Will Bitcoin Hold $40K?

GM friends.

The ETFs were a sell the news event after all, and now we’re ranging in the low $40Ks.

Will we hold the line here or dump into the $30Ks? Let’s discuss.

Pour up a fresh coffee and strap in, because here comes your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on where the price of Bitcoin is heading, the return of Core Scientific, Tether apparently having the money they say they do & Chainlink partnering with Circle.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on creating a bull market sell plan.

- In case you missed it by Rebecca.

🚀 Hot new airdrop confirmed for Kiloex! 🚀

This is positioned to be the top perpetual DEX on both opBNB and the Manta network.

Start trading today to earn points towards the airdrop. Sign up with this referral link and enjoy a 15% fee rebate on all trades.

Will Bitcoin Hold $40K?

On Thursday January 11th, which was the first day of spot ETF trading, bitcoin peaked at $49,000.

By the next day, it dumped 15% to $41,500. At the time of this writing, we’re ranging between $42K and $43K.

It appears the dump can be attributed to two groups in particular:

- The first is traders taking profits from this past 10 week price run-up. Data from Keiko shows that significant selling pressure came after the approval from Binance, OKX, and Upbit.

- The second is GBTC holders cashing out. By the end of last Friday, a total of $579M flowed out of the Grayscale ETF.

While we’re bullish in the medium and long-terms, the main question on everyone’s minds at this point is will we hold $40K in the short-term?

Here’s the arguments for both sides of that question.

Hold the Line!

First, there’s the $40K and $41.5K support levels.

After breaking $40K on the week of December 4th, we retested $40K the very next week and bounced right off it.

We’ve held above $41.5K for the past three weeks, including last week when bitcoin was under somewhat significant sell pressure from the fake ETF news and post approval sell-off.

Second, we’ve now got spot ETF net inflows on our side.

According to the latest data available, the spot ETFs had total net inflows of $818M within the first two days of trading. So, these ETFs are already serving as a new bitcoin buyer, and therefore are further helping suck up already limited bitcoin off the exchanges.

Finally, Japan-based crypto exchange bitBank said this week that $40K has become an important level of psychological support for bitcoin.

Thus, it’s possible that retail, ETF buyers, and others will see low $40K bitcoin as a bargain and form a buy wall that holds.

The Sky is Falling!

According to analysts at 10x Research, multiple technical indicators are showing signs that we’re going lower.

Specifically, 10x Research thinks we’ll fall to and hold $38K due to the MACD and RSI both signaling weakness.

Next, there’s the bitcoin futures data.

As of January 13th, bitcoin futures basis rates have entered into neutral market territory, but these rates had been in bull market mode since early December.

And finally, there’s the historical data regarding the bull market support band during the halving years. Specifically, in the month of February during every previous halving year, bitcoin has always dropped to and touched the bull market support band.

So if history repeats this time, we’ll touch $37K to $38K next month.

Core Scientific is Back Baby

Your favorite publicly traded bitcoin miner that went bust – Core Scientific – is making a glorious second go of it.

On Tuesday, the Southern District of Texas bankruptcy court approved Core Scientific’s Chapter 11 reorganization plan. Therefore, the company is back in business and will be re-listing its shares (CORZQ) on the Nasdaq by the end of the month.

Better yet, wait until you hear their future projections. According to a share-holder presentation, the company says it will have 182K rigs running in 2024 and 279K rigs in 2027.

With regards to total revenues, Core Scientific projects $583 million in 2024 and $968 million in 2027. Whoa.

During the 2021 bull market, Core Scientific was the largest publicly traded bitcoin miner by hashrate, with a total of 143K mining rigs in operation. But the 2022 bear market, high energy prices, increased miner difficulty, and the bankruptcy of Celsius all put the squeeze on the company and forced it into Chapter 11.

However, it seems that higher bitcoin prices and renewed investor interest have given the company a second chance. Core Scientific now says it will be able to pay all its debts in full, and that it successfully raised $55 million in an equity rights offering this month.

Tether has the Cash

Arby’s has the meats, but Tether has the cash – at least according to Wall Street CEO Howard Lutnick.

Lutnick is CEO of the firm Cantor Fitzgerald, which is one of Wall Street’s most prominent bond trading firms. In fact, the firm is so highly regarded that it’s one of 25 primary trading dealers with the U.S. Federal Reserve.

Cantor Fitzgerald manages Tether’s money. Specifically, the firm is a custodian of Tether’s U.S. T-Bills. And Tether’s T-Bills are what back 87% of Tether’s $95 billion in issued USDT stablecoins (the other 13% is composed of bitcoin, gold, and other investments).

One long-running point of crypto FUD has been skepticism as to whether Tether actually has the goods.

