Switzerland to Add BTC as Reserve Asset?

GM friends,

There’s a new push in Switzerland for the country’s central bank to add bitcoin to its balance sheet. So will Switzerland soon be the new El Salvador of Europe?

Well pour a coffee and let’s look at the details, because this is your mid-week crypto update. ☕️📰

Here’s what’s in today’s issue:

- David shares his thoughts on Switzerland possibly adding Bitcoin as a reserve asset, Jack Dorsey developing a Bitcoin mining system, a Spot ETF news roundup & Shiba Inu building a new blockchain.

- Rekt Capital has the latest technical analysis for you on the market.

- Erik has an article on staking your BTC on Babylon Chain.

- In case you missed it by Rebecca.

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

Will Switzerland Add Bitcoin as a Reserve Asset?

Pro-bitcoin advocates in Switzerland are petitioning the country’s central bank – the Swiss National Bank (SNB) – to include bitcoin as a reserve asset.

The initiative is being spearheaded by Yves Bennaïm, who is the founder and chairman of 2B4CH, a Swiss pro-bitcoin think tank. And it appears that Bennaïm and company are taking a two-pronged approach in order to make this happen.

First, the group will formally propose the idea to SNB committee members this Friday. And second, 2B4CH is filing the appropriate paperwork to initiate a national referendum (popular vote) to amend the Swiss constitution to require the SNB to hold bitcoin on its balance sheet. In order to initiate the referendum, 2B4CH will need approximately 1.15% of the Swiss population to sign a petition over the next 18 months.

Proponents argue that if the SNB holds bitcoin as a reserve asset, the country will make further gains in political neutrality, self-sovereignty, and economic freedom from the European Central Bank.

Switzerland is arguably the most independent and pro-freedom country in Western Europe. The nation is not a member of the European Union, and it has a long history of respecting private property rights, gun ownership, and self-sovereignty via direct democracy.

It should be noted that advocates made a similar pitch to the SNB back in 2022. The SNB was planning to purchase 1 billion in German bonds to diversify its reserves, and advocates asked for the 1 billion to be spent on bitcoin instead. The SNB ultimately went with the bonds.

I do believe it’s only a matter of time before we see a major western economic power embrace bitcoin as a reserve asset. Would I wager money that we see this occur in Switzerland over the next two years? Probably not. However, it remains a real possibility, and if any country in Western Europe was to make this move, it would be Switzerland.

But make no mistake about it, if by chance this current proposal proves to be successful, it would absolutely be the most significantly bullish event in bitcoin’s history, and it would send price skyrocketing.

Jack Dorsey’s Block is Developing Full Bitcoin Mining System

On Tuesday, Jack Dorsey’s fintech payments company Block (i.e. formerly known as Square), dropped a blog post with two formal announcements.

First, the company has completed the development of a three nanometer bitcoin mining chip. And second, they’re in the process of developing a full bitcoin mining system.

With regards to the chip, Block states that it utilizes the most advanced semiconductor processes currently available, and it will provide the “performance required for mining operators of all types to survive and thrive” during bitcoin’s post-fourth halving period. Apparently, Block has been working on this chip since April 2023.

But we don’t have a lot of details with regards to the mining system. The post did say that Block would leverage their expertise “to bring a compelling, differentiated mining solution to market.” And in 2021, Dorsey stated that “mining isn’t accessible to everyone” and that “mining should be as easy as plugging a rig into a power source; there isn’t enough incentive today for individuals to overcome the complexity of running a miner for themselves.”

We will for sure learn more about this new mining system as it develops. Fingers crossed that Block releases a simple, cost-efficient rig that gives retail the ability to “plug-in-play” when it comes to bitcoin mining.

Spot ETF News Round-Up

We’ve got multiple pieces of breaking news when it comes to crypto spot ETFs around the globe. So here’s the down and dirty.

- Hong Kong regulators have “officially” approved BTC and ETH ETFs. We were all but certain of this last week, when the applicant companies stated that they’d been approved. But now it’s official.

- Hong Kong’s ETFs will begin trading on April 30th. Yes, you read that correctly. Three BTC ETFs and three ETH ETFs will go live then. They will all use the “in-kind” model.

