Market Analysis with Rekt Capital – May 29, 2024

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- Coti (COTI)

- Avalanche (AVAX)

- Theta Token (THETA)

- Kyber Network (KNC)

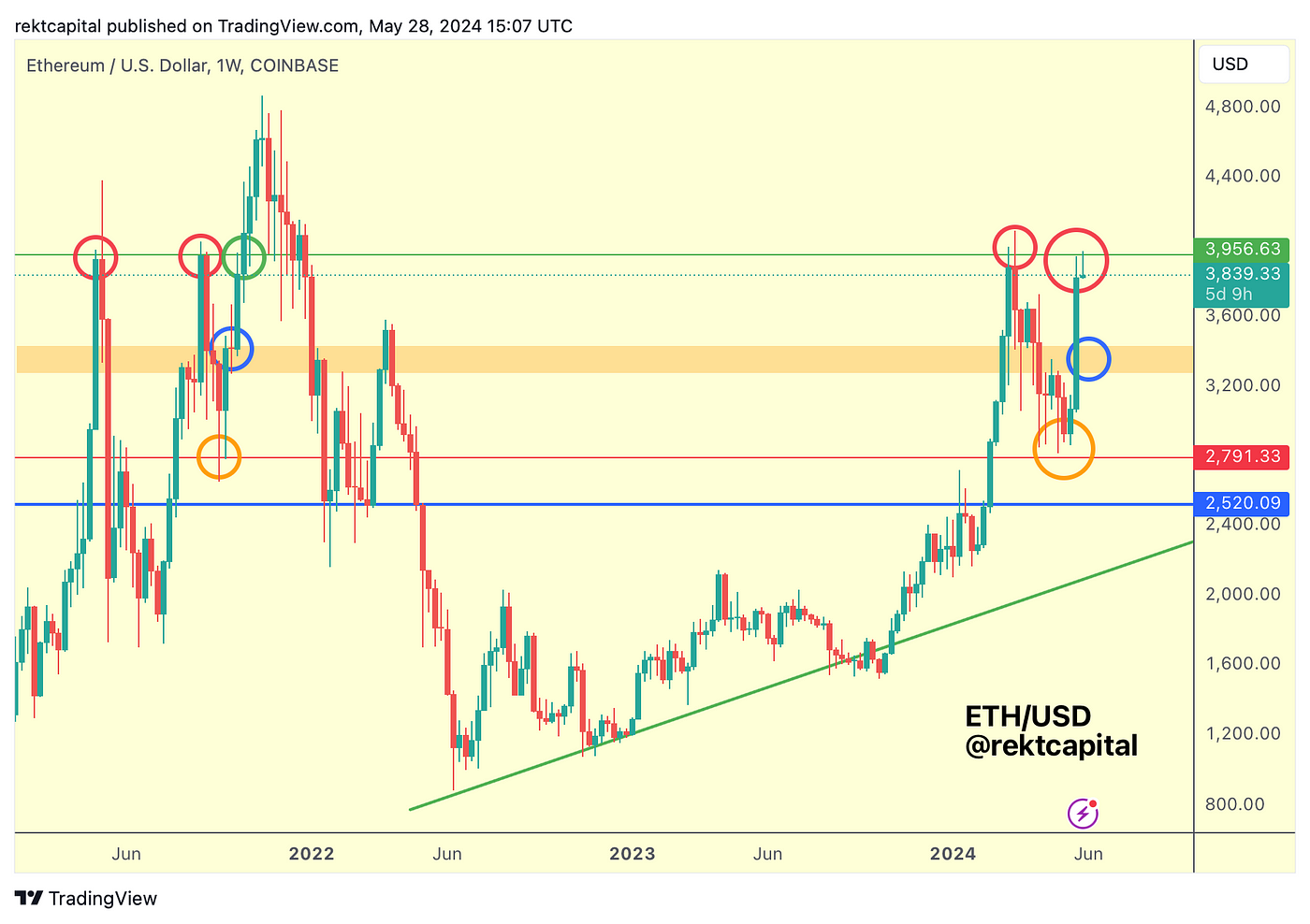

Ethereum — ETH/USD

Ethereum has Weekly Closed below the green $3956 level which means that this level is still acting as resistance.

