$70K to $100K Bitcoin Incoming

GM friends.

In crypto, sentiment can flip on a dime.

Last week, a black cloud of dismay filled the air. But now there’s a renewed sense of bullish optimism for a higher priced bitcoin. And we’ve got some fresh data to back that up.

So pour up a coffee and have a chair, because this is your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on Bitcoin’s potential price action, a Bitcoin-backed synthetic dollar, Robinhood receiving a Wells Notice from the SEC & Ethena’s ENA getting a boost from Bybit.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on Berachain and how the proof is in the liquidity.

- In case you missed it by Rebecca.

Private “Beta 4” Registration is finally here for the beautiful crypto game Illuvium! AND, they are doing a 25 million dollar airdrop for early players!

Register now to be one of the lucky players to farm early!

Multiple Bitcoin Indicators Flashing Green

Last week was bloody. Bitcoin broke south of $60K, touching $56,000, while the rest of the crypto market was in the red. The plebs were depressed.

But late last week, bitcoin rallied back into the $60Ks, in part due to a fairly dovish Federal Reserve meeting on May 1st (i.e. weaker than expected employment numbers increase the chances for a rate cut this year, which means number go up). Fingers crossed, but it appears $56K was the bottom.

Now, we’re seeing multiple data points and technical indicators indicating that bitcoin’s price should be headed up and to the right over the next few months. So let’s take a look at the data and together enjoy a big hit of hopium relief.

