The US Just Stole 10,000 BTC

Gm friends,

The US said, “Holy moly, high inflation could be coming back…quick…we need some Bitcoin…who can we steal it from?”

Samourai Wallet drew the short straw.

Here is your weekend crypto update…

Here’s what’s in today’s issue:

- Rebecca shares her thoughts on Samurai wallet being seized by the US Government, BTC’s top and bottom prices, payment apps going crazy for crypto & Franklin Templeton’s RWA fund going peer-to-peer.

- Altcoin alpha by David.

- This week’s airdrop by Jesse.

- Sam has an NFT report on Are Bitcoin Runes Here to Stay?

Ready to take your crypto journey to new heights? Look no further – Bitget is your ticket to seamless and rewarding trading experiences!

- User Friendly

- Advanced Tools For Traders

- Huge range of top coins to trade

💰 Sign Up Now for Exclusive Bonuses Up To $30,000! 💰

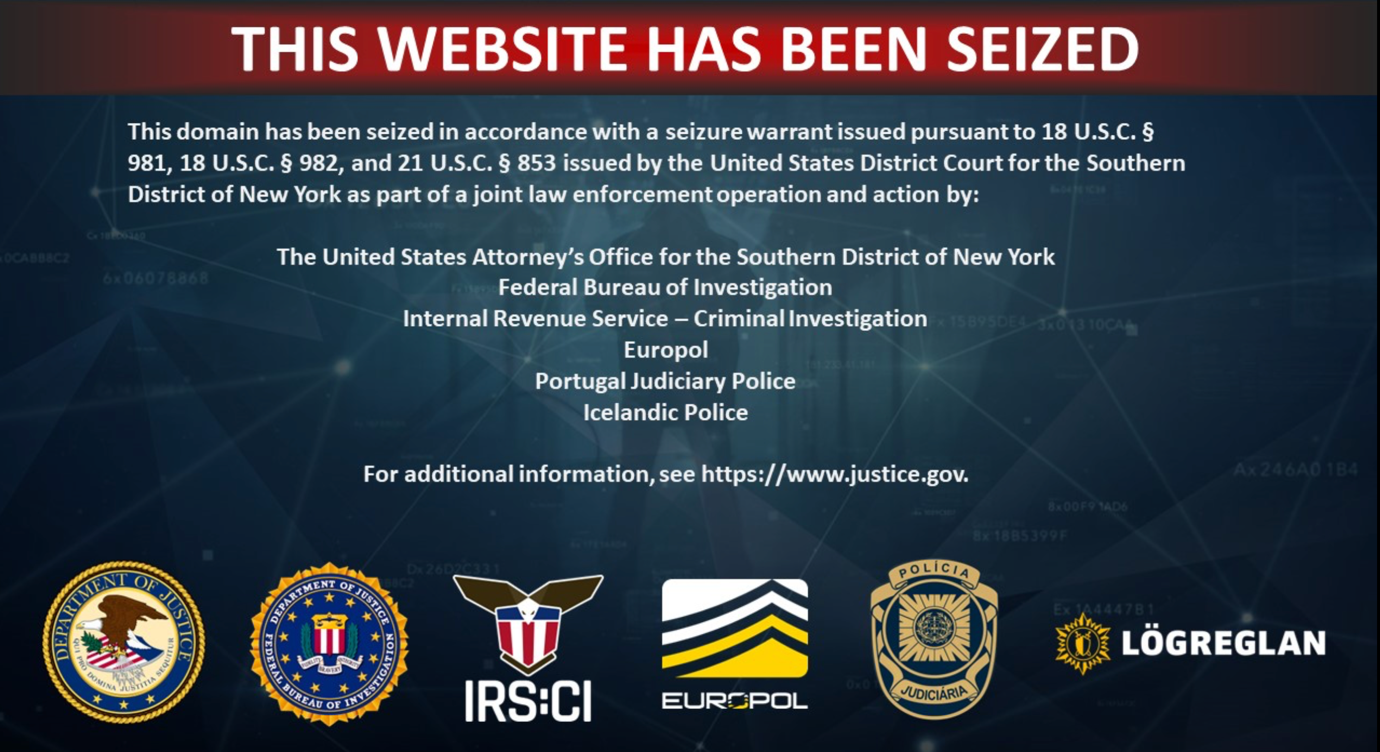

Samourai Wallet Seized

The war on privacy has begun.

Samourai Wallet, a non-custodial Bitcoin wallet has been shut down by the US Department of Justice (DoJ).

They say, “Samourai unlawfully combined multiple unique features to execute anonymous financial transactions valued at over $2 billion for its customers.”

