Hong Kong ETFs Heating Up

GM friends.

The stars really are aligning. The halving + imminent spot bitcoin ETF approvals in Hong Kong = massive price fireworks.

So pour that coffee and strap in. Here comes your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on the Hong Kong ETFs heating up, the Superintelligence Collective, the US government charging KuCoin, Tether launching AI division & RWAs heating up.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on Michael Saylor’s playbook for MicroStrategy.

- In case you missed it by Rebecca.

Step 1: Sign up using this link

Step 2: Fund your account with $100 or more

Step 3: Claim your bonus and free trade

Hong Kong ETFs Heating Up

We’ve got two pieces of breaking bitcoin news, and both have to do with the potential spot bitcoin ETFs in Hong Kong.

First, on Wednesday, VSFG and Value Partners announced that they’d submitted a joint application with Hong Kong’s Securities and Futures Commission (SFC) for a spot bitcoin ETF.

VSFG is a Hong Kong-based digital asset investment firm, and Value Partners is a traditional asset management firm that operates across China, Hong Kong, Singapore, and London.

This latest application adds to a growing list of companies that have applied for spot bitcoin ETFs in Hong Kong. Local reporting suggests that as many as ten firms have or plan to file applications with the SFC.

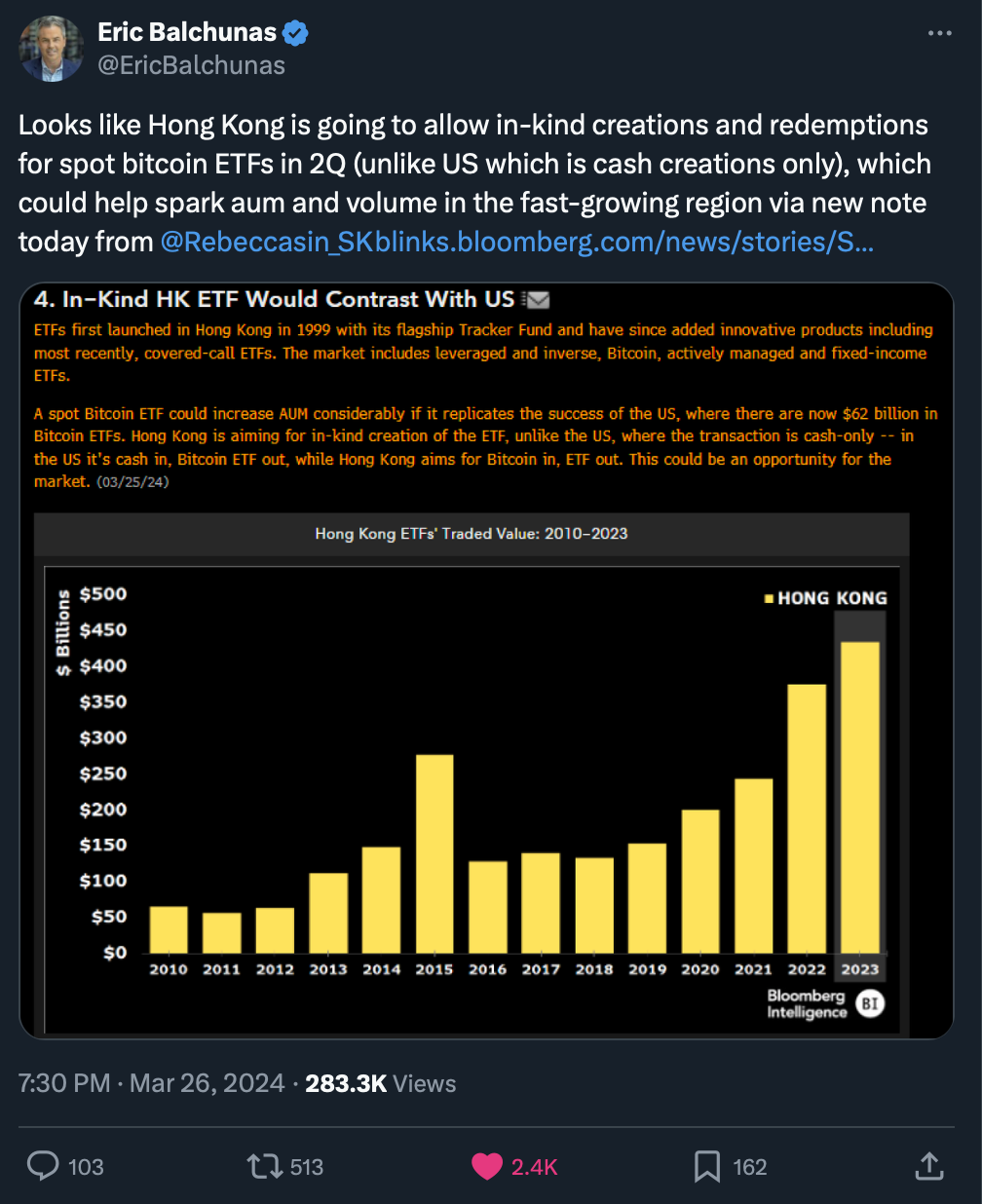

And second, Bloomberg analysts are now saying that the SFC will likely allow for “in-kind” redemptions, and that the agency will probably begin approving ETF applications in Q2 of this year!

