Michael Saylor’s Playbook for MicroStrategy: Long BTC, Short Everything Else

TL;DR In March 2024, Michael Saylor’s software company MicroStrategy owned more than 1% of the total amount of BTC ever to be issued. Still, the company’s Bitcoin buying spree shows no signs of slowing. Let’s see how Saylor employs his ‘speculative attack against the dollar’ and how MicroStrategy is morphing from a software company into a Bitcoin development company.

MicroStrategy is a Nasdaq-listed company that is involved with business intelligence and cloud services – but notorious for its BTC holdings. Michael Saylor, executive chairman of MicroStrategy, has a unique position compared to many of his executive peers:

- He owns 18% of the total outstanding stocks of MicroStrategy and has 65% voting power. He effectively controls the company.

- MicroStrategy is profitable and he has access to the American capital markets so the company can borrow dollars against low rates.

- Saylor has seen the Bitcoin light and wants his company to own a shit ton of it.

Accumulating BTC as Treasury Reserve Asset

At the time of writing, MicroStrategy has 214.000 BTC on its balance sheet, making it by far the largest Bitcoin treasury of any company (for comparison: Tesla owns roughly 9.000 BTC). See how they have accumulated since 2020 here: Bitcoin Treasuries MicroStrategy (and see the list of all public companies that own BTC).

Since the summer of 2020, MicroStrategy has periodically bought BTC and put it in their treasury. There is no intention of selling it back for dollars. In Saylor’s terms: why would you sell the winner to buy the loser?

Not that it has been clear skies all the time. There has been a large stretch of time – roughly between May 2022 and November 2023, when their BTC position was underwater. Some huge buys near the 2021 top were responsible for this.

It didn’t deter Saylor: he kept his spirits up, posting self-deprecating memes – and just kept stacking.

More Than a Software Company

So why all the relentless stacking, what is the plan? Here’s Bit Paine’s take:

What is the ‘massive macroeconomic arbitrage trade’ that this analyst is talking about?

First of all, Bit Paine draws an analogy between what Warren Buffett did with a small textile manufacturer-turned-insurance company called Berkshire Hathaway in 1965. Berkshire got rid of the textile business in 1985. Berkshire Hathaway’s main business and source of capital became insurance, from which it kept investing the premiums in a broad portfolio of subsidiaries, equity positions and other securities.

In other words, the insurance company Berkshire Hathaway, had become something of a shell, a front, for the investment conduit for Buffet and late Charlie Munger.

This applies to MicroStrategy too. Currently, the valuation of their stock leans much more heavily on their BTC holdings than on their software business. Holding and purchasing more BTC is now their core business, it seems 🙂 There’s more to it – but more on that later.

But there is more to the story of MicroStrategy. After all, Buffett didn’t do a ‘massive macroeconomic arbitrage trade’, as Paine calls it what Michael Saylor does. Michael Saylor’s plan with MicroStrategy is more intricate, and is quietly subversive. To make sense of this, let’s draw a parallel with George Soros and how he ‘broke the bank of England’.

Historic Parallel: George Soros Breaking the Bank of England

In 1992, hedge fund manager George Soros speculated that the British Pound was overvalued and that the UK would have to devalue its currency or withdraw from the European Exchange Rate Mechanism (ERM).

Soros short-sold $10 billion worth of pounds, betting on the pound’s devaluation. This meant borrowing pounds, selling them at the current market rate, and then waiting for the currency to weaken. Once the pound dropped in value, he could buy pounds back at a lower rate, return the borrowed amounts, and pocket the difference as profit.

Not long after. the UK government announced its withdrawal from the ERM, and the pound was indeed devalued. Soros’s bet paid off, earning his fund an estimated profit of $1 billion (a staggering trade in 1990s dollar purchasing power) and earning him the moniker ‘the man who broke the Bank of England’.

How does this compare to Michael Saylor’s Bitcoin Strategy? Well, Saylor is long Bitcoin and effectively short the dollar. He views the US dollar as overvalued versus Bitcoin and aggressively buys up BTC with loaned dollars.

Unlike Soros did with the Pound, Saylor can’t of course single-handedly devalue the dollar overnight. The dollar is too big of a currency. But his playbook could set into motion a cascade of corporations employing the same strategy.

A superficial difference between what Soros did and what Saylor is doing, is that one benefits from a devaluation of an asset (the Pound, Soros) and the other from an appreciation of an asset (BTC, Saylor). Another difference is the time scale. Soros’ bet was a short-term trade, whereas Saylor wants to ride a trend over the years or even decades.

On a deeper level, what the strategies share is that they both are a bet against a financial asset that they believe is overvalued or vulnerable to devaluation. In the case of Saylor, this is a bit less obvious. He is aggressively loaning dollars and selling shares to buy BTC, which makes him short the dollar and his shares, and long BTC.

You might ask, what is the difference between these high-profile traders on the one hand and you and me on the other hand? Aren’t we all speculating on the value of the thing going up versus the other going down?

True, we are all speculators. The difference between you and me just buying BTC and Saylor, is that he uses leverage (he loans) and he can issue assets (shares of his company, see below). This makes his bet more risky and aggressive, hence the ‘attack’. Especially the issuance of shares is clever, as it leverages the mispricing – in Saylor’s view – between traditional corporate equity and Bitcoin.

If Saylor’s is a speculative attack, it is a very slow one. And this begs the question: how can MicroStrategy keep borrowing dollars to buy BTC? Won’t they crumble under the debt load? It turns out that Saylor has another trick up his sleeve: issuing shares.