Bitcoin Exchange Inflows Hit 10-Year Low

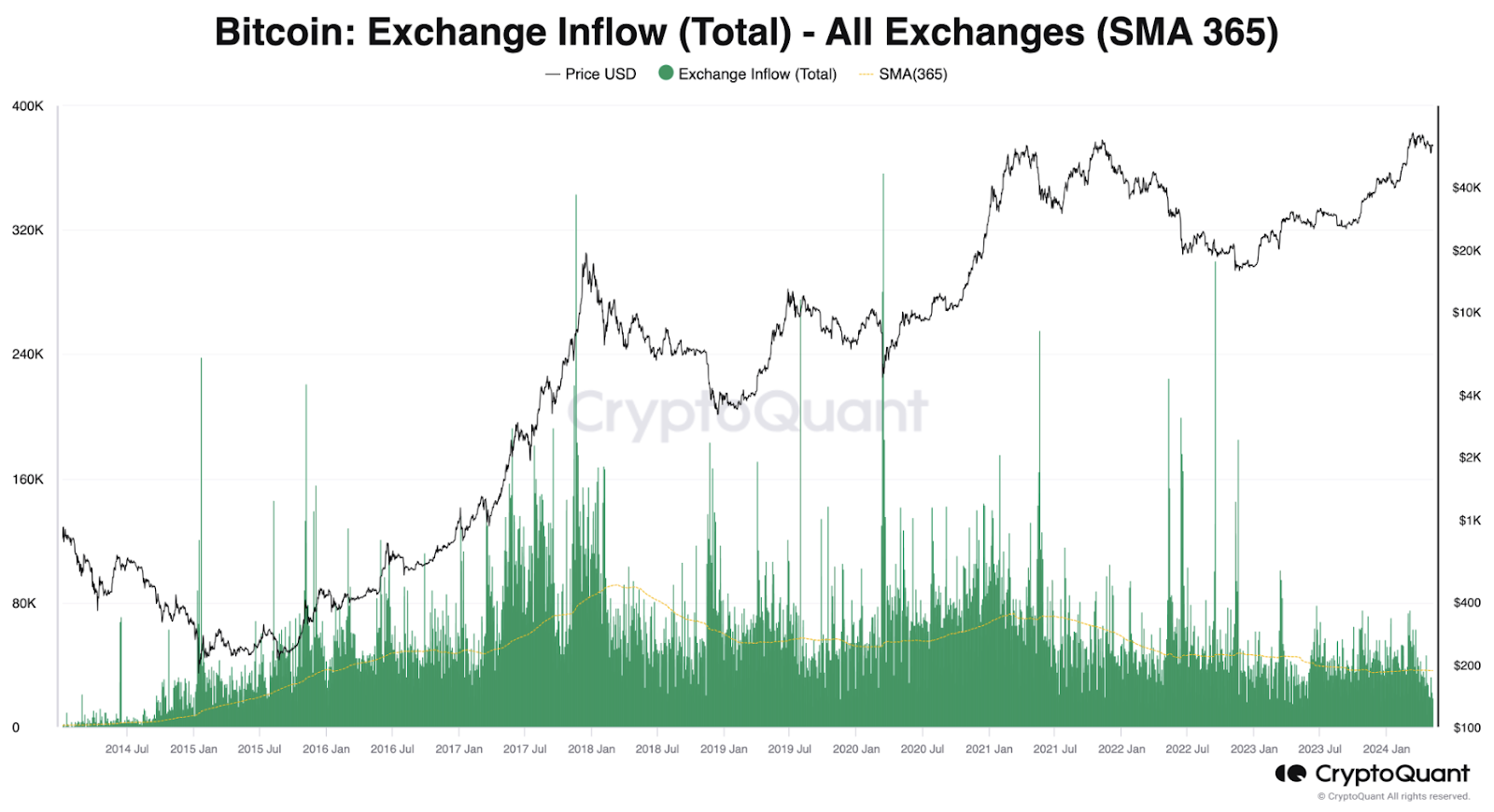

Question: what’s the first thing sellers do when they’re gearing up to unload bitcoin? Answer: they send it to an exchange. Therefore, bitcoin exchange inflows indicate whether the market is in more of a selling or a HODLING mood.

Well, new data from CryptoQuant indicates a HODLING mood. That’s because bitcoin exchange inflows are at a 10-year record low.

If you study the chart above, you’ll notice that lower inflows correlate with lower prices, and higher inflows with the opposite.

