Farming Airdrops: the Good, the Bad and the Ugly

TLDR I interviewed one of Lark’s writers, Jesse, to get some tips from him on how to have fun farming airdrops. How do you not lose your mind, your soul and your funds in the process? A key takeaway: by farming airdrops, you will get a feel for the quality of new projects, and will know if they are good investments – regardless if you qualify for the airdrop itself.

Airdrops in the pure sense of the word are tokenless protocols that you engage with, in the hopes that they will drop a token. For example, testnets. How do you know what airdrops to farm? How to keep track of positions, what to expect in terms of profits? Let’s dive in with Jesse.

Who’s Farming Who?

Who is farming who? Sometimes, the protocol lets the farmers jump through so many hoops that you don’t feel like an honest farmer, but like a circus monkey. Liking this, retweeting that, referring to such and such.

Jesse agrees:

“The protocols want to prove to the investors that they have a lot of interaction, a lot of traction. Pumping up those numbers, farming engagement on social channels. The projects that don’t have a lot of that, are often the most valuable, as they just want you to use their product.”

That isn’t to say that the social aspect doesn’t matter.

Jesse: When it’s done right, the project builds a community, gets people on board who want to support their project. For some projects – I WANT to hold their tokens – even if the price action is bloody – because I believe in them and they value my time. That separates real airdrops from the fakes. Eigenlayer blew it, and now members feel no longer valued.”

Airdrop Farming Evolution

The Uniswap airdrop of September 2020 took people by surprise. Just doing a swap before that month qualified you for a drop ending up being worth thousands.

Jesse: “It’s gotten a lot more complex. 1 transaction and walking away, like with UNI? zero chance of that now. You have to do those tasks daily or monthly. With bridges: touch them at least once a week. You can’t do a no-value trade, you can’t swap a penny. So while you can take some shortcuts, I would say, don’t cheat the system too much. It’s an arms race anyway. On the one hand you have industrial farmers and they try to outsmart defensive measures of the protocols that try to flag them. What you could do, to maximize your chances, is to use a few wallets and apply different amounts. Hope that a few of them won’t get flagged and will qualify.”

Follow the Main Trail

What to farm? There are literally hundreds of projects screaming for your time.

Farming Strategy is mostly following the main trail like Zealy, Galxe. These apps let you explore free mints, testnets, etcetera. (Zealy focuses more on DeFi services, like staking and liquidity provision). They’re like launchpads and communities for airdrops.

You can use such a platform to stay updated on new opportunities, ensuring you don’t miss out on potential token distributions. You connect your MetaMask, Coinbase wallet, etc. You create your ‘passport’ there that keeps you in touch.

Galxy also helps you find a community around specific projects. The hunt is often frustrating and so it can be nice to tap into the community knowledge of how to get over (or around) these hurdles.

Jesse: “Be aware though that you can’t go to Galxe and jump on a random thing. In the end, it comes down to relying on trusted sources like the Wealth Mastery airdrop guide. We vet this stuff.”

Workarounds or Not Going All the Way

Some protocols require you to bring in a certain number of new members before you qualify for an airdrop, through referral links. This can be a hard ask, as not everyone will line up to help you out in this domain of magical internet money.

Jesse: “There are ways around this, such as creating multiple wallets in MetaMask, burner X accounts, etc. But also know that you don’t HAVE to jump through the hoops. It’s also simply an option to skip the testnet phase and wait for the Initial Coin Offering (ICO). In the case of Data Ownership Protocol (DOP), I didn’t participate but simply waited for the ICO that came immediately after the testnet phase airdrop. It gave both people who did and did not qualify the option to get in early.”