Well on Tuesday in Davos, Switzerland, in an interview with Bloomberg TV, CEO Howard Lutnick said the following, “I manage many of their assets. From what I’ve seen, and we did a lot of work, they have the money they say they have.”

Let’s hope this Wall Street CEO is telling the truth.

Chainlink and Circle Do the Dirty

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Circle’s Cross-Chain Transfer Protocol (CCTP) have gotten together, and the result is crypto users will soon be able to easily transfer USDC across multiple blockchains.

In a press release on Tuesday, Chainlink said that developers can now start building applications that tap into both CCIP and CCTP, which thereby will allow users to engage in seamless USDC payments and transfers within the larger crypto ecosystem.

It’s thought that Ethereum, Arbitrum, Optimism, Avalanche, and Base will be the first blockchains to allow for such USDC transfers, with more to follow. Exciting stuff!

Chainlink’s CCIP is a cross-chain communications platform, and Circle’s CCTP is a protocol that facilitates cross-chain USDC transfers.

Let’s dive into today’s Altcoin Watchlist.

In today’s edition of the Newsletter, the following cryptocurrencies will be analysed & discussed:

- Polkadot (DOT)

- UniSwap (UNI)

- Chiliz (CHZ)

- VeChain (VET)

- SushiSwap (SUSHI)

Let’s dive in.