Bitcoin Call Options Indicating $70K to $100K

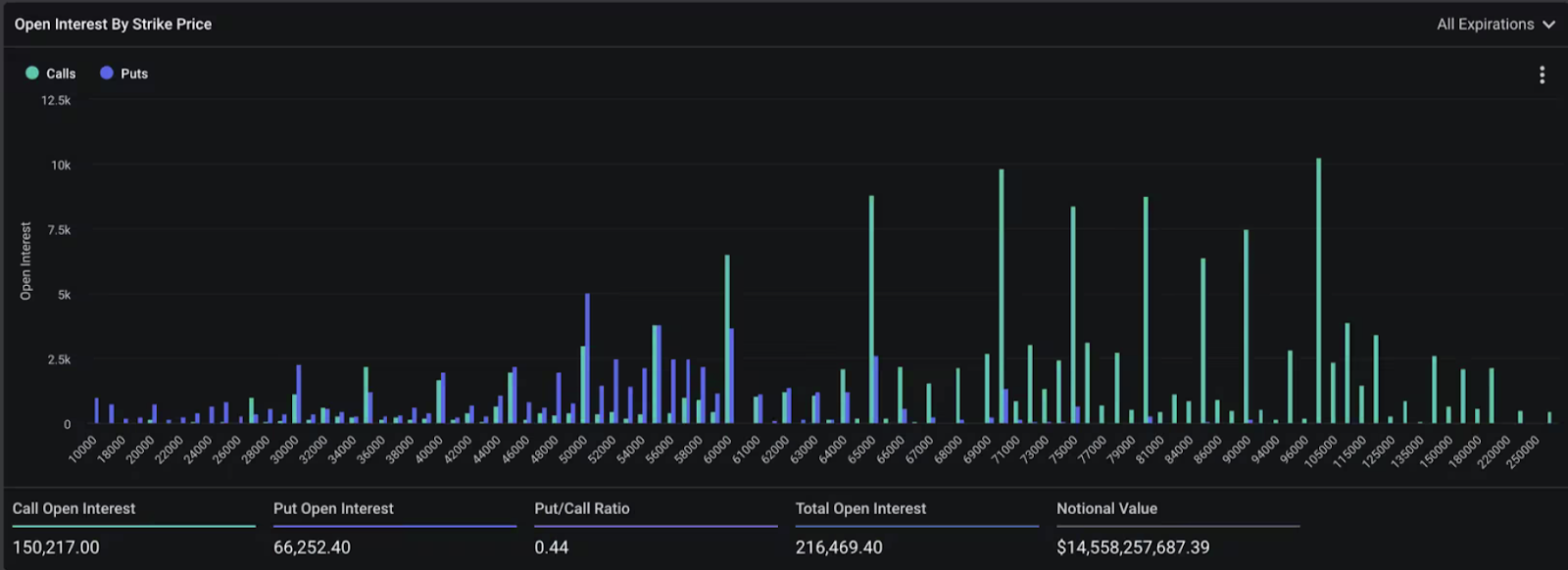

A “call” gives a buyer the right to buy an asset for a predetermined price, on or before a specific future date. A “put” is the opposite.

Generally, higher market demand for calls indicates number to go up, while higher demand for puts indicates number go down.

New data from Deribit currently shows 2X higher demand for bitcoin calls than puts. Specifically, there’s a lot of call options with strike prices between $70K to $100K, across multiple time frames.

This means that a large number of options participants are betting on a $70K to $100K bitcoin price at some point in the future.

Bitcoin’s Volatility Risk Premium has Bottomed

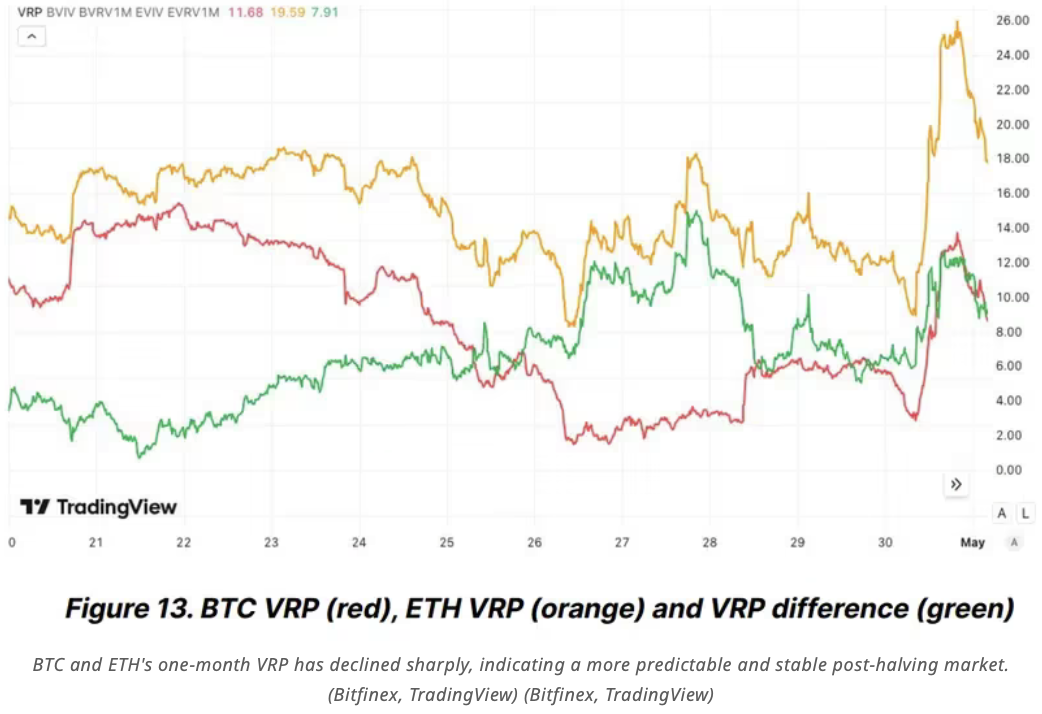

The Volatility Risk Premium, or VRP, is a technical indicator that compares the market’s expected price volatility of an asset to its realized volatility.

The narrower the difference between these two values indicates price stability, while a widening shows the opposite.

Bitcoin’s (in red) VRP has dropped from 15% to 2.5% since the halving in April.

