Getting The Best Return on Stablecoins

If you’re sitting on a bunch of stablecoins in your portfolio, you might want to consider earning some yield on these idle assets. I mean let’s face it, in the fiat world, banks are offering deposit rates of less than 1%. That’s hardly very enticing and it’s well below the rate of inflation which has skyrocketed since Covid-19 shocked the world and governments set their money printers to full blown brrrrrrr……mode.

When it comes to stablecoins, there are plenty of options available to earn yield. So, here’s how to get the best return on stablecoins.

1. Celsius

With over 1.6 million users and $21 billion in assets under management, Celsius have become a major player in the yield generation space.

They are currently offering 7.10 % APY (Annual Percentage Yield) on USDC, USDT, BUSD, GUSD, TUSD and PAX. They also offer yield on other currencies via the True stablecoin family which includes TGBP, THKD, TCAD and TAUD, all available with the same APY.

Celsius gives their users the option to earn a bump in their interest rate of 2.22% (so total 9.32%) if they accept their native $CEL token as rewards, rather than in-kind rewards. Interest is paid on a weekly basis and they also offer yield on other popular cryptocurrencies as well.

2. Nexo

Nexo has over 4 million users and $12 billion in assets under management.

The platform offers yield on a range of stablecoins and are currently offering 10% APR (Annual Percentage Rate) on USDC, USDT, TUSD, USDX, EURX and GBPX. They are also offering 15% APR on UST.

Similar to Celsius, Nexo gives users the option to earn additional interest (+2%) if users accept their native $NEXO token as rewards, rather than in-kind rewards. Interest is paid on a daily basis and they have a $375 million insurance fund in the event of hacks or theft.

3. BlockFi

BlockFi is a major competitor to Celsius and Nexo. They offer bank-like services to their users including interest on crypto assets deposited, a token swap service and a credit card so that users can spend their earnings.

BlockFi is currently offering 7.25% APY on GUSD, USDT, USDC, BUSD, DAI and PAX. Interest accrues daily and is paid to users on a monthly basis.

Note that BlockFi does not have its own native token.

4. Yield App

Yield App is a global fintech company managed by an experienced team in capital markets. Users can buy, swap, and earn yield on a range of crypto assets, including stablecoins.

Yield App offers incentives to holders of their native token, $YLD. By owning and staking the $YLD token, users can enjoy interest rate boosts. There are 4 different tier levels available, from Bronze to Diamond membership.

The platform currently offers between 6 to 10% APY on DAI, USDT, USDC and TUSD. With added bonuses to token holders of between 1 to 3% depending on their tier level. These additional rewards are paid to users in the $YLD token. By way of example, Diamond tier holders earn in-kind rewards of 10% plus 3% in $YLD token rewards (total 13%).

5. Anchor Protocol

Anchor Protocol is a decentralized money market savings and lending platform built on the Terra blockchain. The platform offers users approximately 19.5% APY on deposits of $UST which is the TerraUSD stablecoin.

Leading stablecoins such as USDC and USDT, are pegged to the price of the USD by a mixture of cash and debt. Unlike this, UST is an algorithmic stablecoin which maintains its peg to the USD through a network of arbitrageurs who buy and sell Terra’s volatile cryptocurrency called $LUNA. The elasticity of supply is designed to keep the peg in place.

6. Crypto.com

Crypto.com offers trading and yield generation services to its users. They are well known for their popular Visa Debit Card.

The yields that the platform offers are based on two key factors. Namely, the term that a deposit is locked and also how much $CRO, the native token of the crypto.com ecosystem, that a user owns. For example, a user that deposits any supported stablecoin for 3 months and also has 4,000 $CRO tokens staked would earn 8% APR. The platform pays interest on a weekly basis.

Stablecoins supported include USDC, USDT, DAI, PAX, TrueUSD, TrueAUD, TrueCAD, and TrueGBP.

7. Gemini

Gemini is an exchange where users can buy and sell crypto assets. They also offer yield services on popular assets, including stablecoins.

Gemini prides itself on security and has insurance on the user deposits that it holds.

The platform currently offers 6.43% APY on DAI, 6.36% APY on USDC and 6.9% APY on their very own GUSD.

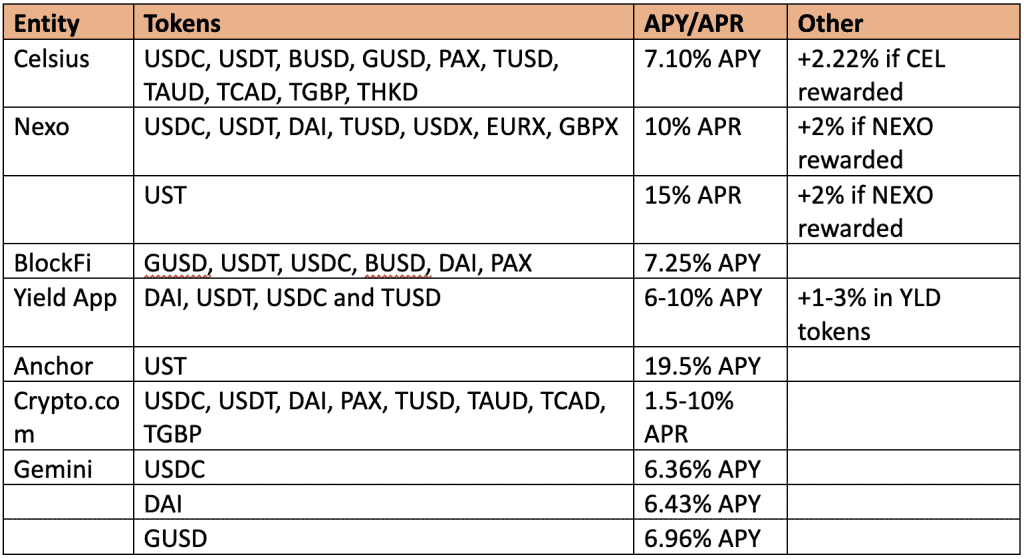

Return on Stablecoin Summary

Risks

Investors should be mindful that there are risks to consider whenever they relinquish control of their crypto assets to any yield generating platform. As the saying goes, ‘not your keys, not your crypto’. Users need to weigh up the risks compared to the expected rate of return.

Hacks and outright theft are unfortunately commonplace in the DeFi/CeFi sector. Unlike traditional banks which are often backstopped with Government guarantees, crypto platforms do not offer the same peace of mind. If an event occurs which impacts the underlying principle, there is a possibility that user funds may be lost.

Be mindful of token locks and withdrawal limits. Most platforms have quite flexible arrangements when depositing and withdrawing assets however some require users to lock up their crypto for a period of time and may also have daily withdrawal limits. So, check the terms and conditions before depositing your funds.

A final note. Investors should be aware of the difference between quoted APR and APY. These terms may sound very similar but they are actually quite different. APR represents the annual % rate earned while APY also takes into account the compounding of interest earned.

Users should take the time to do their own due diligence and consider the reputation of each platform, the security of the assets that they manage and any insurance which may be in place to protect them. Consideration should be given to splitting assets across multiple platforms to reduce risk exposure to any single entity. https://youtube.com/c/CryptoBadgers