Tools to Keep Track of Positions

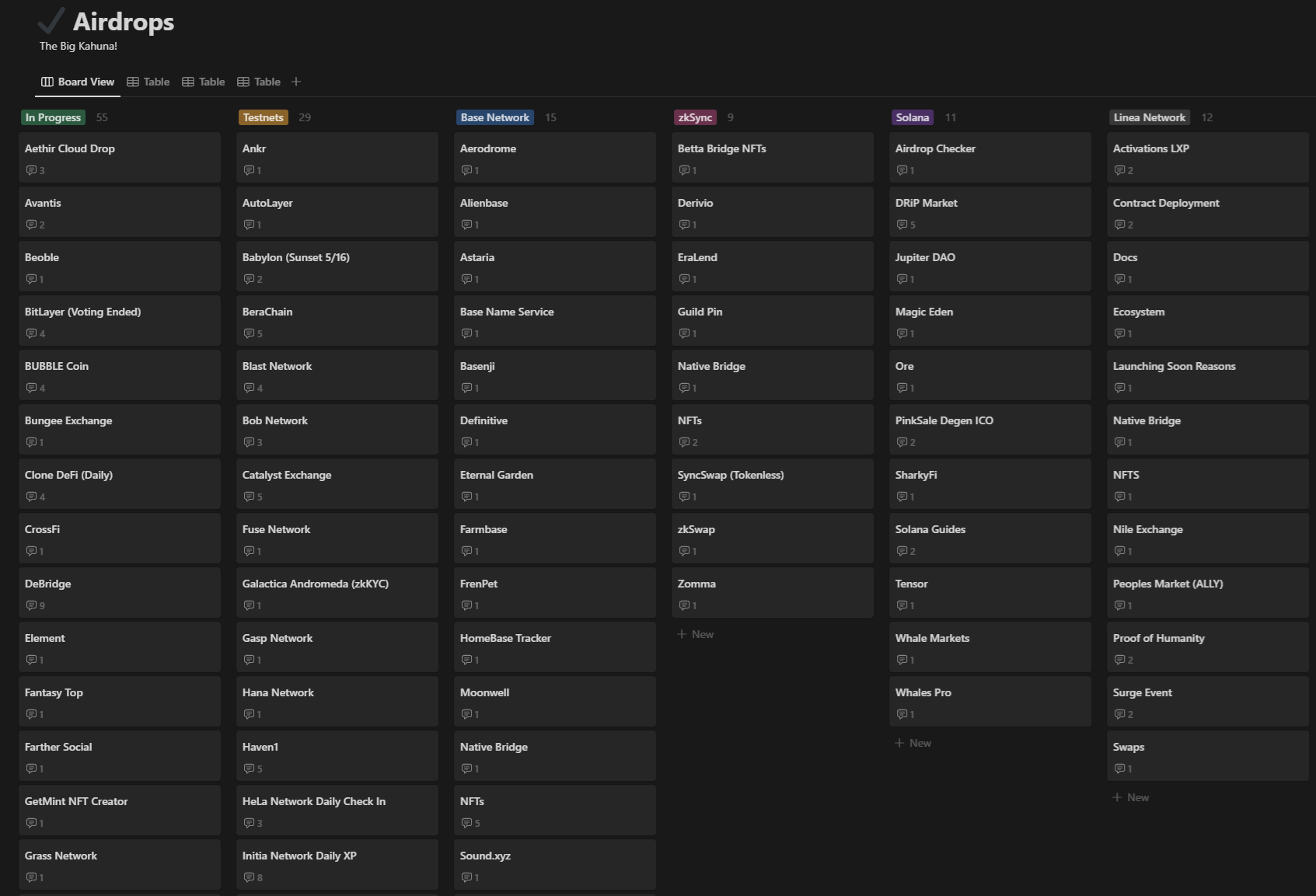

Managing positions can be done using tools like Notion. You just make a simple task board separated by what you’re doing, ordered by chain, for example.

Jesse: “Having some kind of calendar is a big deal. I used to have folders in my Brave browser, sorted by week. When I hit 100 projects it became a mess. So I converted it to Notion. This has made it less overwhelming, but it still is all in my face. There are also paid tools that let you track airdrop payouts but they can’t cover every drop: there are just too many. In the end, it’s about finding a bunch of these airdrop tracking tools and combining them into a system that works for you.”

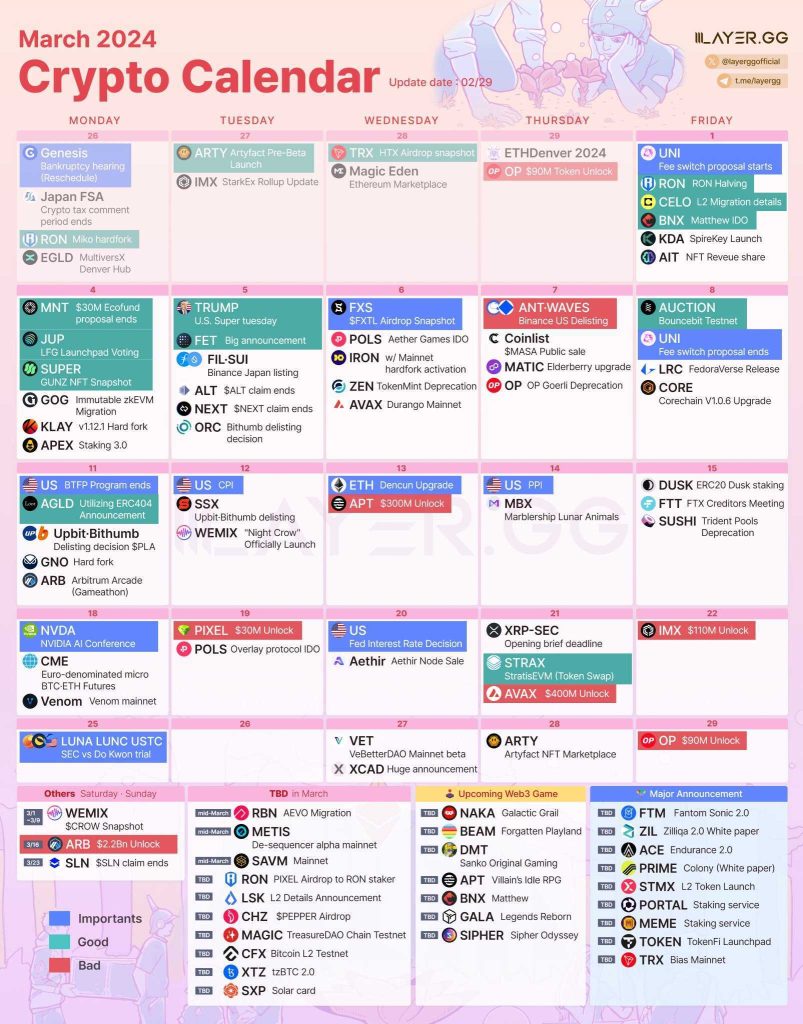

Another tool, just as an example, is Layeregg. It releases calendars like the one below. It helps you spot missed projects.

