Leverage For Dummies: Earning Triple-Digit Yield with Origami Finance

Before we get started, this is not a recommendation or endorsement to buy any token(s) mentioned.

This week, we cover a newly launched automated leverage protocol, aka folding protocol, for yield strategies outperforming market rates!

Historically, leveraged farmers increase their exposure to a yield-bearing token or airdrop strategy by depositing that same token to borrow on a money market where it is whitelisted as collateral. The borrowed funds can then be swapped to generate more of the same collateral.

By looping or folding this debt position repeatedly, a highly leveraged exposure can be achieved depending on the maximum LTV (Loan-to-Value) of the pool. In Wealth Mastery, we cover these strategies often!

However, manually entering a folded position can be tedious, risky, and gas-intensive. Users must monitor their health ratio to ensure that market volatility or high interest rates do not bring their debt position above the liquidation threshold.

Back in April, Origami Finance launched on Ethereum Mainnet to enable users to fold their exposure to yield bearing tokens with minimal position management. Now with Origami Leveraged Vaults (lov), users can simplify the folding process into one click and instantly create a leveraged yield-bearing position that automatically maintains a high LTV to maximize returns.

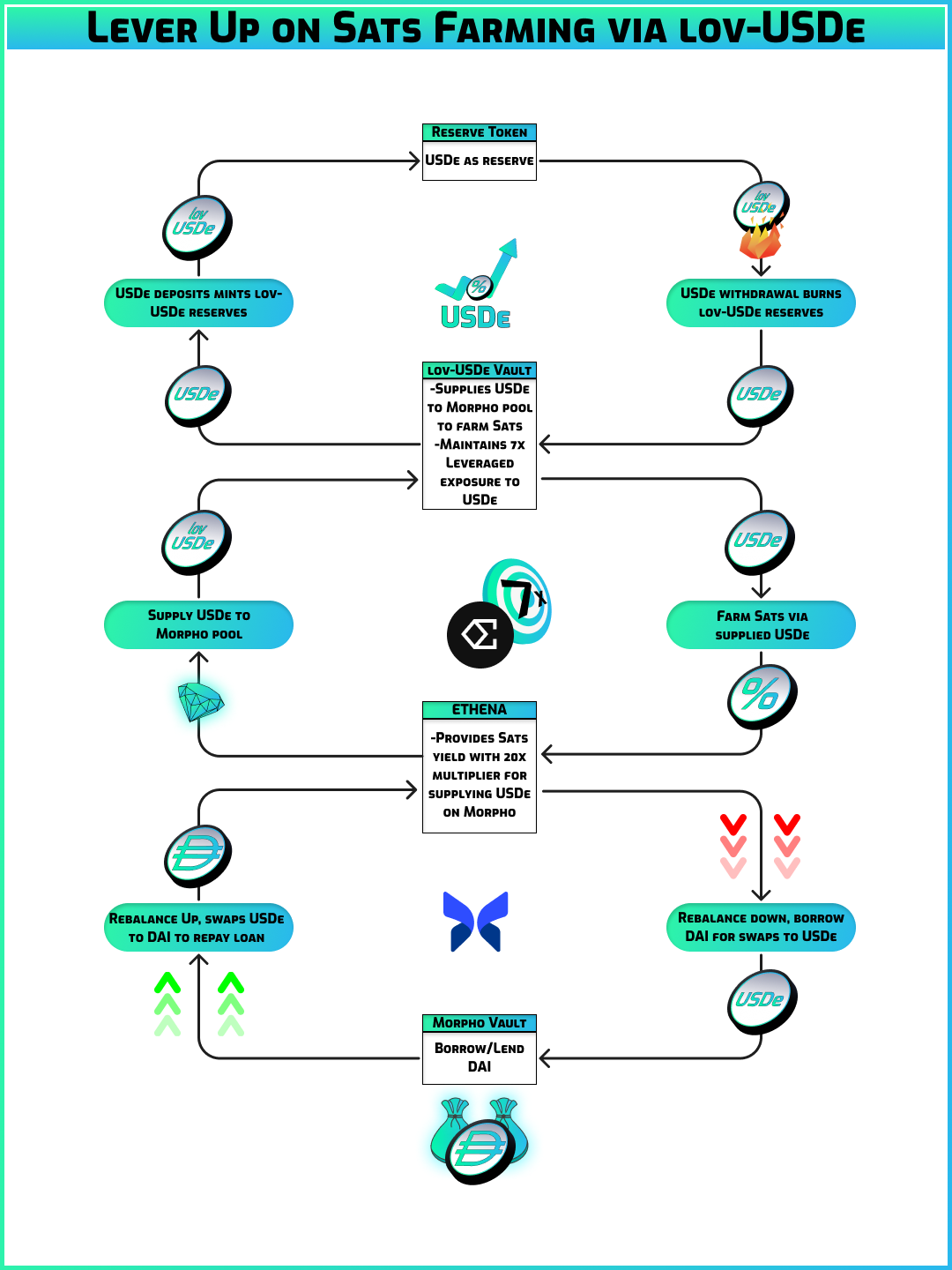

One example of a yield-bearing token that’s ideal for such a folding strategy is USDe by Ethena. For yield farmers earning Ethena Sats, users can maximize their potential farming power by applying 7x leverage relative to their actual USDe holdings. See an example below for how a lov-USDe vault works on Origami!

The liquidity required for

Responses