Premium Investor Report #304

Gm friends,

Welcome back to another edition of the Wealth Mastery Premium Investor Report.

As usual we have lots of good stuff for you today so let's get after it!

Here's what's in today's issue:

- Rekt Capital has the latest technical analysis for you on the market.

- Defi Dad has a tutorial on how to earn maximum passive LP yields with Opal.

- Jesse has a ton of hot new airdrops for you.

For any crypto related questions please comment on the website.

Step 1: Sign up using this link

Step 2: Fund your account with $100 or more

Step 3: Claim your bonus and free trade

In today’s edition of the Newsletter, the following cryptocurrencies will be analysed & discussed:

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Crypto Com (CRO)

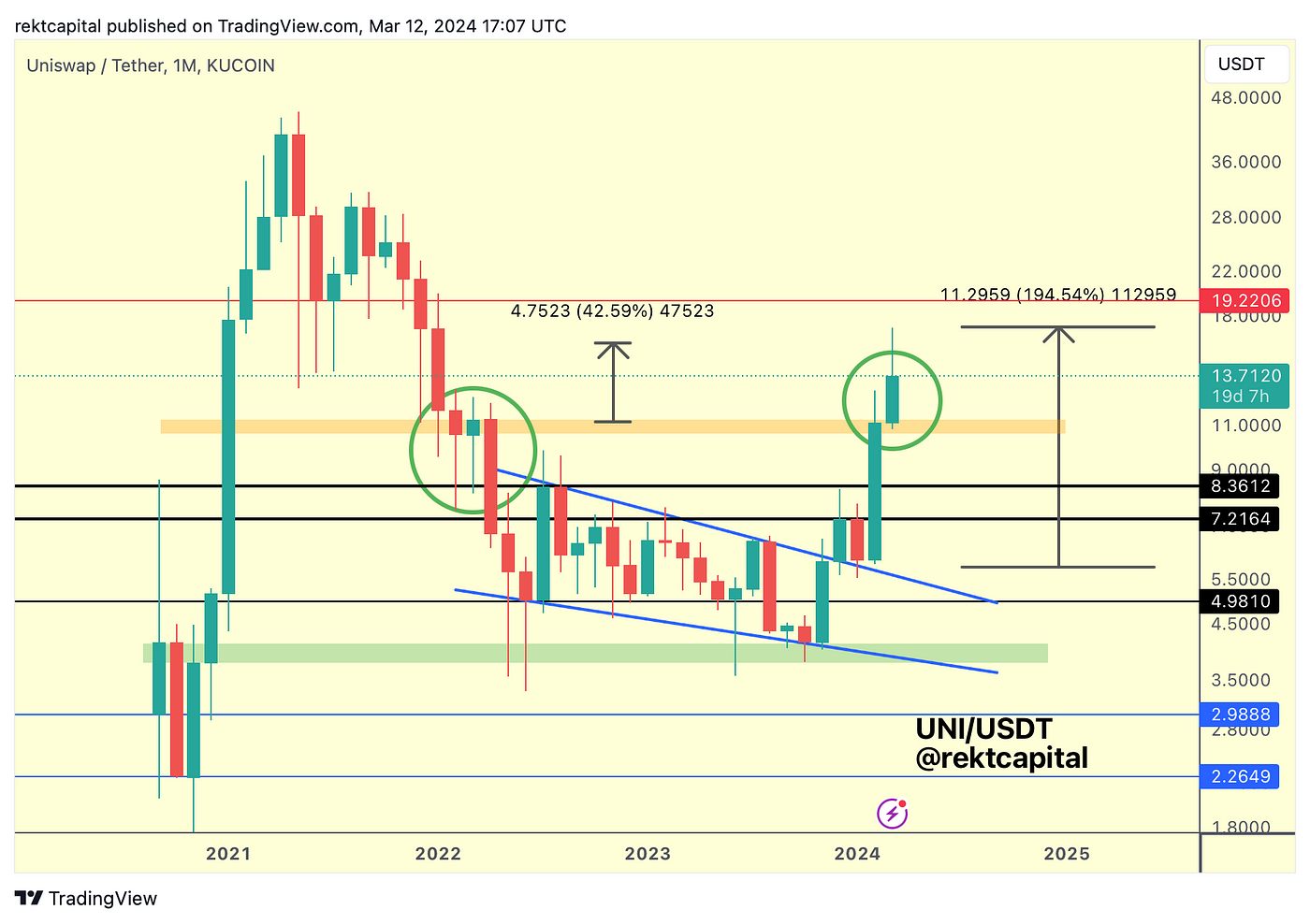

UniSwap — UNI/USDT

UniSwap has come a long way since retesting its macro market structure:

Here is today’s chart:

Do know why have Theta Token not been listed on the Coinbase exchange yet until now?

No idea, none at all, Coinbase listing process is a mystery

Some say that this bull run will be over by the Q3 or Q4 of 2024 and it will be a shorter cycle, any thoughts on that?

It is one theory. We made a video on it https://youtu.be/g9-v3N48TGo

Hi Lark. I see that you’ve minted some PUFF. I put a very modest amount of ETH (paying exorbitant fees) into PUFF and I have claimed the “genesis potion” tokens. But I hear there’s an NFT for us early participants. Did you get the NFT? And if you did can you explain to this newbie how I can mint the NFT? At the link https://www.methlab.xyz/puffpenthouse, I see my balance of PUFF tokens (3500) and a tiny amount of of mETH (.022) but no NFT. I have no EFT on my MM wallet either on eth mainnet or mantle. Appreciate any help. Thanks.

The potion was the nft. The nft was what let you claim the tokens. I can under the confusion, but there is no other nft.

Hey Lark,

What in your opinion makes Nibiru a promising play?

Cosmos ecosystem coins do well, IE INJ, low market cap, solid tech, solid backers, obviously still early days, but I think it has potential.

Hi Lark

I was wondering 🤔 if you and rest of the team have some information about SHIDO token…? Is this project going dead or they training move forward?

Hey, we don’t have any information beyond what the team has shared publicly. Sorry.

Ok 🙂

Thank you for your time