Now, its two founders have been arrested on charges of money laundering and conspiracy to operate an unlicensed money-transmitting business. Each is facing a maximum prison sentence of 25 years.

The US has once again made privacy a crime.

But here’s the kicker, there were 10,868 Bitcoins in Samourai’s whirlpool, which the US has now seized.

They always get what they want through theft. Yet according to X user, @sethforprivacy, the DoJ estimates that only 3.6% of the volume in Samourai Wallet was illicit. Completely ignoring that 96.4% of usage was a legitimate attempt from Bitcoiners at transaction privacy.

That’s absurd, if accurate.

Now, the FBI has issued a warning to Americans against using non-KYC services. The authorities can’t resist overstepping their mark.

Will this be Bitcoin’s Market Top and Bottom Prices?

The questions every crypto investor wants to know the answers to…When should I sell? When should I buy back?

Whilst it’s dangerous to think you can time the market tops and bottoms perfectly, someone has built a model to try and achieve exactly that.

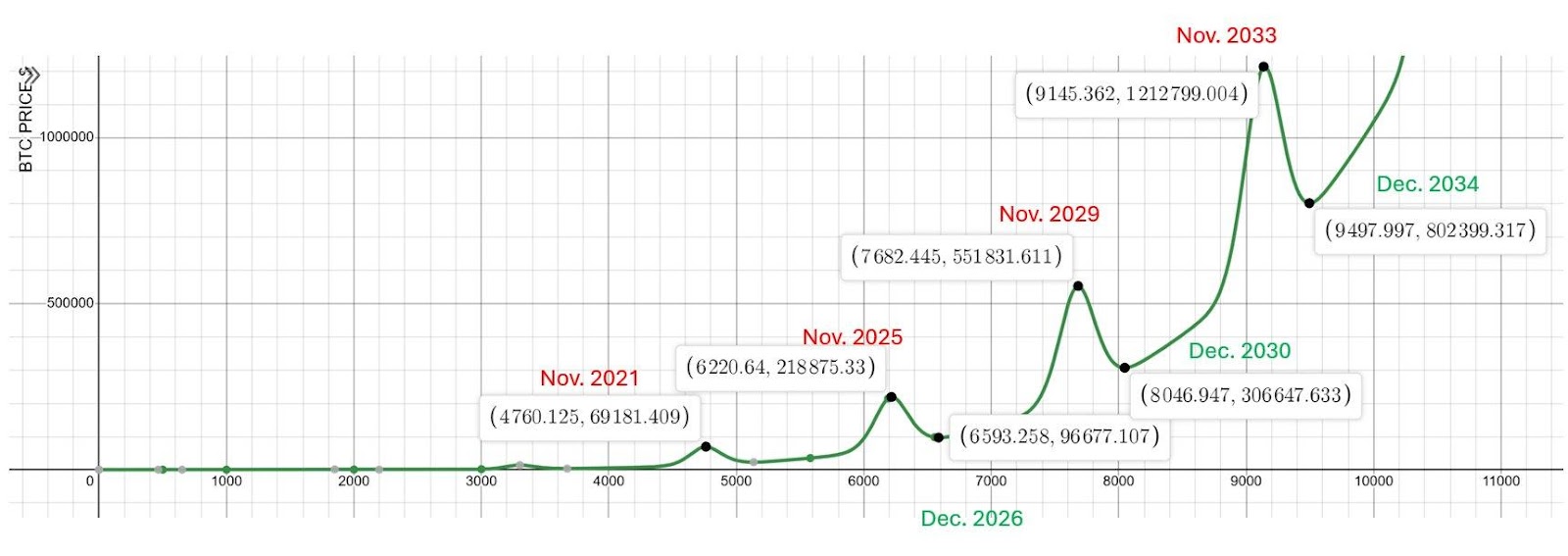

The Bitcoin Power Law model was built by former physics professor Giovanni Santostasi and was first shared back in 2018 on Reddit. It’s designed to forecast Bitcoin’s future price as if it were within the laws of physics.

Now that the halving has happened, it’s doing the rounds online again.

It’s predicting a BTC price of $10 million by 2045. Okay, I know what you’re thinking, you want to know when to buy and sell right now. So, get ready to bookmark the following BTC price predictions for the current cycle:

- Bitcoin’s peak: $218, 875 in November 2025

- Bitcoin’s bottom: $96,677 in November 2026

If it turns out to be correct, then this is your cheat code. But in reality, what’s it going to take to send Bitcoin’s price to over $200K?