In-kind redemptions are considered as more of a bullish catalyst for bitcoin, because they allow investors to redeem their ETF shares for actual bitcoin. This is contrasted to cash only redemptions (the US spot bitcoin ETF model) where investors can only redeem their shares for cash. Ultimately, in-kind redemptions can mean less selling pressure on bitcoin.

And if Bloomberg is correct that the Hong Kong ETFs are coming in Q2, then expect some serious price action madness. These ETFs will open the floodgates to funds within the larger Chinese region, and it will all be happening post-halving.

Whoa. We really aren’t ready for what’s about to happen.

Three Crypto-AI Projects to Create “Superintelligence Collective”

On Wednesday, it was announced that three blockchain-based AI projects are merging together to create a new decentralized AI platform. Apparently, the merger is an effort to counter big tech companies from controlling the AI sector.

The projects in question are Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN). The plan is for the three protocols’ tokens to merge together to form the ASI token (ASI = “artificial superintelligence”). The market cap of ASI post-merger is expected to be around $7.5 billion.

According to project leaders, ASI will be the native token for a new, open, decentralized AI network, called the “Superintelligence Collective”. Little is known about the specific plans for this new network, but here’s what we do know.

The goal of the Superintelligence Collective is to provide a market alternative to monolithic, big tech AI products. Ben Goertzel, founder of SingularityNET, will be spearheading the new network. And the three projects will continue to operate as separate entities under the Superintelligence Collective.

FET, AGIX, and OCEAN are up 7%, 10%, and 20% respectively, on the news.

U.S. Government Charges KuCoin with AML Violations

One of the world’s top cryptocurrency exchanges faces new criminal charges from the U.S. government.

On Tuesday, U.S. federal prosecutors in Manhattan formally charged KuCoin and its two founders (both Chinese nationals) with violating U.S. anti-money laundering (AML) laws. Prosecutors allege that KuCoin operated in the U.S. without proper registrations, failed to maintain appropriate KYC and AML programs, and lied to investigators about its U.S. operations.

In the indictment, U.S. government lawyers said that due to KuCoin’s lack of controls, the exchange was used for laundering money from “criminal activities, sanctions violations, darknet markets, and malware, ransomware, and fraud schemes.”

Prosecutors are seeking criminal penalties against the exchange and its founders.

For several years now, KuCoin has been one of the world’s top ten centralized exchanges, competing against Binance, Coinbase, OKX, and others in terms of spot and derivatives trading volumes. KuCoin is formally registered in Seychelles (i.e. small Island off African continent), but has been accessible in most regions around the globe.

About $1 billion in funds left the exchange within 24 hours after the news broke. KuCoin has responded stating that the remaining assets on the exchange are safe, and that its lawyers are reviewing the charges.

Tether Launches AI Division

There’s some interesting news breaking about Tether, the world’s largest stablecoin issuer. On Tuesday, the company announced that it’s launching a new AI division.

In its press statement, Tether stated that the AI division will focus on developing cutting-edge open-source AI models, work to integrate these models into the real world to solve real problems, and contribute to the border AI development community. Tether further stated that it wants to “democratize privacy-preserving open AI technology.”

The company is currently searching for a head of AI research and an AI engineer.

Tether’s core product is USDT, which currently has over a $100 billion market cap. However, according to its latest press release, the company also invests in telecommunications, renewable energy, and bitcoin mining. Therefore, it appears that this AI move is in-part an effort to further diversify Tether’s operations and revenues.

Tether first got involved in AI last year when it invested in Northern Data, a German-based company that specializes in crypto mining and providing computing power for AI related services.

Tokenization of Real World Assets is Accelerating

Last week, we reported about BlackRock launching a $100 million asset fund on Ethereum. The details suggest that the fund will give investors exposure to tokenized real world assets (RWAs).

Well it seems that RWAs are gaining momentum, because there’s been two more developments in the space.

On Wednesday, HSBC, a global banking powerhouse, announced that they’ve made tokenized gold available to its Hong Kong retail customers via HSBC’s online banking platform and through its mobile app.

The gold tokens are tracked on HSBC’s Orion platform, which is a private, permissioned blockchain network. HSBC says it’s the first bank to offer tokenized RWAs to retail investors.

Also on Wednesday, Oasis Pro, a crypto securities trading platform, announced that they’d created a securities token that gives investors exposure to the Diamond Standard Fund, which is a diamond fund available to IRAs and institutional investors. The token is traded and runs on Avalanche’s C-Chain.

Expect much more RWA adoption across the major L1 chains over the next few years.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- UniSwap (UNI)

- Theta Token (THETA)

- Coti (COTI)

- Chiliz (CHZ)

- Crypto Com (CRO)

