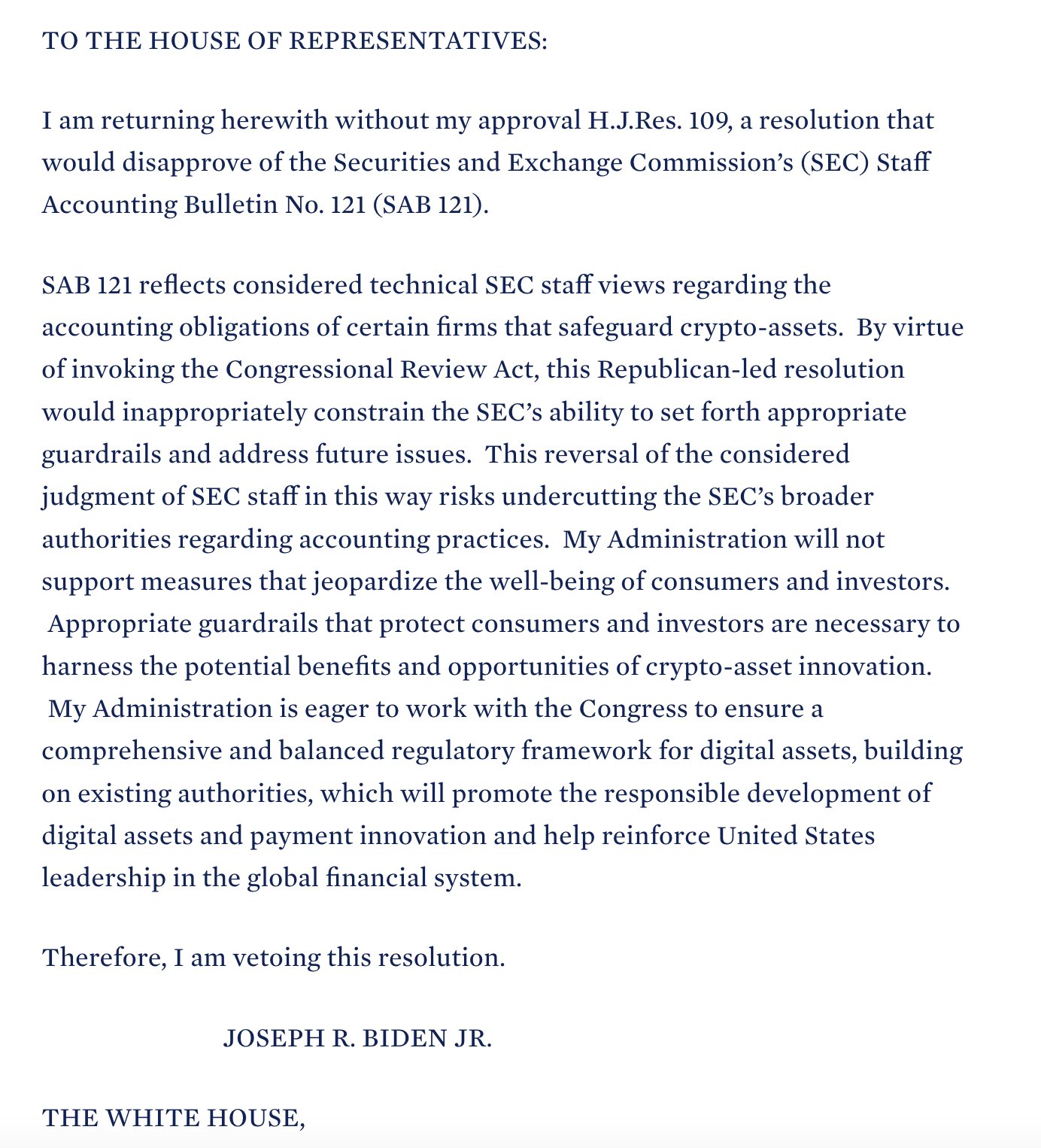

Biden Vetoes Pro-crypto Resolution

In a move that looks decidedly anti-crypto, Joe Biden has vetoed a new resolution that would have been positively pro-crypto. To summarize the key events here:

- The SEC (which hates crypto) proposed new accounting rules called SAB 121. These made a point of making it difficult for regulated financial institutions (like banks) to custody crypto assets. Critics say this means the SEC is determining government policy through accounting procedures.

- The Senate voted in favor of a resolution–known as H.J.Res. 109–which would nullify SAB 121. This was a pro-crypto result, and along with 48 Republicans, 12 Democrats defied party lines and also voted in favor, despite President Biden stating prior to the vote that he would veto the resolution if it went through.

- Last Friday afternoon, Biden vetoed the resolution, releasing a message stating, “appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation.”

But but but… you might at this point be yelling in frustration that surely highly regulated financial institutions are the most fully guardrailed way of accessing crypto.

Which in turn means that logically–as SAB 121 deliberately hinders financial institutions from being involved in crypto–the presidential veto simply comes across, yet again, as point blank crypto-hostility.

Bankers Not On Board

In an interesting twist, the American Bankers Association–who previously co-wrote Senator Elizabeth Warren’s anti-crypto bill (the Digital Asset Anti-Money Laundering Act)–wrote to Biden requesting him not to veto H.J.Res. 109.

This didn’t stop the president, but indicates a change of tune from the bankers, who may have looked at the enormously profitable new spot BTC ETFs (which were recently acknowledged as a good thing by the NYSE president) and decided that actually crypto might be an industry they’d like a slice of.