What ETH needs to do is to Weekly Close above the green level, much like it did in mid-2021, to continue its momentum.

If ETH isn’t able to do that this week, then there’s scope for downside from here, maybe even into the orange boxed region where the blue circle resides; this blue circle represents a historical retest point.

In mid-2021, ETH needed to perform this blue circled retest to move higher.

At this stage it seems difficult to envisage that ETH could drop that much following its ETF catalyst but if ETH isn’t able to reclaim the green $3956 level, then there will always be a threat of rejection and the next major support would be that orange boxed area for a historical blue retest.

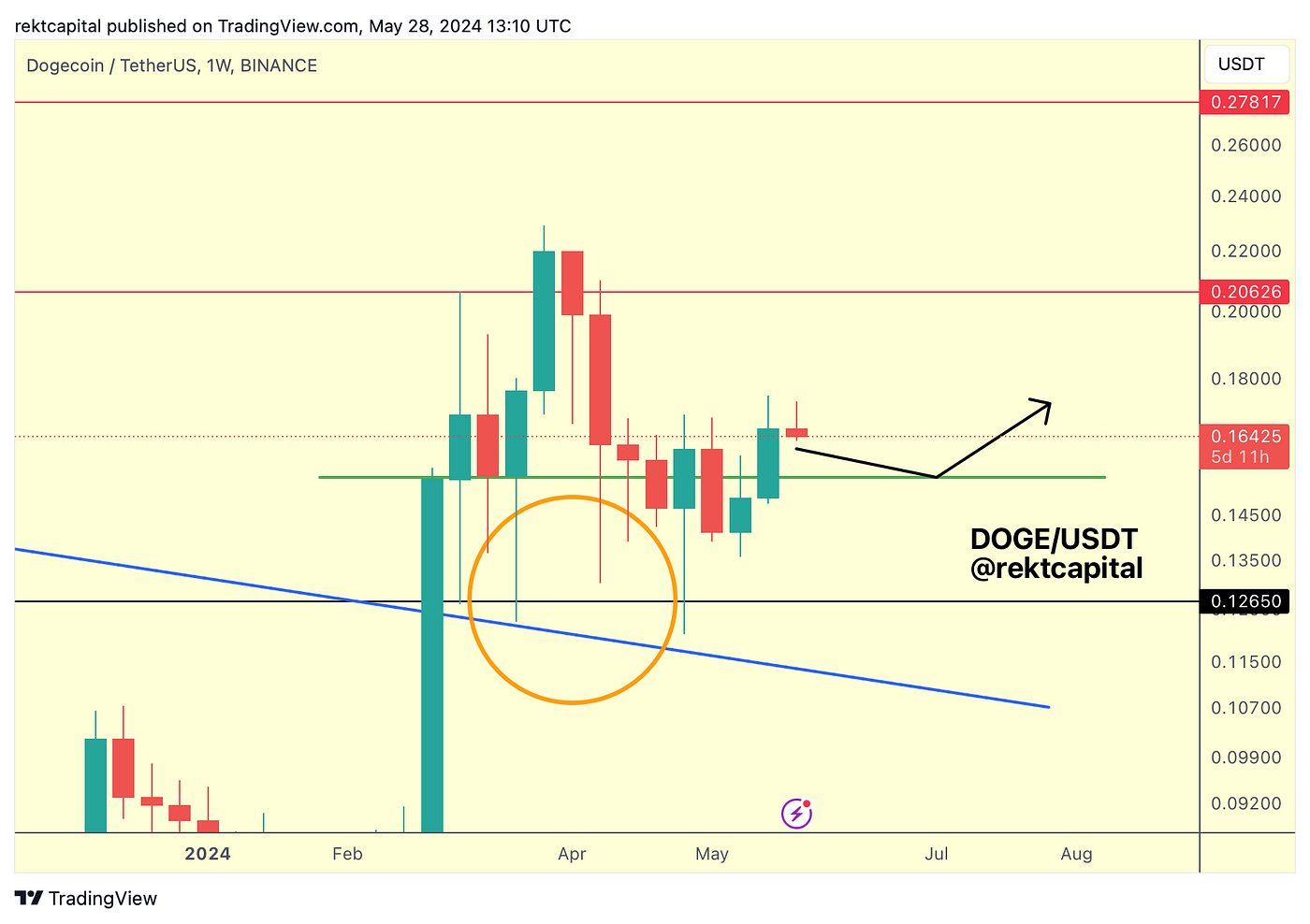

Dogecoin — DOGE/USD

DOGE Weekly Closed above the green level which means that price is positioning itself for a possible reclaim of this level.

Dips in towards this level would be a retest attempt in an effort to solidify a base at higher levels to further build on this recent rebound.