- Back in the U.S., the Fidelity spot bitcoin ETF was purchased by two investment advisors, Legacy Wealth Asset Management and United Capital Management. Each firm allocated $20 million, which amounts to 6% and 5% of their investment portfolios, respectively. This also means that Fidelity’s ETF now holds the record for the largest received allocation from any investment advisor. The institutions are coming.

- BlackRock and Grayscale submitted updated ETH ETF applications to the SEC on Tuesday. This indicates a little bit of positive movement, but Bloomberg’s Eric Balchunas is still issuing a 25% chance that the SEC approves the applications in May.

Shiba Inu to Build New Privacy-Focused Blockchain

On Monday, the development team behind Shiba Inu announced that they’ve received $12 million in a private investment round for the development of a new privacy-focused blockchain.

As you probably know, Shiba Inu is an Ethereum-based memecoin and ecosystem. The plan is for the new blockchain to be built on the Shibarium layer-2 network.

Apparently, the blockchain will utilize Fully Homomorphic Encryption, which allows developers to unlock the value of data from untrusted domains without the need to decrypt it.

Most of the backers for Shiba’s new blockchain were the usual crypto-heavyweights. Some of the names include DWF Ventures, Polygon Ventures, and Comma 3 Ventures. Apparently, the investors gave the Shiba Inu team cash in exchange for TREAT tokens.

It’s thought that TREAT will serve as the utility and governance token for the new blockchain.

In today’s edition of the Wealth Mastery Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Theta Token (THETA)

- VeChain (VET)

- Crypto Com (CRO)

- Kyber Network (KNC)