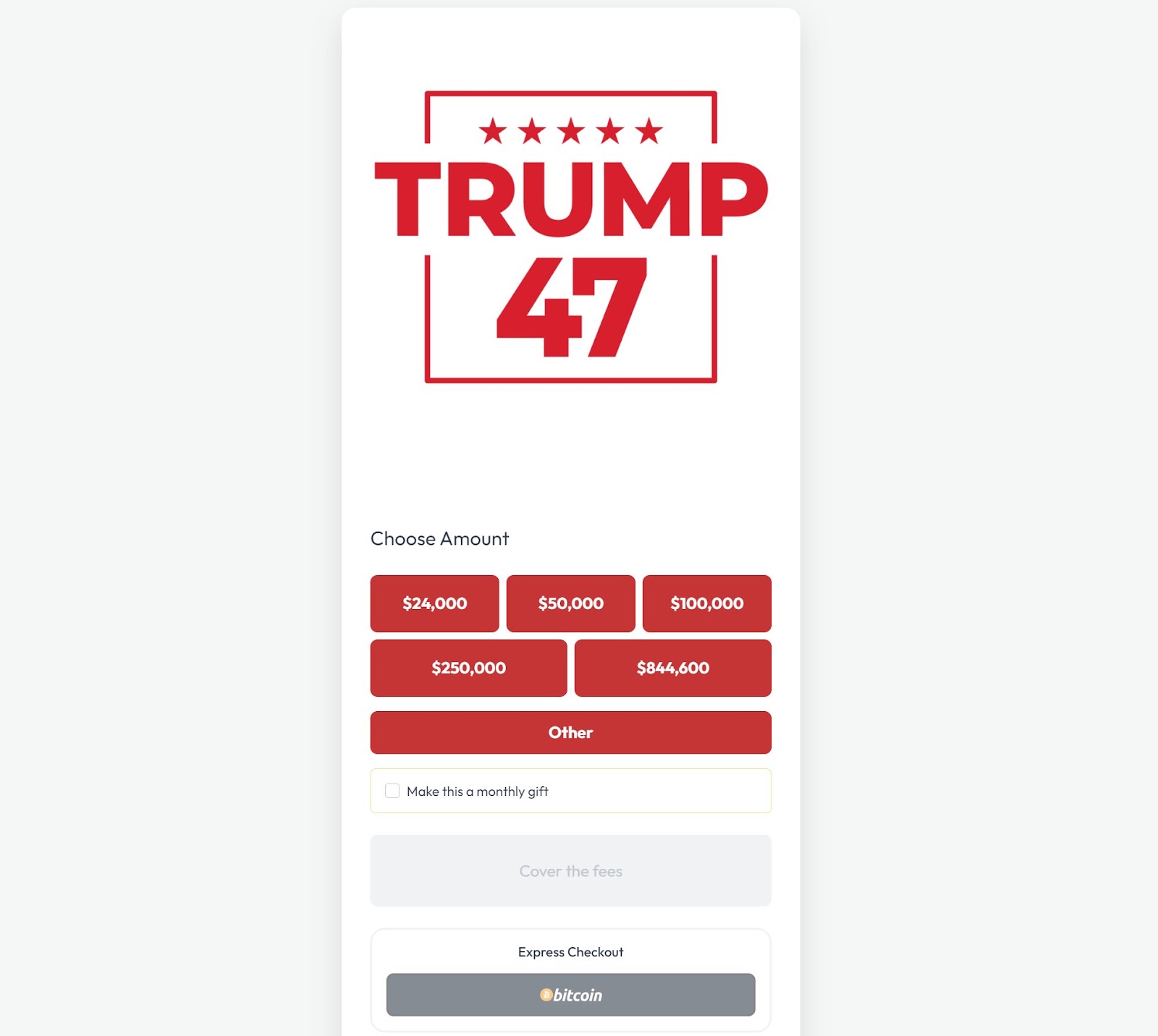

Trump Campaign Now Accepting Lightning Network Donations

And if you were hoping that crypto could be a non-partisan issue, then, well, that’s not happening right now, sorry, as in the starkest possible contrast to Biden’s crypto-hostility, the Trump campaign chose this weekend as the moment to accept donations directly across the Bitcoin Lightning Network.

Those payment rails are up-and-running right now in partnership with Bitcoin infrastructure specialists OpenNode, and besides showcasing Bitcoin’s real world utility, are a billboard for the two presidential candidates’ enormous differences in opinion towards crypto.

Franklin Templeton Announces ETH ETF Fee

A notable feature of the spot BTC ETFs on launch was their very low fees, and the incoming ETH ETFs look set to follow a similar trend, with Franklin Templeton revealing that its ETH fund will charge a fee of just 0.19%, and will waive all fees on the first $10 billion in assets during the initial six month period after it goes live.

This plan was revealed in an updated S1 filing to the SEC, and as an indicator of how important fees can be, keep in mind that Grayscale was the only BTC ETF not to set low fees (its rate is 1.5%), and it has seen over 300,000 BTC in outflows since January, having started with a stack of over 600,000 BTC.

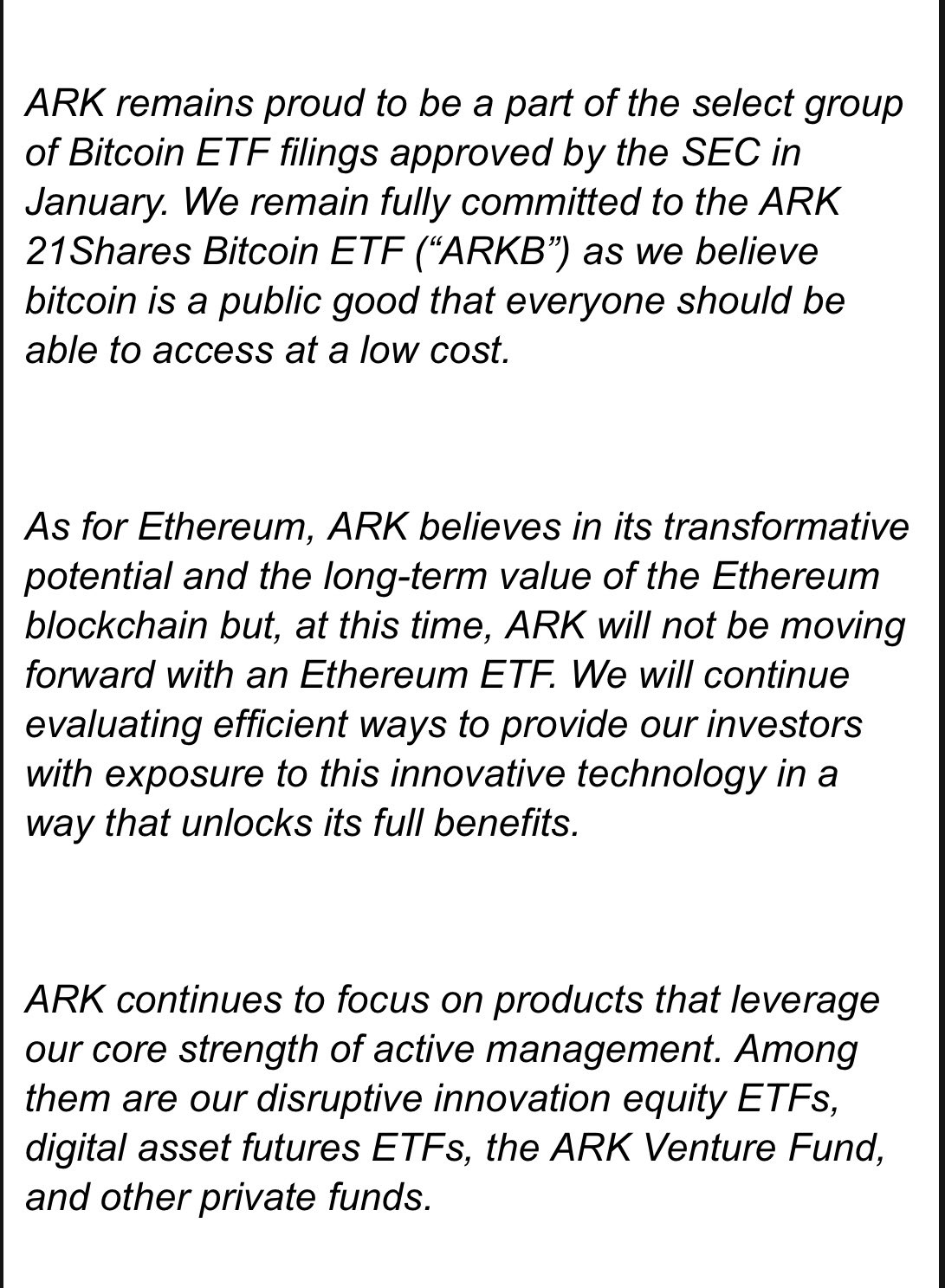

Ark Invest No Longer Working With 21 Shares on ETH ETF

In other ETH ETF news, Ark Invest is no longer partnered with 21Shares, meaning the Ark 21Shares Ethereum ETF is now known simply as the 21Shares Core Ethereum ETF.