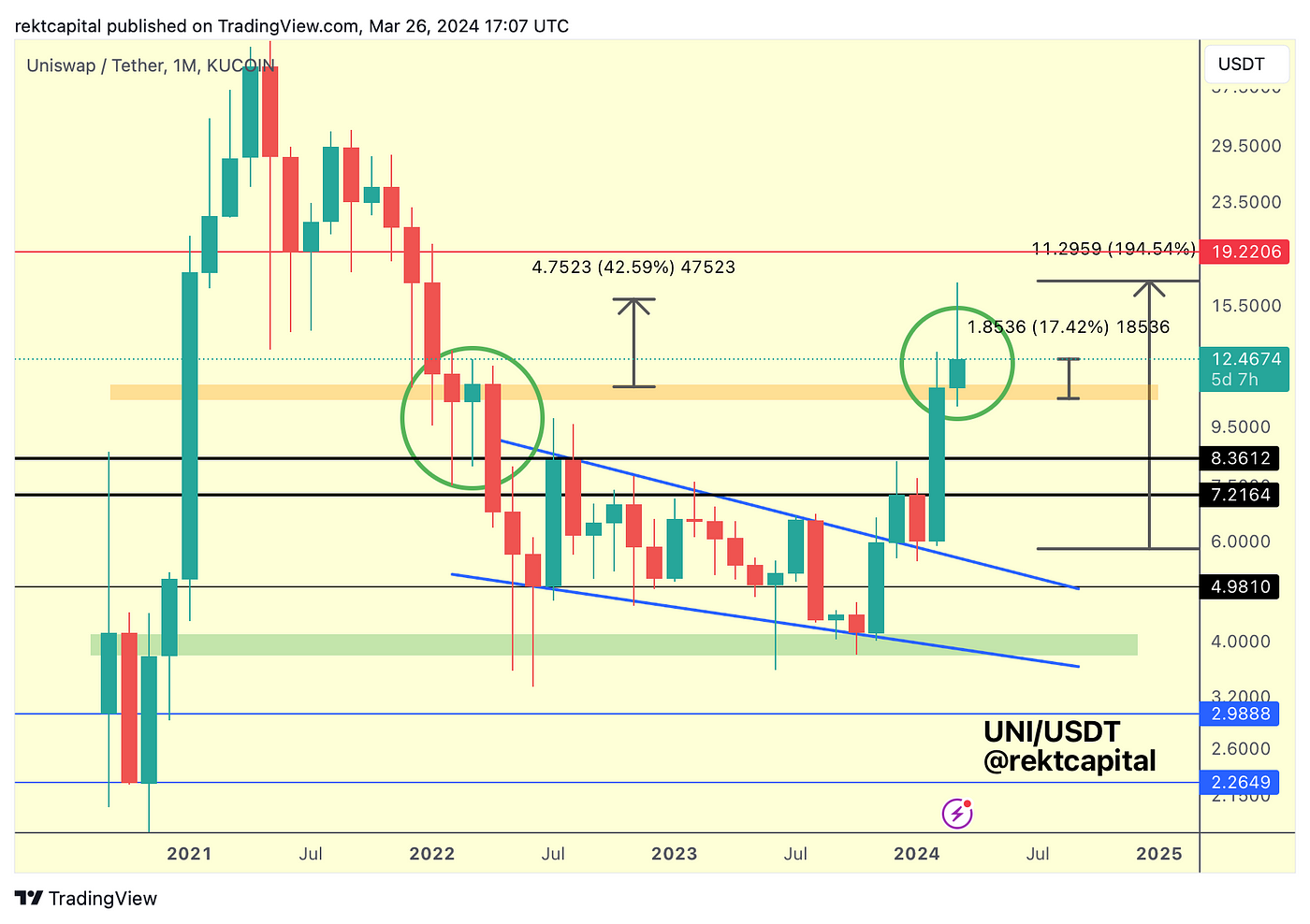

UniSwap — UNI/USDT

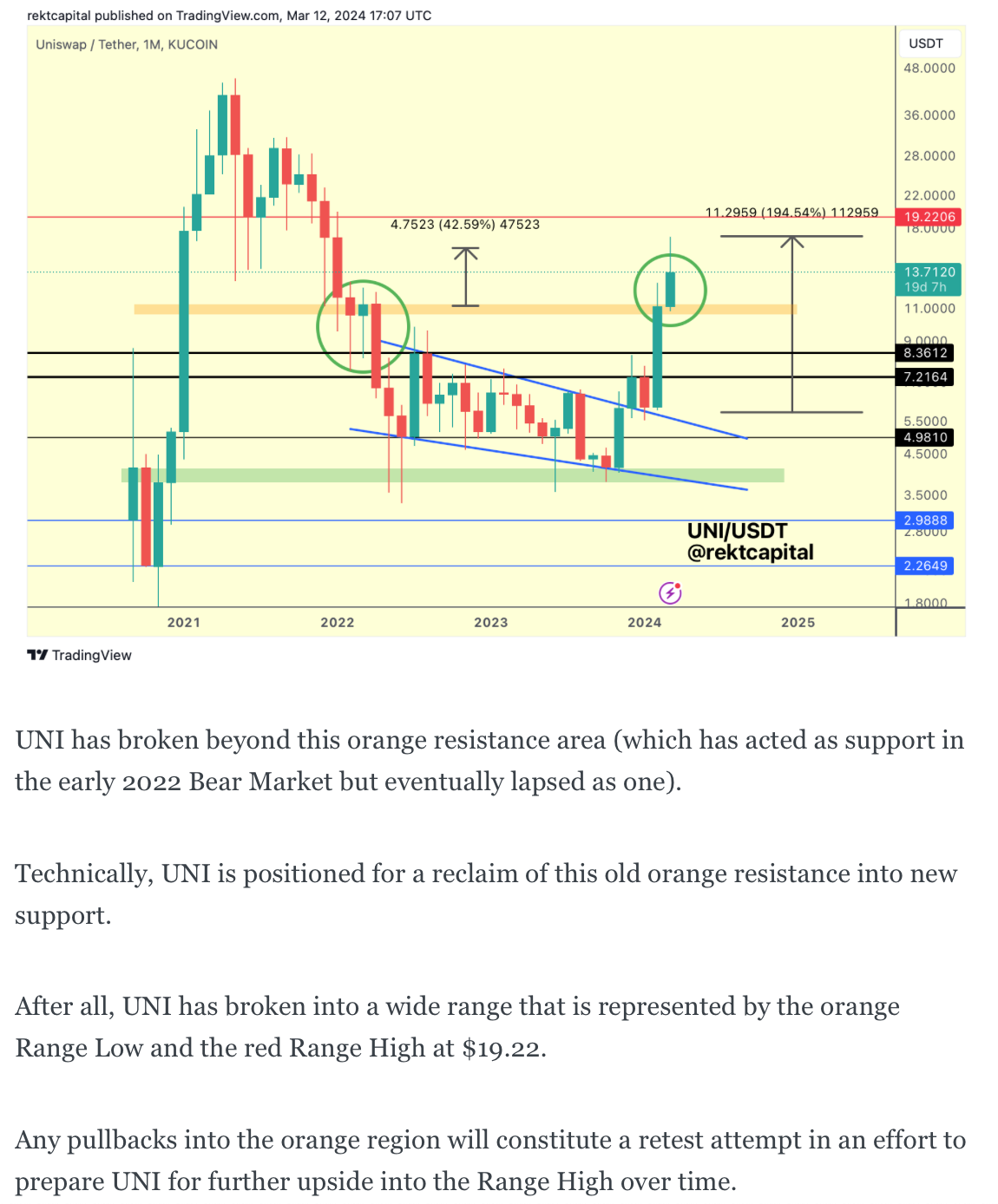