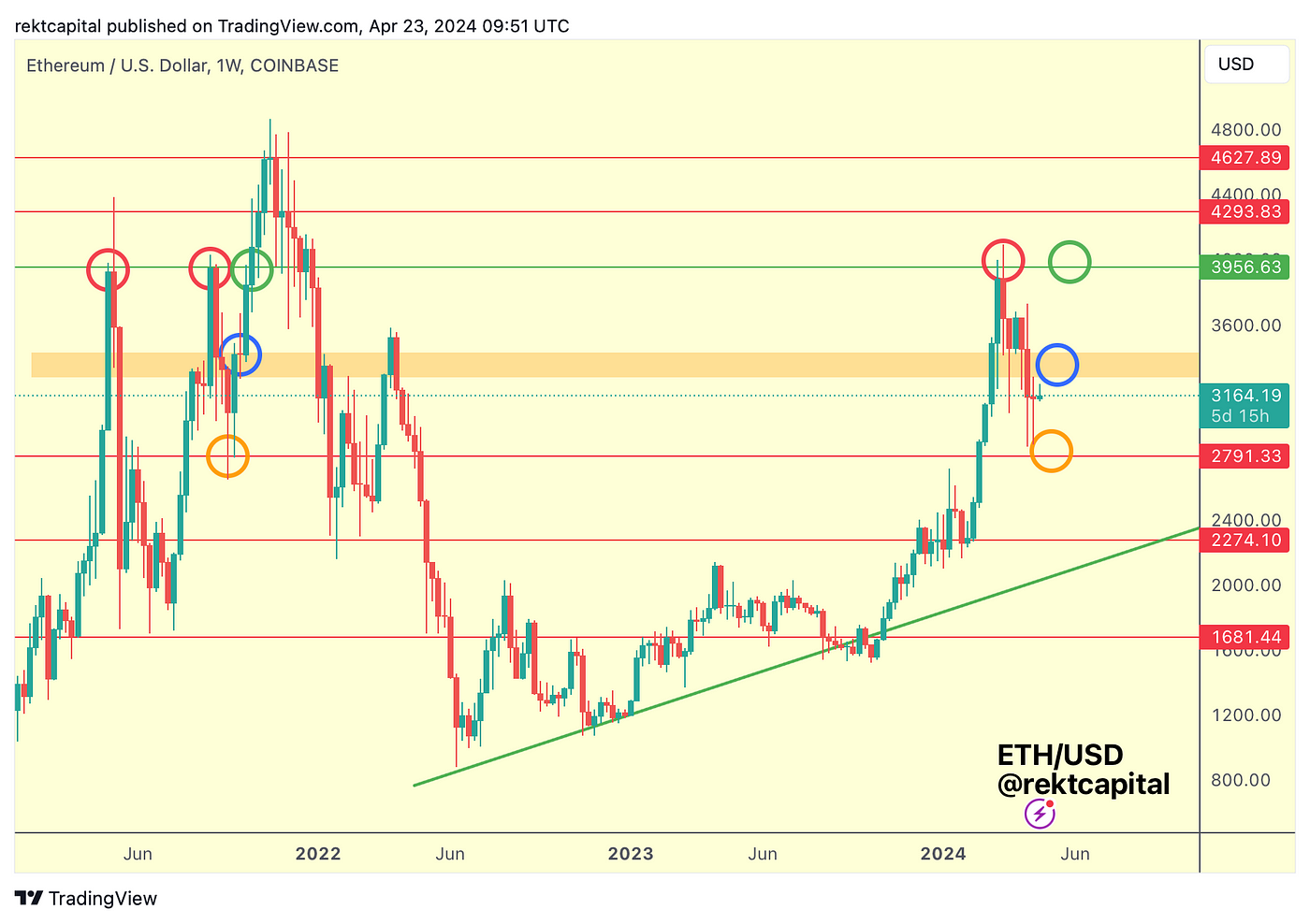

Ethereum — ETH/USD

Two weeks ago, Ethereum Weekly Closed below the orange area, beginning the first step to confirming the breakdown process from this old support.

And over the past two weeks, ETH has been downside wicking into the $2791 (orange circled) support level but has been rejecting from the orange box area which now may be figuring as resistance.

Essentially, ETH has broken-down into the $2791-$3300 range, with the orange circled area being the Range Low support and the orange boxed region acting as the Range High resistance.

Right now, ETH is at the very top of the range but struggling to break beyond it, which will always predispose price to a bearish bias; that is, as long as this orange boxed area continues to act as resistance, then there will always be a chance ETH could drop lower into this aforementioned range.