Ark and 21Shares remain partners in the ARK 21Shares Bitcoin ETF and in several other crypto funds, and although Ark’s statement on the ETH decision doesn’t reveal much, it does hint at the potential for other ETH-related plans, stating, “we will continue evaluating efficient ways to provide our investors with exposure to this innovative technology in a way that unlocks its full benefits.”

Uniswap Foundation Delays Fee Vote

As mentioned here last week, the Uniswap Foundation was planning to hold an on-chain vote regarding its plans to change its fee mechanism. If the protocol changes go ahead they would enable revenue sharing, meaning UNI token holders–if they stake and delegate tokens–would start to receive a share of fees.

However, that vote–which had been scheduled for last Friday–has now been postponed, with the foundation posting on Twitter that,

“A stakeholder raised a new issue relating to this work that requires additional diligence on our end to fully vet. Due to the immutable nature and sensitivity of our proposed upgrade, we have made the difficult decision to postpone posting this vote.”

Having risen to a price of $11.68 the weekend prior to the originally slated voting date, and then stayed at around $11 as the vote approached, the UNI token price dipped below $10 after the delay was announced.

Phantom Wallet Integrates Bitcoin and Ordinals

Finally, leading Solana wallet Phantom announced last week that it had integrated Bitcoin, along with Ordinals (which are like NFTs on Bitcoin), and BRC-20 tokens (which are a kind of fungible token on Bitcoin).

As Phantom is the wallet of choice for anyone either gambling in the Solana meme coin casino or picking up Solana NFTs, this is an interesting addition, but at the same time–and without wanting to FUD a positive new development–it stands out that Runes, which enable meme coins on Bitcoin, haven’t also been integrated into Phantom, considering the degree to which the wallet is associated with meme trading.

As for how the Runes Protocol is doing, it has–arguably–superseded BRC-20s, and Runes tokens have the potential to kick off a sustained meme coin run on the oldest blockchain around.

Although the ecosystem as a whole experienced a deep post-hype dip after launch, it’s recently been looking lively again, with leading token DOG making major gains over the past week, while the Runes total market cap has more than doubled to over $2 billion.

But what’s your take, do you use Phantom wallet, and if so, would you now use it for Bitcoin and Ordinals too? And how about Runes, are you picking up any tokens? Reply to this email and let us know what you think.

It’s amazing to think about how much crypto capital, over the years, has flowed through the markets on the strength of one special dog’s image, so thanks for everything, Kabo-chan.

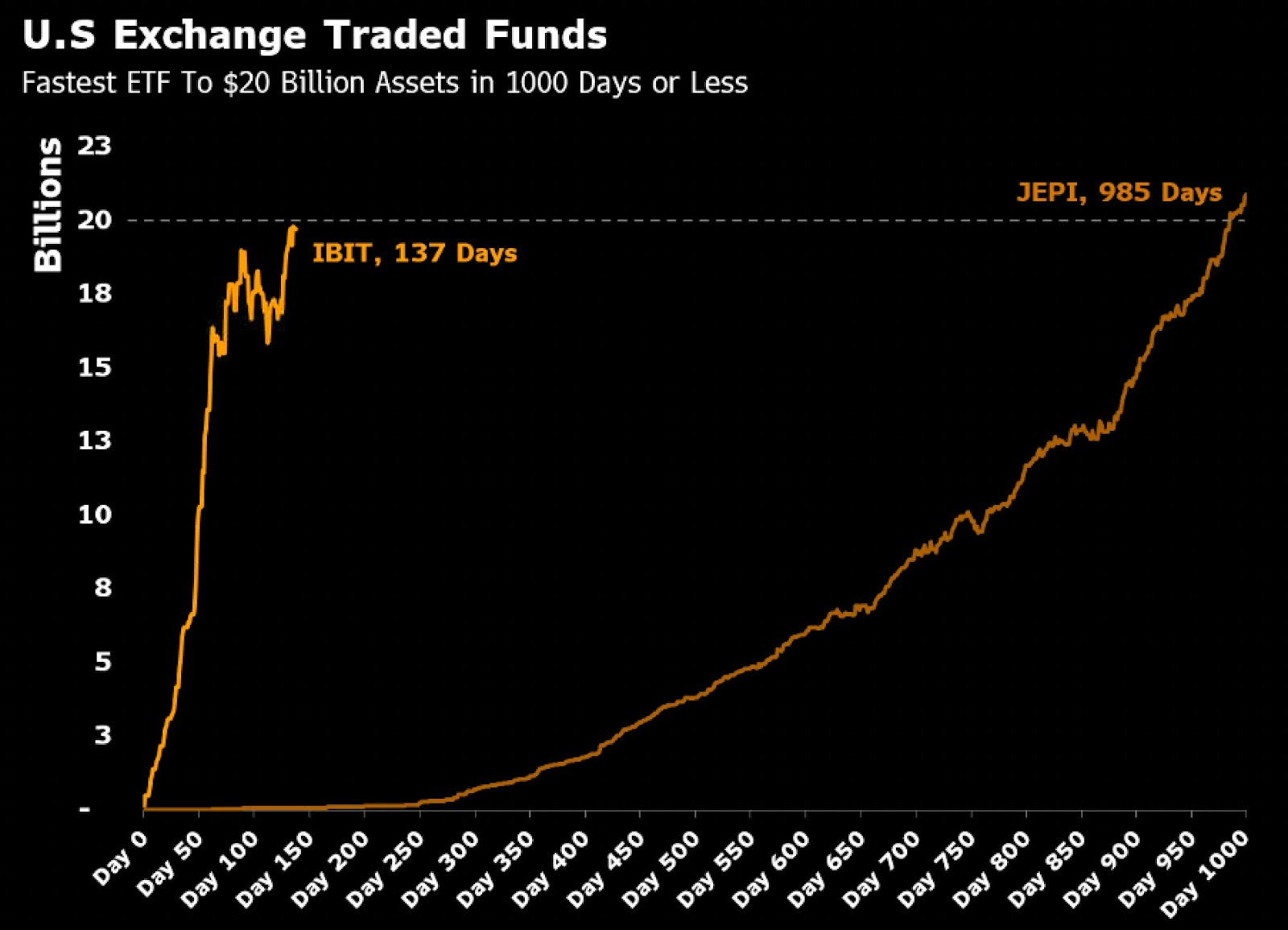

Week 16 Crypto Portfolio Updates

More holding and chilling.

I missed the Param airdrop because again, I do not have access right now to the wallet I was farming on… There is a lesson there.

Hopefully I am able to catch zkSync as there are rumors it will launch soon.