There are 2 key drivers right now:

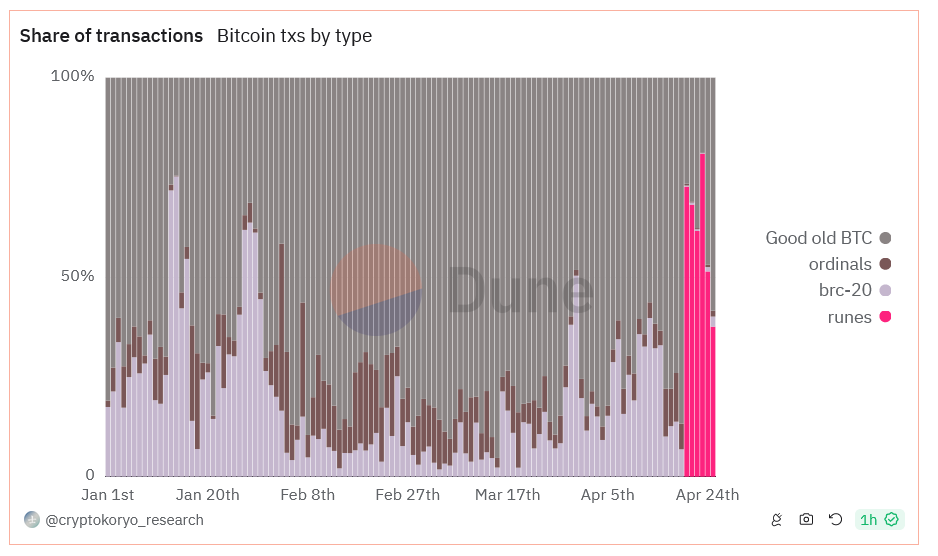

1. Bitcoin Runes Protocol

Bitcoin Runes currently makes up around 68% of all BTC transactions and April 23 saw its biggest day with over 750,000 transactions.

Miners have been loving the extra revenue with Runes making up almost 70% of miner fees on Bitcoins halving day.

Now, Runes is making up between 33% to 69% of miner fees.

There’s no telling how long Runes will last, but if it does it has the power to push Bitcoin’s price to new heights.

2. Inflation Resurgence

Stagflation seems to have gotten the better of the US, with the inflation rate heading in the wrong direction—rising and currently sitting at 3.5% year-on-year.

Hashkey Capital says inflation could be a key driver for Bitcoin’s price pushing higher.

Unsustainable budget deficits mean we could see increased demand for store-of-value assets. Coincidentally, The World Bank is also sounding the alarm on a second wave of higher inflation.

That’s if tensions escalate in the Middle East causing an energy shock that could send oil prices to $102 per barrel.

It’s almost as if they need inflation to go higher and are hinting at what they have planned…as Ray Dalio recently said…“Do you have enough non-debt money?”

What do you make of these Bitcoin price predictions? Reply to this email and let us know.

Payments Apps are Going Crazy for Crypto

The next phase of the bull market is loading…more access options mean more users will come. It’s time to open up the floodgates…

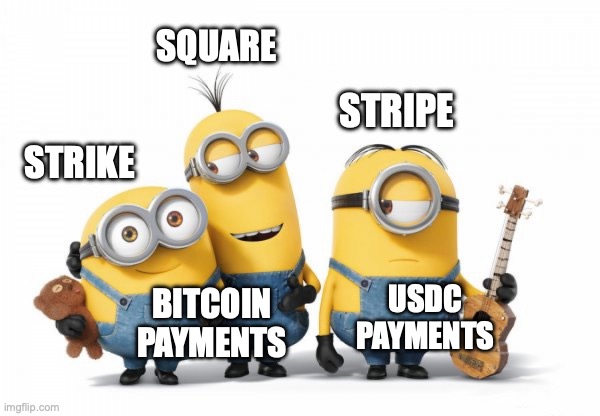

1. Strike App Continues its Global Expansion

Jack Mallers’ Bitcoin payments app Strike has finally launched in Europe.

This comes off the back of its recent launch in Africa back in February.

Next up, will be its UK launch which was announced at Podcaster Peter McCormack’s recent Bitcoin Conference in Bedford, called CheatCode.

2. Stripe Brings Back Crypto Payments

Stripe became the first big payment provider to integrate Bitcoin back in 2014.

However, Stripe discontinued Bitcoin payments in 2018.

Now, it’s had a change of heart. Well, kinda. Stripe is bringing back crypto in the form of stablecoin payments. USDC payments on Solana, Ethereum and Polygon will be available from Summer this year.