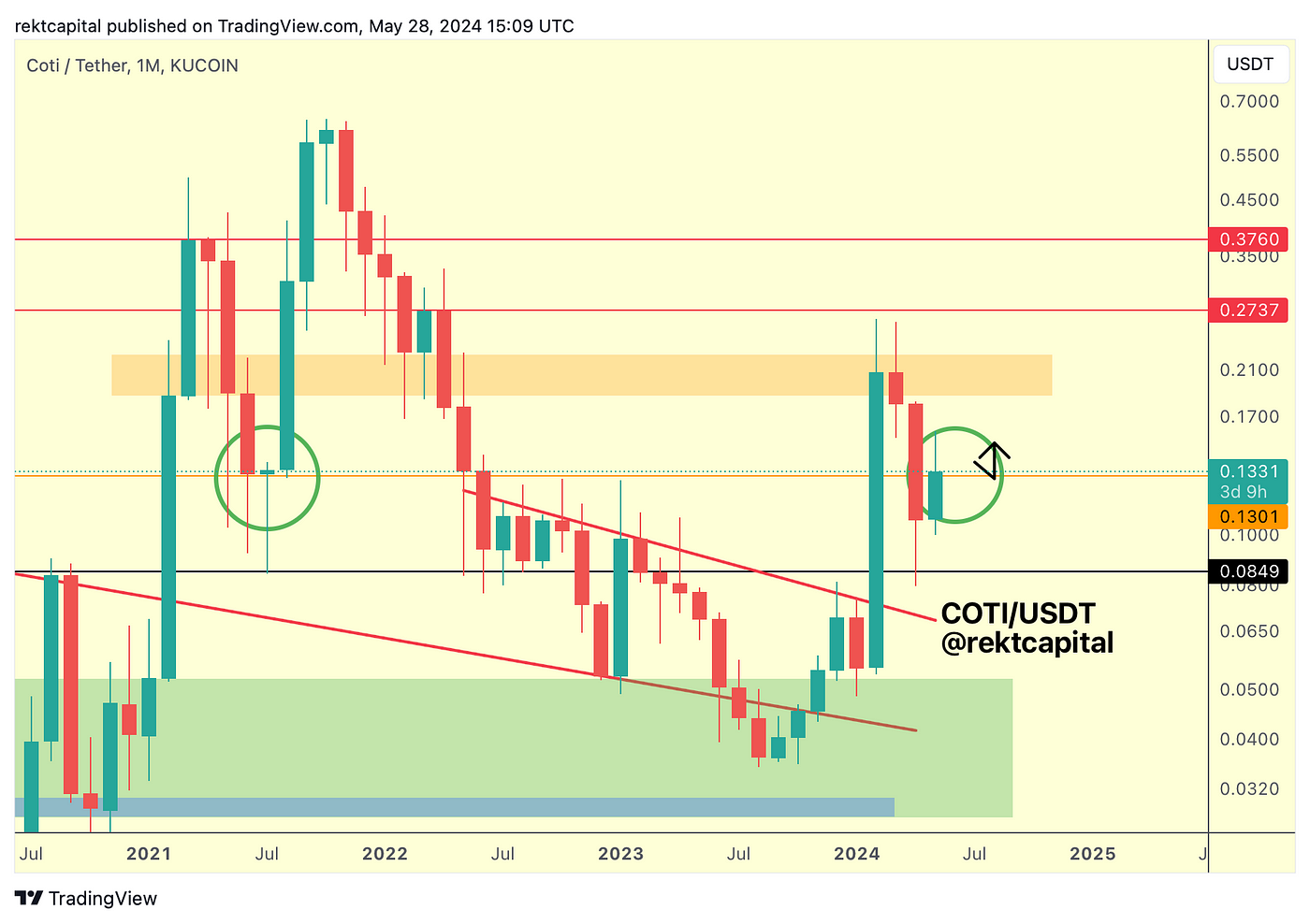

Coti — COTI/USDT

COTI needs to Monthly Close above the orange level to position itself for a reclaim of said level.

In mid 2021, COTI performed a downside wicking retest of the orange level whereas in this cycle, COTI has briefly performed a deviation, the effects of which it could essentially reverse if it is able to reclaim orange as support.

Effectively, if COTI were to Monthly Close above the orange level, this cycle’s volatile retest of the orange level would technically mimic what happened in mid-2021.

The only difference would be in the wicks and candle-closes relative to the orange support; the volatile retest in both cases saw price venture into the black $0.08 level briefly and enabled a recovery to the upside afterwards.

Avalanche — AVAX/USDT

AVAX wasn’t able to reclaim the light blue level as support this past Weekly Close but it has one last chance to do so despite that with a successful Monthly Close above said level.

Just like in mid-2021 and earlier this year, an orange circled retest of the light blue level would precede upside for AVAX.

AVAX doesn’t have much to go to position itself for such a favourably close.

If AVAX fails to perform that sort of close, then it could continue to consolidate between the green and light blue levels until further notice.

If we think of AVAX’s price positioning as being located between the green and red levels to form a macro range, then the light blue level is acting as a mid-point of the macro range.

At the moment it is acting as resistance which will sentence price to hovering in the lower half of the range.

But a Monthly Close above the light blue mid-point would essentially mean that AVAX is ready to meander within the upper half of the range.