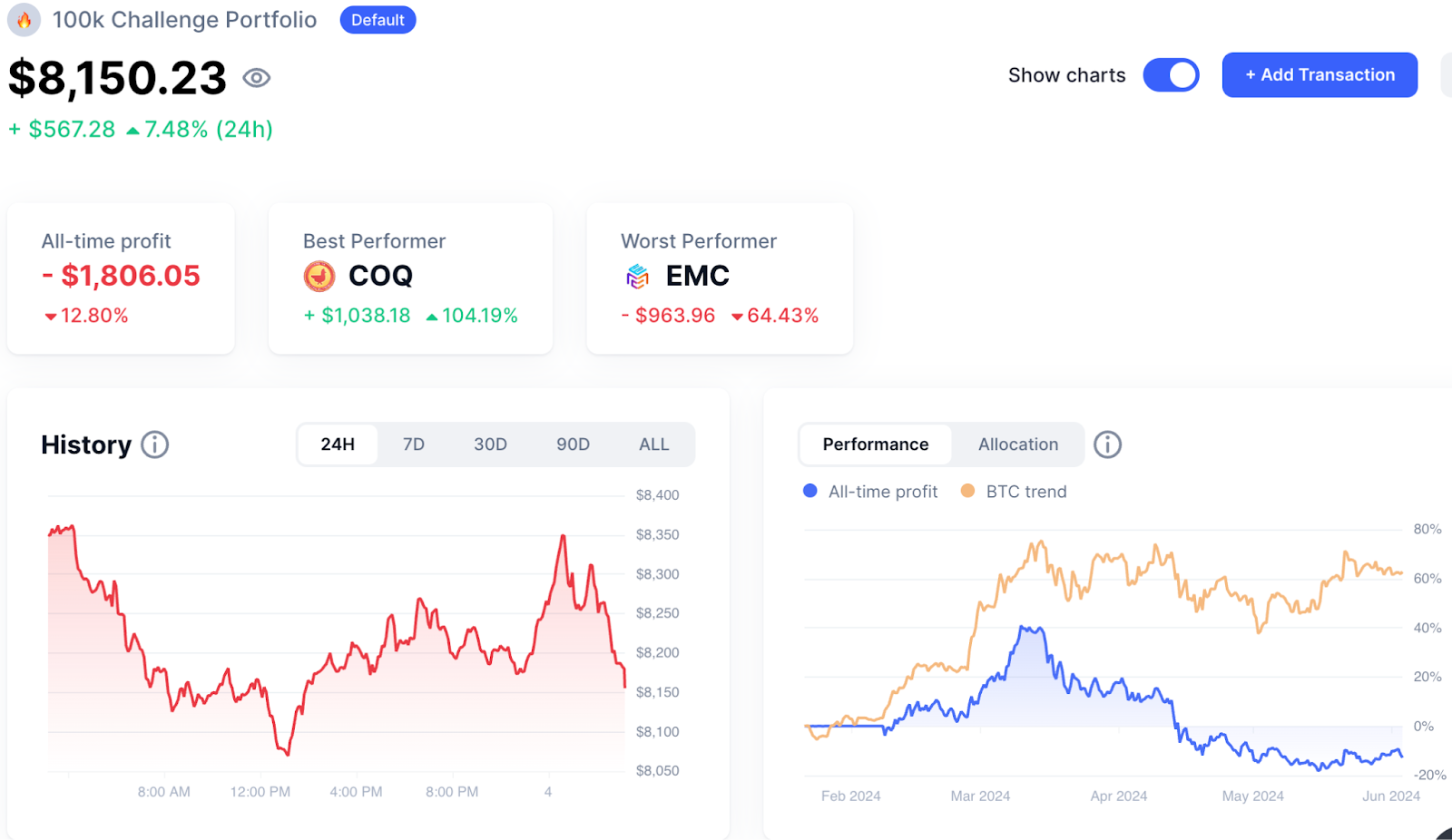

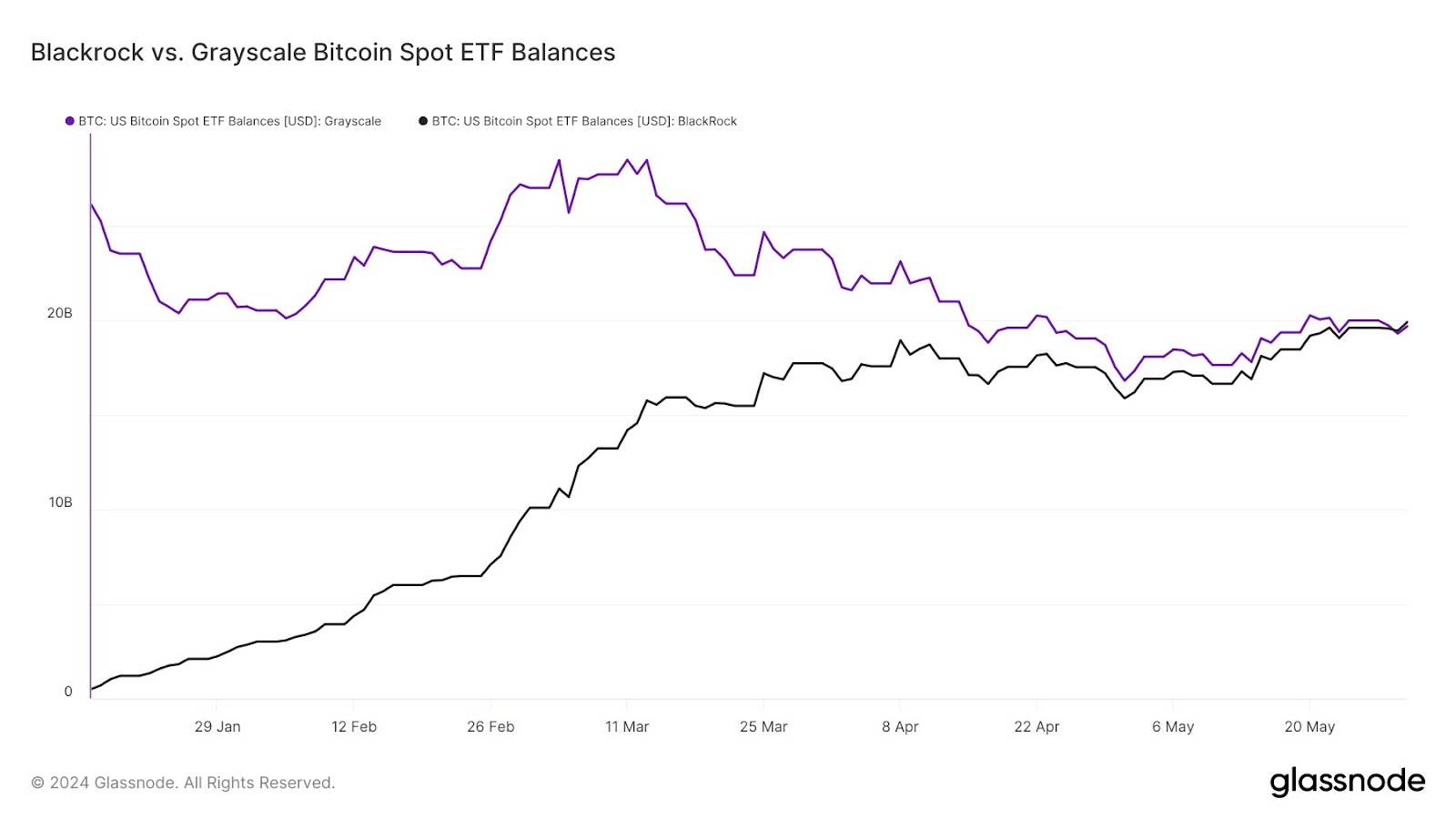

Starting with the spot BTC ETFs, the inevitable has finally happened, with BlackRock’s IBIT overtaking Grayscale’s GBTC in terms of assets held.