MicroStrategy’s Own ‘Money Printer’: Issuing Shares

Initially, in August of 2020, MicroStrategy bought BTC with cash on hand. Later, it raised capital by issuing corporate bonds. In recent months, a third pillar was added to the playbook: issuing shares.

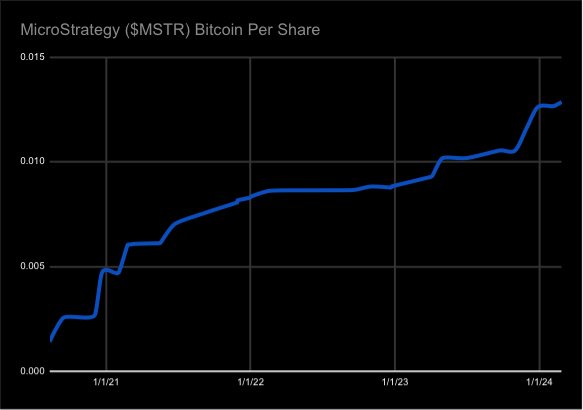

But doesn’t issuing shares dilute the shareholder value? Indeed, that’s what would normally be the case: a company that issues shares, is effectively debasing their shares outstanding. But in MicroStrategy’s case, from a Bitcoin per share basis, it is anti-dilutive. This means that while the number of shares increases, the number of Bitcoin per share also increases, which is great for shareholders.

Saylor’s playbook of issuing shares to buy BTC is similar to what he does with dollar loans. But in the former case, the assumption is that MSTR shares are overvalued versus BTC. So it makes sense to sell shares and buy BTC.

Is just the MSTR stock overvalued or is the implication that the current equity valuations across the board, with Price-to-earnings ratios around 30 to 35 times, are overvalued compared to BTC? If so, then this playbook could be adopted by other companies too… The idea would be for any company to issue shares at these high valuations and convert the proceeds into Bitcoin to hold on the company’s balance sheet. Should that become common practice, BTC valuations could indeed skyrocket.

MSTR’s Valuation – or Overvaluation?

Adopting the Bitcoin strategy has been good for MicroStrategy stock (MSTR). The stock is up over 1,100% since that date (August 11, 2020). At current bitcoin prices, MicroStrategy’s BTC is worth about $14 billion in total. The underlying software business is valued at roughly $1 billion. However, the market capitalization of MSTR is about $30 billion. So the company is trading at roughly a 100% premium to the BTC and the software company it holds. It’s become a levered Bitcoin ETF.

In the below chart, you can see that the stock price is even more volatile than BTC, especially in bull markets (the candlesticks graph is the price of MSTR, the yellow line is the price of BTC).

Whenever the stock trades well above its net asset value – as it does now – it gives room to issue shares and buy more BTC, which will drive up the share price, which gives room to issue shares and buy BTC… and.. you get the picture.

(According to some analysts, MSTR’s recent price spike has to do with short sellers of MSTR being squeezed. Saylor loves it: his opponents are squeezed and he can buy more BTC as a result)

MicroStrategy as a Bitcoin Development Company

So is MicroStrategy just going to sit on its BTC and wait? Not quite. It still has its traditional software business. It is now positioning itself as a significant player in the Bitcoin ecosystem, emphasizing its commitment to integrating Bitcoin into its operations and strategic vision: it wants to become a Bitcoin Development Company.

What does this mean? It could mean offering some of the following services:

- Bitcoin Advocacy and Education: Saylor and MicroStrategy actively promote Bitcoin, advocating for its adoption and utility. This includes public speaking, social media engagement, and educational initiatives.

- Participation in the Bitcoin Network: This could involve initiatives to support the Bitcoin network’s infrastructure, such as investment in Bitcoin mining operations or contributions to software development

- Innovative Financial Products: MicroStrategy explores and potentially develops financial products and services related to Bitcoin. This might involve creating mechanisms for institutional investors to gain exposure to Bitcoin or developing new financial instruments tied to Bitcoin’s performance.

Let’s zoom in on the latter, the financial products. This sounds dry, but Saylor wouldn’t be Saylor had he not coined a great phrase for his idea: The Digital Hotel.

The Digital Hotel Analogy: Loan BTC Globally

In podcasts with Lex Fridman and Peter McCormack Saylor has likened Bitcoin to a digital hotel: a company can rent out their digital property (BTC). He gives the example of a trader in Singapore who might need it for 17 minutes for an arbitrage deal.

Indeed, unlike a physical hotel, digital property can be rented out anywhere around the globe to the person or institution that is willing to pay you the highest rate or yield, and potentially for short durations of time (Flash loans). Saylor:

“I tapped into the benefits of cyberspace. I created a global property. I started monetizing at different frequencies. And, of course, now I can mortgage it to anybody in the world. Right? I mean, you’re not going to be able to get a mortgage on a Turkish building from someone in South Africa.”

Sitting on a huge stash of Bitcoin, it’s conceivable that Saylor will put this capital to work. It’s just one of the examples of his vision of a Bitcoin development company.

Conclusion

Michael Saylor’s strategy of leveraging his access to cheap dollar loans and high equity valuations to buy Bitcoin is a possibly transformative approach to corporate treasury management. It’s conceivable that more companies will follow his example. For example, Coinbase recently announced it plans to raise $1 billion by issuing convertible bonds. It’s not clear, though, if they want to purchase BTC from the proceeds. Still, we must not forget that Saylor is in a unique position. Not many CEOs effectively control their company to the extent he does – let alone that they have his strong conviction to keep executing in good times and bad times. These two factors have put MicroStrategy in a great position to milk this short dollar/ long BTC arbitrage trade a bit longer.