Market Analysis with Rekt Capital – June 5, 2024

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Arweave (AR)

- Coti (COTI)

- Avalanche (AVAX)

- Kyber Network (KNC)

- Bitcoin Cash (BCH)

- Theta Token (THETA)

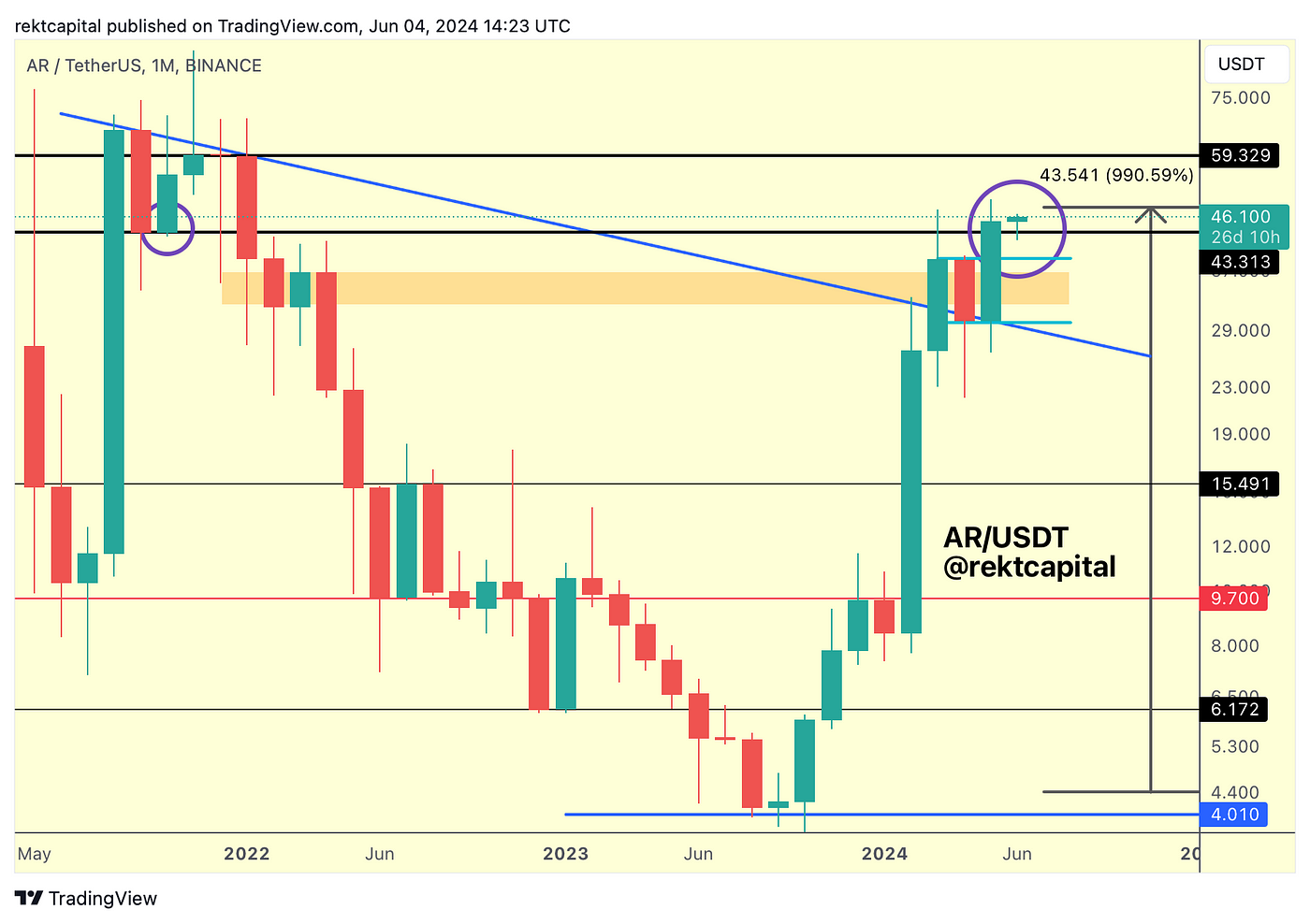

Arweave — AR/USDT

In recent months Arweave has accomplished the following:

- Broke the blue Macro Downtrend in March

- Retested the blue Macro Downtrend as new support in April

- Formed the light blue Bull Flag just above the Macro Downtrend in April/May

- Broke out last month from the Bull Flag

- Enabled a Monthly Close above the black $43 level to begin a break back into the $43-$59 range.

- Currently retesting the $43 level as support this month.

AR is potentially mimicking late 2021 price action by holding this $43 black level as support (purple circle).

The retest in progress and a successful retest here would enable a move across the entirety of the black-black range from the $43 Range Low to the $59 Range High.