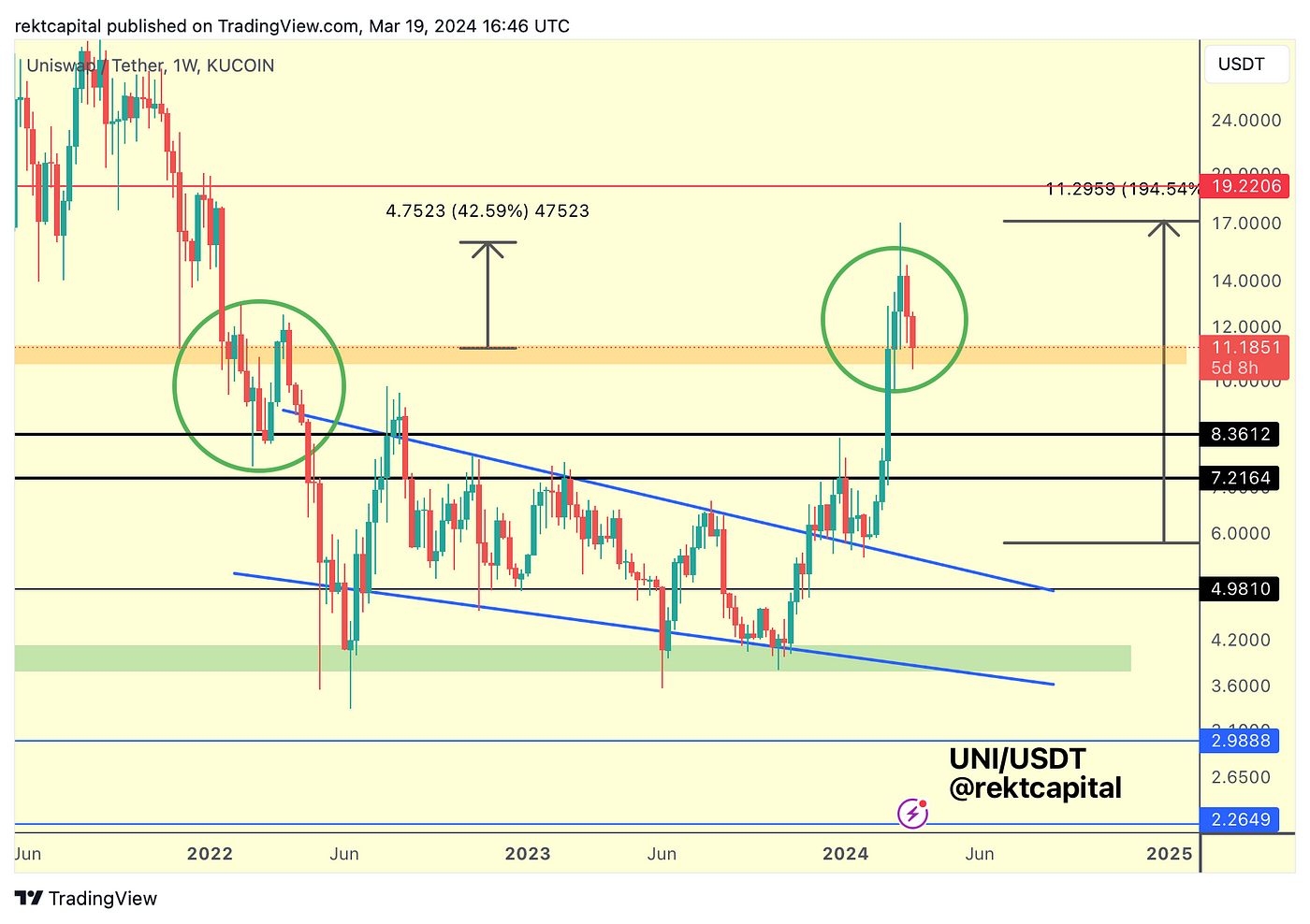

Over the past few weeks, we spoke about an incoming retest of the orange area as new support:

Last week, UNI indeed dropped into the orange area for that retest attempt:

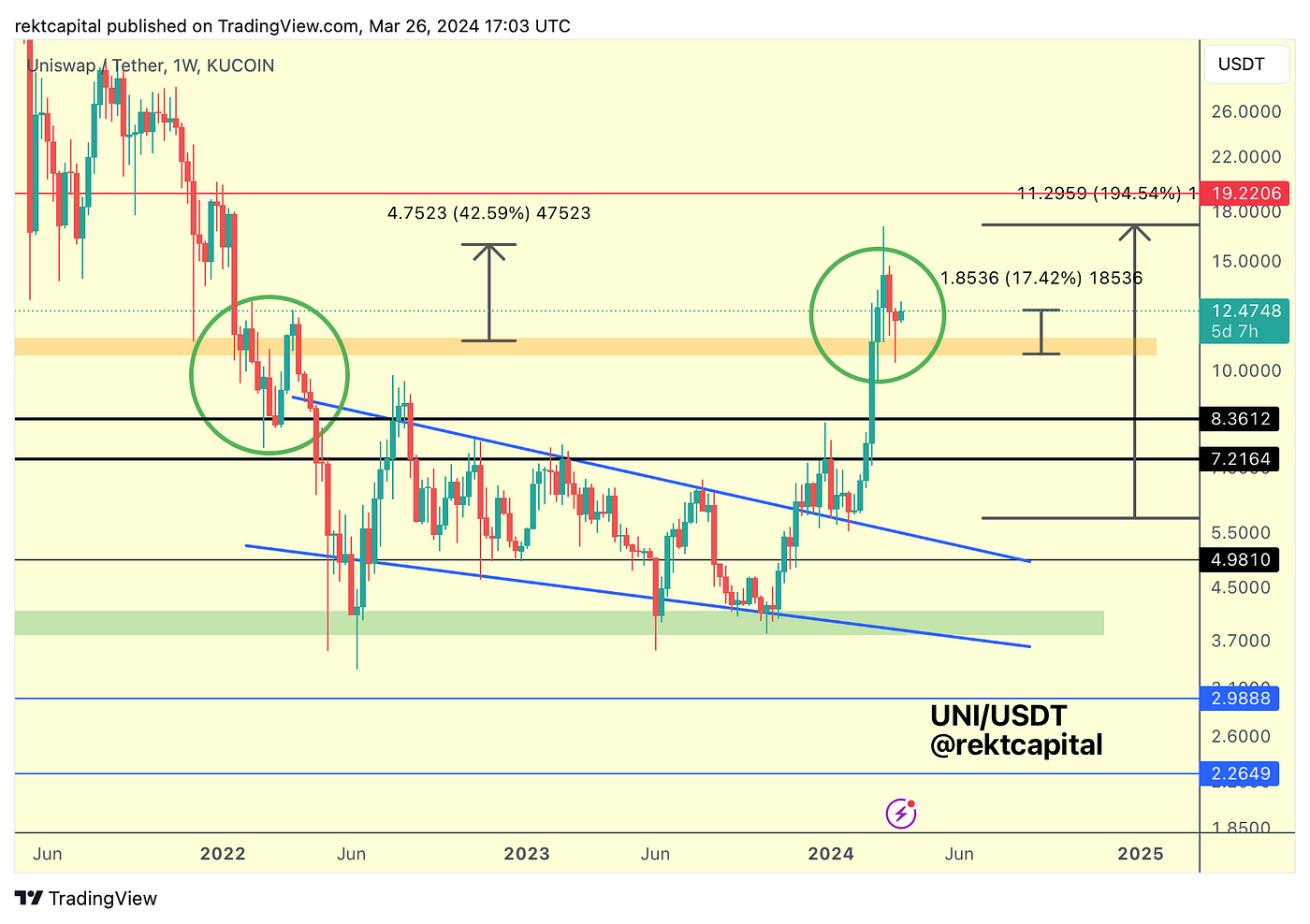

Here’s today’s update:

UNI has thus far successfully retested the orange area as new support, bouncing +17% from there.

Continued stability above this orange area would be bullish for UNI; it needs to continue holding above the orange area heading into the Monthly Candle Close:

A Monthly Candle Close above the orange area would mean that UNI is getting closer to confirming its positioning within the current macro range which is the orange Range Low and the red Range High at $19.22.

That’s why UNI’s stability here is so important.

In saying that, while a Monthly Close above the orange area would be bullish, it could still technically set up another pullback into the orange area for another retest.

This isn’t a guarantee, especially since the retest has already occurred, but should another occur it would be healthy, normal textbook retesting action on the monthly timeframe; should any dips occur, the dips will figure as this retest.

We’ve seen successful retesting on the Weekly and if we see the same on the Monthly, that’ll only serve as additional confirmation that UNI is ready to traverse across the orange-red macro range over time.

