A Selling Strategy for the Bull Market

TL;DR

It takes a strategy to leave a bull market with a meaningful profit. The two pillars of the strategy are to formulate financial goals – both short-term and long-term – that make sense to you. These goals have to be – again – meaningful. I propose to put these goals into two ‘buckets’. And second, you need to formulate a selling strategy for the bull market. Finally, you still need to execute this strategy, which is easier said then done.

The hardest part of investing in crypto isn’t buying – it’s selling. When your portfolio is up a zillion percent, it can feel impossible to kill the goose that laid the golden eggs.

Sticking to our plans… can be the hardest part. Our own emotions get in the way at precisely the time we should buy or sell according to our plan. Fear and greed, uncertainty, and doubt… The best investors and traders are the ones who are best able to control their emotions. Before we talk about making a selling plan, let’s look at the condition for sticking to any plan: emotional stability.

The Foundation: Emotional Strength to Stick to a Plan

“Human emotion is both the source of opportunity in trading and the greatest challenge. Master it and you will succeed. Ignore it at your peril.”

This is a quote from Trader Curtis Faith’s classic on trading: Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders.

The author relates the story of his apprenticeship as a trader in Chicago of the early 1980’s. Like other rookies (the class is called the ‘turtles’) he was taught a clear system. They were all taught a trading system based on the analysis of the company’s founders. It wasn’t anything spectacular: just a certain type of breakout trading consistently and systematically applied. They traded commodity futures such as heating oil contracts.

After a few weeks of trading, rookie Faith was astonished to find out that he was by far the most profitable trader of his class. Why? Because he had cleverly invented his own secret trading sauce? No, he outcompeted others by simply sticking to the system, whereas other rookies had gone all over the place.

“The difference in return had nothing to do with knowledge and everything to do with emotional and psychological factors. It seemed crazy to me. We all had been taught exactly the same thing, but my return for January was three times that of the others in the class or more. These were very intelligent people who had been taught by the most famous trader of that time. Several of them would be among the most successful traders in the world within a few years, yet they had failed to execute the plan during the practice trading period. Over the years I kept finding evidence that emotional and psychological strength are the most important ingredients in successful trading.”

Preaching this or practicing this are two different things. You will find out, but it’s good to know in advance. Volatility will shake you to your core. You’ll be depressed near bottoms, stopping you from buying. And euphoric near tops, stopping you from selling. But when you have a system in place, you’ll at least have a fighting chance of executing on it.

Stay Humble, and also Not Too Hard on Yourself

There’s another important emotional skill you will need to master during the gut-churning rollercoaster ride that is called crypto. First, the realization that no, you’re not a genius. Stay humble. You were lucky that someone told you to buy early. Great. But don’t pat yourself on the back too much.

The flip side is to not be too hard on yourself when prices drop. It’s not your fault, you didn’t make a mistake. You weren’t a genius when they went up and you’re not an idiot now that they go down. Dampen your emotional volatility.

The Basis of a Selling Plan: What Kind of Goals do you want to Set?

What kind of goal do you want to set? It’s great if your goal is to help your mother to become financially independent. It’s also totally fine if your goal is to buy a Lambo (never a Ferrari though, it’s owned by Fiat, har har). It’s also cool to not have a goal, as a big amount of savings is always a good idea.

The goals you set yourself are valid, as long as you have thought them through! Does a Lambo really make you happy? If so, that’s great. If not, then you are playing the wrong investing game. So, let’s take a second to reflect on what is important to you in life.

Before you even start listing goals, reconsider for a second what it’s all about. Why do you want to ‘get rich’? Define the game you’re playing.

Be clear about the game you’re playing, and don’t let your actions be influenced by others playing a different game.

Meta Goal: Control over Your Own Life

I don’t want to be preachy, but it’s good to have this ‘meta advice’ top of mind: it’s not about the shiny objects that money buys you – it’s about getting up each day and living life on your terms. It’s about having options, and not having to worry about the bills. This is one of the pieces of advice from the great book The Psychology of Money by Morgan Housel.