BlackRock always looked set to dominate, and although GBTC selling has slowed down significantly, with the fund even registering some positive inflow days, IBIT is now on top with over 288,000 BTC held, while GBTC is just below that 288,000 mark, which puts both funds around the $20 billion level, with the likelihood that IBIT will from now remain the biggest BTC ETF.

What’s more, in a broader ETF context, IBIT has reached the $20 billion mark incredibly quickly, as it took IBIT just 138 days to achieve this feat, while the second fastest is JEPI (that’s the JP Morgan Equity Premium Income ETF), which launched in 2020, took 985 days, and is the only other ETF to hit $20 billion in less than a thousand days.

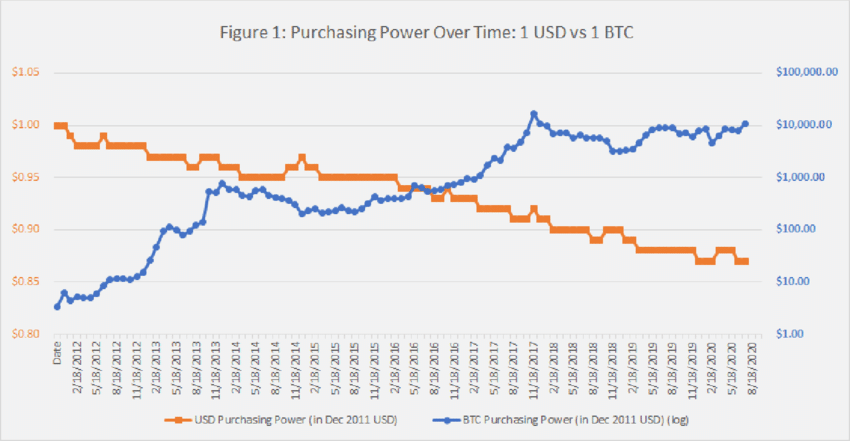

And just in case you needed a reminder as to why exactly bitcoin is a big deal, here’s a chart comparing the purchasing power of 1 BTC and 1 USD between 2012 and 2020, and as you can see, it’s a clear cut picture, with BTC headed consistently up while USD goes in the opposite direction.

The message is genuinely stark–if you were saving in dollars, your hard work was being eaten into the whole time, but bitcoin provides a working alternative.

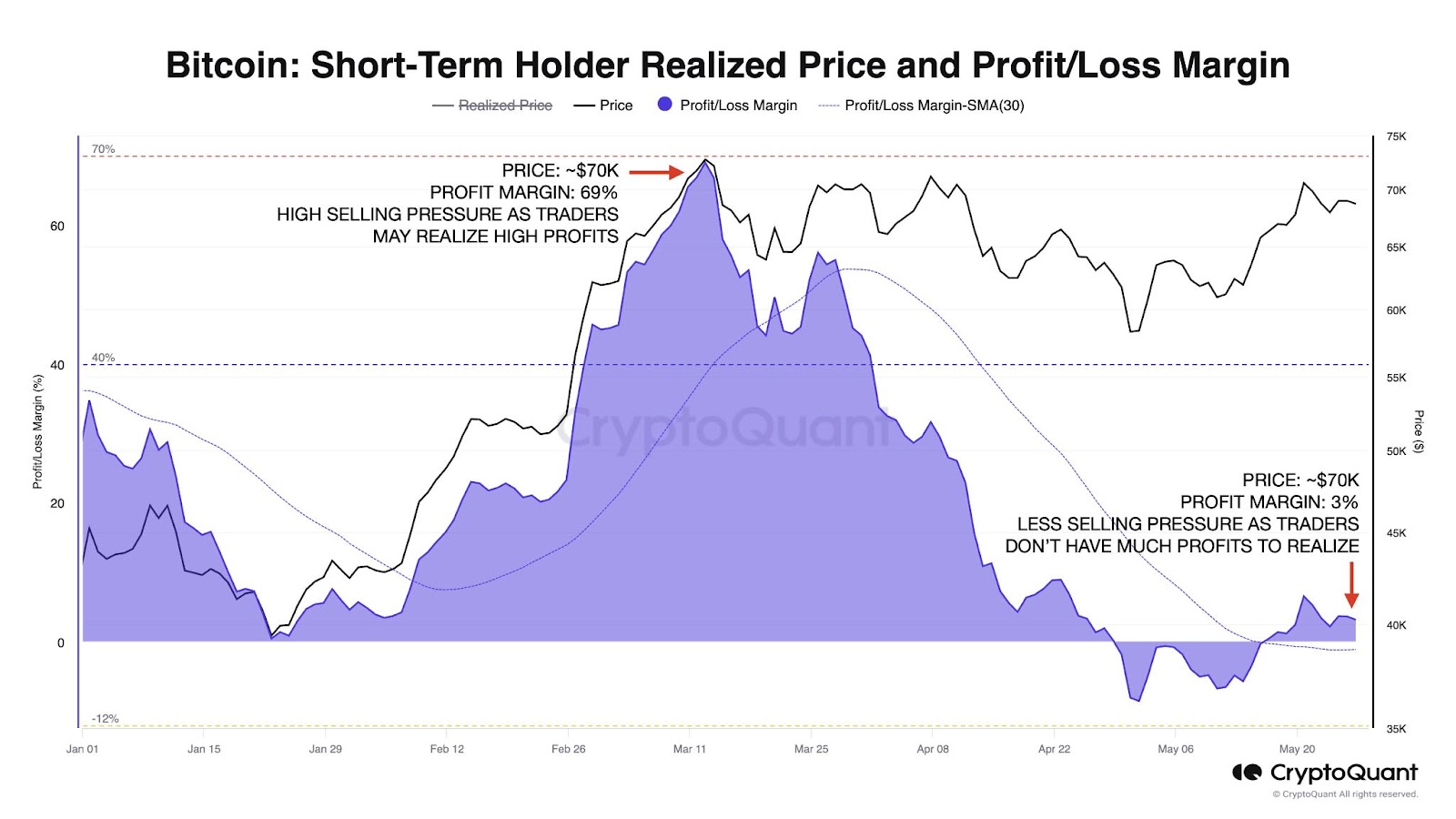

As for the bitcoin price, if you were watching it range below 70K and thinking back to March, when a similar price triggered selling, you might have been wondering if the same will happen again.

But while anything can potentially happen, a major difference in March is that there were big unrealized profits asking to be taken off the table–with a profit margin around 69%–while now, the profit margin is down to around 3%, meaning that particular kind of sell pressure isn’t currently there.