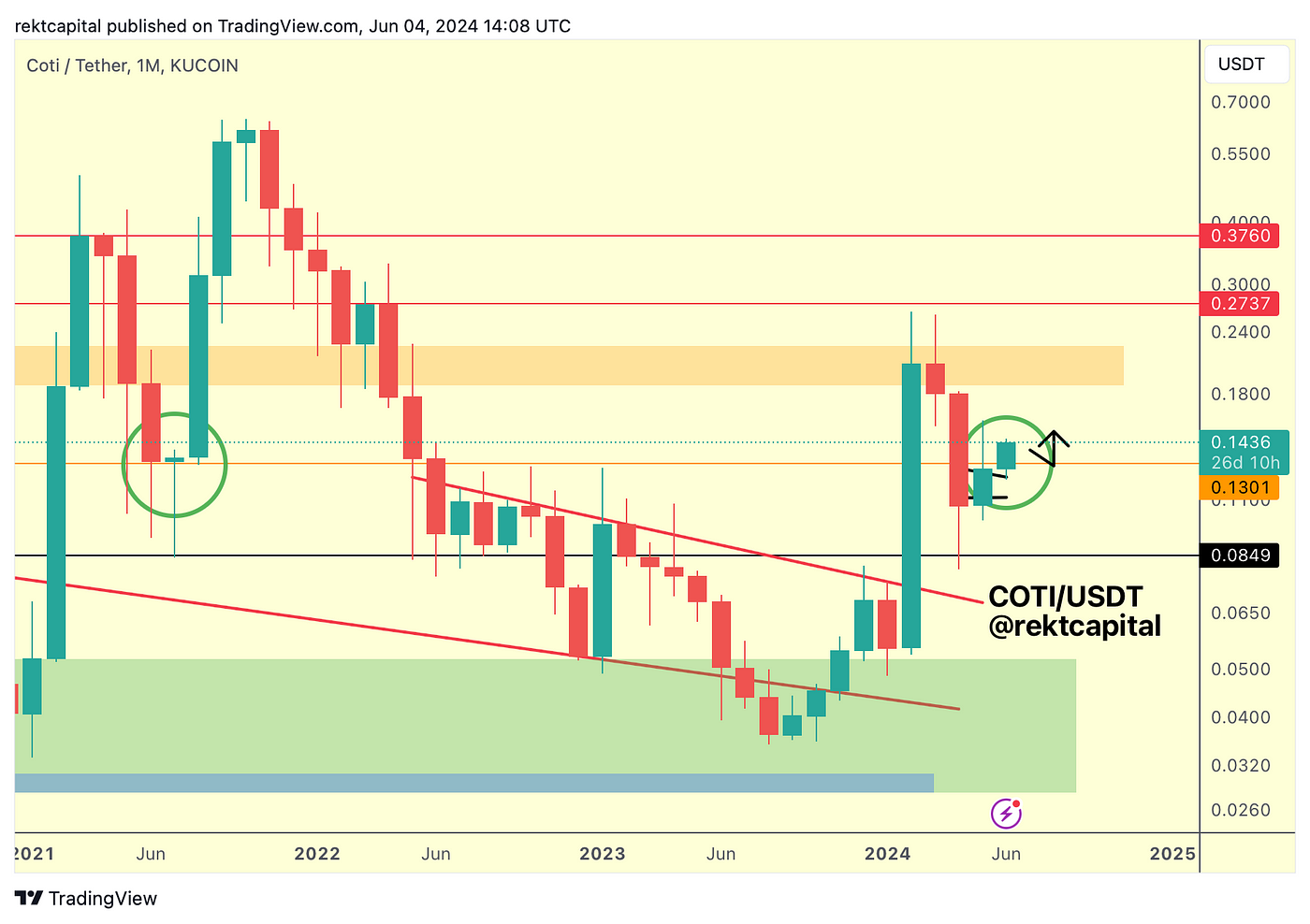

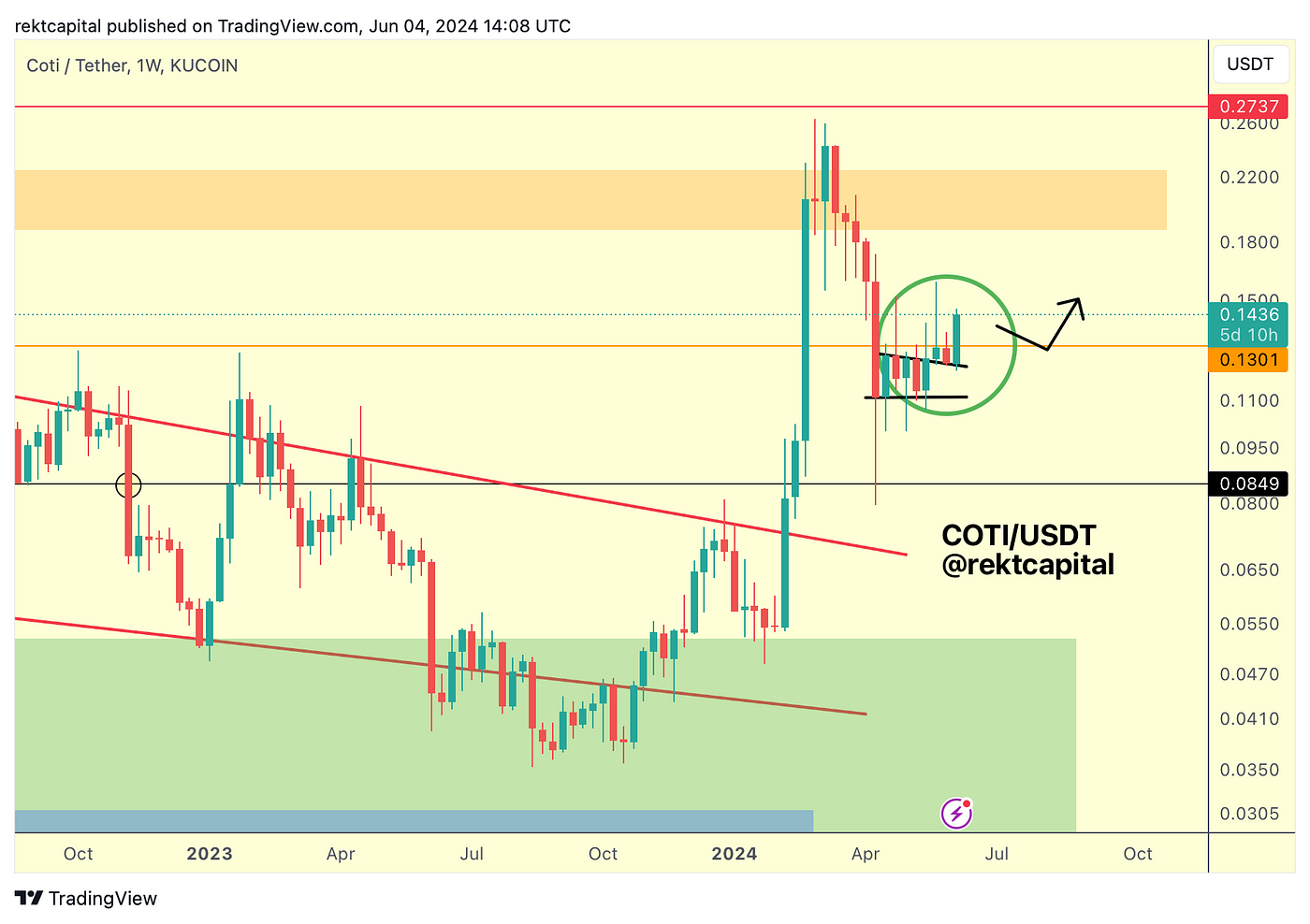

Coti — COTI/USDT

We’ve been waiting for the COTI Monthly Close; COTI needed to Monthly Close above the orange $0.13 level to build bullish momentum.

This didn’t occur however COTI has actually successfully retested the top of the black wedging structure on the Weekly timeframe, positioning COTI for a potential reclaim of this orange level:

The retest of the top of the pattern was perfect and for COTI to confirm this recent breakout, it would need to Weekly Close just like this.

Doing so, would position COTI for a potential pullback right back into the orange level.

So while the recent Monthly Close didn’t satisfy requirements for a reclaim, it looks like the recent wedge breakout on the Weekly is giving COTI another chance to reclaim the orange level, to follow the proposed black path.

We’ve seen upside wicks beyond the orange level many times over the past several weeks which is why that Weekly Close is so essential.

Avalanche — AVAX/USDT

AVAX, much like COTI, didn’t perform the necessary Monthly Close to position price for a successful reclaim.

Instead, price Monthly Closed below the light blue level, which means that price will now continue to occupy the lower half of the range (i.e. green-light blue, $32.66-$38.57).

The Weekly timeframe will give a better idea as to how AVAX may continue to occupy the lower half of the range:

AVAX is potentially forming this downtrending channel (black) and AVAX may need to consolidate here for as long as it needs to before breaking out towards the light blue level and also in an effort to reclaim this level as new support.

This downtrending channel is likely developing with the sole aim of enabling AVAX to propel into the upper half of the range.