This is of course not a shockingly new piece of advice, but truly worth remembering when it might be time to start taking profits. Do you want to risk relatively modest profits BUT life-changing financial independence for that extra 50% you might gain, which will only buy you an extra-fancy car?

It’s worth noting in this context that not every rise or drop has the same consequences for your life. Compare the drop of the temperature from 15 to 10 degrees Celsius to a similar drop from 0 to -5. The world looks different in the second case.

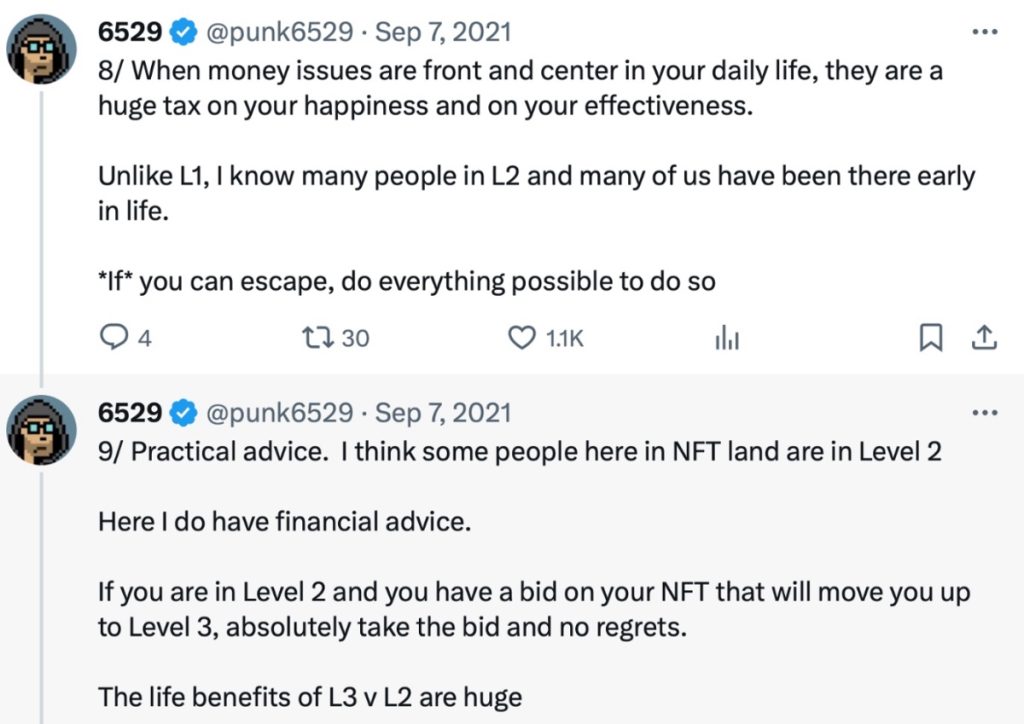

We measure gains in percentages. But realize that not every 50% gain in dollars creates an extra 50% gain in happiness. Some price ranges matter more than others. Tweetooor and NFT/metaverse entrepreneur Punk6529 made a nice tweet storm about this.

6529 defines 5 levels of financial freedom:

- Crushed by circumstances: extreme poverty

- The struggle is real: day-to-day, financial problems are a hassle. You work 2 jobs. You don’t have any savings. You worry about a medical emergency.

- Middle class: You have a house. You have a car. You have some savings. Not a lot of financial stress.

- We like nice things: enough money to choose your life on your terms.

The point 6529 makes is that the jump from level 2 to 3 means much more for your happiness than the jump from level 3 to 4. Not having to worry about money is what really counts. The rest is a bonus.

From the mentioned book The Psychology of Money comes this interesting anecdote. It’s what a successful entrepreneur told a friend about his most important financial success moment.