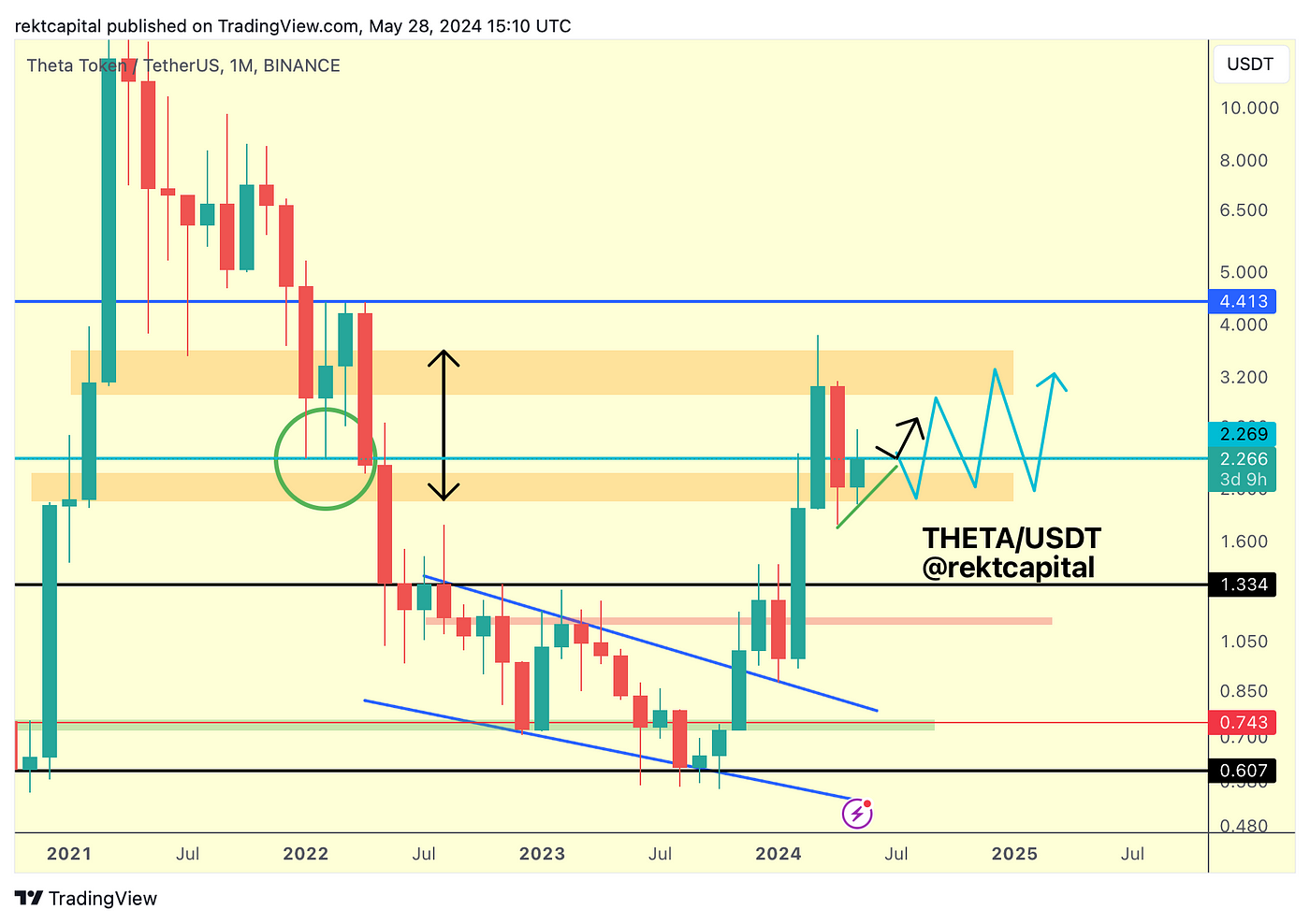

Theta Token — THETA/USDT

THETA is going to try to Monthly Close above the light blue level in an effort to position itself for a retest of said level into new support.

Only a few days away from the Monthly Close and it could still go either way.

A Monthly Close above the light blue level would set THETA up for upward consolidation via the light blue path to as high as the orange resistance box above.

After all — THETA is just consolidating between these two macro orange boxes.

The lower orange box is the Range Low area for THETA and price is holding support here well.

Monthly Closing above the light blue level would essentially confirm that THETA is ready to move higher across the orange-orange macro range.