3. Square’s Bitcoin Cash App Conversions

Jack Dorsey’s payments company Block announced a Bitcoin mining chip and mining system just days ago.

But wait, there’s more…Square and Cash App have teamed up to launch Bitcoin Conversions. Square merchants can now connect to Cash App to get 1-10% of their store’s revenues converted automatically into BTC.

The rollout to businesses will be phased with immediate access to sole proprietors and single-member LLCs to start, before opening it up to all merchants over the coming months.

Franklin Templeton’s RWA Fund Goes Peer-To-Peer

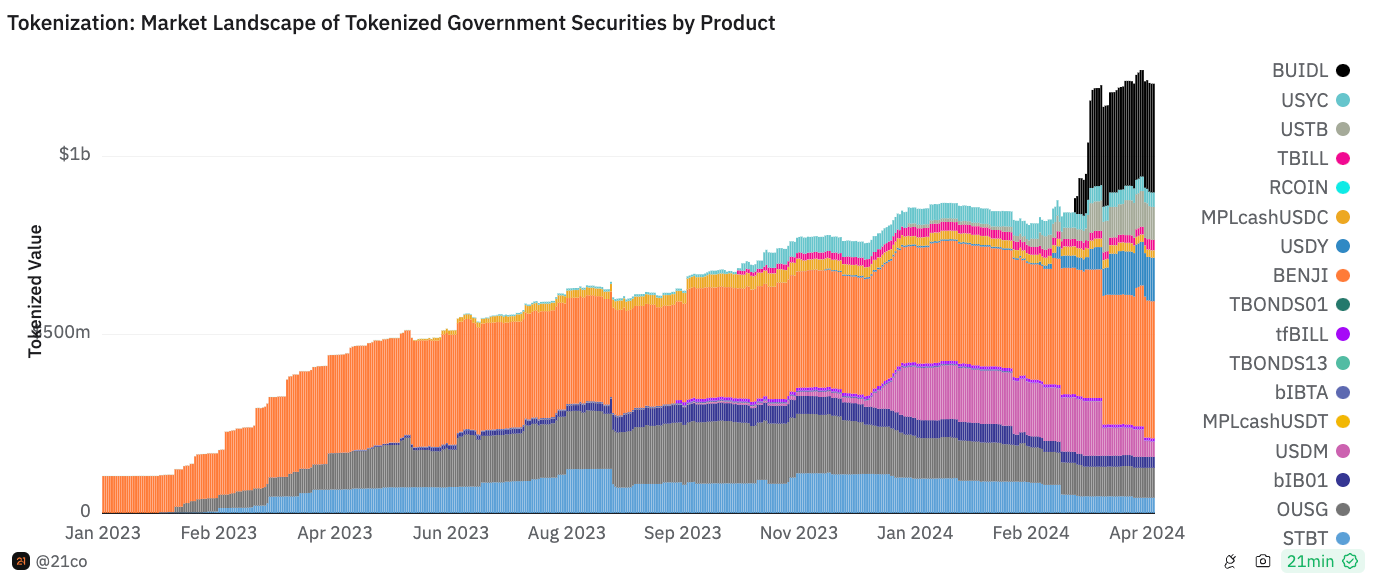

Long before BlackRock’s tokenized BUIDL fund, there was BENJI.

Bitcoin ETF issuer Franklin Templeton became the first to launch a US-registered fund on-chain in 2021. Its OnChain US Government Money Fund (FOBXX) launched on the Polygon and Stellar blockchains.

One BENJI token represents one share in its FOBXX fund. Now, it’s upgraded the fund to allow BENJI token holders to transfer shares between one another.

Not only this, but it’s also even easier for individual investors to access the fund, now you can do so through the Benji Investments app.

Franklin Templeton’s BENJI fund is the largest in its category with 32% of the market share. Its market cap is around $380 million as of April 25, putting it way ahead of BlackRock’s BUIDL fund, at least for now.

Existing Projects / Tokens

- Chainlink’s [LINK] CCIP has entered into “general availability” across 9 blockchains. This means developers can now initiate cross-chain token transfers and messaging across these networks with CCIP. Remember, the higher demand for CCIP services, the higher demand for LINK.

- Injective [INJ] has just released INJ 3.0. Developers say this upgrade will make INJ “the most deflationary asset” in all of crypto. The deflation is set to occur over the next two years.

- Stacks [STX] has initiated the highly anticipated “Nakamoto” upgrade. Nakamoto will increase Stack’s block processing from 10 to 30 minutes to just five seconds. This increase in block processing should bolster Layer-2 applications, DeFi, and usability for settlement on the bitcoin network.