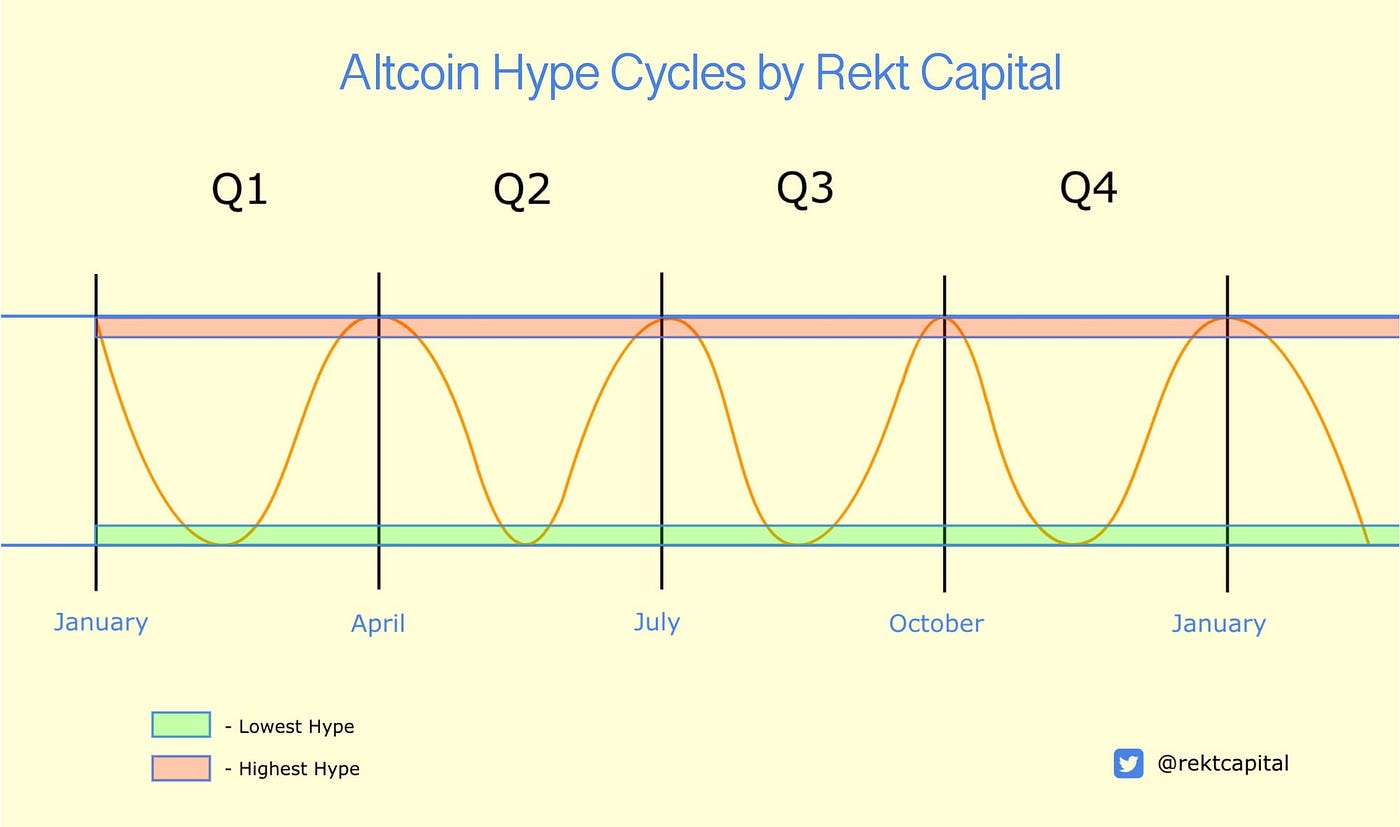

The Halving has historically been a bearish event for the Altcoin Market and this is even accentuated more so by the Altcoin Hype Cycle theory:

The hype still needs to dissipate after a fantastic Q1 and whether that means that ETH’s price needs to continue to dwindle within this range and consolidate here, perhaps that is what the upcoming weeks may hold for crypto’s second biggest asset by market cap.

However, this also means that Altcoins should bottom out on their retraces in the coming several weeks in preparation for the new Q2 Altcoin Hype Cycle.

This would translate into Altcoin bottoming in as early as mid-May, more realistically end of May, early June.