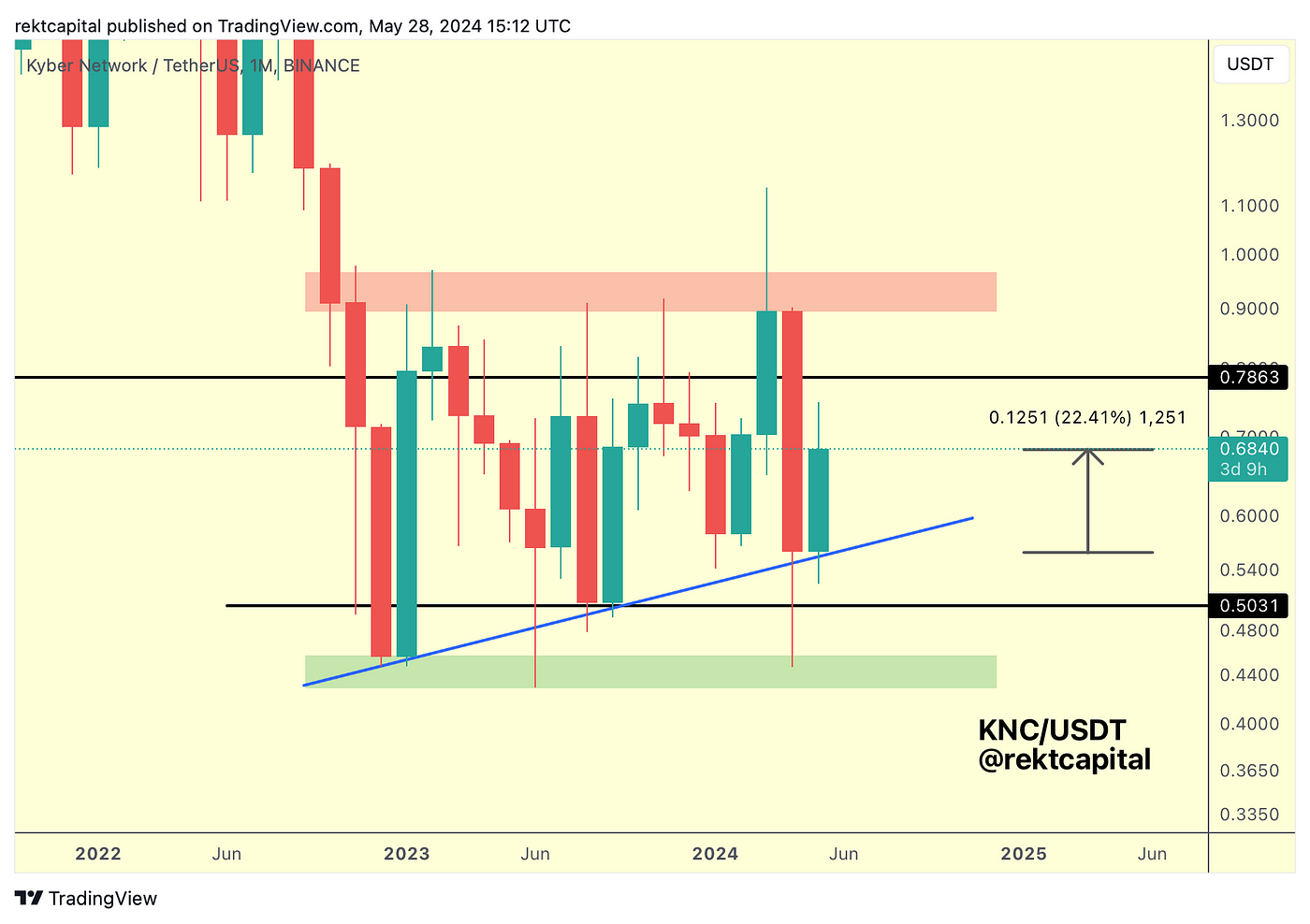

Kyber Network — KNC/USDT

Over the past few weeks we really emphasised the Higher Low for KNC:

Here’s today’s update:

KNC has bounced +22% from the Higher Low.

Price was able to upside wick very close to the black resistance at $0.78.

Generally, KNC is consolidating between the blue Higher Low and the black horizontal resistance, with scope for upside deviation beyond it to as high as the red resistance above.

On this recent rebound for KNC, price will try to search for higher levels but it’s possible KNC will reject at those higher levels following its strong recent reaction.