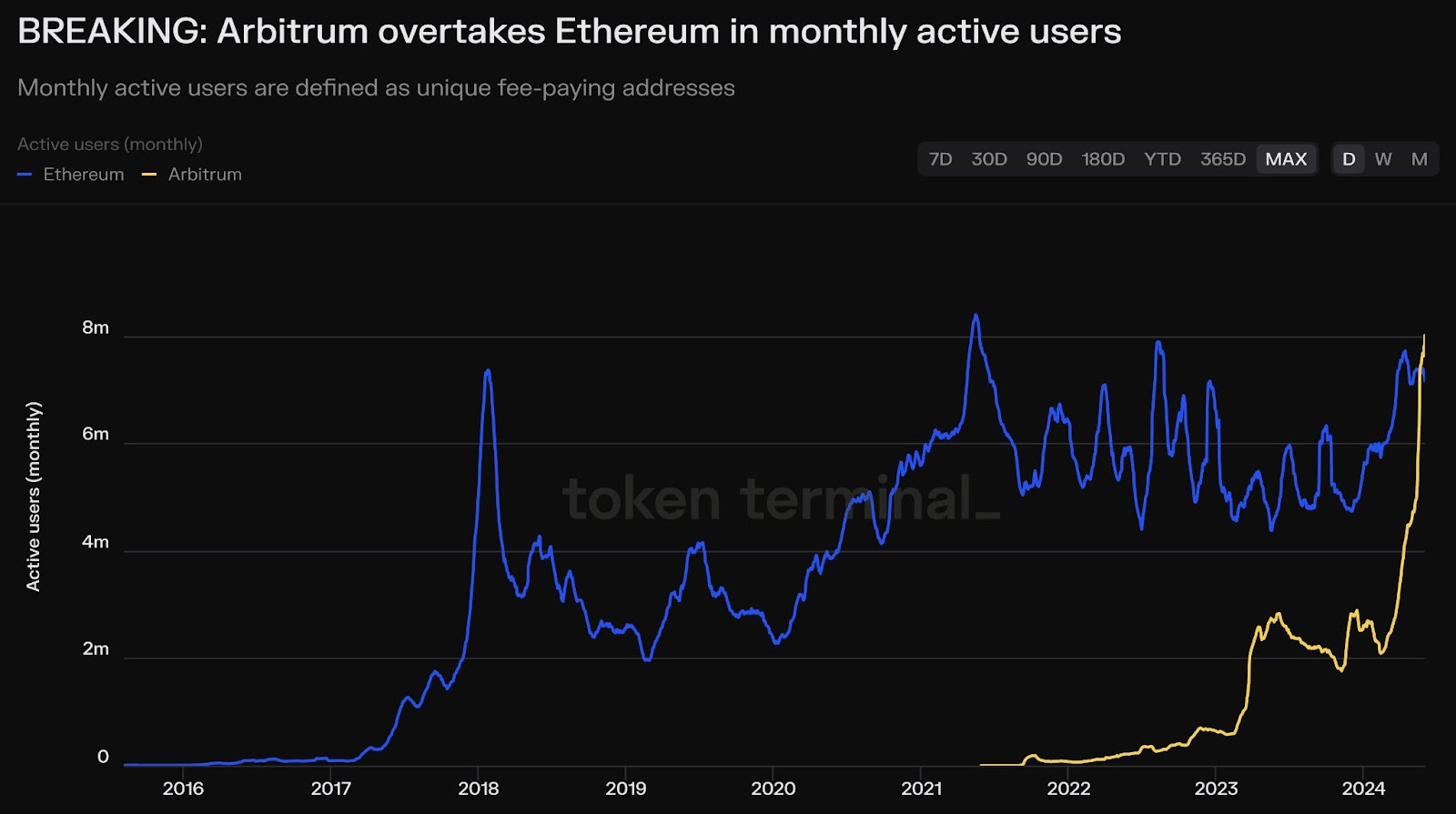

Over on Ethereum, activity continues to move towards Layer-2s, with Arbitrum surging to exceed Etherum itself in terms of monthly active users, a trend that is likely to continue not only on Arbitrum, but across the Layer-2 landscape.

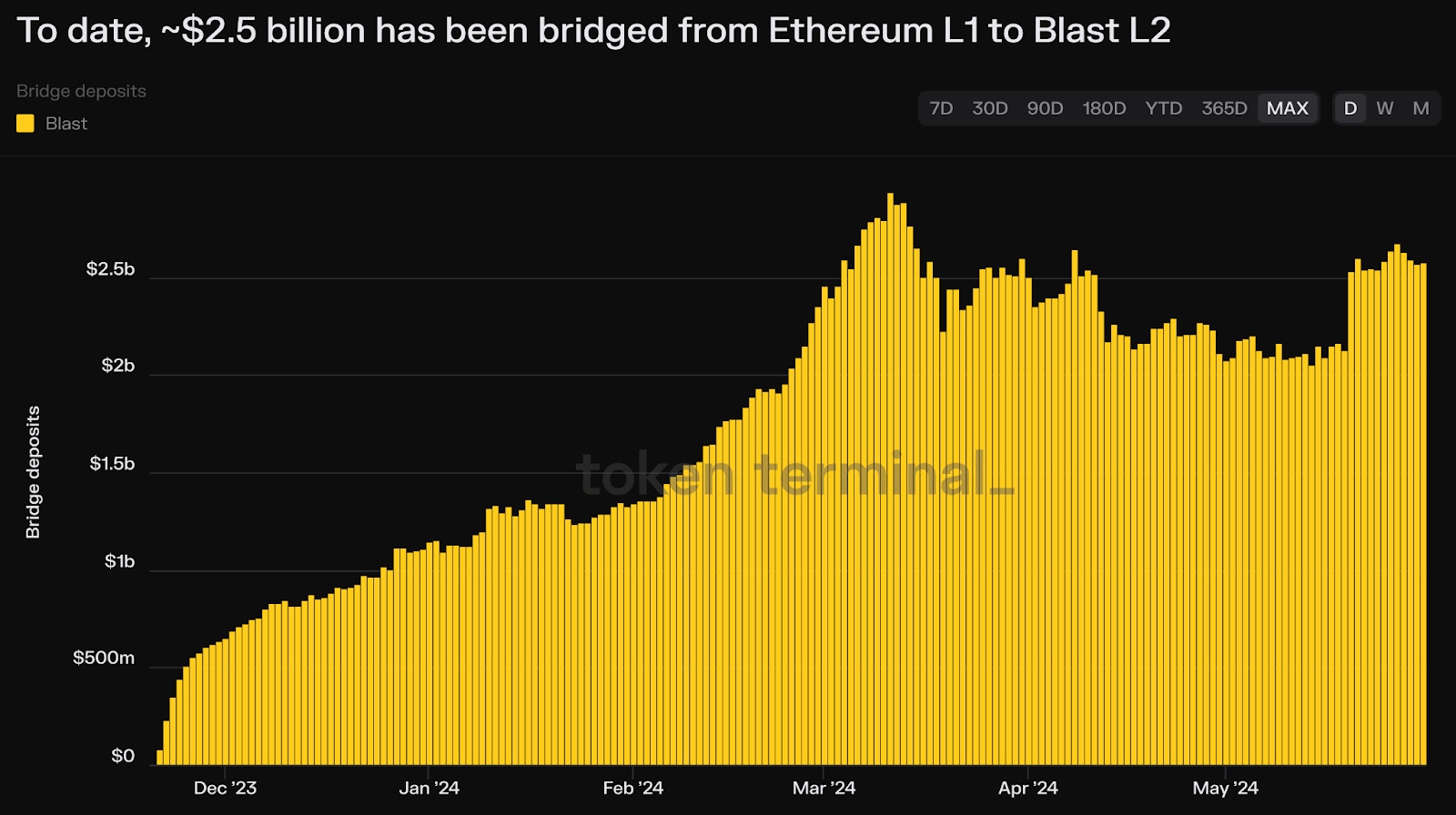

And in fact, similarly, we can also find that over $2.5 billion in assets have up to now been bridged across from Ethereum mainnet to the relatively new Layer-2 Blast.

