NFT Secondary Collections: Azuki Under Fire

TL;DR

The Azuki Elementals companion collection has been heavily criticized for being too similar to the original collection and diluting supply, causing Azuki prices to crash. However, many other projects have executed efficient companion drops, and traders can benefit from these kinds of launches.

Everybody likes free money, which is one reason you often see NFT projects issuing airdrops and other rewards, including access to NFT secondary collections. And then third collections. And sometimes there are more after that.

This kind of plan makes sense, as satisfied holders keep a project buoyant, and releasing shiny new things generates interest. At the same time though, these strategies need to be executed carefully, and in a surprise turn of events, NFT drama this week revolved around heavy fire directed at a hugely hyped-up companion drop from major project Azuki.

Azuki Elementals

In case you missed it, Azuki released its 20,000 item Elementals collection, half of which were airdropped to Azuki holders, while for the other half, mint priority was also given to Azuki holders, and then to holders of Beanz (an earlier companion collection).

The Elementals minted out easily at a hefty 2 ETH each and Azuki raked in close to $40 million, but then the reveal came around. Yes, buyers had forked out close to 4K USD each for unseen JPEGs, and when the collection was unveiled, the majority of the new NFTs looked… almost exactly the same as the old NFTs. In fact, to an outside observer it’s impossible to tell which items are new and which are original Azukis.

The floor price on the original collection then plummeted from over 16 ETH to, currently, 9.4 ETH, while Elementals are currently trading at 1.6 ETH, well below mint price. From there, a common view is that a lot of people just paid thousands of dollars to have their favorite project’s supply inflated, thereby pushing down prices.

All in all, not the result anyone was hoping for, and a surprising misstep from the Azuki team. There’s still speculation the situation will (somehow) be rectified, but this all raises questions about the purpose of companion collections.

Effective Expansions

Azuki demonstrated what not to do, but let’s look at some projects that executed more effective strategies, and where both holders and creators benefitted as a result.

Bored Ape Yacht Club

Yuga Labs collections have been experiencing a big dip and there are valid complaints that supply has now expanded too far. But it was Yuga who set the template for companion drops, first through the Kennel Club, then with Mutant Apes, and there was also the ApeCoin airdrop, all of which gifted enormous value to Bored Ape holders who simply sat back and picked up the rewards sent their way.

As for whether or not this strategy worked for Yuga, from releasing 10,000 ape pictures with zero utility back in April 2021, the company was last year valued at $4 billion, so it’s been an explosively positive journey so far.

Pudgy Penguins

The Pudgy Penguins project has been very successful, branching into physical toys, and focusing on onboarding Web3 newcomers. It also used a companion drop effectively, releasing 22,222 Lil Pudgy NFTs, with 8,888 going for free to holders of the original Penguins.

Lil Pudgys were cheap for new buyers (0.03 ETH), brought benefits (IP rights) and, through being clearly distinct from the originals, didn’t seem like they were diluting supply. What’s more, the project then went beyond simply releasing companion drops, utilizing profits and attention to move into physical merchandise.

Renga

Like many formerly high flying projects, Renga is now experiencing a dip, but in late 2022 it dominated the NFT space, and its origins go back to an airdrop tying together art and PFPs.

Renga founder Daniel Isles had originally released artworks called The Art of Seasons, which didn’t garner much attention, but holders were airdropped Black Box NFTs. These were later opened to reveal Renga PFPs, and prices soared on everything involved: The Art of Seasons, Black Boxes, and Renga itself.

While the project appears to have lost some momentum, it’s still operating and active, and its airdrop-enabled launch dynamic was extremely profitable.

Ordinal Maxi Biz

Over on Bitcoin, Ordinal Maxi Biz (OMB) is a disruptive project establishing itself as potentially iconic, and pulling stunts such as encouraging CryptoPunks holders to burn their PFPs.

OMB had a very limited available supply, consisting of just 191 items divided into two categories, Red Eyes and Blue Eyes, and this week released the final wave of the collection: Green Eyes, of which there are 1900 items, with some whitelist spots given to Red and Blue OMB holders.

This extended, staggered launch strategy created the sense of a complete collection being gradually put into place, and has been an effective method of generating interest.

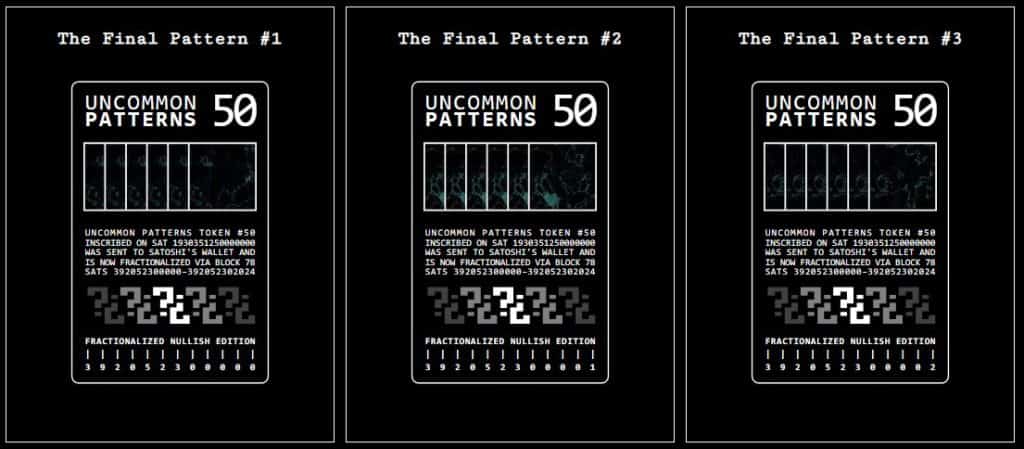

Nullish

The Ordinal Maxi Biz project is closely associated with an artist/developer named Nullish, who’s demonstrated that airdrops can play a role in art projects as well as PFP collections.

Holders of his earlier Ethereum NFTs have subsequently been able to acquire Nullish Ordinals, simply through patiently holding and sometimes following some technical instructions in order to bridge from Ethereum to Bitcoin.

What Strategy Should NFT Traders Adopt?

From a purely profit-motivated point of view, some general ideas to keep in mind are:

- Don’t anticipate that all companion collections and airdrops will hold value for long. Unless it’s a high conviction play, take opportunities to sell into hype.

- At the same time though, recognize when a project is developing and has momentum. Sometimes it’s profitable to do nothing, meaning hold genesis items and pick up companion drops, following instructions as required.

- Genesis NFTs pump when a reward is anticipated. If you don’t have strong conviction in a project, lock in profits by skipping the airdrop and just selling beforehand into the anticipation pump.

- Unrevealed items may have higher floor prices than revealed items because, basically, NFT flippers like to gamble. So if you’re planning to sell, consider keeping your NFTs pristine and unrevealed where possible.