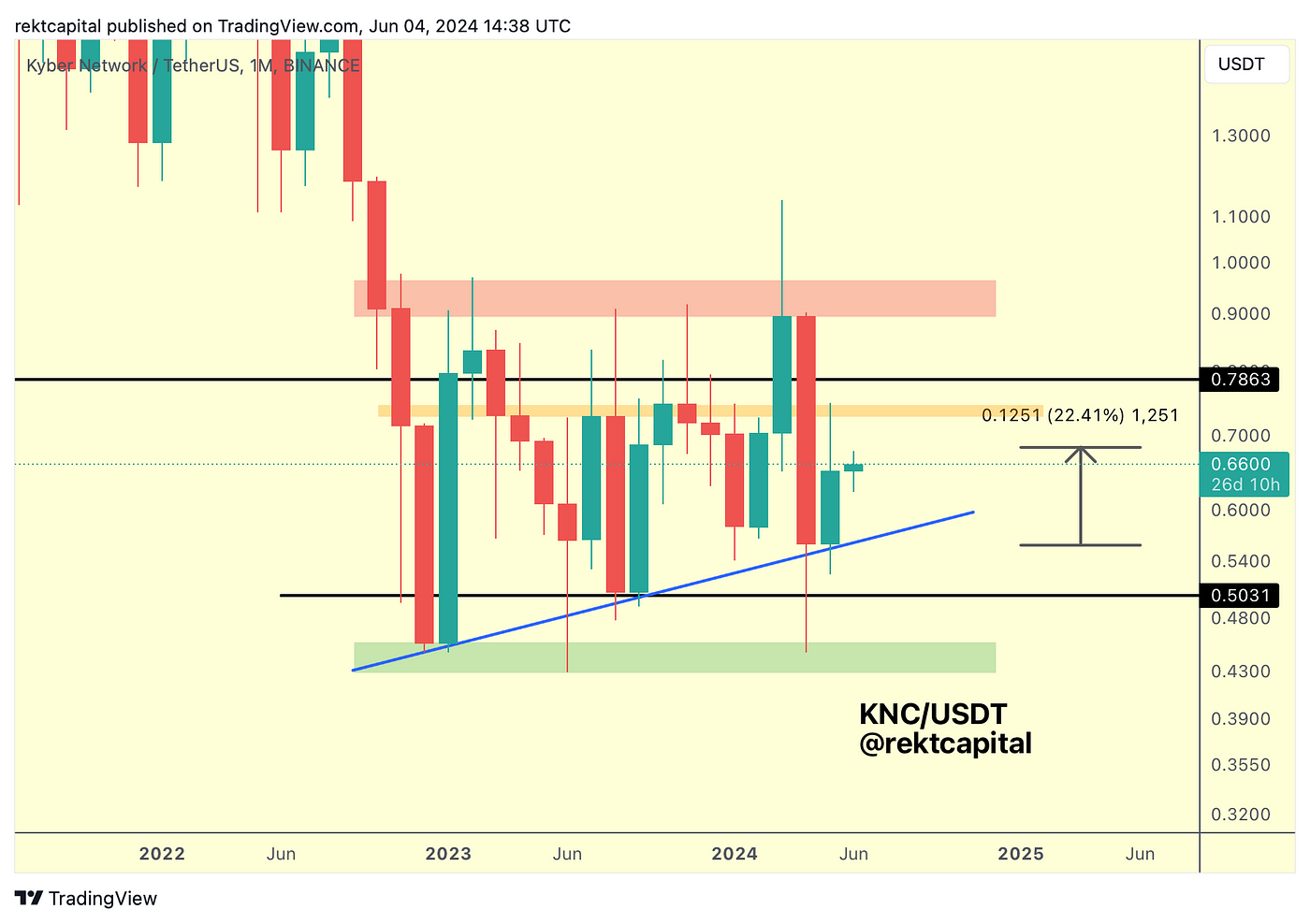

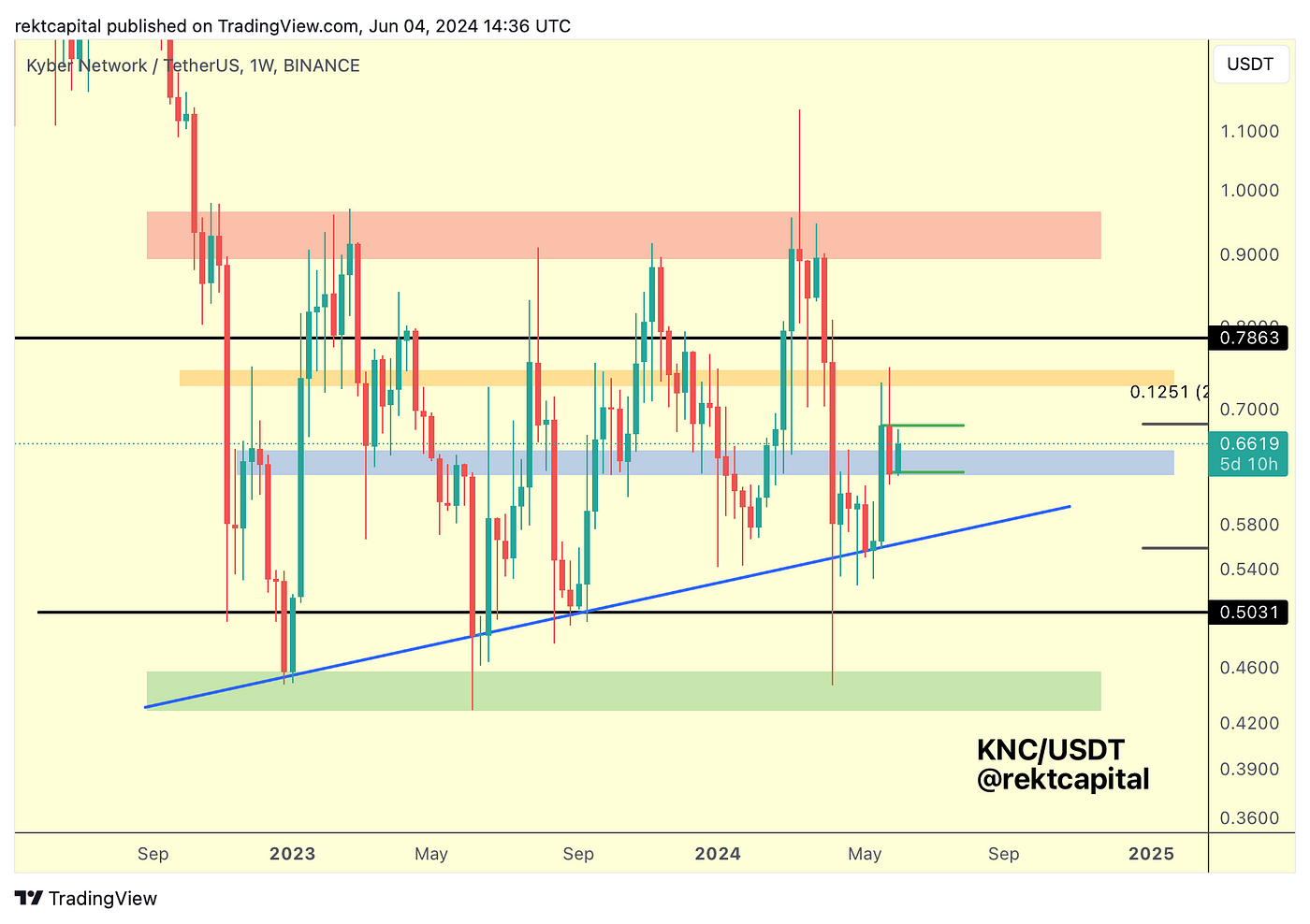

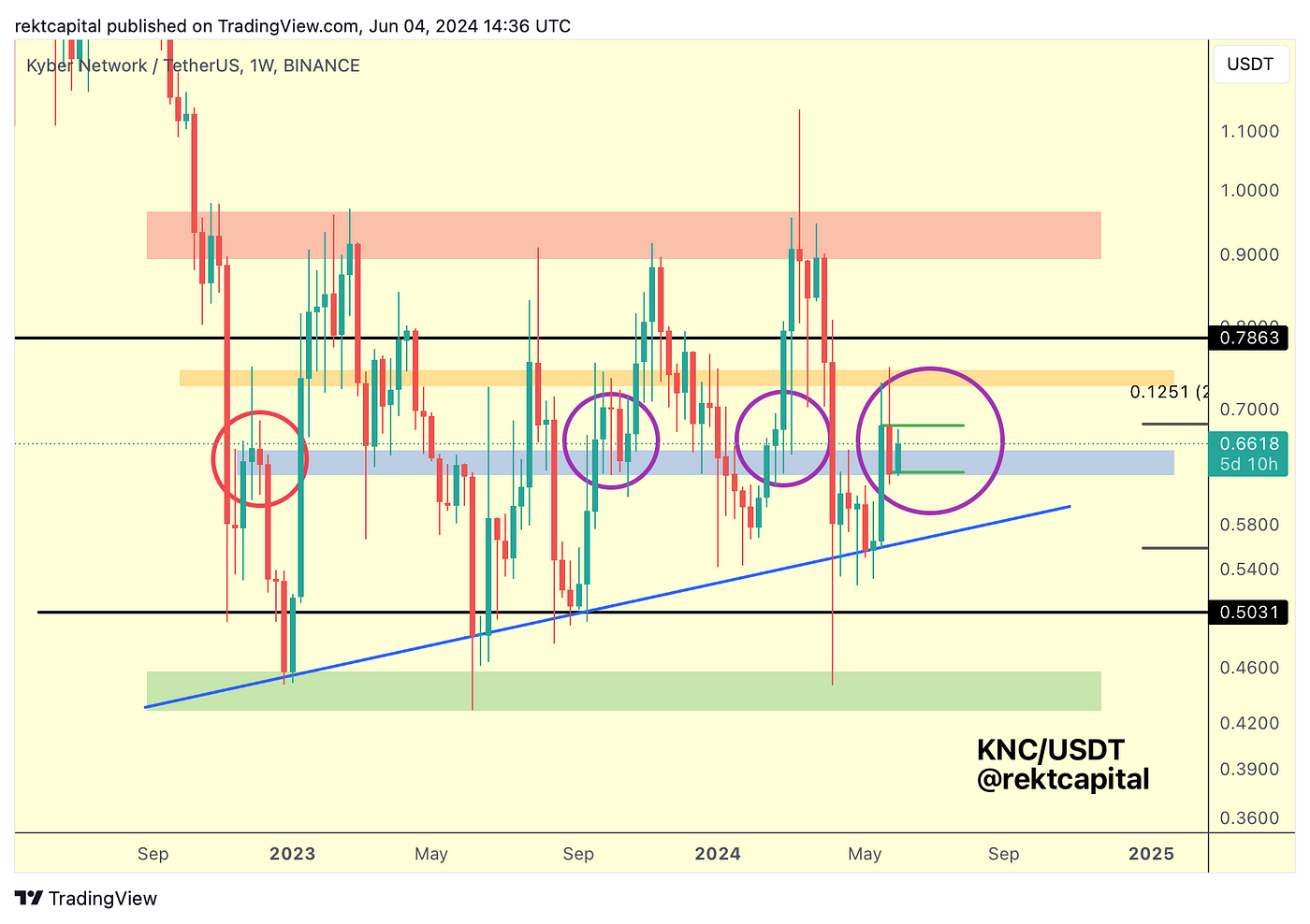

Kyber Network — KNC/USDT

The new Monthly Close is quite unremarkable for KNC which is why it’ll be better to zoom into the Weekly timeframe to better uncover it’s price predicament and what may be currently brewing for price.

On the Weekly timeframe, KNC is finding support at the blue area, possibly even developing a Bull Flag just on top of this support, following its strong recovery from the blue Higher Low two weeks ago.

Continued price stability is all KNC needs to be able to fight for a chance at trend continuation, especially since price stability at this blue boxed area has been a recipe for success, historically:

The purple circles showcase successful Weekly Closes above the blue boxed area followed by a successful retest of the same area.

Technically, KNC is undergoing a retest at this area right now.

Successful retest would enable a Bull Flag breakout to revisit the orange boxed resistance above, possibly even towards the black Range High of $0.78.

