Premium Investor Report #280

Gm friends,

The market has been a little sideways lately but that doesn't mean you shouldn't know what to expect! Rekt Capital has another edition of his TA so that you can know what's around the corner.

DeFi dad also has a new airdrop stategy with Parcl where you can earn points with real estate perps.

And last but not least, Jesse has another Airdrop Report with lot's of new opportunities.

Let's go!

PS: For any crypto related questions please comment on the website.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Woo Network (WOO)

- Coti (COTI)

- Polygon (MATIC)

- Band Protocol (BAND)

- UniSwap (UNI)

- VeChain (VET)

Let’s dive in.

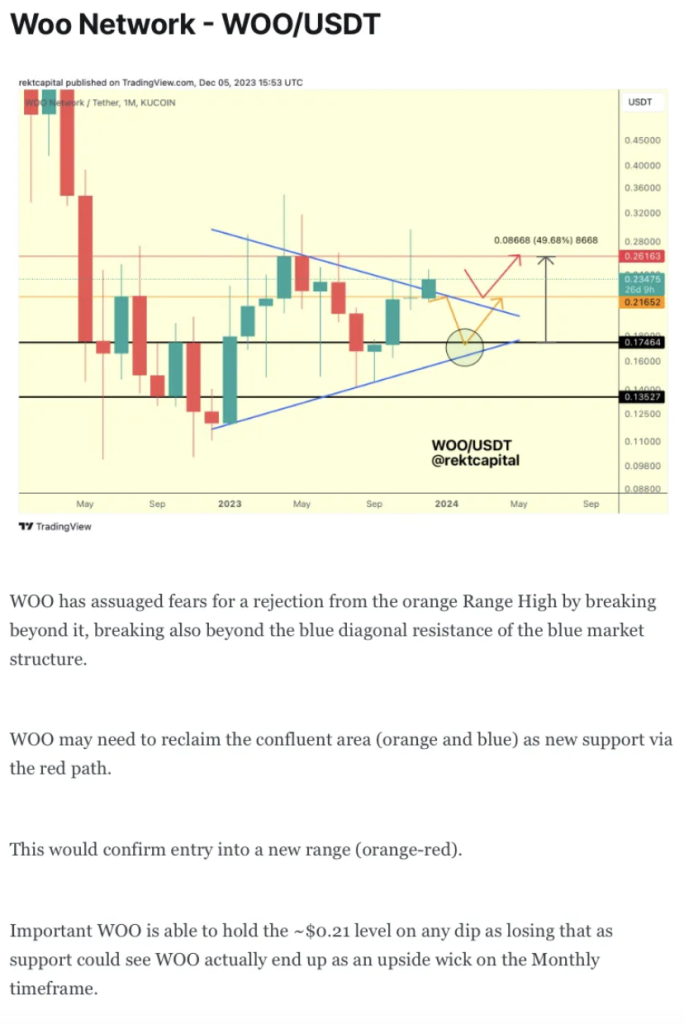

Woo Network — WOO/USDT

Two weeks ago in the Altcoin Watchlist, we discussed a crucial retest for WOO:

The following week, we spoke about how it was successful to enable a +29% rally but also how another retest was on the horizon (green path):

And here’s today’s update:

WOO not only followed the green path — it tore right through it.

Generally, WOO has rally +118%

Responses