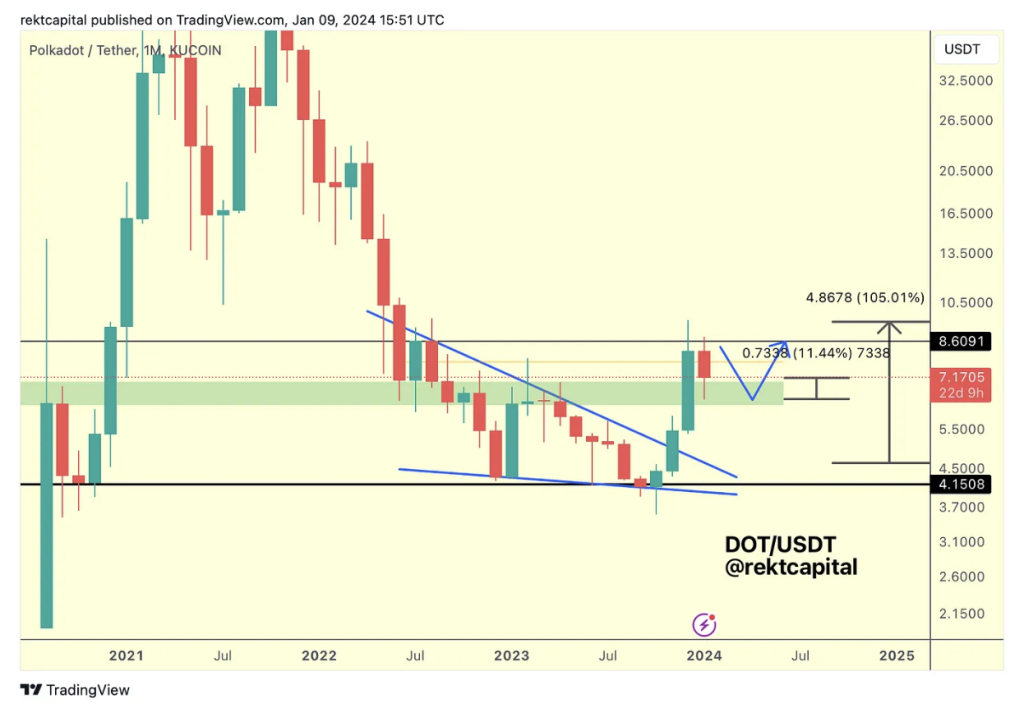

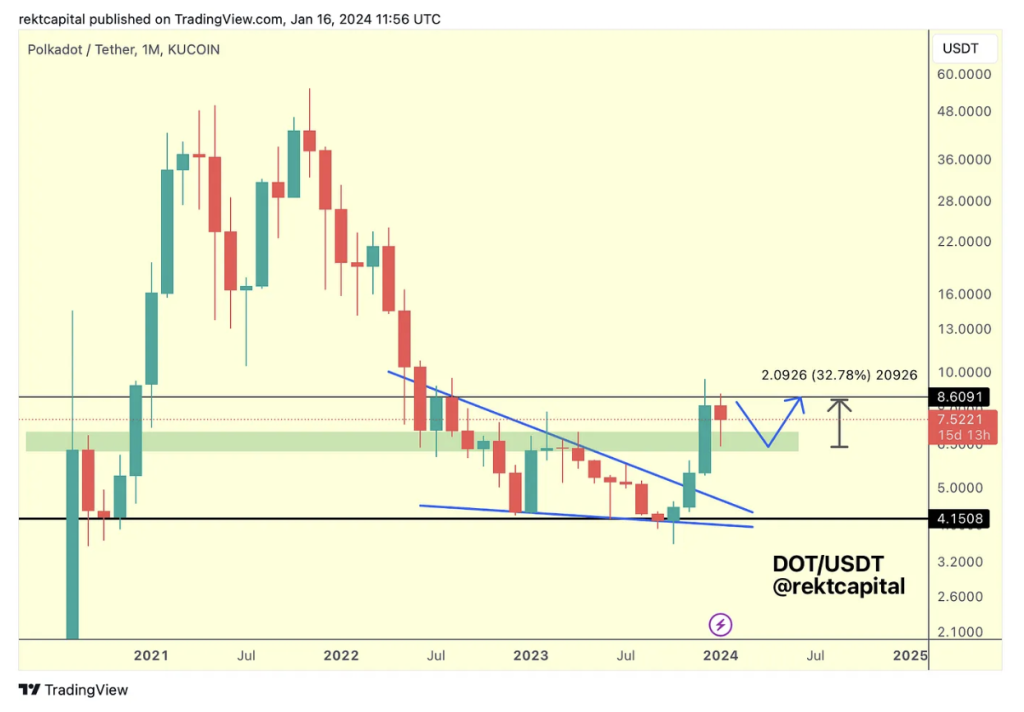

Polkadot — DOT/USDT

On Twitter (X), we spoke about how DOT would be going for a pullback into the green region in an effort to reclaim green as new support:

DOT was already following the path in last week’s edition of the Altcoin Watchlist, having already bounce +11% from the green region of support:

But here’s today’s analysis which showcases that DOT followed the blue path in its entirety:

DOT rallied +32% to the black resistance and followed the blue path to completion.

That being said, given how DOT is positioned on the Monthly timeframe, not only could this blue path could still technically repeat but price could move even higher than the blue path.

Especially since the blue path has already occurred to potentially grab sell-side liquidity at the black resistance and as a result potentially weaken that area as a resistance.

After all, on the Monthly DOT is trying to reclaim the green region as support; green acted as resistance on two previous occasions (early 2023 and pre-2021) and now is looking to finally act as support.

Even though the blue path already occurred for a +32% move, there’s still scope for this blue path to not only repeat but for price to have a real chance of breaking beyond the black resistance on a second time of asking.

Retest is still in progress.

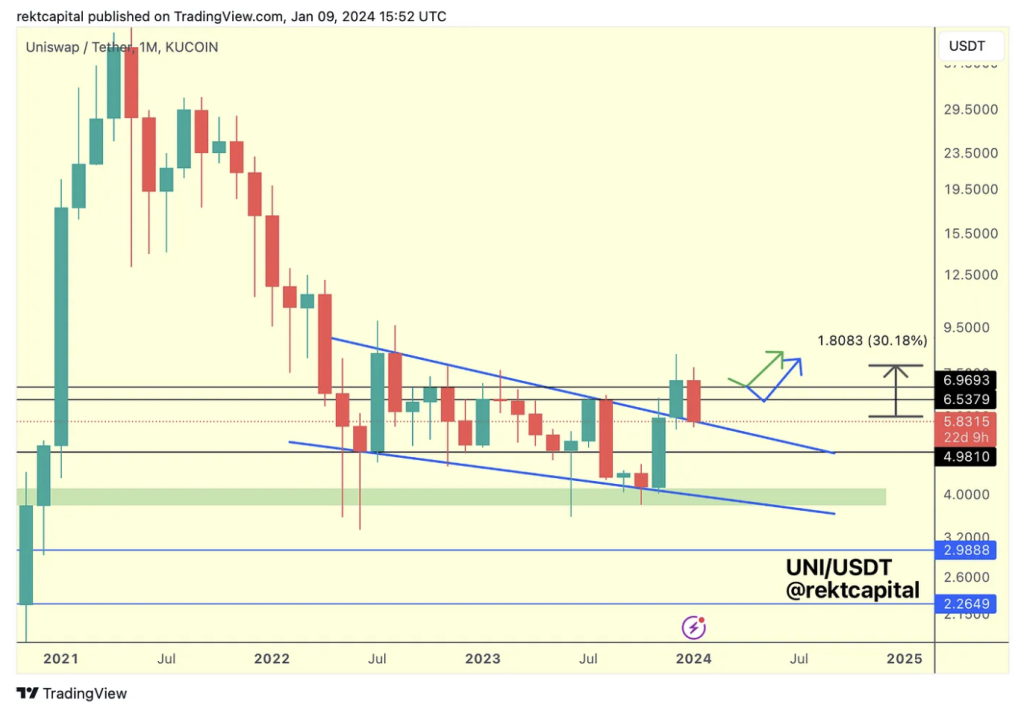

UniSwap — UNI/USDT

As a preface to today’s analysis, here’s the analysis on UNI from two weeks back:

And here is last week’s analysis, showcasing the retest being in progress:

And here is today’s analysis:

UNI has performed a picture-perfect retest of the macro market structure, rallying already +16% to the upside.