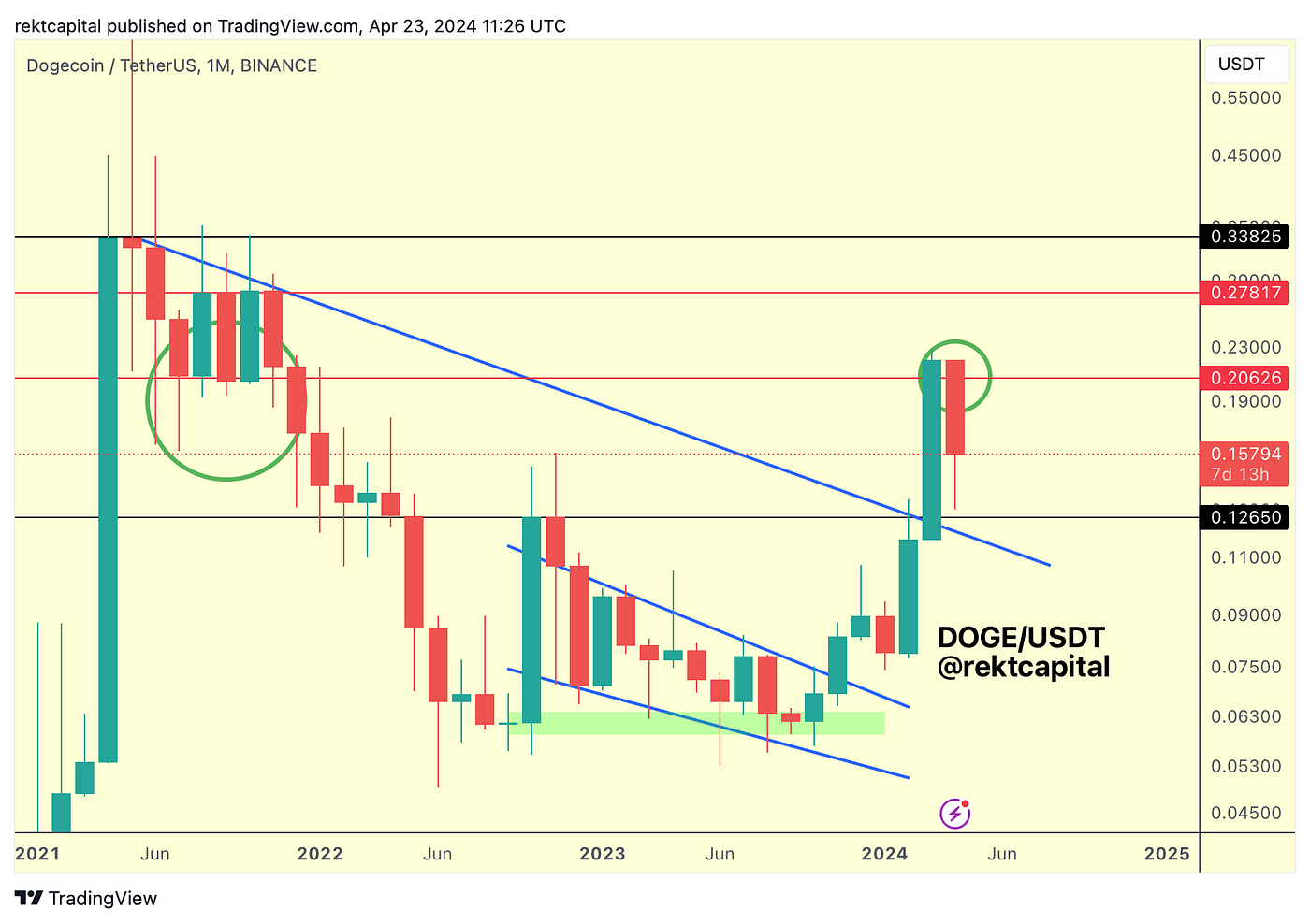

Dogecoin — DOGE/USDT

We know that DOGE has failed its Monthly retest of the red $0.20 level and dropped back down into a confluent support area that is the Range Low of $0.12 and the Macro Downtrend that price broke out from last month.

DOGE has dropped into the Range and though there is still time for price to technically recover about the Range High, the chances for that occurring look slim.

It looks like DOGE will be sentenced to consolidating inside this black-red range for the time being, with the Range Low area providing the best bargain opportunity.

The Weekly showcases that the Range Low is acting as a strong support and has been doing so for the past several weeks:

On the Weekly, many downside wicks into the Range Low and Macro Downed have occurred, indicating strong buy-side interest in that confluent area of support.

This buy-side pressure at the Range Low has enabled for DOGE to reclaim the bottom of the Bull Flag it had broken out from many weeks ago.

Losing this old Bull Flag bottom would see DOGE drop closer into the Range Low area but for a loss of this level to even occur, DOGE would need to Weekly Close below the Bull Flag bottom.

That hasn’t occurred.

But one scenario to keep an eye on is a potential Head and Shoulders formation developing here:

If DOGE were to soon rebound from old Bull Flag bottom to old Bull Flag top but reject to form a Right Shoulder, then a loss of the old Bull Flag bottom (i.e. Neckline) could enable this H&S formation and see price drop into the Range Low but this time as candle-bodies rather than wicks.

Breaking beyond the Bull Flag Top would invalidate this H&S formation, whereas losing the Bull Flag Bottom (neckline) after rejecting from the Bull Flag Top would validate it.

CLICK HERE to go Premium and read the rest of this week’s Market Analysis – Premium subs can read Rekt capital’s full report.

Babylon Chain: Staking Your BTC

Babylon Chain will allow Bitcoin holders to stake their BTC without the need for third-party custody, bridging, or wrapping. Instead of rewards in BTC, Bitcoin stakers will receive their yield in the currency of the chain they secure.

