No-Loss Lottery with stETH: Earn Up to 900% Randomly with Asymetrix

Before we get started, this is not a recommendation or endorsment to buy any token(s) mentioned including ASX.

For weeks, we’ve been covering the rise of LST-fi (short for Liquid Staking Token DeFi)! With Gravita and Lybra, users are able to borrow against staked ETH tokens as collateral and mint new stablecoins, which is very compelling in terms of the value it brings to the current DeFi ecosystem, but it also carries lots of risk by introducing a new dollar-pegged stablecoin.

Instead, we’ll take a step back today and review a familiar DeFi protocol design, optimized for stETH holders to gamble with their staking yield for a chance at winning a no-loss lottery (or savings game) by Asymetrix.

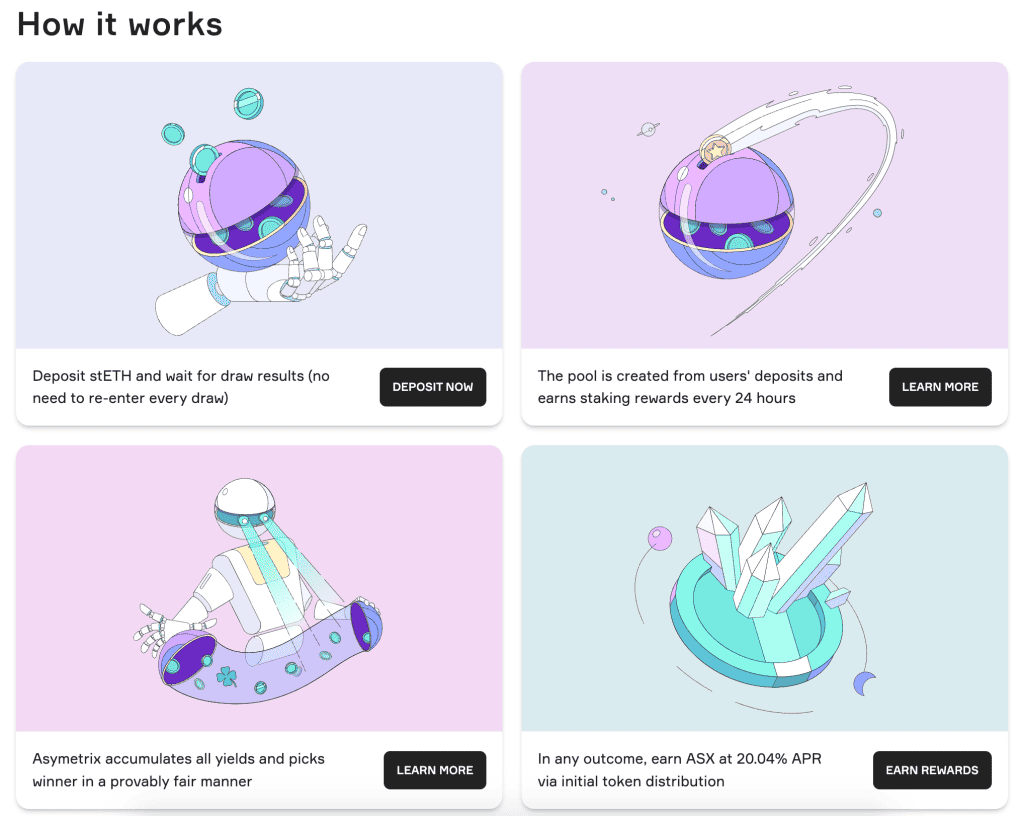

Similar to PoolTogether, Asymetrix gamifies savings where users deposit stETH collectively into a pool and wait for a weekly drawing, whereby the pooled staking yield from everyone’s stETH is randomly awarded to 3 winners, as specified below. Asymetrix uses Chainlink VRF, which is widely considered the best practice solution in crypto for ensuring provably fair randomness.

- 1st Place = 50% of stETH yield

- 2nd Place = 30% of stETH yield

- 3rd Place = 20% of stETH yield

Your odds of winning change dynamically in real-time based on how much stETH is deposited in the pool. However at the moment, all Asymetrix users earn an additional ~20% APY in ASX rewards.

If a user wins, they automatically receive stETH rewards

Responses