Retest has been successful and now UNI needs to try to reclaim either of the black levels as support at these levels over the coming weeks.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

A Selling Strategy for the Bull Market

It takes a strategy to leave a bull market with a meaningful profit. The two pillars of the strategy are to formulate financial goals – both short-term and long-term – that make sense to you.

These goals have to be – again – meaningful. I propose to put these goals into two ‘buckets’. And second, you need to formulate a selling strategy for the bull market.

Finally, you still need to execute this strategy, which is easier said then done.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “A Selling Strategy for the Bull Market“

Crypto Market News

- Bitcoin spot ETF trading volume hit $1.6 billion within minutes of launch. Source

- Vanguard has restricted customer access to the newly approved Bitcoin ETFs. Source

- Bitwise has pledged to donate 10% of its ETF profits to open-source Bitcoin development. Source

- Bitcoin ETF approvals may lead to more ETF approvals in the Asian markets. Source

- Robinhood has listed all 11 spot Bitcoin ETFs on its trading app. Source

- CoinShares is progressing with a potential acquisition of Valkyrie now that the spot Bitcoin ETFs have been approved. Source

- Elon Musk has said it could be possible to use Bitcoin on Mars. Source

- Fundstrat’s Tom Lee is predicting $500K per Bitcoin in 5 years due to the institutional demand. Source

- ProShares Bitcoin Futures ETF BITO has hit a record $2 billion in assets under management. Source

- The Securities and Exchange Commission (SEC) is coordinating with the FBI to investigate its ETF approval false alarm tweet. Source

- X has removed support for NFT profile pictures from its premium subscription. Source

- FTX is seeking court permission to sell several of its luxury properties in the Bahamas. Source

- Dubai’s regulator has granted OKX a conditional license to operate in the country. Source

- GameStop is shutting down its NFT marketplace on February 2 due to regulatory uncertainty. Source

Coins and Projects

- Bitcoin Layer-2 Bitfinity has raised $7M in funding from Polychain Capital, ParaFi Capital, Warburg Serres, Dokia Capital and Draft Ventures. Source

- Vitalik Buterin has suggested increasing the Ethereum gas limit by 33% to 40M. Source

- Ethereum has overtaken Bitcoin in derivatives trading volume. Source

- Ethereum’s network transactions have reached its November 2021 levels. Source

- Ethereum Layer-2 Metis has launched community testing for its proof-of-stake sequencer pool on the Sepolia testnet. Source

- Ethereum Layer-2 Taiko has launched its final testnet, Katla, ahead of its expected mainnet release by the end of Q1. Source

- Tether’s dominance has reached 71% as its market cap reached a new record of $95 billion. Source

- USDC issuer Circle has filed for a stock market IPO in the US. Source

- USDC wallets holding $10 or more grew by 59% in 2023 despite its market cap decreasing by $20 billion. Source

- Chainlink has teamed up with Circle to integrate its Cross-Chain Transfer Protocol (CCTP). Source

- Aave’s community is voting to integrate PayPal’s PYUSD stablecoin into its Ethereum pool. Source

- Solana Mobile is planning on launching a second smartphone which will be priced lower than its existing Saga model. Source

- Avalanche has seen its inscriptions surpass 100M since its launch last year. Source

- Injective has launched its Volan upgrade which adds support for real-world assets. Source

- Fantom has finally cut its staking requirement by 90% over 6 months after the governance vote passed. Source

- Hedera and Algorand have partnered to build a decentralized wallet recovery system. Source

- Filecoin has completed a demonstration that sent files from Earth to outer space through its InterPlanetary File System (IPFS). Source

- Google Cloud has joined Flare network as a validator and infrastructure provider. Source

Macro News

- Crypto-friendly Republican candidate Vivek Ramaswamy has dropped out of the 2024 US presidential race. Source

- The Bank of England governor has said Bitcoin is inefficient as a payment method. Source

- Argentine President Javier Milei has said he will not oppose any province’s attempts to launch their own currencies. Source

- Banking group IIF has raised concerns about record global debt levels. Source

- The ongoing Red Sea disruption could have “significant consequences” for global growth, says Maersk CEO Vincent Clerc. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

📈 TRADING VIEW: BEST CHARTING SOFTWARE ON THE INTERNET 👉 JOIN NOW

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.