What is Flooring Protocol?

TL;DR

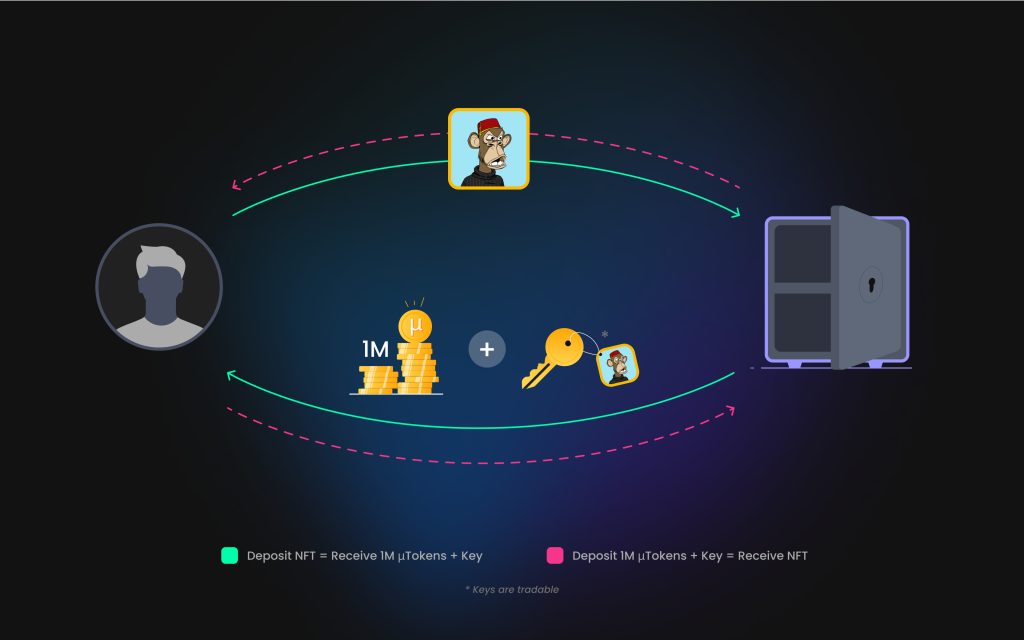

Flooring Protocol is a new NFT platform that allows users to fractionalize NFTs in return for fungible µTokens. Tokens can then be exchanged and traded, and later burned to reclaim an NFT again. If the Vault option is used, the reclaimed NFT will be randomly allocated from the Vault, whereas the Safebox option will return the same NFT as was initially placed in the Vault. However, to use a Safebox, users must also stake Flooring Protocol’s native token, FLC.

There’s a new NFT trading platform vying for attention, called Flooring Protocol, and it’s been picking up new users since it went live. However, it differs a lot from the big NFT exchanges you might be used to, and it could change the way we think about NFTs.

Let’s get an overview of what makes Flooring Protocol different and what it’s designed to do, run through the mechanics and how it’s been performing so far, and then consider whether it has a viable future and what it might do for NFTs over the longer term.

What’s Special About Flooring Protocol?

Launching in the middle of October, Flooring Protocol is based around a simple core premise: to take non-fungible tokens, and make them fungible.

Before we go on, let’s just clarify exactly what that means. NFTs are non-fungible, meaning they’re unique items, in the same way as, for example, a real-life artwork. By contrast, a fungible item is interchangeable with other identical items: one unit of ETH, for example, is interchangeable with any other unit of ETH.

This means NFTs can be rare and valuable, but that they’re relatively illiquid compared to regular cryptocurrencies. So, addressing this, Flooring Protocol aims to take your NFT and split it into a million fungible tokens, which can then behave more like altcoins.

Essentially, you get a bag of tokens connected to an NFT, enabling flexible trading, and providing a way to access liquidity quickly without actually selling the NFT.

Also, you might want to buy tokens connected to other NFTs, an option allowing users to gain exposure to collections without having to hold whole, sometimes expensive, NFTs.

How Does Flooring Protocol Work?

To get started switching an NFT for tokens, you’ve got two options: the Vault and the Safebox.