Focus

As mentioned, the sheer number of chains and ecosystems has exploded. Where to even start?

Jesse: “I pick my battles and I, for example, do very minimal Liquidity providing stuff. That’s DeFi Dads thing. We can’t all be good at everything right? It’s easy not to go crazy as long as you focus on what’s in front of you at that time. So that’s how I manage that feeling of being overwhelmed or missing out.”

“Keeping focus will ensure that you won’t get burned out too quickly. Stick to one network, such as Solana, or Base. Get familiar with the tech on that chain. Don’t do more than a few networks, let’s say four/five a week. A lot of those require just a few steps. You may get a reward, you may not. It’s about getting to that point of being consistent. Having a few that you’re actually committed to.”

Keeping Level-Headed

Jesse: “ I’m sure I’ve missed dozens of Airdrops I’ll never know I forgot to claim. But, I know I’ve got all the important ones (right now). Anyone who tells you they never lost funds or missed out on airdrops they could have claimed is either a liar or has their head shoved up their ass. Haha…

Losing funds is the cost of investing. There’s no guarantee of anything. I could be disqualified for some unknown reason, there could be an exploit next week, or it could take a year before any governance tokens are released. Any number of things could go wrong between now and the finish line. Accept it. Keeping a level head and low expectations is required for participating in Airdrops.”

Indeed, hacks and exploits are part of the risk. Jesse points at the Velocore dex, an app on Linea, which was exploited. The Linea team had to freeze the blockchain to mitigate the damage. It shows that Linea isn’t (yet) a decentralized, censorship-resistant environment.

Profits

What to expect from airdrop farming in terms of profits?

Jesse: “I don’t view farming in terms of an hourly income. If I did, it would probably be five bucks an hour, haha, it wouldn’t be worth it. I spent a hundred hours on Base and got nothing, until maybe later this year. It’s like a game to me, keeping up with new tech.”

That doesn’t mean there are no big cheques to be cashed. One big airdrop worth thousands of dollars can make up for a lot of hours of clicking buttons, tinkering with wallet extensions and block explorer gazing. Just don’t focus on the potential profits too much.

Sort the Wheat from the Chaff

To participate in testnets is to size up the quality of a project. It gives you some sort of insider knowledge.

Jesse: “Scroll is a garbage network. It is not up to speed. Polygon ZkEVM is garbage. I know this because I tried their products. Neon, supposedly bridging the gap between EVM and Solana, isn’t working at all.”

Everyone who farms testnets, will have similar experiences. Some projects are great, some aren’t. Use this obviously useful info and have it guide you in your investment decisions.

Jesse: “I also operate validator nodes. I’m not a coder, but following the manual gets me quite far. This too helps me separate the wheat from the chaff. For instance, I spent about 15 hours setting up an Eigenlayer node. Every time, another error popped up. It tells me enough about the quality of this project. That and the fact that they screwed up the airdrop distribution itself.”

Advice for Beginners

Jesse has the firm opinion that newbies start getting financially literate before moving on to airdrop farming.

“Airdrops are a fun playground for people who understand the markets. But it all has to start with owning some BTC. Understand it, learn how to store it, get a grasp of what makes self-custody fundamentally different from money in a bank.”

“If you jump into airdrops right away, you will hit a brick wall. There is no guarantee of free money. If you just chase wealth, you miss the entire point, which is to take responsibility for your financial future.”

A second piece of advice is to start with testnets.

Jesse: “The reason is obvious: there is no risk of loss. You learn how to touch a faucet, do a swap, put some fake tokens in a liquidity pool. Minting your first nft gives you confidence. Zksync, for example, had a testnet. Testers use sepolia ETH, which isn’t real money. Then, if mainnet goes live, you know what to do, as it works the same. Even in that case, as a beginner, don’t allocate more than 100 dollars.

Conclusion

Farm for the fun of it, don’t greedily farm for max gains. Looking for quick money airdrops will burn you out. With experience, you will get a feel for which projects are ‘just a token’ versus the ones which introduce something new. Focus on the latter. Think of airdrop farming as taking your spare time and turning it into a surprise future payout. Sure, sometimes you will get farmed yourself. But all it takes is one Pyth, one Jito, to make it all worthwhile. One good drop per year… In the meantime, you will keep the pulse on crypto, you will know how to separate bs from the real thing. You’ll be miles ahead of the people who are puzzled by the exotic ticker names of tokens on Binance.