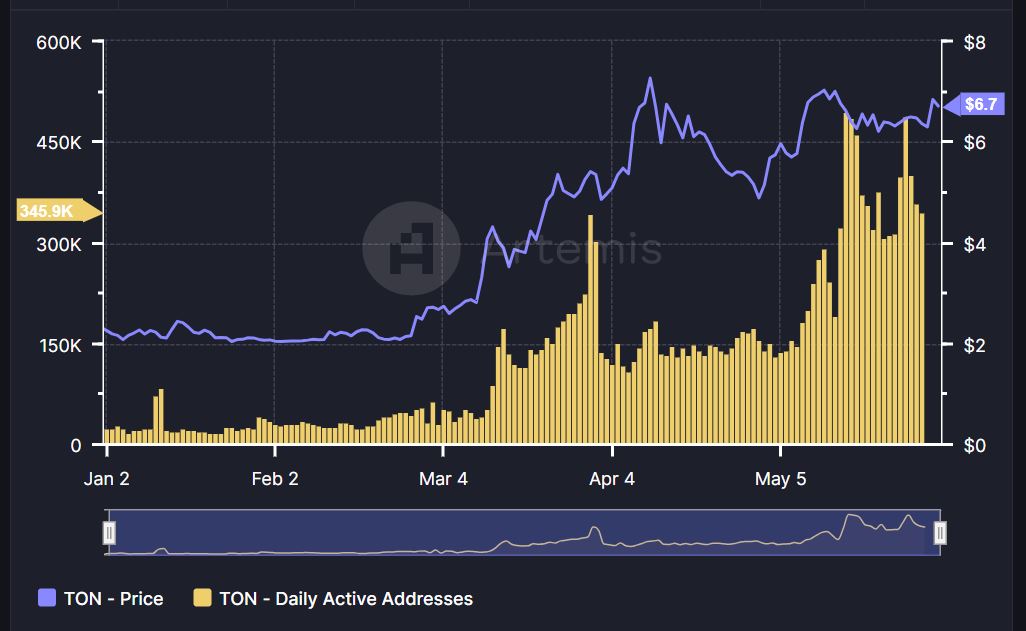

Meanwhile, away from the Ethereum ecosystem, TON Network user adoption is growing fast, with the number of daily active addresses accelerating from around 25K at the start of the year, to approaching 350K right now, with the Toncoin price tagging along correspondingly.

What’s more, messaging app Telegram–which is associated with TON–has around 900 million monthly active users, so if TON can tap into even just a small part of that base, then there could be plenty more upside potential.

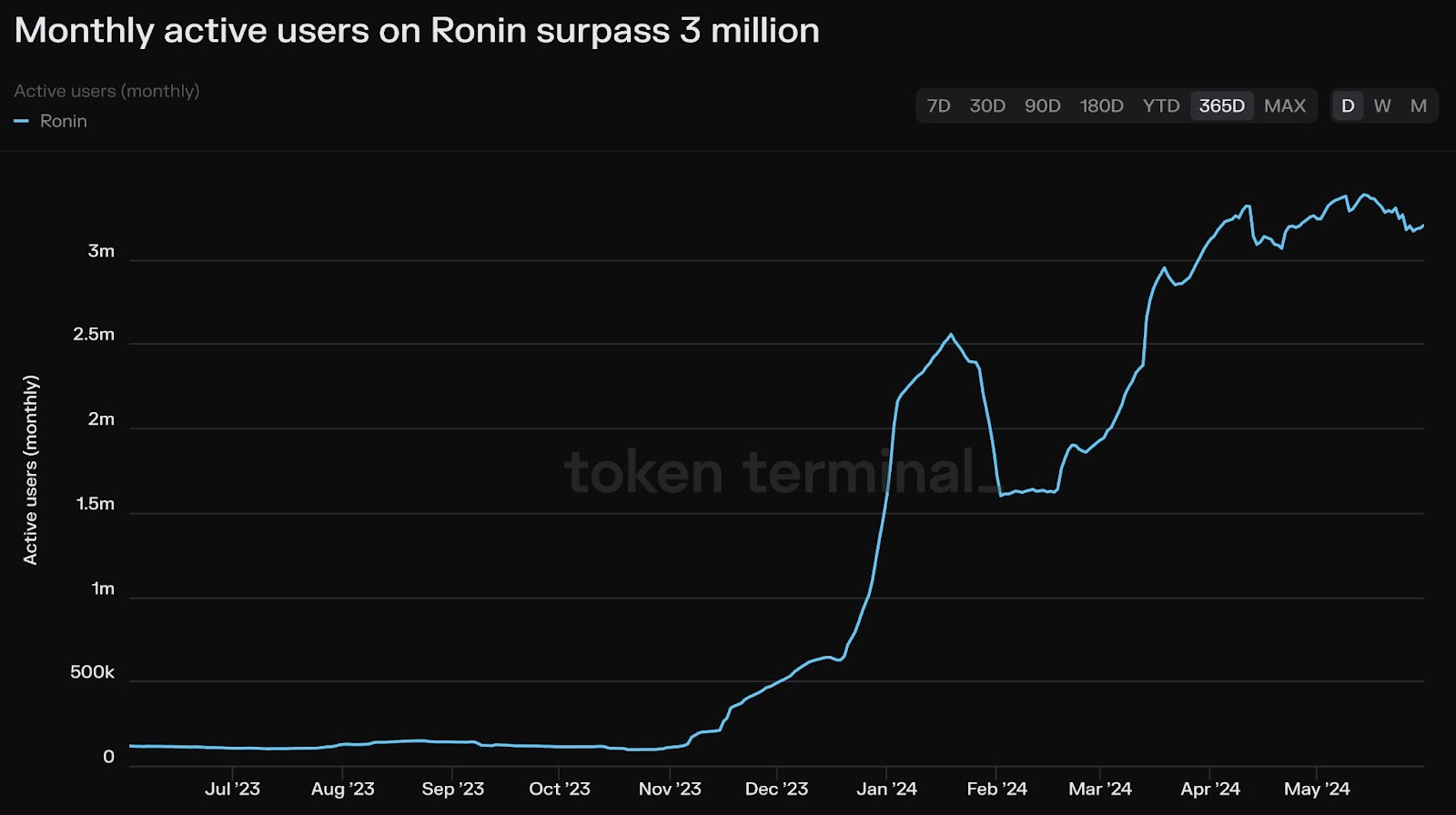

Another network picking up new users is Ronin.