Babylon has successfully secured $18 million in funding and is currently in its testnet phase.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Babylon Chain: Staking Your BTC”

Crypto Market News

- Telegram’s CEO has said he’s held a few hundred million dollars in his “bank account or Bitcoin” for 10 years. Source

- El Salvador’s Chivo wallet has suffered a breach of its source code and VPN access information. Source

- Big four accounting firm Ernst and Young has used zk-proof technology to launch an Ethereum-based solution to automate contracts. Source

- Former a16z partner Kathryn Haun has announced her retirement from Coinbase’s board after 7 years to focus on her own VC portfolio. Source

- The IRS has released its draft tax form for reporting crypto transactions. Source

- The Human Rights Foundation has launched the Finney Freedom Prize to reward contributors for every halving. Source

- The Philippines regulator has ordered Apple and Google to remove Binance from app stores. Source

- Binance is being sued in Canada for securities violations despite leading the Canadian market in May 2023. Source

- PayPal wants to reward Bitcoin miners with sustainability incentives on top of the Bitcoin network. Source

- Crypto exchange Crypto.com has postponed its South Korean app launch after reports of money laundering. Source

- Kraken has launched its self-custodial wallet for mobile and open-sourced the code. Source

- Sam-Bankman Fried has agreed to help investors go after celebrity promoters after a group of customers dropped a class action against him. Source

- Ledger Live will start offering users instant-buy and swap services via MoonPay. Source

Coins and Projects

- Jack Dorsey’s Block has developed a Bitcoin mining chip and is in the final stages of producing the design. Source

- Bitcoin’s fourth halving has been activated and will see the miner reward drop to 3.125. Source

- Bitcoin has been outperforming Tesla stock for the first time in 5 years. Source

- Fidelity’s Bitcoin ETF has seen two financial advisors buy $20M in shares each making it the single largest investment from advisors. Source

- Runes Protocol has launched on the Bitcoin network sending fees skyrocketing. Source

- Bitcoin’s Layer-2 Stacks has started the phased rollout of its major overhaul Nakamoto and is expected to be completed in late May. Source

- Tether is expanding its business beyond stablecoins by introducing four new business divisions. Source

- Tether has said it will freeze addresses linked to sanctioned entities after Venezuela’s state-owned oil company was using USDT to go around sanctions. Source

- Franklin Templeton’s Ethereum ETF has been delayed until June 11 by the US SEC. Source

- Ethereum ETFs are unlikely to be approved in May, says Standard Chartered. Source

- Magic Eden has launched a beta platform for Runes allowing users to swap for Bitcoin and buy Runes and Ordinals with their Magic Eden wallet. Source

- Sui has partnered with TikTok’s parent companies’ tech arm, BytePlus to explore Web3 gaming and AI capabilities. Source

- Aptos Labs has partnered with Microsoft, Brevan Howard and SK Telecom to launch Aptos Ascend which will give institutions access to DeFi. Source

- Injective’s community has approved a proposal to change its tokenomics which would increase deflation by 400%. Source

- Cardano founder Charles Hoskinson’s studio has launched its first game Voyager—but it’s on Gala Chain. Source

- Celo has chosen Optimism’s OP stack to transition from a Layer-1 to a Layer-2 network. Source

- Worldcoin has launched its own Ethereum Layer-2 network called World Chain. Source

- Shiba Inu has raised $12M from institutional investors in a private sale for its yet-to-be-released TREAT utility and governance token. Source

Macro News

- Robert F Kennedy Jr. wants to put the US national budget on the blockchain for transparency. Source

- Canada is proposing to increase capital gains tax to 66% for investors with annual profits of over CA$250,000.Source

- New Zealand has opened a 101-day public consultation for its CBDC. Source

- Israel’s central bank has said CBDCs are a positive for the economy. Source

- The New York Stock Exchange is considering opening 24/7 and has launched a survey to gather feedback from traders. Source

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, I highly recommend that you check out my new altcoin course: Mastering Altcoin Investing

In this course we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

Learn how to build your portfolio so that growth is ensured and risk is mitigated. Let me help you build a strategy that’ll change your life forever in the upcoming bull run.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.