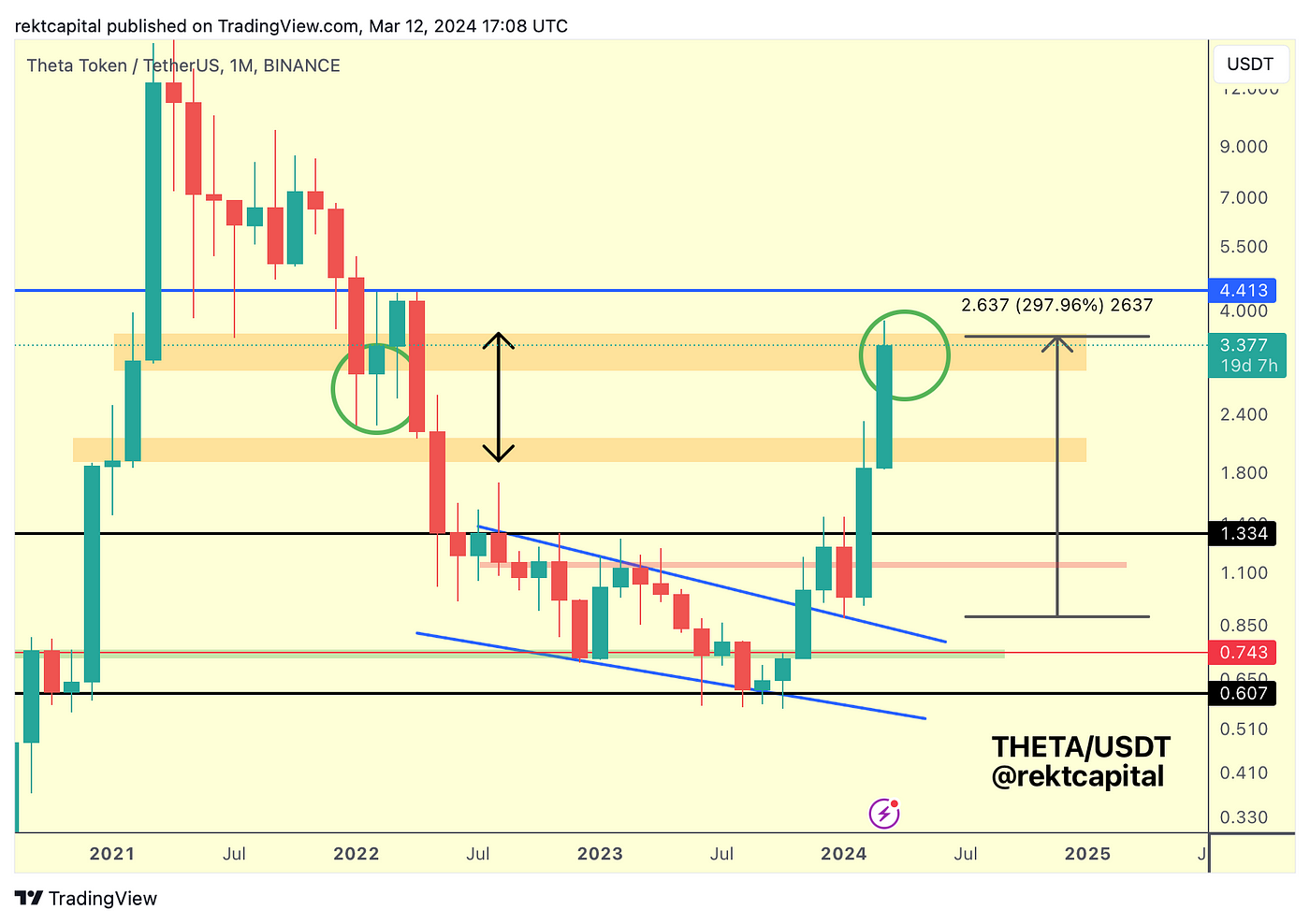

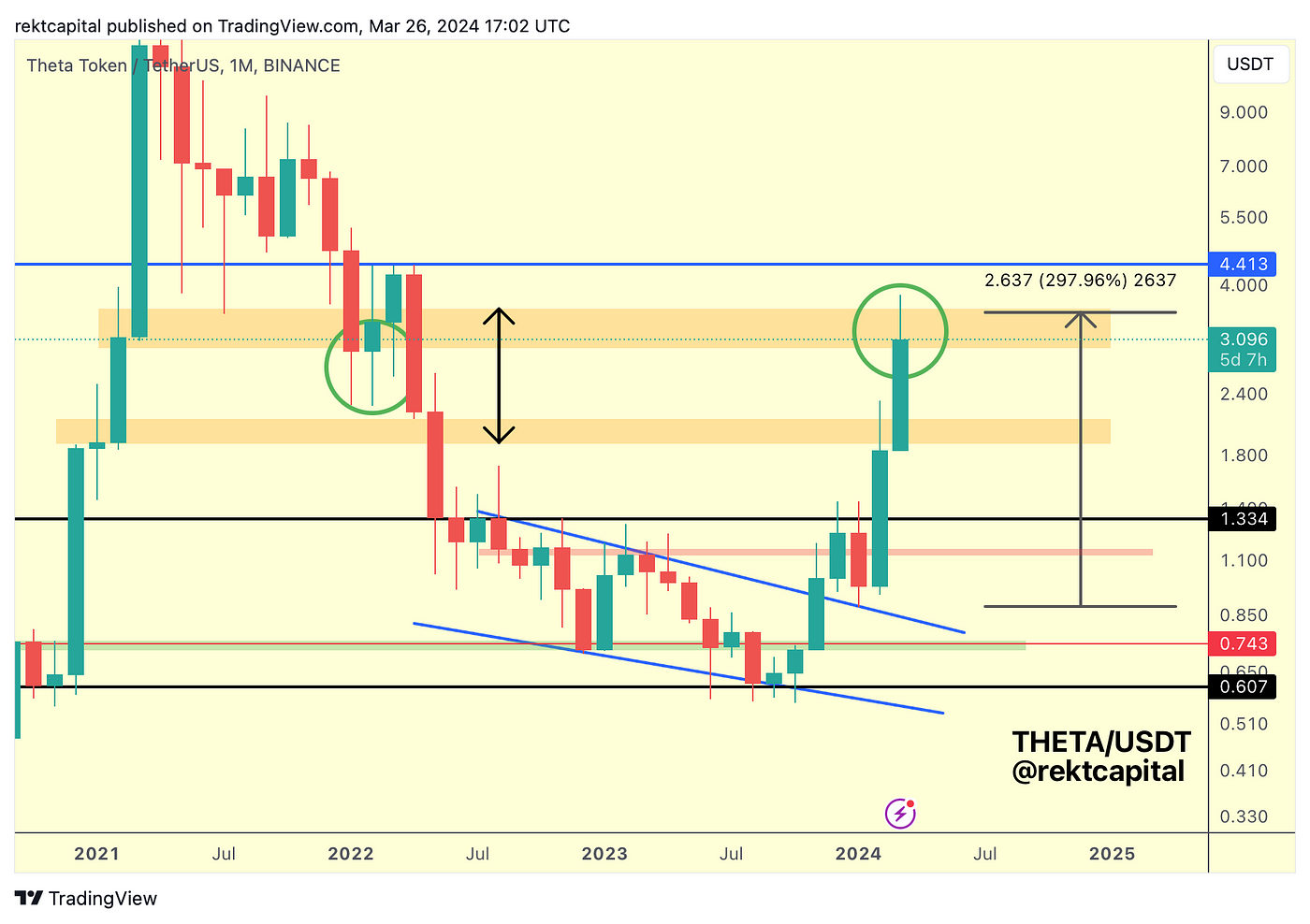

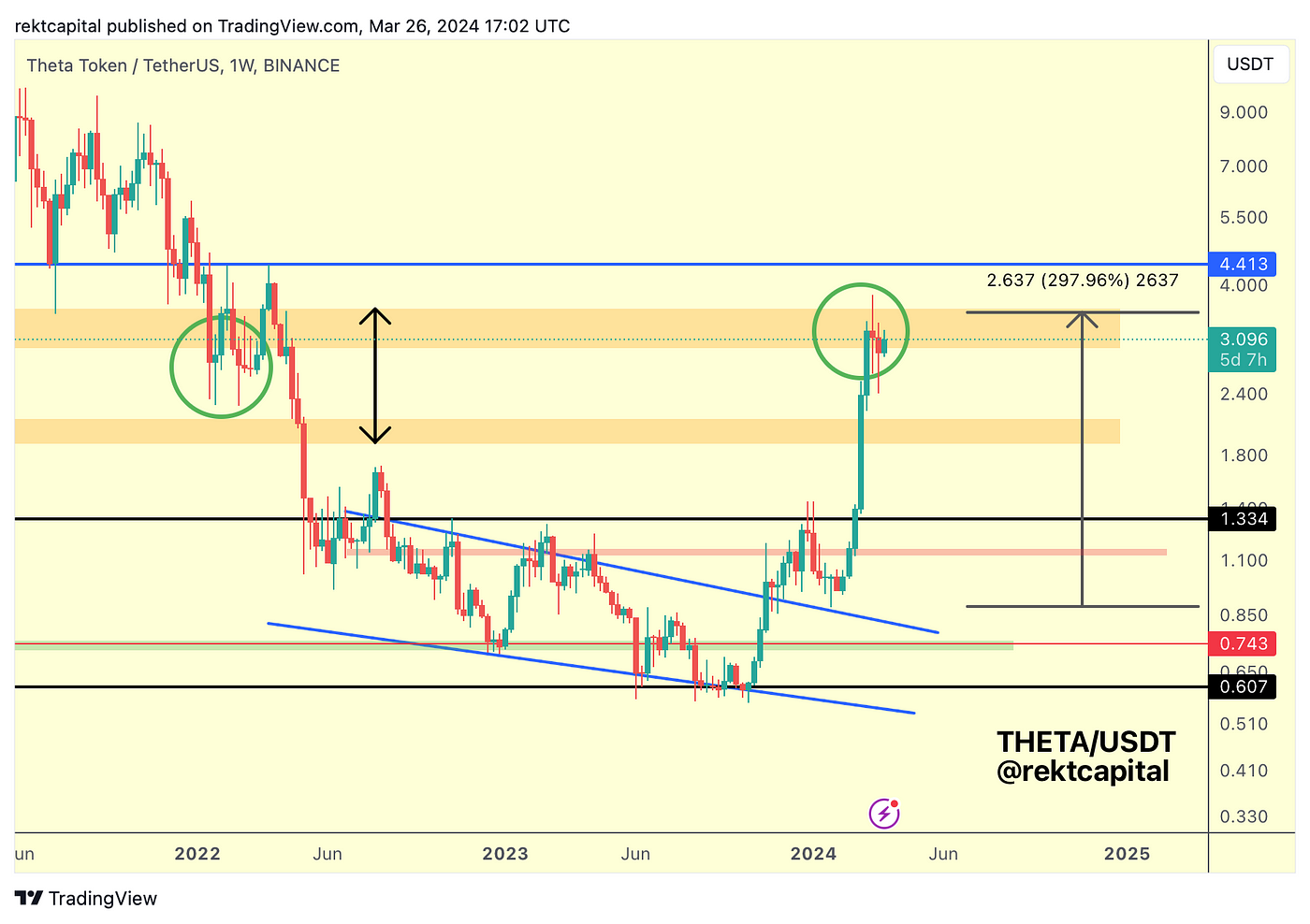

Theta Token — THETA/USDT

A few weeks ago, we spoke about how THETA could dip into the orange box for a retest, akin to early 2022 (green circle):

Last week, THETA briefly lost this orange area but it looks like price is reclaiming it as we head into the new Monthly Close:

THETA is trying to reclaim this orange area as new support and this is even clearer on the Weekly timeframe:

Downside deviation below the orange is fine (green circle) as long as THETA is able to Monthly Close inside the orange area.

A Monthly Close inside would set THETA up for a successful retest at highs.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Michael Saylor’s Playbook for MicroStrategy: Long BTC, Short Everything Else

TL;DR In March 2024, Michael Saylor’s software company MicroStrategy owned more than 1% of the total amount of BTC ever to be issued.

Still, the company’s Bitcoin buying spree shows no signs of slowing.

Let’s see how Saylor employs his ‘speculative attack against the dollar’ and how MicroStrategy is morphing from a software company into a Bitcoin development company.

Crypto Market News

- A record $1 billion left crypto funds last week according to data from CoinShares. Source

- Coinbase International saw record daily trading volumes in March. Source

- Apple’s M-series Macbook chips have a vulnerability that allows hackers to steal your crypto. Source

- KuCoin has been charged with violating anti-money laundering laws by the US Justice Department. Source