Upcoming Projects / Tokens

- Lyra Finance [LYRA] is migrating its native token, LYRA, to LDX. This new token will serve as the utility token for the Lyra Derivatives Network. The Lyra team is saying that LDX will be distributed in Q3.

- Merlin Chain [MERL] released its native token – MERL – on April 19th. Merlin Chain is a new layer-2 solution built on top the bitcoin network.

- Renzo Protocol’s [REZ] native token drops April 30th. Currently, you can farm REZ on Binance’s Launchpool before official trading begins. Renzo Protocol is a liquid restaking token platform for EigenLayer and Ethereum.

- Shiba Inu [TREAT] developers are building a new privacy focused blockchain. The new chain will be built on top of the Shibarium L2. It’s thought that TREAT will serve as the new chain’s native token. Multiple big investors, including DWF Ventures, just completed a seed round investment with protocol investors by exchanging cash for TREAT.

Level Up Your Altcoin Investing Game

Explore the new Mastering Altcoin Investing Course. In this value-packed course, we’ll teach you all about how to spot, choose and acquire the winning altcoins of the next bull market.

MilkyWay Celestia Airdrop

MilkyWay is offering a new liquid staking solution for the Celestia ecosystem. Initially deployed and operated on Osmosis, MilkyWay is migrating to Celestia’s rollkit for native milkTIA issuance. These new liquid restaking tokens can then be used to expand the Celestia ecosystem and allow for better capital efficiency.

MilkyWay has launched a points campaign called “mPoints” and confirmed that they will airdrop 10% of the total supply of “MILK” tokens to users who collect points. All you have to do is Stake your TIA tokens on MilkyWay to get the liquid staking token milkTIA. By doing this, you’ll earn mPoints based on your milkTIA balance.

You can take these milkTIA tokens and interact with various projects in the MilkyWay Ecosystem. To make the most of your milkTIA tokens, you can use them to provide liquidity in the Osmosis milkTIA Pool, or Quasar milkTIA Pool.

Are Bitcoin Runes Here to Stay?

Runes Protocol, which enables fungible tokens on Bitcoin, is closely connected to Ordinals Protocol, which enables NFTs on Bitcoin.

NFT marketplace Magic Eden is leading the way in integrating Runes, and though there are criticisms around initial friction, the Runes ecosystem is building rapidly. In these early stages, some leading Runes to have emerged so far include DOG•TO•THE•MOON, MAGIC•INTERNET•MONEY, and SATOSHI•NAKAMOTO, with PUPS also gaining traction, although it has yet to release its Runes token.

TO READ THE REST OF THIS ARTICLE, CLICK HERE – “Are Bitcoin Runes Here to Stay?”

Go Premium To See This Weeks Top 3 NFT Mints

Subscribe to the Wealth Mastery Premium Investor Report to get this weeks top 3 NFT mints AND gain full access to the premium archives.

Thank you so much for your support, and I truly hope that today’s issue will give you insights needed to help you master your wealth.

If you are reading this it means you are on the free version of the Wealth Mastery Investor Report, which is great for news and tips on the crypto markets.

If you really want to take advantage of fastest growing asset class EVER, then the Premium subscription is for you.

Premium Members get access to:

- My updated portfolio

- Technical Analysis from Rekt Capital

- Deep dives on altcoins

- DeFi tutorials

- Airdrop reports

- NFT drop reports

The time to build your portfolio is now. Don’t get left behind.

See you next time!

Lark and the Wealth Mastery Team

💰 BINANCE: BEST EXCHANGE FOR BUYING CRYPTO IN THE WORLD 👉 10% OFF FEES & $600 BONUS

🚀 BYBIT: #1 EXCHANGE FOR TRADING 👉 GET EXCLUSIVE FEE DISCOUNTS & BONUSES

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE 👉 BUY LEDGER WALLET HERE

1️⃣ COINLEDGER: #1 CRYPTO TAX SOFTWARE 👉 IF YOU OWN OR TRADE CRYPTO YOU NEED THIS

Wealth Mastery (Lark Davis, and the Wealth Mastery writing team) are not providing you individually tailored investment advice. Nor is Wealth Mastery registered to provide investment advice, is not a financial adviser, and is not a broker-dealer. The material provided is for educational purposes only. Wealth Mastery is not responsible for any gains or losses that result from your cryptocurrency investments. Investing in cryptocurrency involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire investment. Investors should consult their financial adviser before investing in cryptocurrency.

You can find a full disclosure of all my crypto & venture investments here.