This one is a dedicated gaming chain, and it’s currently reached a level above 3 million monthly active users, having been below 1 million at the start of the year.

This growth suggests not only that Ronin is doing things right, but that Web3 gaming is an area of crypto not to be slept on.

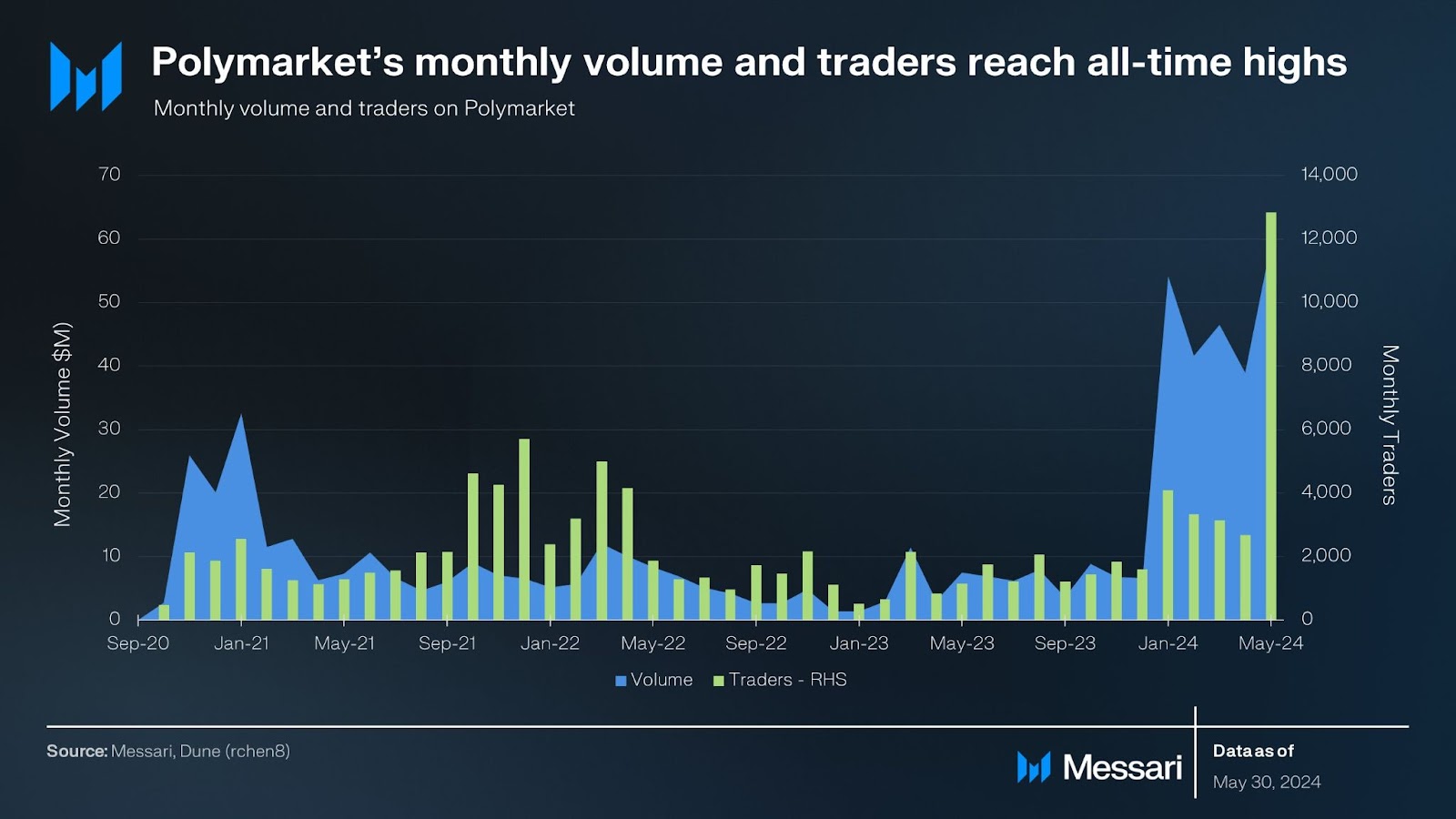

And if you’re looking for a decentralized protocol that has easily-understood utility, functions well right now, and is growing steadily, then Polymarket might be the product for you.

It’s a prediction market built on Polygon, and for monthly volume and users, it’s recently been hitting new all-time highs, with volumes reaching around $60 million, and trader numbers approaching 13,000.

Here are my key takeaways from the trends this week and whilst Bitcoin is still in an accumulation phase, the altcoins are alive and mooning!

- Gala is a play-to-earn (P2E) gaming and music ecosystem that’s seen Snoop Dogg live-stream Live Expedition on Twitch. A hacker has also returned $22M to Gala and the tokens have been burned.

- Notcoin is a Telegram-based game that’s skyrocketed almost 160% in a week to a new all-time high.

- Pepe is a memecoin that’s reached a new all-time high on May 27 due to the recent approval of 8 Ethereum ETFs.

- Toncoin is a Web3 ecosystem within Telegram messenger that’s jumped 3% on the news that it’s launched a new currency called STARS. Hamster Kombat is also planning to launch its hamster ecosystem on TON.

- Ondo is a Real-World Assets (RWA) platform that’s partnered with MANTRA to power its new high-yield savings vault with USDY.

- FOMO Network is a social media and Web3 apps ecosystem that’s launched its social network on June 1. The FOMO trading bot has also been integrated into all TTF scans.

- GME is a Solana-based memecoin that’s jumped 224% in 24 hours after Keith Gill AKA Roaring Kitty returned once more to social media.

- Brett is a memecoin on Base that’s reached a market cap of $1 billion ahead of launching on Coinbase Smart Wallet on June 5.

- MANTRA is a Real-World Assets (RWA) blockchain that’s partnered with Ondo to launch a high-yield savings vault powered by Ondo’s USDY stablecoin.

- Toshi is a memecoin on Base that’s giving away 2 million TOSHI tokens in collaboration with Tegro. The Toshi team will also be joining Base God on June 6 at the first Base Meme Summit.

- Ethereum ETFs could be trading on the US stock market as early as late June according to Bloomberg analyst Eric Balchunas. Since the May 23 approval, over $3 billion in ETH has left exchanges.

- MAGA Hat is a Donald Trump-inspired memecoin that’s jumped more than 500% in 24 hours after Trump was found guilty on all 34 charges of falsifying business records.

- Waves is a blockchain that’s seen its founder Sasha Ivanov appear as a guest on the Traders Brawl podcast. However, the token dropped 24% after Binance announced its being delisted and will no longer be supported.

- Solana is a Layer-1 blockchain that’s being speculated as the next altcoin to be approved for a spot ETF. Paypal’s PYUSD has also launched on Solana.

- Ethena is a synthetic dollar that’s launched on Ethereum Layer 2 Blast. Ethena’s USDe stablecoin has become the fastest USD asset to reach $3 billion in supply.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my Altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the upcoming bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.