- Robinhood has expanded its crypto wallet to Android users and is now available on Google Play. Source

- Nigeria has ordered Binance to disclose information relating to all its users. Source

- Kraken’s institutional platform has launched a custody service called Kraken Custody. Source

- Grayscale plans to lower its spot Bitcoin ETF fee which is currently at 1.5% to become more competitive. Source

- Bitcoin demand in Argentina has reached its highest levels in 20 months according to Bloomberg. Source

- Trezor has said a phishing attack, not a SIM swap, caused its X account to be compromised. Source

- Ark Invest has sold $52M of Coinbase shares after its price broke above $270. Source

- London Stock Exchange is set to launch crypto exchange-traded notes (ETNs) from May 28. Source

- Nigeria has charged Binance with tax evasion after one of the detained Binance execs escaped. Source

- South American gold miner Nilam Resources has reportedly filed a letter of intent to buy 24,800 bitcoins. Source

- Insurance broker Marsh has launched a new crypto custody insurance product. Source

Coins and Projects

- The Ethereum Foundation website has been changed and hints that it’s under a confidential investigation by a state authority. Source

- Ethereum developers have launched a new “pump the gas” initiative in a bid to raise the gas limit from 30 million to 40 million. Source

- Ethereum Name Service balances are now visible in Google searches. Source

- Starknet plans to launch a new feature in Q2 that will allow parallel transactions. Source