Professional analysts believe that this data combined with bitcoin’s historical price action after halving events indicates that we’re likely due for stable but increasing price action over the next several months.

Bitcoin-Backed Synthetic Dollar with Yield is Coming

In June – USDh – the world’s first bitcoin-backed synthetic dollar with yield-generating capabilities, is expected to drop. And by yield-generating capabilities, I’m talking up to 25%.

USDh is being developed by Hermetica, which is a DeFi protocol that will operate on both Runes and Stacks. Users will be able to stake their USDh to the protocol to begin receiving yield.

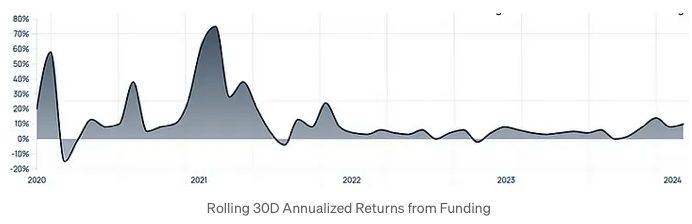

So where does the yield actually come from? Well, from bitcoin futures funding rates.

According to developers, USDh tokens will be backed by actual bitcoin plus short futures positions. Therefore, USDh is effectively in a delta-neutral position.

But because bitcoin futures funding rates are historically almost always positive (i.e. longs pay shorts premiums to keep their positions open) – then so long as history repeats – the protocol can almost always pay the premiums back to USDh stakers.

To put it another way, Hermetica is taking users’ dollars and opening up short futures positions, while at the same time protecting their shorts with real bitcoin. And because short futures holders almost always receive premiums from the longs, Hermetica is able to send the yields back to USDh holders.

Very interesting stuff. Cards on the table, I love it.

Having said that, by the way I see it, one of the ways USDh collapses is by bitcoin going into a brutal bear market, to the point that futures premiums flip negative for a prolonged period of time.

Robinhood Receives Wells Notice from SEC

Gary Gensler and company have struck again.

On May 4th, Robinhood revealed via a regulatory filing that they’d been served with a Wells Notice from the SEC. A Wells Notice means that the SEC is about to pursue an enforcement action against the company (i.e. pay us money, we sue you, etc.).

Robinhood’s stock took a hit on the news. Good job at protecting investors, SEC.

And of course, the Wells Notice accuses Robinhood of selling unregistered crypto securities through the company’s trading services.

At this point, we’ve lost count as to how many companies the SEC has pursued over alleged crypto unregistered securities violations. It only seems like the SEC is just making more enemies for itself and preparing for another epic loss in court.

Ethena’s ENA Gets Boost from Bybit

Ethena’s ENA token is up 8% this week, as the protocol is benefiting from a pretty big endorsement from one of the world’s largest crypto exchanges, Bybit.

Ethena is an Ethereum-based DeFi application that issues the USDe synthetic dollar. ENA is the protocol’s governance token.

Well Bybit has officially integrated USDe as acceptable collateral for derivatives trading on the exchange. This move essentially signals to the market that Bybit believes USDe is relatively safe. And therefore, ENA number go up.

For context, Bybit is ranked 2nd in centralized exchange derivatives trading by CoinMarketCap, with 24 hour trading volume currently at $16 billion.

Interestingly, USDe is backed the same way as USDh, which we discussed above. The difference is that USDe is backed by ETH liquid staking derivatives paired with short ETH futures positions. USDe currently has a $2.2 billion dollar market cap, and is paying 15.3% APY.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- Coti (COTI)

- Avalanche (AVAX)

- Theta Token (THETA)

- VeChain (VET)

- Kyber Network (KNC)