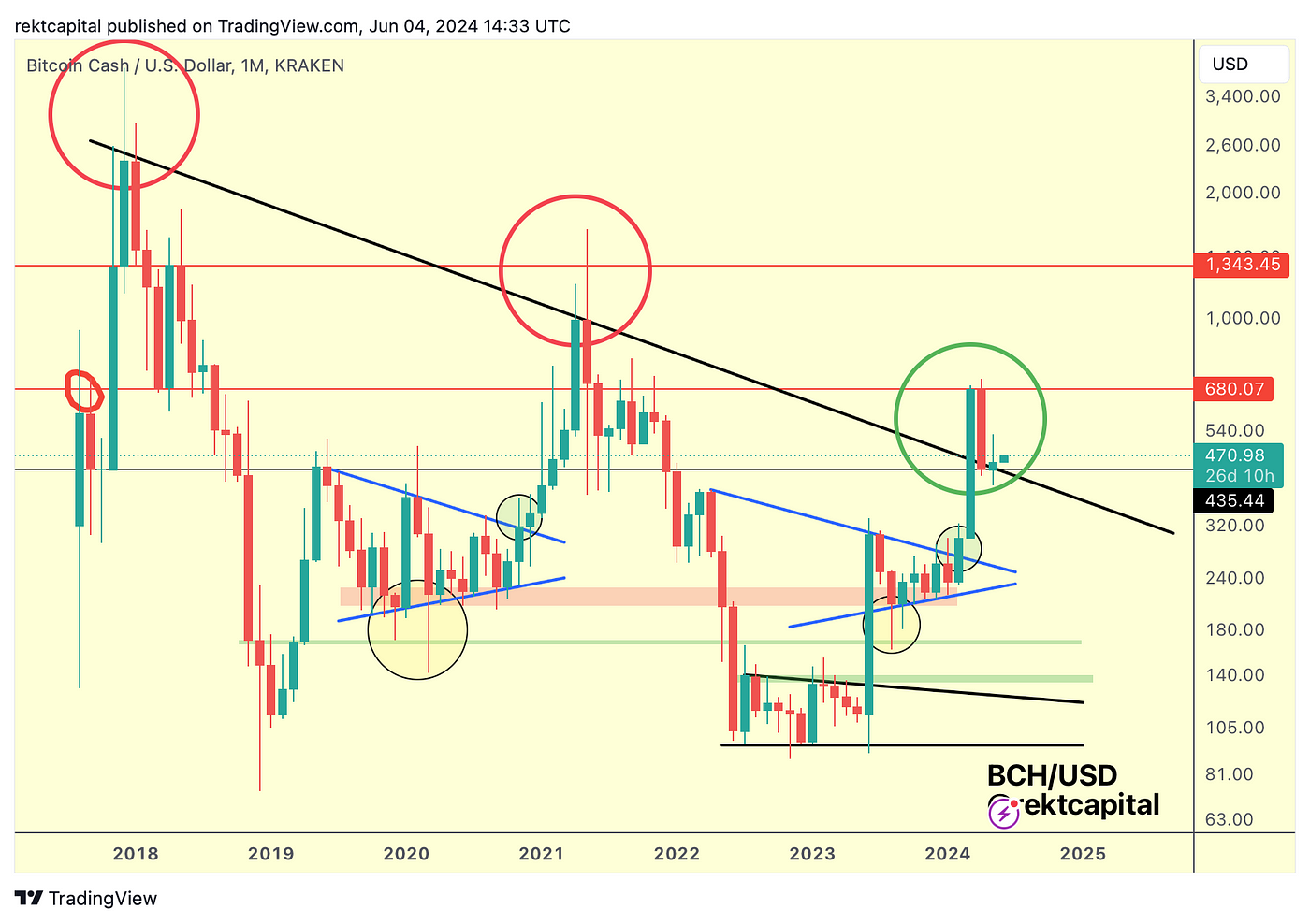

Bitcoin Cash — BCH/USD

Historically, BCH has produced upside wicks beyond its black Macro Downtrend (red circles) until earlier this year when BCH finally Monthly Closed above the Macro Downtrend (green circle).

Ever since that Monthly Close, BCH pulled back into the Macro Downtrend for a retest which has been successful thus far.

The Macro Downtrend is a confluent support with the $435 Range Low (black).

Holding here would position BCH for a revisit of the $680 Range High (red) over time.

But looking even further out, the fact that BCH broke its Macro Downtrend and successfully retested it as support means that price is ready for a new Macro Uptrend and as a result BCH should be able to break beyond the $680 resistance.

Historically, whenever BCH broke the $680 resistance, it would accelerate tremendously towards the $1300 level (red).

Could history repeat, over time?