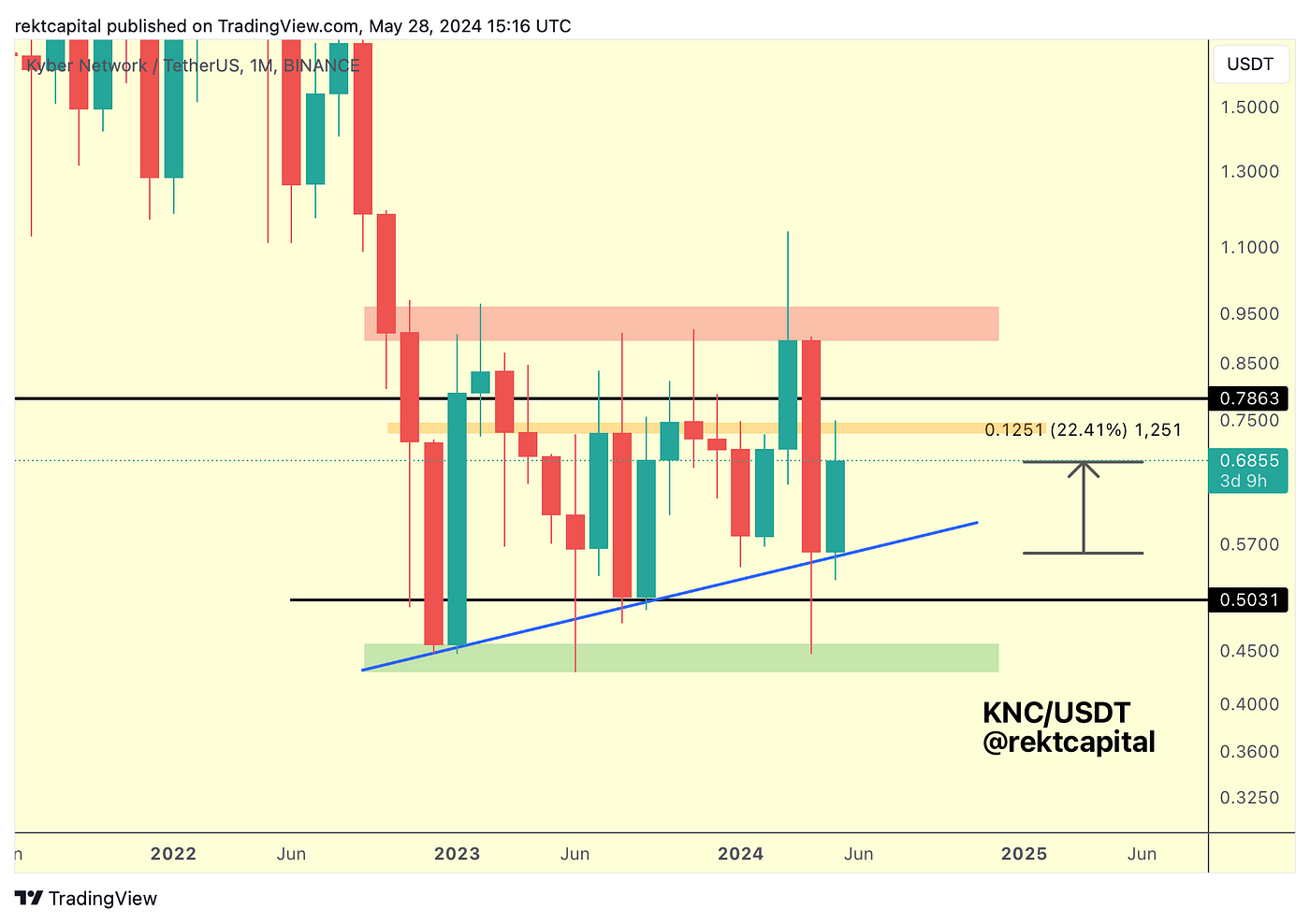

Let’s see how the Monthly Closes because every time KNC Monthly Closed below the orange boxed area, price would pullback:

KNC rejected already from that orange box most recently so a Monthly Close could set price up for a pullback period, if history is any indicator.

Thank you for reading.

Rekt Capital