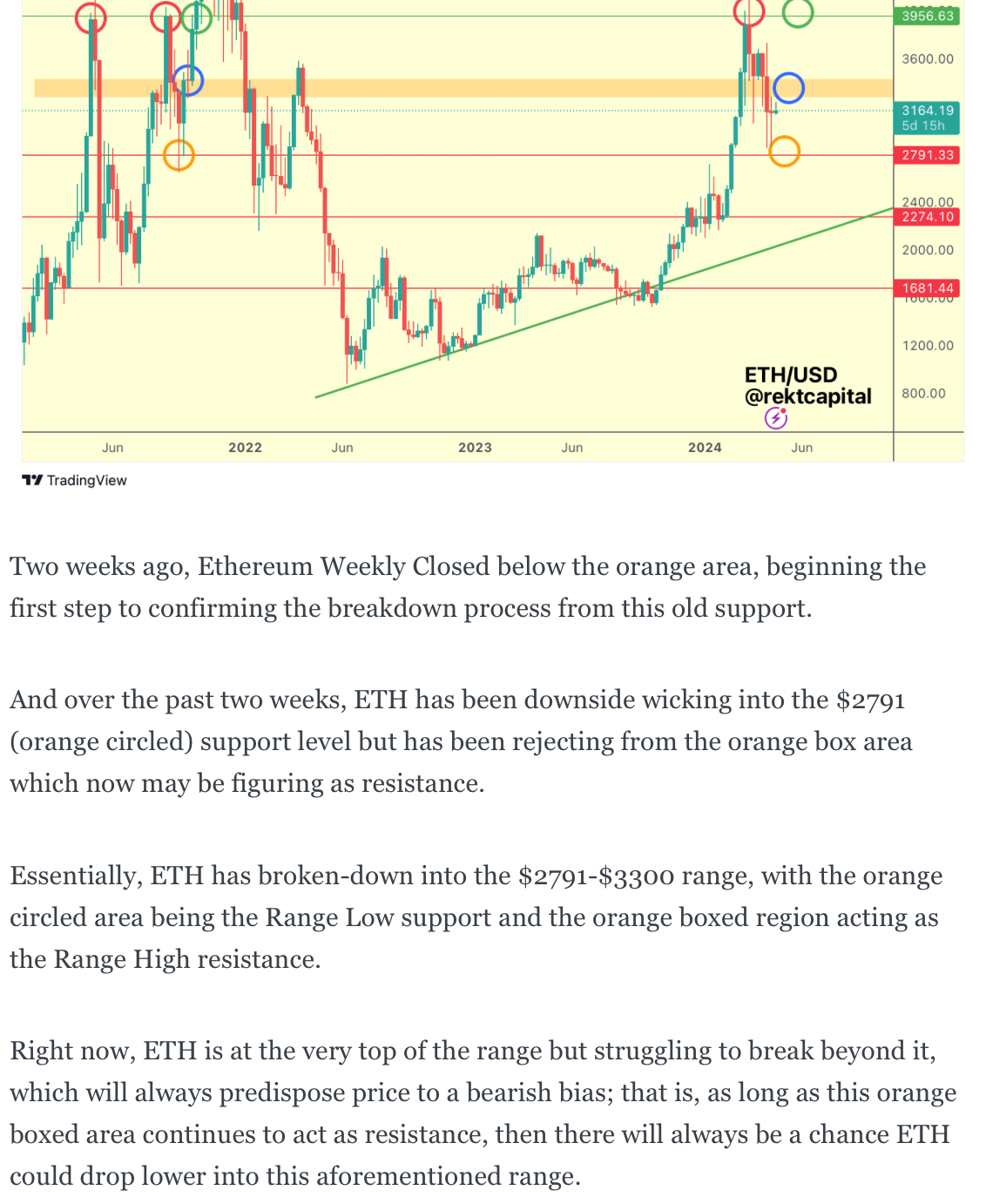

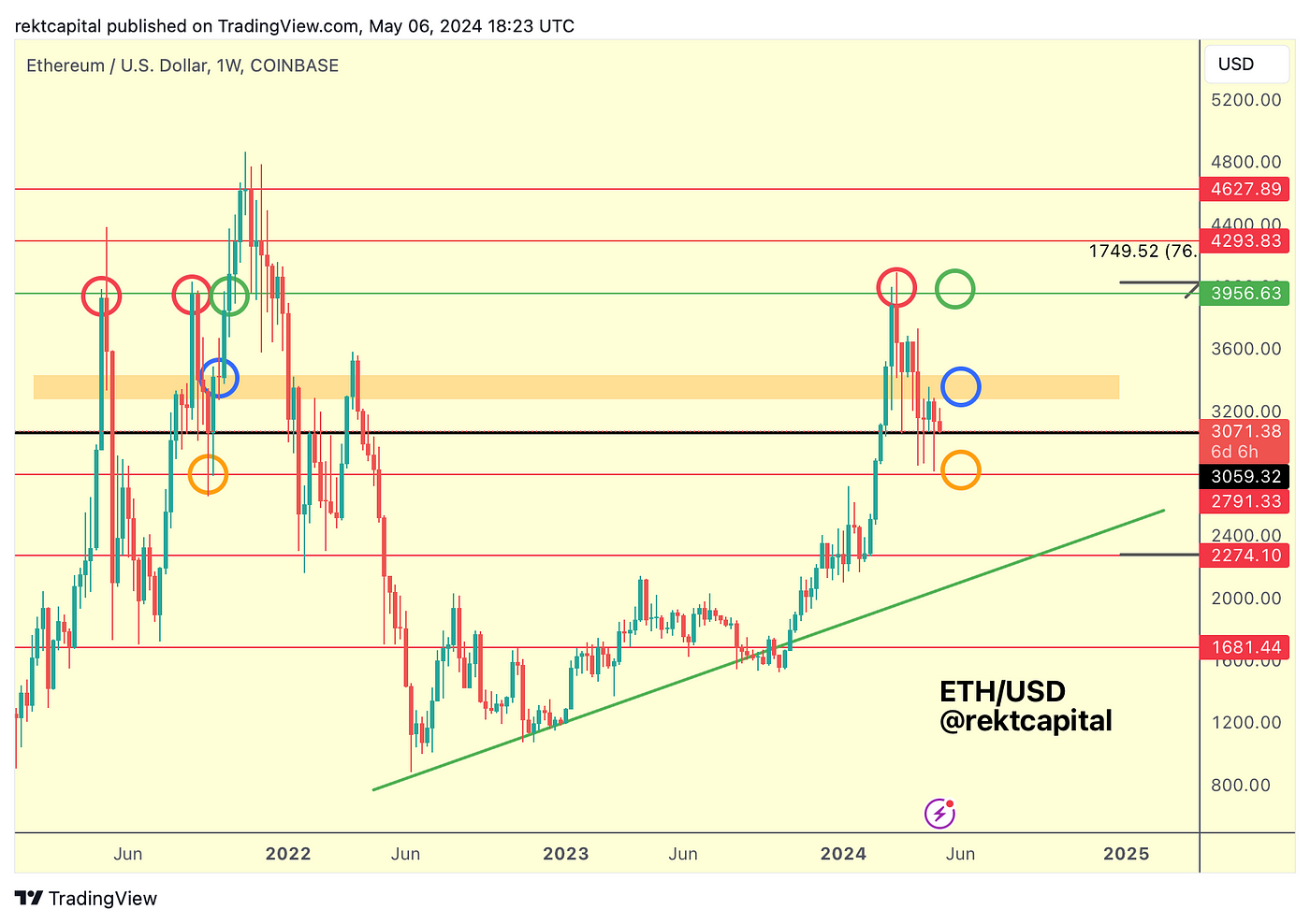

Ethereum — ETH/USD

Over the past few weeks, we’ve covered ETH in a lot of detail, first talking above how a potential rejection from the blue circled area could see price drop into the orange circled level:

Here is today’s analysis:

ETH indeed dropped into the orange circled level but also rebounded from it.

But ETH hasn’t been able to build on that rebound as of yet.

Still, it is holding the black level here, which is acting as a mid-point to its current orange circle to blue circle range.

Losing black here would probably see ETH revisit the orange circled Range Low but this time, in candle-bodied form instead of the downside wicks we’ve seen produced there over the past few weeks.

ETH needs to continue holding this black level to avoid a scenario where ETH would test the orange circled Range Low and potentially showcase a weakening of it.