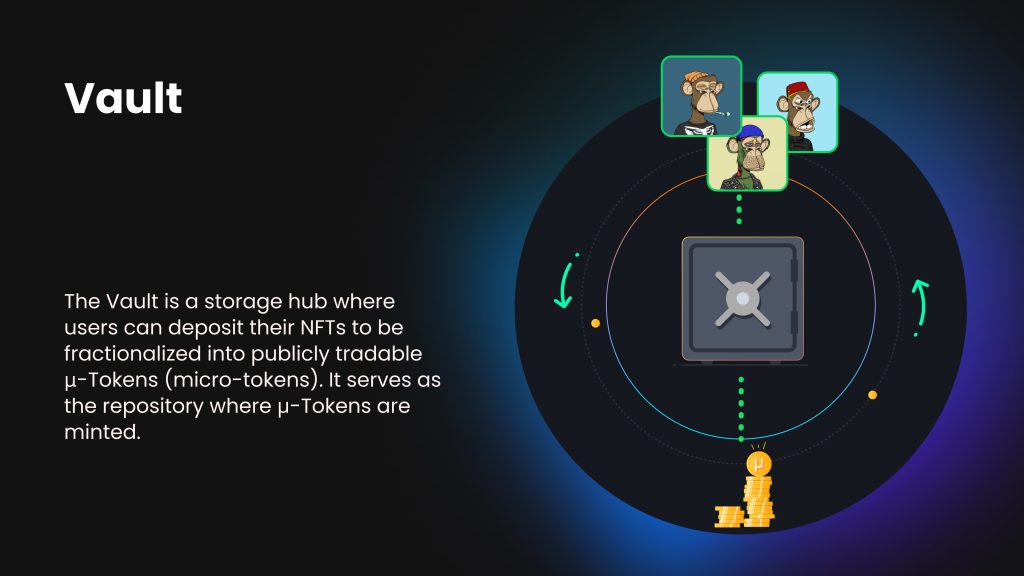

Vault

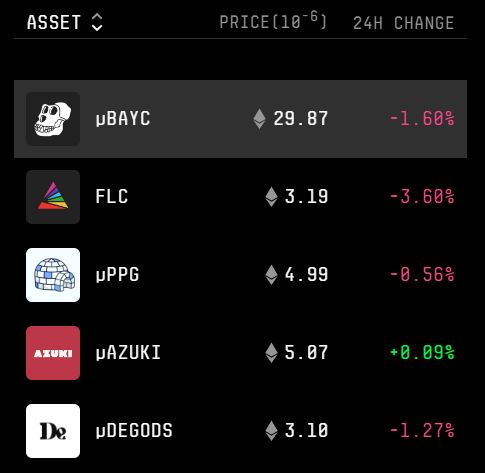

Place your NFT in the Vault and you’ll receive one million µTokens (pronounced micro-tokens) in return. These are fungible ERC-20 tokens, but each collection has its own custom µTokens, so if you fractionalize a Bored Ape, for example, you’ll get µBAYC, whereas an Azuki will get you µAZUKI.

µTokens can then be used however you like. You can sell them for ETH, trade them on a DEX, or provide liquidity on Flooring Protocol in exchange for farming rewards.

If you want to get your original NFT back, then you simply burn one million corresponding µTokens, but actually… you won’t receive the exact same NFT that you originally threw into the Vault, you’ll instead be issued with a different one from the Vault, taken at random.

On the other hand, if you want to make sure you get the same NFT as you originally fractionalized, you’ll need to use the second option on offer.

Safebox

This is a similar process to the Vault, with key differences being that you need to stake some FLC (Flooring Protocol’s native token) in order to create a Safebox–in which you place your NFT–and then as well as receiving a million µTokens, you’ll also get a Safe Key.

The Safe Key corresponds to your specific NFT, and so to finally reclaim that NFT later on, you’ll need to hand over not only the million µTokens, but also the Safe Key. Although of course–this being crypto–Safe Keys themselves are also tradable, opening up further market possibilities.

Also, Safeboxes are initially created with a fixed locking period, and the longer the lock, the higher the FLC deposit. These periods can be extended, but if you don’t either extend or redeem, your NFT is at risk, as expirations trigger auctions, meaning other users will then be able to bid for your NFT (which in that case, is actually not your NFT anymore.)

FLC Token

The native token of Flooring Protocol, FLC, can be staked (which, as we saw, is a requirement to create a Safebox) for various benefits, including further FLC rewards, membership of the platform’s various VIP tiers, and access to auctions, and there are also opportunities to engage in FLC liquidity mining on Uniswap.

Flooring Protocol’s Prospects

It’s early days, but Flooring Protocol has got off to a strong start, despite having reportedly spent precisely zero on marketing.

TVL rose in the space of about a week to over $17 million, and is currently holding steady at around $17.5 million. The FLC token price has not fared so well, surging initially, memecoin-style, before dropping back down again. However, FLC is actually not a memecoin, and if the protocol grows, the token may experience corresponding gains.

Flooring Protocol has been quickly adding to its list of supported collections, and has clear utility that makes immediate sense: creating NFT liquidity, and allowing wider access to highly priced NFTs. With the NFT market starting to feel more energetic again, while crypto sentiment overall is growing stronger, Flooring Protocol looks a platform with real potential to build from here.