Blur, Amazon & Sotheby’s Shake Up NFT Marketplaces

TL;DR

- NFT trading platform Blur has launched perpetual loans protocol Blend, offering collateralized loans and a buy now, pay later feature.

- Amazon is set to open an NFT marketplace, but despite rumors and speculation, the launch date remains unknown.

- Renowned auction house Sotheby’s launches digital marketplace Sotheby’s Metaverse, which specializes in curated NFT artworks.

NFT marketplaces have moved on a lot since the days when it was OpenSea for everything, and despite NFTs going through a lull as attention switches to memecoins–there have been plenty of new developments recently when it comes to trading platforms.

Let’s go through some key developments, and get a handle on what effect they might have, near and long term.

Blur Blends NFTs and Finance

The big news has been fast-moving and disruptive marketplace Blur launching its next innovation, a peer-to-peer perpetual lending protocol called Blend. It has no expiry dates on loans, doesn’t use oracles to track NFT values, and has two features: collateralized loans and buy now, pay later.

Loans

For the loans, NFTs can be used as collateral, and they’re offered at fixed rates decided by the lender. Borrowers can exit at any time by fully paying back the loan, while lenders can exit at any time by triggering a refinancing auction, meaning a new lender can come in and take over the loan on new terms, or if no-one takes on the deal, then the result is liquidation (in which case the borrower has to pay back the loan or lose the collateral).

Buy Now, Pay Later

The buy now, pay later facility means buyers are borrowing ETH to purchase NFTs, and the amount a buyer has to put down up front may be very low (you can currently pick up an Azuki for less than 0.8 ETH up front). Again, both parties can exit the deal at their leisure, by paying the owed amount or triggering a refinancing auction (and possible liquidation). And if the NFT goes up in price before the loan is paid off, the buyer can list it for sale, and then take profits after paying off the loan with the proceeds.

Opportunity and Risk

A criticism that can be leveled at Blend is that it potentially enables predatory lending. Lenders can trigger a liquidation auction at any time, a new lender moves in, and with zero protections for borrowers, you can imagine a scenario where rates get hiked on borrowers whose debt is not locked in with one counterparty.

One more thing to note is that lending activity is rewarded with Blur tokens, and, as a lender, the more ETH you offer and the lower your APY, the higher the rewards. However, once a loan is accepted, rewards are no longer given, which may actually incentive lenders to liquidate early so they can then earn further rewards on new loan offers.

On the whole, Blend makes for an interesting system to explore, with opportunities and risks for all parties. As this is a loan-related product tied to NFTs, users should tread very carefully and be prepared for volatility. Blend is currently active for four collections–CryptoPunks, Azuki, Milady Maker, and DeGods–but expect more to be added.

Amazon NFT Marketplace to Launch Soon?

At first there were reports that Amazon would be launching an NFT marketplace in April, and it then appeared that the launch might be taking place this month, with May 15th being speculated on as a likely date. However, that timetable has gone unconfirmed by Amazon itself, and it now seems as though the launch will take place later this year.

Firmer information currently circulating indicates that the platform will be called the Amazon Digital Marketplace, thereby avoiding the term NFT in favor of a more mainstream-friendly title. It’s also being reported that Amazon will allow purchases to be made in fiat with credit cards and an Amazon account, and that the company is looking at ways of combining NFTs with physical purchases.

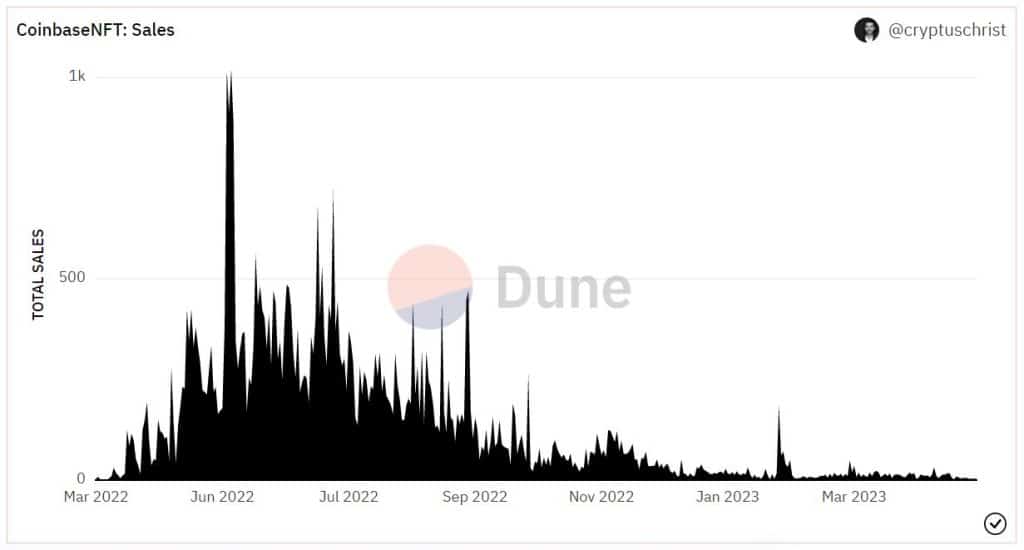

Relatedly, it’s probably a good idea to keep in mind what happened when Coinbase launched its own NFT marketplace last year. It’s understandable if that event has slipped your mind since it has subsequently turned into a washout.

Speculation that Coinbase would be the great NFT on-boarder to pump everyone’s bags (sorry, I mean, to spread the joy about NFTs) was just wishful thinking, and checking in on Coinbase NFT trading volume over the last 24 hours, it comes to a spectacular… $55. The point being that big name hype can go either way: sometimes it explodes, and sometimes it fizzles out.

NFT Art Finds a Home at Sotheby’s

And for one more significant development in the world of NFT marketplaces, let’s turn our attention to Sotheby’s. The prestigious art auction house launched its own NFT trading platform at the beginning of this month, making use of both Ethereum and (as is recently very popular for Web3 builders) Polygon.

It’s called Sotheby’s Metaverse and, as you might expect, it specializes in curated artworks. The aim is to make it easier for collectors to navigate the world of NFT art, since 1/1 digital pieces tend to be scattered across a variety of platforms and are sometimes difficult to track down.

Included from the start are some famous artists who cross over comfortably between the degen JPEG casino and the respectably champagne-quaffing traditional art scene, such as Tyler Hobbs, Claire Silver and XCOPY, and, among others, the world-renowned high-tech installation creator Refik Anadol (who also releases NFTs) catches the eye as part of the initial line-up too.

For all the speculation about the long-term future of NFTs, and the constant questions around utility, it’s curious that they seem to have found a natural home in the high-end art world, where they’re viewed simply as collectibles with artistic value. As such, Sotheby’s Metaverse feels like a logical extension to the Sotheby’s name.