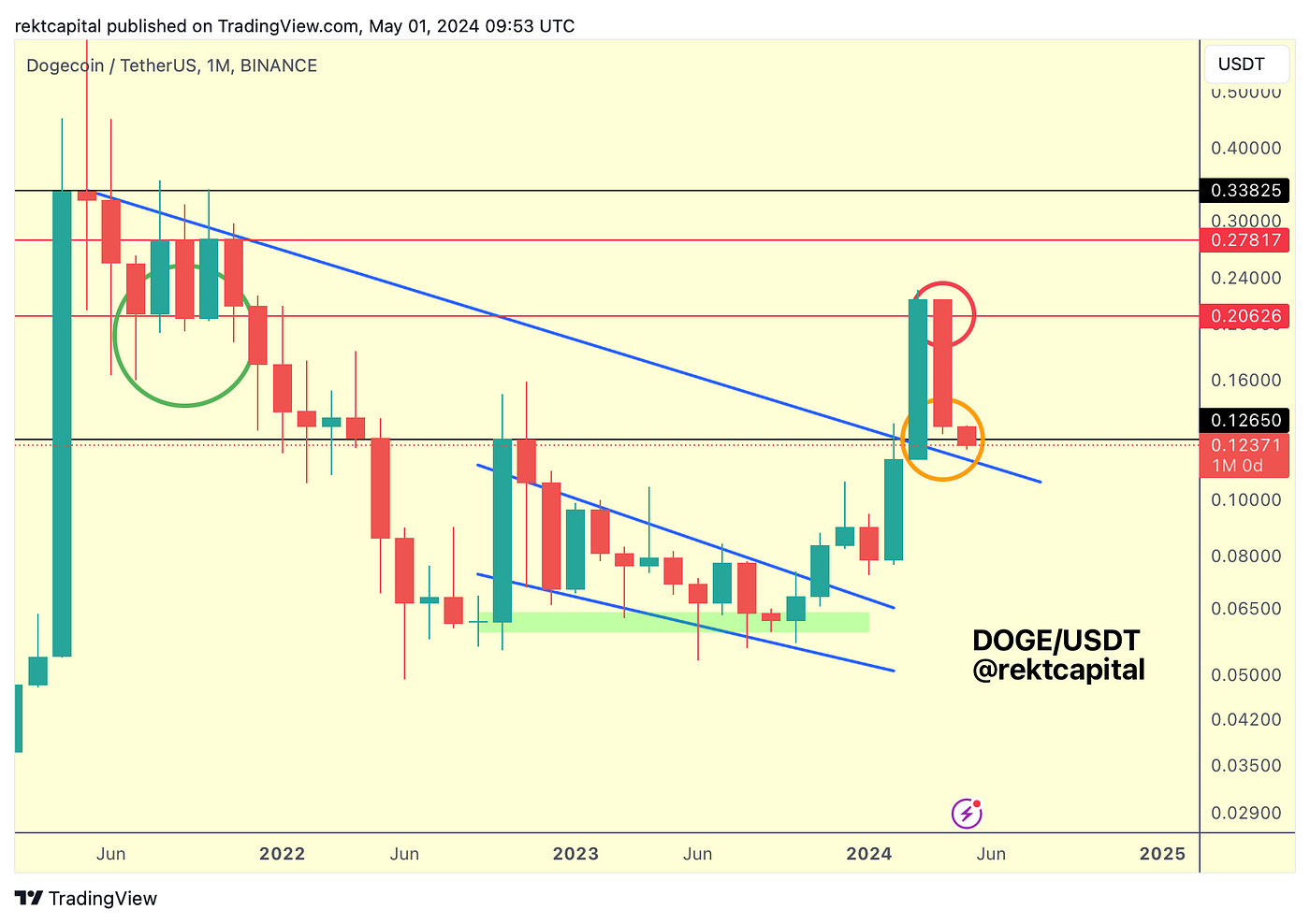

Dogecoin — DOGE/USDT

Last week we spoke about how DOGE was in the process of a crucial macro retest:

Price was in the process of retesting both the Macro Downtrend as well as the black Range Low at $0.12.

DOGE successfully retested this confluent area of support:

DOGE has since rebounded almost +23% to the upside, successfully confirming a new Macro Uptrend in the process.