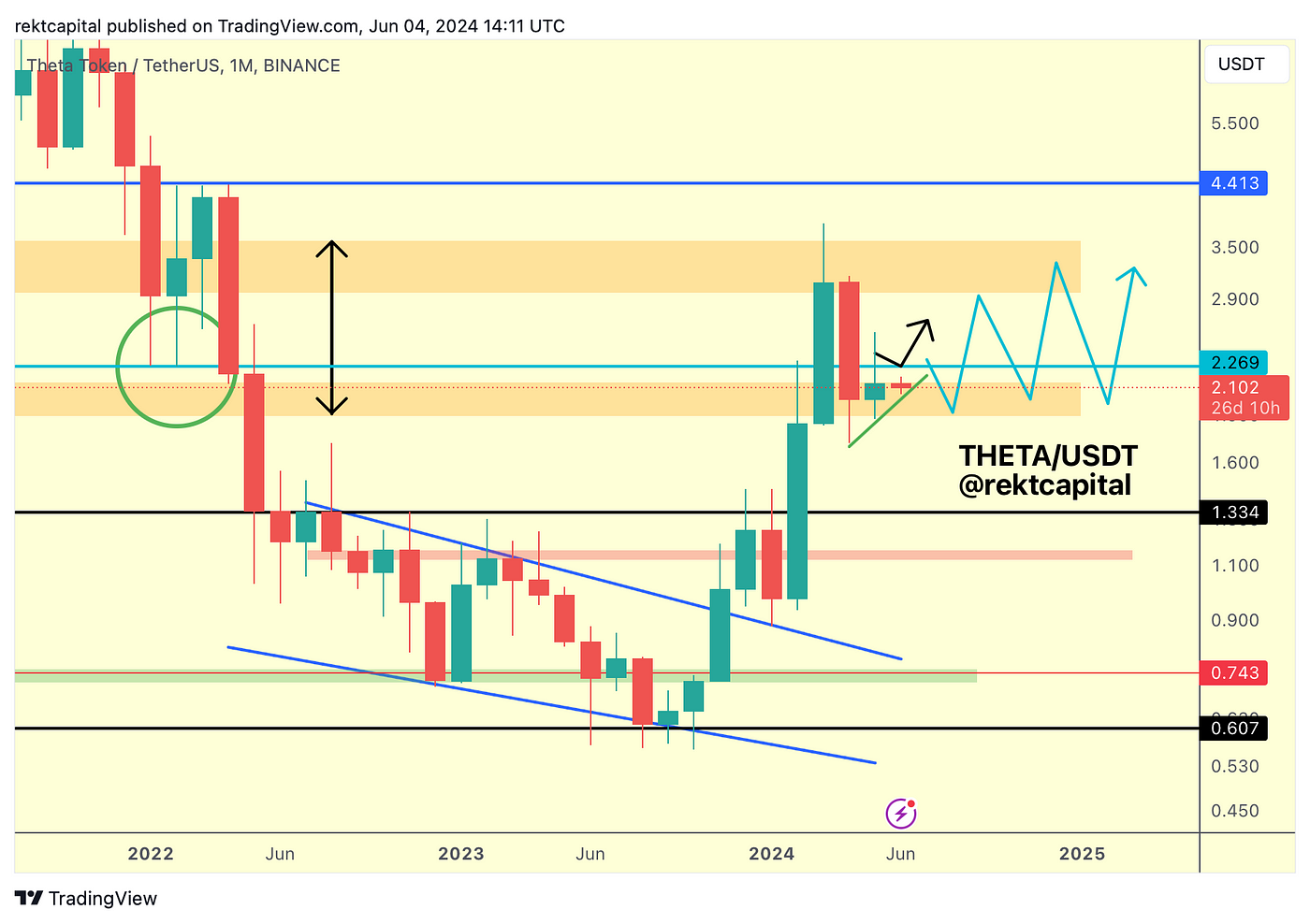

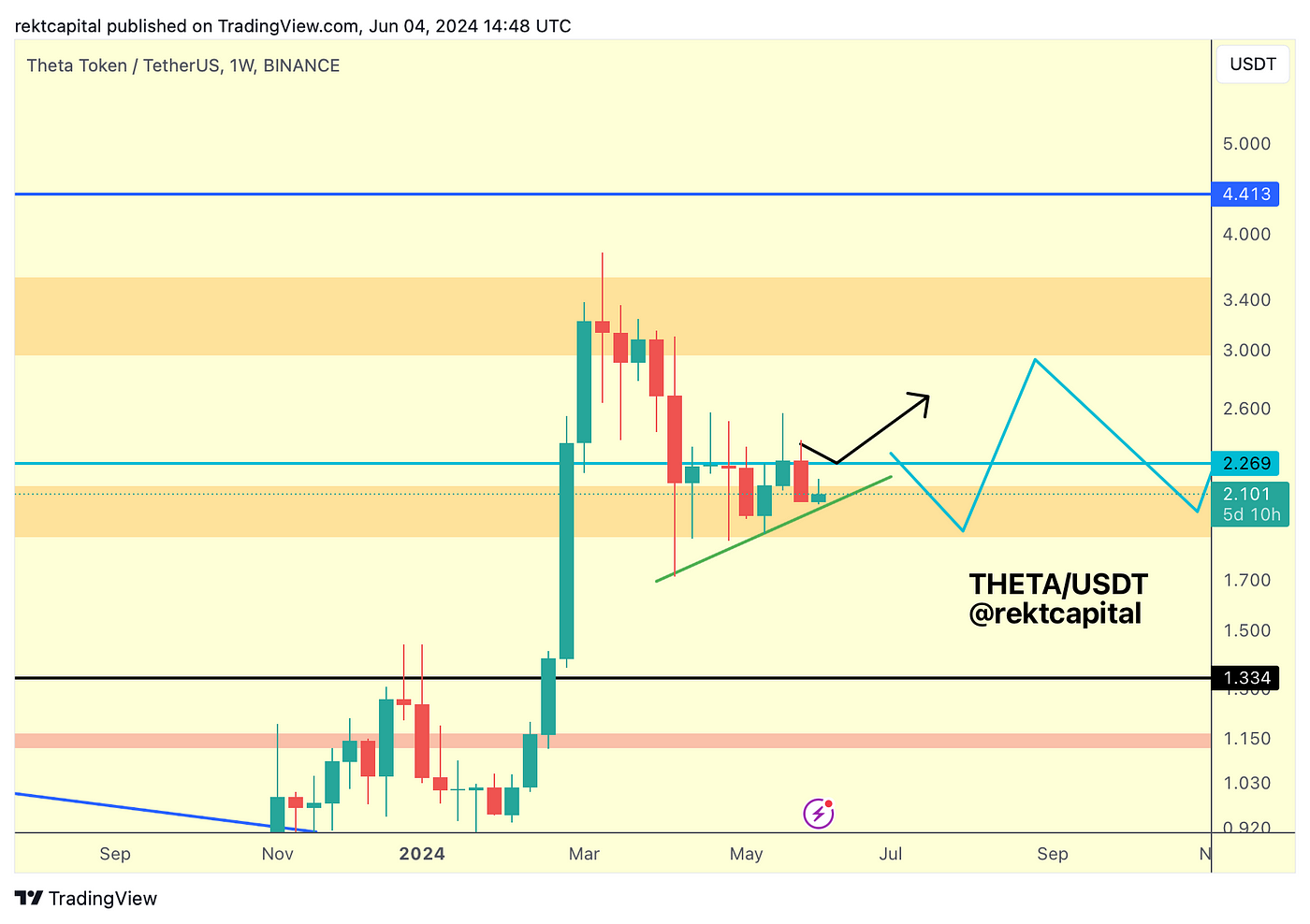

Theta Token — THETA/USDT

Another seemingly lacklustre Monthly Close for THETA but if we zoom into the Weekly timeframe, THETA is showing interesting signs of stability at the pivotal Higher Low (green):

THETA continues to struggle with the light blue resistance but the green Higher Low continues to hold as support.

Could THETA develop an ascending triangle at these highs?

Whatever the structure that evolves here, THETA needs to reclaim the light blue level to continue moving upwards and a Weekly Close above the light blue level would suffice to kickstart that breakout.