- Coinbase’s Base network has hit a record $2 billion in total value locked (TVL) after Ethereum’s Dencun upgrade. Source

- BlackRock has launched an Ethereum tokenized asset fund requiring $100K from investors. Source

- Polygon Labs and Immutable have launched a $100M gaming fund. Source

- Polygon zkEVM suffered a 10-hour outage on March 23 due to issues with its blockchain sequencer. Source

- Avalanche has announced “Memecoin Rush” which will provide $1M in rewards for liquidity providers. Source

- EDF Energy’s French subsidiary has become a validator on the Chiliz blockchain. Source

- Worldcoin has open-sourced components of its iris scanning software. Source

- Worldcoin has received a 3-month ban on collecting data in Portugal. Source

- Jasmy has partnered with Panasonic to launch a controlled identity platform for the Internet of Things. Source

- DeFi protocol Angle has unveiled a real-world asset (RWA) backed US stablecoin called USDA. Source

- WAX blockchain has signed a deal to integrate with Amazon Web Services. Source

- Floki Inu has unveiled its 2024 roadmap which includes regulated digital banking accounts. Source

Macro News

- US interest rates have been held at 5.25-5.5% and the Fed says 3 cuts are coming. Source

- The UK’s annual inflation rate has dropped from 4% in January to 3.5% in February. Source

- UK interest rates have been held at 5.25% but it’s “not yet” time to cut rates. Source

- Japan has increased interest rates for the first time since 2007, ending negative rates. Source

- Switzerland has become the first major economy to cut interest rates. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.