“Derek Sivers, a successful entrepreneur, once wrote about a friend who asked him to tell the story about how he got rich: I had a day job in midtown Manhattan paying $20k per year—about minimum wage … I never ate out, and never took a taxi. My cost of living was about $1000/month, and I was earning $1800/month. I did this for two years, and saved up $12,000. I was 22 years old. Once I had $12,000 I could quit my job and become a full-time musician. I knew I could get a few gigs per month to pay my cost of living. So I was free. I quit my job a month later, and never had a job again. When I finished telling my friend this story, he asked for more. I said no, that was it. He said, “No, what about when you sold your company?” I said no, that didn’t make a big difference in my life. That was just more money in the bank. The difference happened when I was 22.”

Take all this wise advice into account… And now, let’s draft your concrete goals.

Setting Concrete Goals

This part of the article is inspired by Kyle Reidhead’s piece for Web3Academy.

What are your different goals? You can have short-term goals, such as getting out of college debt, purchasing a car, or a down payment on a house. And then there are the longer-term goals, such as a retirement fund.

As these goals have different time horizons, it’s good to realize you might not achieve all of those in this market cycle. Maybe the car or the debt issue should be the primary this cycle and retirement will be the focus of the next cycle.

Or maybe you have made enough profits to reach the smallest goal (at least, the smallest in numbers, not in importance) and still keep some coins in cold storage for bigger goals.

Just as an example, these could be your goals for 2024/2025:

- Buy a 15.000-dollar car

- Pay off $20.000 of college debt

The Sell Plan

With the short-term goals firmly in place, you can think about selling. In the example, you’ve established you want to sell $30.000 worth of crypto this cycle. The rest you can leave on your hardware wallet and/or stake for passive income through the years.

This effectively means you have segmented your portfolio into two buckets: the long-term holding-staking-bucket and the sell-this-cycle bucket for the short-term goals.

When to Sell?

We want to sell our Bucket 2 bags high. But how high? No one knows where the market top will be – the old Wall Street saying still applies: no bell rings when the markets top.

What to base your top prediction on? For the big established coins like BTC and ETH, it’s unlikely they will do a 10x from previous all-time highs. A 3x is possible though. Conservatively, a 2x? Remember, there are no guarantees, not even that they will get back to ATH’s.

So, make an educated guess of the top based on previous cycles – and then sell or start selling a certain percentage below that price point.

You can dollar-cost-average out just like you dollar-cost-averaged in.

Why not try to sell at the top? Because you don’t want to miss the opportunity to reach your goals because the price ends up 2 dollars shy of your top prediction! If your best guess is that SOL will top at $400 this cycle, why not start selling at $300? Or even lower, if you want to be more conservative?

Sure, you’ll miss gains, but here’s the thing: you’ll always miss gains. No one sells at the top. You will sell either before the top or after the top.

Some selling approaches you might take, from conservative to riskier:

- Sell what you need to reach your bucket 2 goal if and when your coin reaches its previous all-time high.

- Start selling in weekly or monthly tranches when your coin’s price hits the previous cycle’s all-time high.

- Start selling in weekly or monthly tranches when the price hits (let’s say) 75% of your price target.

- Start selling off in weekly or monthly tranches once your coin hits your target

- Sell off what you need to reach your bucket 2 goal once it’s clear that the bull market is over.

For people who don’t work with buckets / discrete goals: you could still take this approach and aim for selling let’s say 50% of your portfolio around the bull market top.

Pro tip: instead of price targets, you could use technical indicators or on-chain metrics that have in the past marked top formations of market cycles.

Conclusion

Be clear about what you want in life, both in the shorter and longer term. Think this through. Based on those ideas, set concrete goals for how much you want to sell. Next, stick to this plan. Have fun with this, it sounds easy on paper but it’s hard in practice. And that’s ok. No one said it was going to be easy. Don’t let them tell you you were ‘lucky’!