After all, the retest of the Macro Downtrend occurred so that price could confirm that said downtrend is no longer a resistance but now exists as a support.

When a Macro Downtrend get broken and retested as new support, a new Macro Uptrend is confirmed.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Berachain: The Proof is in the Liquidity

Berachain is an EVM-compatible Layer 1 (L1) chain, currently in test net phase. Built on Cosmos SDK, it focuses on Defi apps.

It stands out through its adoption of a so-called Proof-of-Liquidity (PoL) consensus mechanism and separate gas and governance tokens.

Berachain recently raised an impressive sum of $100 million in a Series B funding round. There is a large active community hoping for an airdrop.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Berachain: the Proof is in the Liquidity”

Crypto Market News

- Bitcoin miner Marathon Digital is set to join the S&P SmallCap 600 from May 8. Source

- Bernstein has doubled down on its Bitcoin price prediction of $150K by the end of 2025. Source

- MicroStrategy has announced a decentralized ID platform on the Bitcoin network leveraging Ordinals called MicroStrategy Orange. Source

- Europe’s second-largest bank BNP Paribas has bought exposure to Bitcoin through BlackRock’s spot ETF. Source

- Bitcoin miner Riot Platforms has reported a record net income of $211.8 million in Q1—a 1,000% increase on the same period last year. Source

- Colombia’s largest bank, Bancolombia, has launched a crypto exchange called Wenia. Source

- Nigeria is preparing to ban peer-to-peer cryptocurrency exchange using its national currency. Source

- Revolut has unveiled a new crypto exchange for its UK users can Revolut X. Source

- Jack Dorsey’s Block is to raise $1.5 billion in a senior notes offering to qualified institutional investors. Source

- Robinhood has received a Wells Notice from the US Securities and Exchange Commission (SEC). Source

- Vodafone, a UK-based telecoms provider, is looking to integrate crypto wallets with SIM cards. Source

- Australia’s tax office has told crypto exchanges to hand over transaction details of 1.2 million accounts. Source

- MoonPay has partnered with BitPay to make crypto payments easier. Source

- Crypto wallet Exodus has received approval to list its stock on the New York Stock Exchange (NYSE) from May 9 and will be tokenized on the Algorand blockchain. Source

Coins and Projects

- Bitcoin has reached the milestone of processing over one billion transactions throughout its history. Source

- Bitcoin’s 200-day moving average has hit an all-time high of $50,178. Source

- Bitcoin could get Ethereum-style programmability in the next 12 months as Layer-2 Rootstock reveals plans for a “BitVMX” project. Source

- Bitcoin Layer-2 Ethereum rollup Build ON Bitcoin (BOB) has launched its mainnet. Source

- Bitcoin exchange inflows have dropped to a 10-year low showing that traders are not interested in a quick sale on exchanges. Source

- Tether reported record net profits of $4.52 billion in Q1 due to the appreciation of Bitcoin and gold. Source

- Solana is seeing a restaking rollout into its ecosystem with platforms such as Jito. Source

- A Solana-to-Bitcoin cross-chain bridge from Zeus Network is aiming to launch in Q3. Source

- Uniswap users can now use Robinhood Connect to buy crypto with Robinhood funds, a debit card or bank transfer. Source

- Polygon has launched an alpha version testnet of its zk-rollup solution called Miden. Source

- Celsius Network has burned its CEL holdings, removing 94% of the total supply. Source

- Cardano founder Charles Hoskinson has proposed the idea of a Bitcoin Cash integration in a poll on X. Source

- Sui has been playing damage control after criticism about its token supply. Source

- Polkadot has proposed a flexible inflation upgrade for the network to address issues relating to its inflation logic. Source

- TON blockchain has received investment from Pantera Capital, which has over $5 billion in assets under management. Source

- Aave has revealed its V4 roadmap and launched a series of governance proposals. Source

Macro News

- The Fed has held interest rates steady between 5.25%-5.50% due to the lack of progress on reducing the inflation rate. Source

- The Reserve Bank of Zimbabwe has launched a physical version of its new tokenized currency that is backed by a basket of gold and foreign currencies. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.