RWAs, NFTs, and Americana

TL;DR

RWA-backed tokens represent real world assets, including property, commodities, financial instruments, and intangible assets. The Americana platform offers services to vault and custody valuable physical assets, also creating digital tokens of receipt and ownership which can then be traded, or used later to redeem vaulted items.

An area of crypto getting increased attention recently is RWAs–or RWA-backed tokens, or RWA tokenization–which tie in neatly with NFTs, and, as one example of a new NFT-focused project that’s already getting up and running, there’s an interesting new platform called Americana.

Let’s begin by clearing up exactly what RWAs are and why they’re important, and then look at Americana, along with some other comparable projects.

What Are RWAs?

In the world of crypto, RWA means Real World Asset (not to be confused with Risk-Weighted Assets in banking), and so RWA tokens refers to crypto tokens (both fungible and non-fungible, depending on requirements) that represent real, non-crypto assets.

This could include physical property and commodities, such as real estate and art, or gold and agricultural produce. But it could additionally include financial instruments, such as Treasury bills and equities, and also intangible assets such as patents and royalties. Stablecoins like USDT and USDC can also be seen as a kind of RWA token, since they’re tokenizing an underlying, real world currency.

In fact, ideally, almost anything you can own in the real world can be tokenized and traded on-chain.

What Are The Benefits of RWA Tokens?

Some immediate benefits include:

- Fractionalization: we can take an expensive item, such as a house or a painting, and break ownership into shares.

- Easy access: we can lower the barriers to entry when it comes to all kinds of assets.

- Increased liquidity: with easy access, instant trade, and always-open markets, we gain liquidity.

We could add to this list factors like the removal of middlemen, the transparency of the blockchain, and, overall, the creation of more efficient and free-flowing digital markets.

However, an emerging requirement of RWA-tokenization in some cases (depending on the asset) are custodians, meaning services to take care of the underlying physical assets that are being tokenized. And that’s where a project like Americana can step in.

What is Americana?

Americana opened for business at the end of July, and offers a range of services. The first feature is that it can take custody of your valuable, physical objects, storing them in secure, climate-controlled conditions. This can take in everything from artworks, to jewelry, to vintage cars.

After that, Americana creates a digital representation of the item, that can be displayed, and a digital certificate, in the form of an NFT on Ethereum, to authenticate ownership.

From there, items in the vaults can be exhibited, but also, ownership can be traded through exchange of the digital certificates. In this way, ownership can change hands without the underlying item itself ever moving from the Americana vaults (although of course, owners can choose to take physical possession whenever they like.)

Americana can also custody digital items, and puts a strong emphasis on art. It’s still early days, but it looks like new collectibles will be offered for sale through the platform, and some artists well known in (but not limited to) the NFT space–such as Vinnie Hager, Danny Cole, and Tom Sachs–are working with Americana and creating personal profiles on the platform.

Americana was founded by Jake Frey, of design studio Frey Labs (which has worked with the likes of Apple and Shopify), and has backing from high profile names including OpenSea, and VC firm Seven Seven Six, which is itself run by Alex Ohanian, the co-founder of Reddit.

In April 2022, Americana minted 10,000 membership NFTs called Something Token, but while holders were granted access to the beta version of the platform, it’s not clear what role, if any, Something Tokens will play as the project opens fully and continues to develop.

Comparable Projects

Americana is not alone in taking care of and tokenizing familiar real world items, and there are some comparable projects working along similar lines, although not always using crypto.

StockX

Heavily focused on sneakers, the StockX platform launched a vault service, along with tradable NFTs to prove ownership, back in January 2022. As with Americana, NFT owners can redeem the corresponding physical items whenever they like, or can simply keep hold of the NFT.

Masterworks

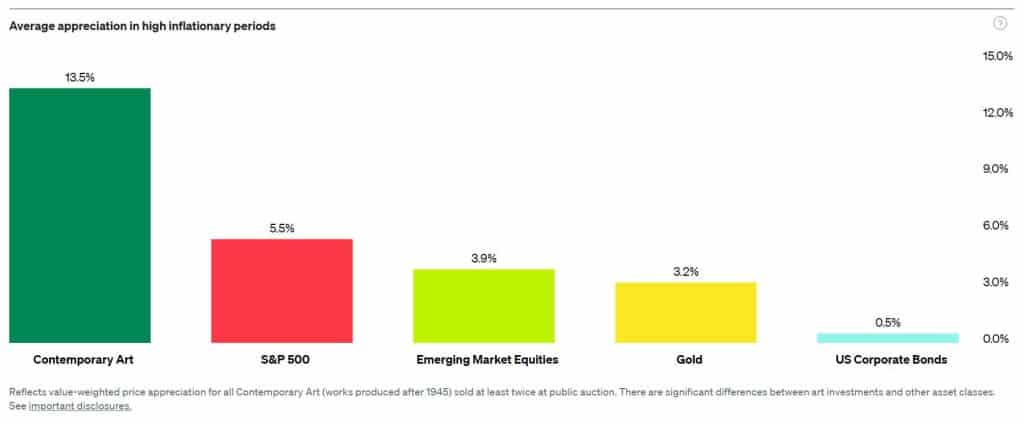

In the world of fine art collection, Masterworks does not use RWA tokens, but offers shares in the securitized physical artworks in its collection, which is made up of blue chip contemporary work.

Masterworks demonstrates that although crypto is offering new methods, many of the core concepts–including the fractionalized ownership and abstracted trade of underlying physical assets–are already familiar.

HyFi Blockchain

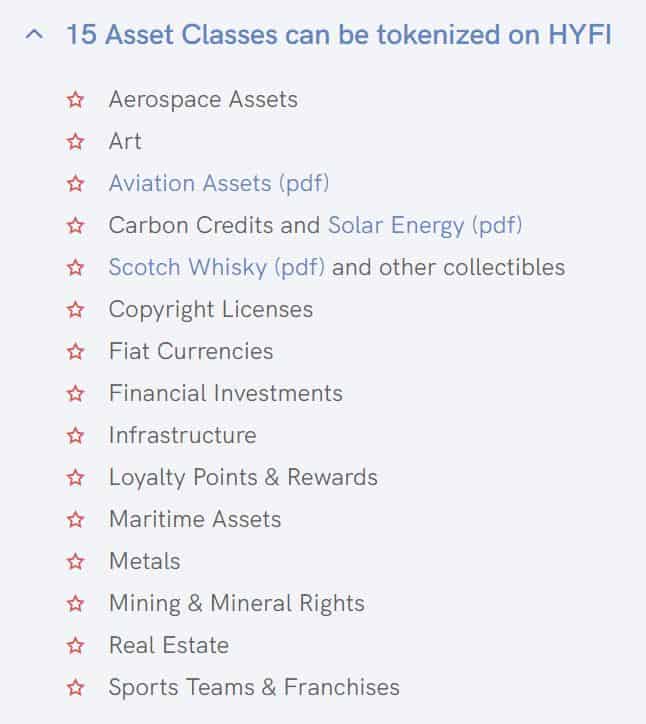

HyFi Blockchain (the HyFi part stands for hybrid finance) is a blockchain development specializing in the tokenization of real world assets. It’s a permissioned network (meaning it’s not decentralized, in contrast to a public blockchain like Ethereum), and it lists fifteen asset classes that it works with, taking in a broad range of sectors.

In June, HyFi offered fractionalized investment in casks of Scotch Whisky, although involvement required acquiring an invitation to the project community. HyFi is an example of RWA tokenization that sits somewhere between traditional and crypto-oriented financial cultures.